BitMine (BMNR) Stock Jumps 15% But Misses Critical Recovery Signal By Inches

BitMine Immersion Technologies has seen intense volatility this month, with its share price plunging 42% since the start of January. The company sparked renewed optimism on Monday after announcing a significant purchase of 69,822 ETH, a move that briefly lifted BMNR by 15%. However, despite the rally, a confirmed reversal signal has yet to emerge.

BitMine Immersion Technologies has seen intense volatility this month, with its share price plunging 42% since the start of January.

The company sparked renewed optimism on Monday after announcing a significant purchase of 69,822 ETH, a move that briefly lifted BMNR by 15%. However, despite the rally, a confirmed reversal signal has yet to emerge.

BitMine Continues To Accumulate ETH

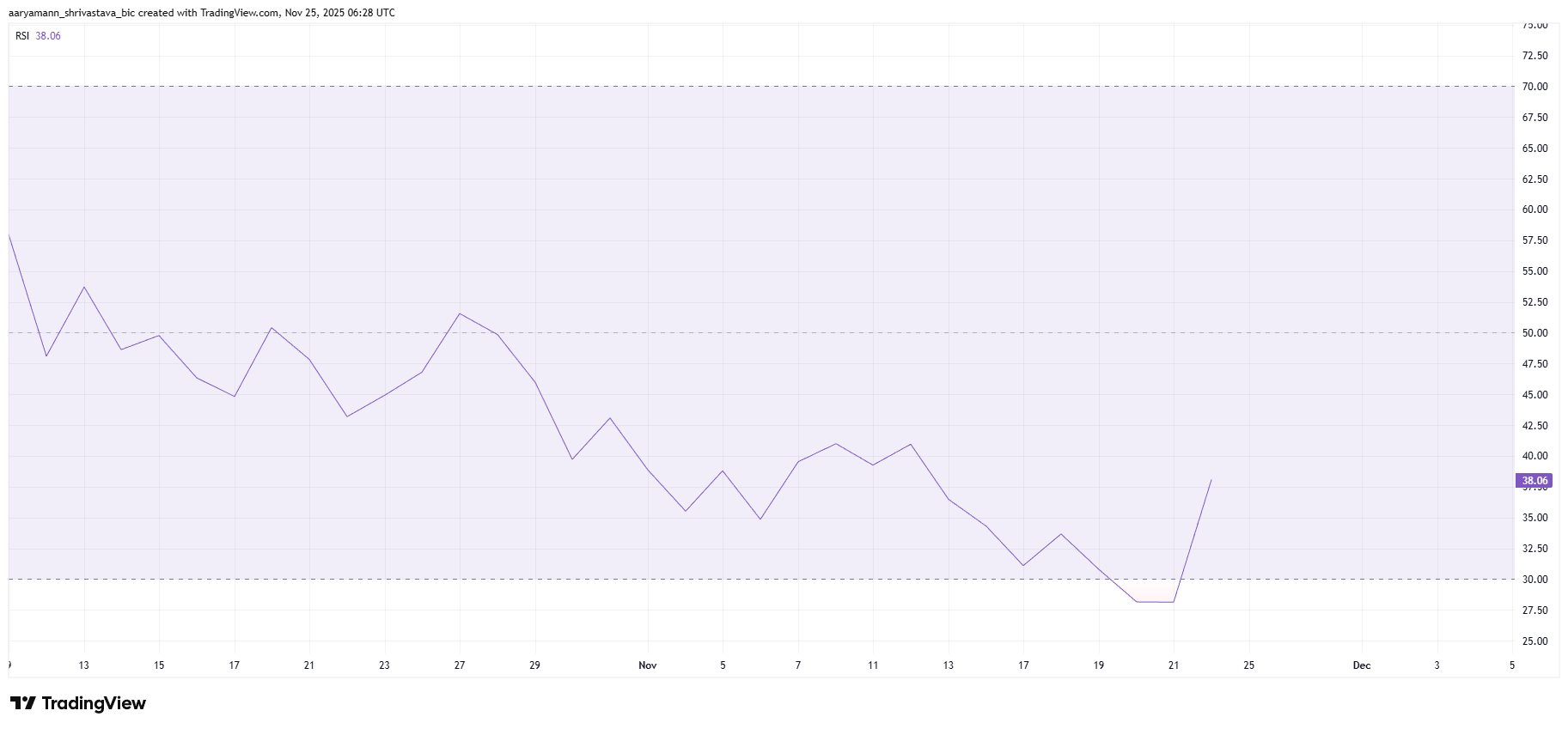

The relative strength index is showing a sharp uptick following BitMine’s major ETH acquisition. The purchase, equivalent to roughly 3% of Ethereum’s total circulating supply, sent a clear signal of confidence from the company. This triggered widespread optimism among investors and lifted the RSI out of oversold territory, a zone that typically precedes trend reversals.

However, the RSI alone cannot confirm a sustained bullish shift. While the indicator’s rise suggests improving sentiment, BMNR still requires consistent buying pressure to support a full recovery.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

BMNR RSI. Source:

BMNR RSI. Source:

BMNR RSI. Source:

BMNR RSI. Source:

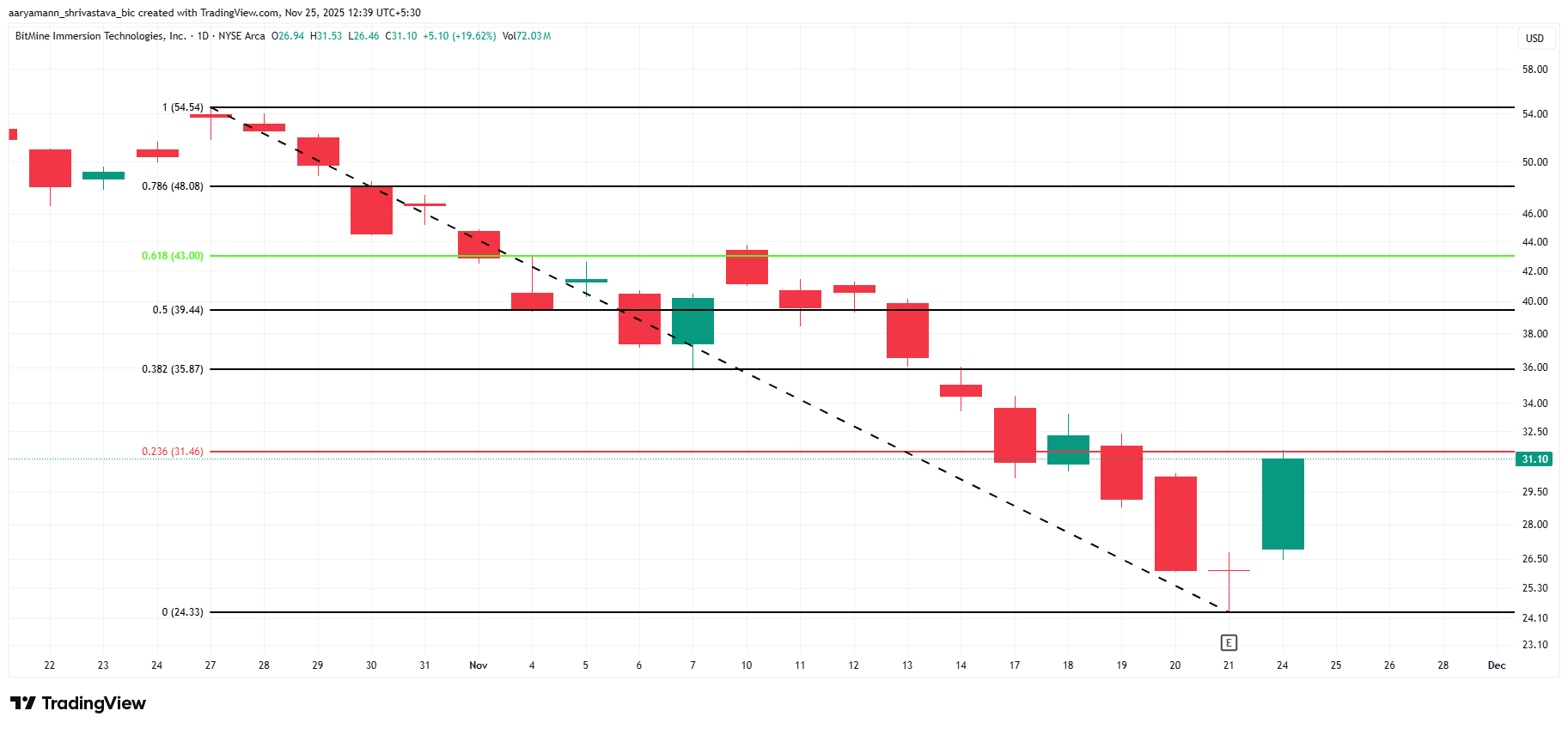

Macro momentum indicators highlight another critical area to watch. The Fibonacci Retracement tool shows that BMNR is approaching the 23.6% Fib line, a historically important support level during bearish phases. This threshold, positioned at $31.46, represents a potential pivot point for the stock.

Reclaiming this level as support would strengthen BitMine’s recovery outlook and enable a more convincing bounce. However, the stock remains just below this threshold and still requires stronger bullish participation to break through.

BMNR Fibonacci Retracement. Source:

BMNR Fibonacci Retracement. Source:

BMNR Fibonacci Retracement. Source:

BMNR Fibonacci Retracement. Source:

BMNR Price Reclaims $30

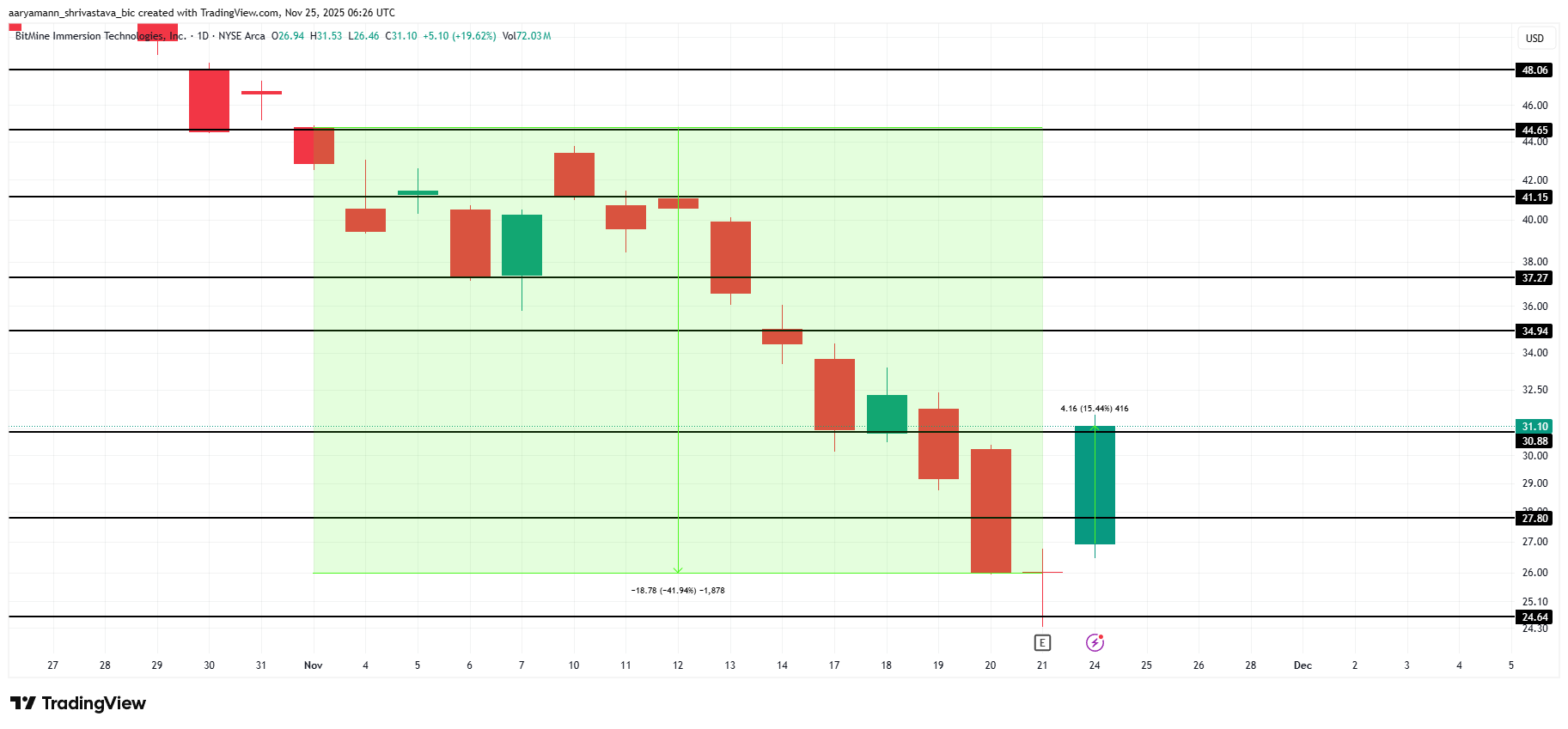

BMNR is trading at $31.10, hovering above the crucial $30.88 support zone. Despite the recent ETH-driven rally, the stock remains down nearly 42% for the month. This positions Monday’s surge as an important—but not yet decisive—step toward recovery.

If bullish momentum persists, BMNR could climb toward the $34.94 resistance level. A break above this barrier may pave the way for further gains toward $37.27 and beyond. This is especially true if investor confidence strengthens around BitMine’s aggressive accumulation strategy.

BMNR Price Analysis. Source:

BMNR Price Analysis. Source:

BMNR Price Analysis. Source:

BMNR Price Analysis. Source:

If uncertainty prevails and the company fails to capitalize on the excitement surrounding its ETH purchase, BMNR risks losing the $30.88 support. A breakdown could send the stock to $27.80 or even $24.64. This would invalidate the bullish thesis and signal continued weakness in the short term.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Russia Moves Away From The Dollar With Yuan Bond Issuance

Blockchain’s Backbone Reinvented: Avail Connects Disparate Chains through Nexus

- Avail's Nexus Mainnet launches as a cross-chain execution layer to unify liquidity across Ethereum , BNB Chain, and other major blockchains. - Its intent-solver architecture optimizes transaction routing with multi-source liquidity, enabling seamless asset and user movement between chains. - Projects like Lens Protocol and Vanna Finance adopt Nexus for unified collateral management, using the AVAIL token ($0.0080) for governance and coordination. - Avail plans to expand Infinity Blocks to 10 GB per block

Bitcoin News Update: Will Strategy's 71-Year Bitcoin Reserve Withstand Industry Volatility?

- Bitcoin treasury firm Strategy claims 71-year dividend sustainability with $56B Bitcoin holdings, even if prices stagnate at $87,000. - Industry faces instability from JP Morgan boycotts and MSCI's 2026 index exclusion plan, risking automatic crypto sell-offs. - Strategy's 5.9x asset-to-debt ratio and Nasdaq 100 inclusion contrast with peers selling Ethereum reserves amid liquidity pressures. - Market debates long-term viability as Saylor insists on "HODL" strategy, but prolonged Bitcoin declines below $

Bitcoin News Update: Crypto Downturn Intensifies as Technical Indicators and Economic Factors Combine Against Bullish Sentiment

- Bitcoin faces bearish pressure with MACD sell signals and price below key EMAs, risking a 10% drop to $83,111 if support fails. - Ethereum's death cross pattern and XRP's weak technical structure highlight vulnerability near $3,000 and $2.00 support levels. - Macroeconomic uncertainty over Fed rate cuts and ETF outflows amplify downward pressure on crypto markets. - Bitcoin ETFs show fragile recovery with $74M inflow, while Ethereum ETFs face sustained outflows and bearish sentiment. - Speculative intere