Is This the Next Big Crypto Shift? Quantum Tokens Hit $9 Billion

The quantum-resistant crypto sector now exceeds $9 billion in market capitalization, seeing daily trading volumes above $1.5 billion. Investor focus on specialized blockchain projects has surged after Vitalik Buterin, Ethereum’s co-founder, warned about the threats posed by quantum computing that could compromise current cryptographic security. Market Data Reveals Growing Quantum-Resistant Sector Analysts expect quantum resistance

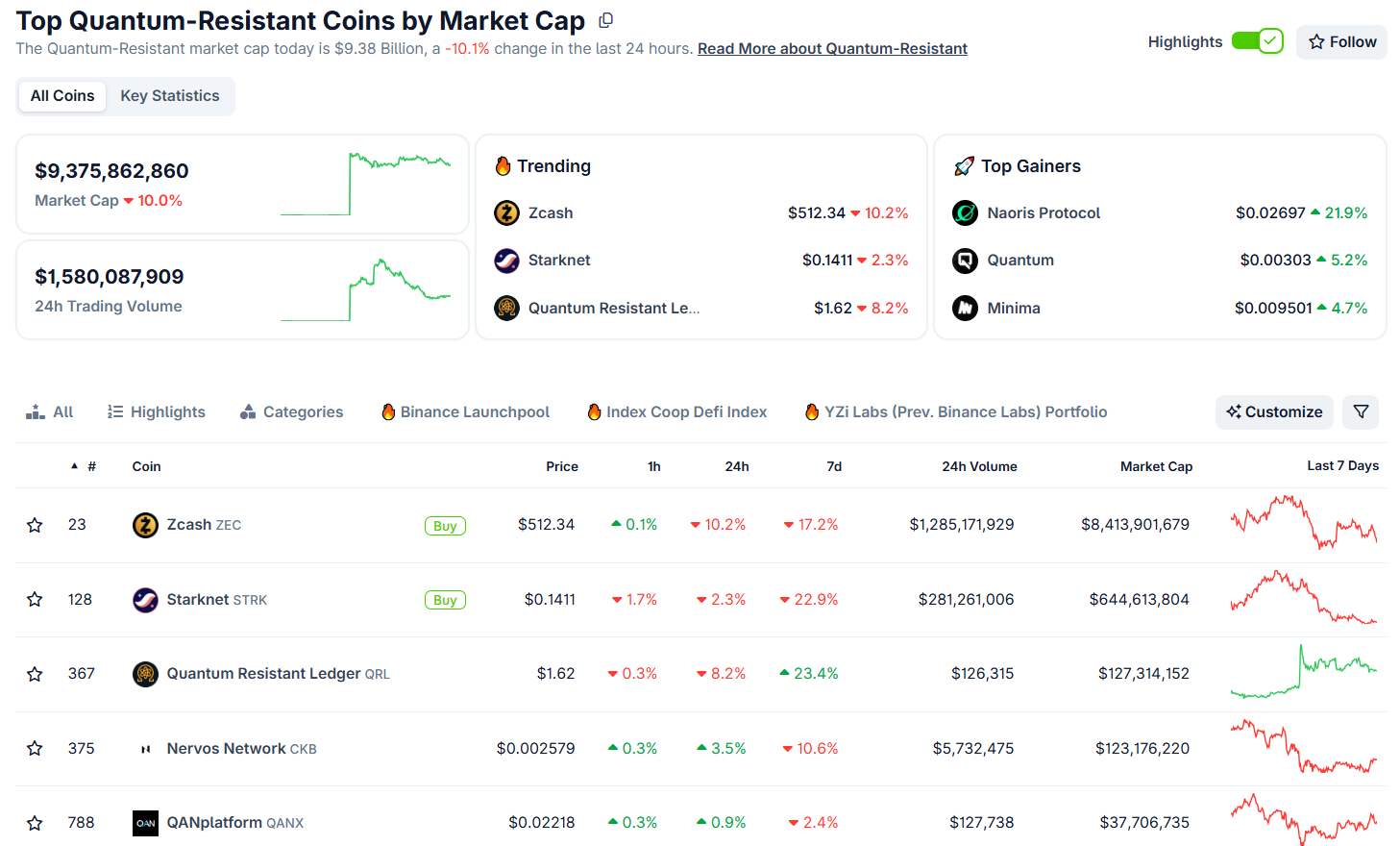

The quantum-resistant crypto sector now exceeds $9 billion in market capitalization, seeing daily trading volumes above $1.5 billion.

Investor focus on specialized blockchain projects has surged after Vitalik Buterin, Ethereum’s co-founder, warned about the threats posed by quantum computing that could compromise current cryptographic security.

Market Data Reveals Growing Quantum-Resistant Sector

Analysts expect quantum resistance to become a key theme by 2026, due to both technological urgency and investor sentiment.

Major projects, including Zcash, Starknet, Nervos Network, Quantum Resistant Ledger, and Abelian, are attracting attention from those seeking protection against future quantum vulnerabilities.

According to CoinGecko data, quantum-resistant tokens reached a market capitalization of $9.37 billion on November 25, 2025, despite a 10% drop over the previous 24 hours. The daily trading volume reached $1.58 billion, indicating strong activity and liquidity.

Quantum Resistant Tokens Market Cap. Source:

CoinGecko

Quantum Resistant Tokens Market Cap. Source:

CoinGecko

These projects stand out with the use of post-quantum cryptographic techniques. Hash-based and lattice-based algorithms are at the heart of these architectures, offering resistance against quantum attacks.

In contrast to blockchains that use elliptic curve cryptography, quantum-resistant tokens employ alternative methods validated by institutions like the National Institute of Standards and Technology.

Zcash leads the sector, trading at $512.34 despite a 10.7% gain. Starknet and Quantum Resistant Ledger follow in the top three.

Technical progress has accompanied the sector’s growth. Zcash recently launched a shielded-balance verifier to enable portable proof of funds, bolstering quantum-resistant privacy.

Buterin’s Warning Catalyzes Industry Attention

Vitalik Buterin, co-founder of Ethereum, has repeatedly warned about the risks quantum computing poses to blockchain security.

He cited Metaculus, a prediction platform, estimating a 20% chance that quantum computers capable of breaking modern encryption might appear before 2030.

Speaking at the Devconnect conference in 2025, he cautioned that quantum breakthroughs could endanger blockchain cryptography as soon as 2028.

Buterin’s warnings highlight the vulnerabilities of elliptic curve cryptography, which support networks like Ethereum and Bitcoin.

His advocacy for quantum-resistant protocols has sparked research and redirected investments toward forward-looking projects.

The legitimacy of quantum resistance has been reinforced by government actions. In March 2025, NIST chose HQC (Hamming Quasi-Cyclic) as its fifth post-quantum encryption algorithm to back up ML-KEM.

NIST had earlier standardized ML-DSA (Dilithium) and SLH-DSA (sphincs+) as signature methods, giving blockchain developers trusted cryptographic options.

In April 2025, the Canadian Centre for Cyber Security backed NIST’s adoption process, showing growing global convergence on post-quantum cryptography.

This regulatory unity is speeding up the adoption of quantum-resistant methods across cryptocurrency infrastructure.

Technical Preparedness Sets Leading Projects Apart

Some blockchain projects have integrated quantum-resistant features proactively, rather than relying on future upgrades.

Zcash uses shielded pools for privacy, even if elliptic curve cryptography fails. Starknet’s proof systems, designed with quantum safety in mind, use hash-based cryptography to guard against quantum attacks.

- Nervos Network enables developers to add NIST-standardized quantum signatures without hard forks.

- Quantum Resistant Ledger has used hash-based signatures since launch, omitting vulnerable elliptic curves.

- Abelian, meanwhile, implemented lattice-based cryptography from its genesis.

Market observers note the importance of proactive implementation. One analyst pointed to Starknet’s second-place rank among quantum-resistant tokens.

The project’s quantum-safe design contrasts with protocols that could face disruptive migration down the line.

This technical edge extends beyond cryptographic tools. Projects with modular, quantum-resistant systems can update security as NIST standards evolve, providing long-term protection while maintaining network continuity.

Psychology and Practicality Shape the 2026 Narrative

Though technical groundwork exists, some question whether quantum resistance is more a market narrative than an urgent need.

The arrival of quantum computers is uncertain. While Buterin estimates a 20% chance before 2030, many expect critical advances after 2034.

This uncertainty allows narrative and psychology to influence valuations. Fear of quantum risk could fuel price volatility, as has happened with previous crypto trends linked to anticipated events. Price action can precede real-world adoption or implementation.

Still, the line between speculation and preparation is often blurred in crypto. Investors focused on potential threats can help fund and validate useful project advances.

Market participants are already citing quantum resistance as a likely “next big narrative in 2026,” naming QRL, QANX, XDC, QTC, MCM, and CKB among likely beneficiaries.

This dual dynamic, technical innovation, and powerful market narrative could benefit real quantum-resistant projects, but also brings scrutiny to valuations.

As 2026 nears, the sector’s future will depend on the interplay of quantum technology, regulatory standards, and shifting sentiment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Bearish Trend in Bitcoin Fuels Increased Interest in Mutuum's DeFi Presale

- Mutuum Finance (MUTM) gains traction as a DeFi presale contender, projecting 2,600% ROI with Phase 6 nearing 99% completion and a $0.040 price hike in Phase 7. - Its buy-and-distribute tokenomics and $18.89M Phase 6 raise highlight strong demand, while Halborn Security audit and Q4 2025 lending protocol launch reinforce institutional-grade credibility. - Bitcoin's dip below $83,000 amplifies MUTM's appeal as a hedge, with analysts noting 400% post-launch price potential and 24-hour leaderboards boosting

"Automation and enhanced security are driving cryptocurrency's efforts to make trading accessible to everyone"

- Bitget's Black Friday campaign offers 100% reward matches and a 50,000 USDT prize pool for spot-grid trading, targeting retail investors with automated tools. - Mutuum Finance advances to Phase 2 with 90% presale completion, preparing a Q4 2025 protocol launch supported by Halborn audits and institutional-grade security. - Both initiatives highlight crypto's shift toward democratizing trading through automation, security, and rewards to lower entry barriers for mass adoption.

Bitcoin Updates Today: The 2025–2031 Battle for Bitcoin: Long-Term Confidence Faces Near-Term Uncertainty

- Bitcoin's 2025 price dropped 30% to $85,000 amid Fed policy shifts and ETF outflows, triggering market recalibration. - Institutional investors like Harvard and Japan's Metaplanet are accumulating BTC, signaling potential 2026–2031 bull phases. - Analysts project $160,000–$350,548 targets by 2026–2031, but warn of $53,489–$58,000 bear risks amid macroeconomic uncertainties. - Long-term bullish sentiment persists despite short-term volatility, with on-chain data showing whale accumulation at discounted le

Spain’s Revamp of Crypto Tax Laws May Spark Market Turmoil, Opponents Caution

- Spain's Sumar group proposed crypto tax hikes to 47% and a risk "traffic light" system for platforms in November 2025. - The plan introduces dual taxation for individuals/businesses and expands seizable crypto assets beyond EU MiCA rules. - Experts warn of legal challenges, market instability, and "absolute chaos" if the reforms create compliance burdens for investors. - Critics argue the measures could deter crypto adoption, drive activity underground, and destabilize Spain's emerging crypto sector.