Bitkub Eyes Hong Kong IPO as Thai Market Downturn Stalls Local Listing Plans

Quick Breakdown

- Thailand’s largest crypto exchange is weighing a $200M IPO in Hong Kong.

- Volatile Thai markets and a five-year SET Index low stall the local debut.

- Hong Kong’s booming IPO scene and crypto-friendly stance attract Bitkub.

Bitkub considers overseas listing amid Thai market turmoil

Bitkub, Thailand’s largest cryptocurrency exchange, is exploring an initial public offering (IPO) abroad amid weak market conditions that continue to weigh on local investor sentiment. According to a Bloomberg report citing people familiar with the matter, the company is targeting about $200 million in a potential Hong Kong listing.

The move comes after Bitkub’s earlier plan to go public in Thailand in 2025 was put on hold due to heightened volatility and uncertainty in the domestic equities market.

Thai stock market hits five-year low in 2025

Thailand’s stock market has struggled to find stability throughout 2025 amid escalating political tensions with Cambodia and concerns over trade disruptions.

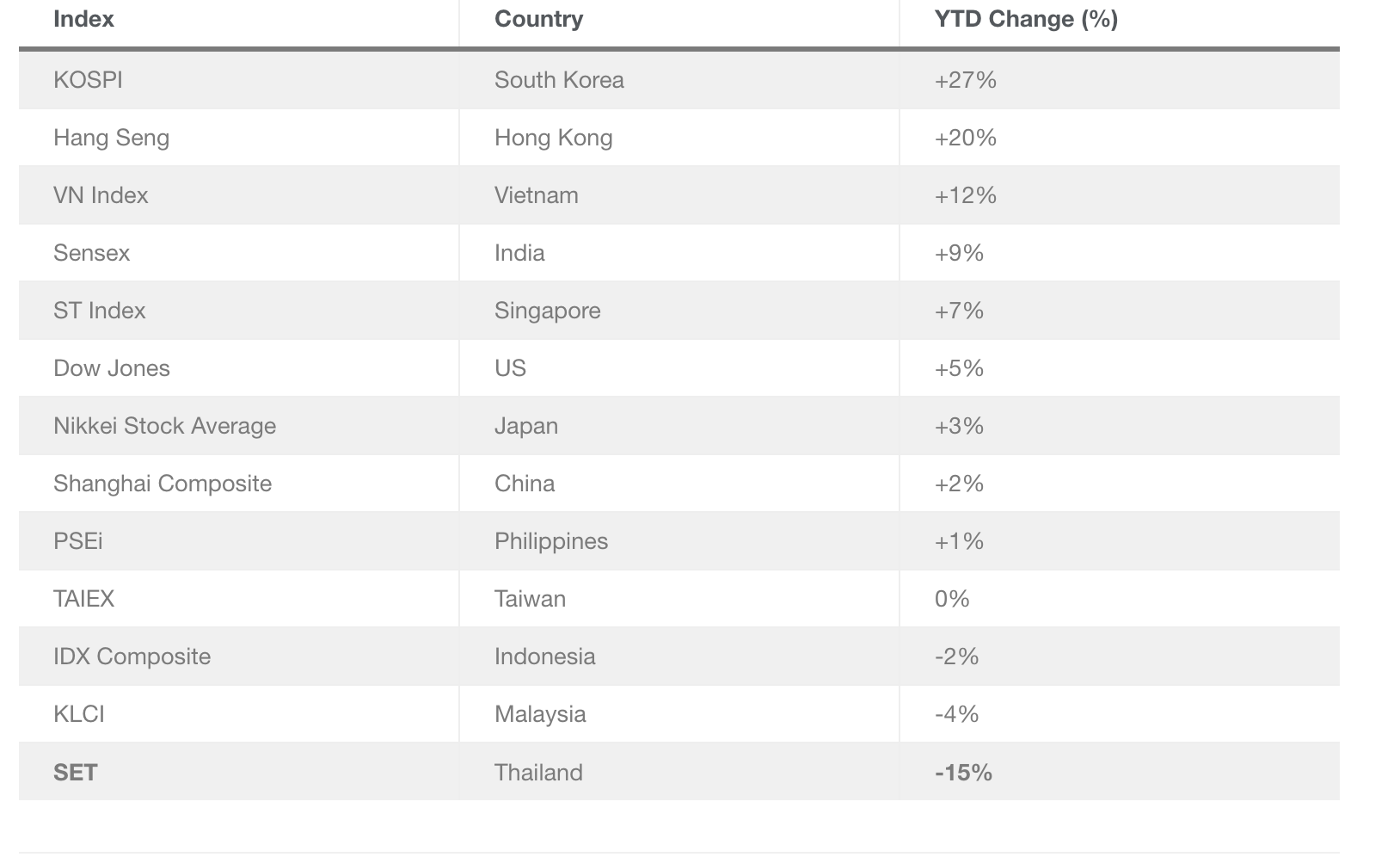

The Stock Exchange of Thailand (SET) has dropped roughly 10% this year, sliding to a five-year low in the first half of 2025, one of the weakest performances in Asia.

Source

:

Thailand Business News

Source

:

Thailand Business News

Even after two months of modest recovery, foreign investors remained net sellers, offloading more than 100 billion baht (about $3 billion) in equities during the first 10 months of the year.

This contrasts sharply with broader regional performance: major Asian markets, including South Korea and Hong Kong, saw gains of 27% and 20%, respectively, over the same period.

Hong Kong’s IPO boom draws global crypto firms

For Bitkub, Hong Kong’s surging IPO ecosystem presents a more attractive path. The Hong Kong Stock Exchange reported raising HK$216 billion (around $27.8 billion) from IPOs between January and October 2025, a massive 209% jump from the previous year.

The city has quickly become a hotbed for digital asset companies. Bitcoin Depot, the world’s largest Bitcoin ATM operator, is among the notable crypto firms expanding into the region.

In October, local crypto heavyweight HashKey Group also filed for a public listing, aiming to raise $500 million ahead of a planned 2026 debut, potentially one of the first local crypto IPOs.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Bitcoin's Plunge Signals Trump's Diminishing Influence, as Crypto Connections Weaken Amid MAGA's Downturn

- Nobel laureate Paul Krugman links Bitcoin's $1 trillion crash to Trump's waning political influence and crypto-linked wealth decline. - Trump family's crypto assets lost $1 billion in value, with Eric Trump's ABTC shares down 50% and memecoins losing 90% of peak value. - Despite losses, complex financial structures like Alt5 Sigma holdings buffer the family, while Krugman ties crypto turmoil to fractured MAGA support. - Trump's pro-crypto policies face scrutiny as Bitcoin's $40k drop undermines his econo

Emerging Educational Technology Platforms and Their Impact on Developing Skills for the Future Workforce

- Global EdTech market reached $163.49B in 2024, projected to grow at 13.3% CAGR to $348.41B by 2030, driven by STEM skills demand. - K-12 STEM education market valued at $44.35B in 2025, expected to surge to $115.13B by 2030, fueled by tech workforce needs and immersive learning tools. - AI-driven platforms (e.g., Squirrel AI) and VR/AR technologies are enhancing personalized learning and industry-aligned training, boosting workforce productivity by up to 250%. - $1.5B in U.S. investments (2023-2025) acce

Global Crypto Regulation Era Begins as UK Implements OECD Disclosure Standards

- UK adopts OECD's CARF framework for crypto regulation, avoiding tax hikes but enforcing stricter compliance by 2026. - HMRC updates guidelines requiring crypto providers to report user data globally, aligning with 70+ countries' 2027 data exchange plans. - Compliance demands automated data collection, KYC upgrades, and penalties for non-compliance under new transparency rules. - Framework excludes self-custody wallets but covers major transactions, reshaping crypto's integration into global financial sys

Cosmos Addresses ATOM’s Inflation and Price Fluctuations through Community-Led Tokenomics Reform

- Cosmos community proposes ATOM tokenomics overhaul to shift from artificial scarcity to usage-based fees and network activity-driven inflation. - Five-step governance process emphasizes transparency, stakeholder collaboration, and addressing 25% price drop, high inflation, and speculative volatility. - Framework separates core economics from add-ons, incentivizes long-term stakers, and aligns ATOM as reserve/settlement asset across Cosmos Stack. - Ecosystem partners like Akash and Pocket Network advance