Monad Token Defies Market Rout With Sharp Post-Launch Rally

Monad’s MON token surged more than 35% on launch day, breaking the industry’s usual post-airdrop decline. The move stands out in a harsh November downturn, with MON outperforming even as broader crypto sentiment hits extreme fear.

Monad’s MON token surged more than 35% within 24 hours of launch, defying both a cold airdrop market and a deep November sell-off across digital assets.

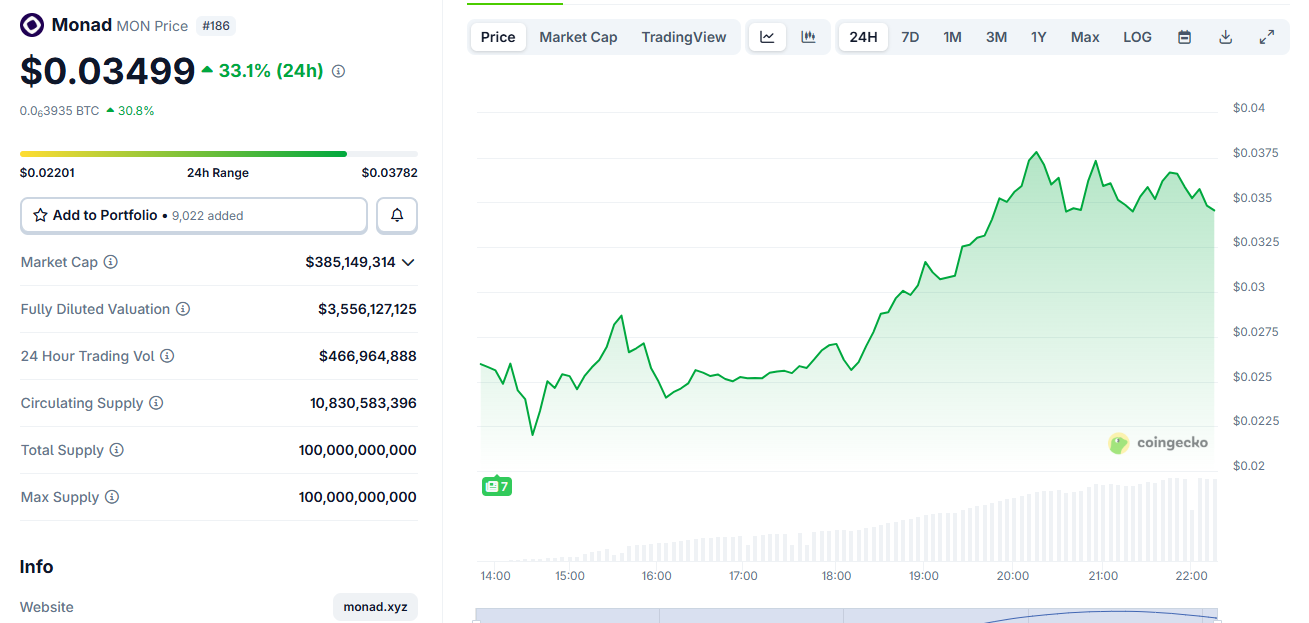

MON traded around $0.035 on Monday, rising from an early range near $0.025 as liquidity spread across major exchanges.

Monad Shines Bright Amid the Bear Market

The move stands out against a market where most airdrops have struggled. Recent industry research shows nearly 90% of airdropped tokens decline within days, driven by thin liquidity, high FDVs, and aggressive selling from recipients.

MON instead climbed strongly despite more than 10.8 billion tokens entering circulation from airdrop claims and a public token sale.

$MON TGE today.Simplest Monad airdrop play is still liquid staking. Stake and forget while farming points.If Monad does well, one of the $MON LSTs will be Lido of ETH and Jupiter for Solana.Question is which.I look for:– Exclusive to Monad– No TGEd yet– Already…

— Ignas | DeFi November 24, 2025

The token launched on November 24 alongside Monad’s mainnet. Around 76,000 wallets claimed 3.33 billion MON from a 4.73 billion-token airdrop, while 7.5 billion more unlocked from Coinbase’s token sale.

Monad Price Chart. Source:

CoinGecko

Monad Price Chart. Source:

CoinGecko

The airdrop alone was valued near $105 million at early trading prices.

MON’s performance also contrasts with the broader market downturn. Bitcoin fell below $90,000 last week after long-term holders sold more than 815,000 BTC over 30 days.

Total crypto market value has dropped by over $1 trillion since October, and sentiment sits in extreme fear territory.

However, MON’s trading demand remained resilient. Its price recovered from initial selling pressure and climbed steadily through the afternoon session.

Most large exchanges listed the token at launch, including Coinbase, Kraken, Bybit, KuCoin, Bitget, Gate.io, and Upbit, supporting deeper liquidity.

Analysts attribute the move to pent-up interest in Monad’s high-performance L1 design and a launch structure that avoided the steep inflation seen in other airdrops this year.

People really gravedancing on Monad right before a 4 hour 50% up candle at the most obvious support on planet earthMan I love this game

— DonAlt November 24, 2025

The project delivered one of 2025’s largest distributions but kept real circulating supply focused on early users and public sale participants rather than speculative farmers.

MON’s rally comes as a rare outlier in November’s bear cycle. Its early strength now positions the token as one of the few airdrops this year to post immediate gains instead of sharp declines.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: ARK Bucks Crypto Slump, Increases Holdings in CoreWeave and Bullish Stocks

- ARK Invest boosted crypto stock holdings by $39M in late 2025, acquiring CoreWeave , Circle , and Bullish amid market declines. - The firm's $31. 3M CoreWeave stake highlights confidence in AI cloud infrastructure, despite the company's widening losses amid rapid scaling. - Contrary to $3.79B crypto ETF outflows and Bitcoin's "death cross," ARK's "buy the dip" strategy reflects long-term optimism about crypto infrastructure. - Mixed reactions emerged as analysts warned about CoreWeave's debt risks, while

Ethereum Updates: BitMine Anticipates Ethereum Rebound Despite Indicators Pointing to a Fall Below $2,000

- Ethereum’s MVRV metrics signal a potential 28% price drop below $2,000, citing historical patterns in 0.8x RP band breaches. - BitMine plans to stake 3.55M ETH via MAVAN and announced a $0.01 dividend, betting on Ethereum’s discounted recovery despite $4B unrealized losses. - Europe’s 3x leveraged ETFs and NUPL nearing 0.25 threshold amplify volatility, risking deeper bearish trends as ETH struggles to defend $3,000.

Ethereum News Today: How Toaster Technology is Fueling Ethereum’s Climb Toward $80,000

- Ethereum's Pectra upgrade and zkSync's Airbender prover breakthroughs enhance scalability, enabling gigagas-level throughput and slashing proof costs to $0.0001 per transfer. - Institutional adoption grows with 3x leveraged ETH ETFs and $1.13B June inflows, while daily ETH burns tighten supply and drive prices toward $2,200 post-upgrade. - Analysts project ETH could reach $80,000 as Layer-2 solutions handle 60% of DeFi transactions, combined with deflationary dynamics and ETF-driven demand. - Challenges

Bitcoin News Today: Investors Shift $3.79B into Altcoins Amid Bitcoin ETF Outflows

- U.S. Bitcoin ETFs recorded $3.79B outflows in Nov 2025 as investors shifted to altcoins like Solana and XRP . - BlackRock's IBIT and Fidelity's FBTC led redemptions, with single-day outflows exceeding $523M. - Analysts attribute the sell-off to profit-taking after Bitcoin's October peak and macroeconomic pressures. - Ethereum ETFs also faced $1.79B outflows but showed recent stabilization amid market shifts. - Concerns grow over Bitcoin's ETF-driven rally sustainability amid thinning liquidity and price