63K Bitcoin Exits Long-Term Wallets: A Surge of Speculative Short-Term Buying

Bitcoin is struggling to reclaim momentum as it trades below the critical $90,000 level, with selling pressure dominating the market and fear spreading rapidly. Many analysts are leaning toward calling the start of a new bear market, arguing that Bitcoin likely topped in early October near $126,000. Momentum has weakened sharply since then, and investor behavior now reflects a shift toward risk-off positioning.

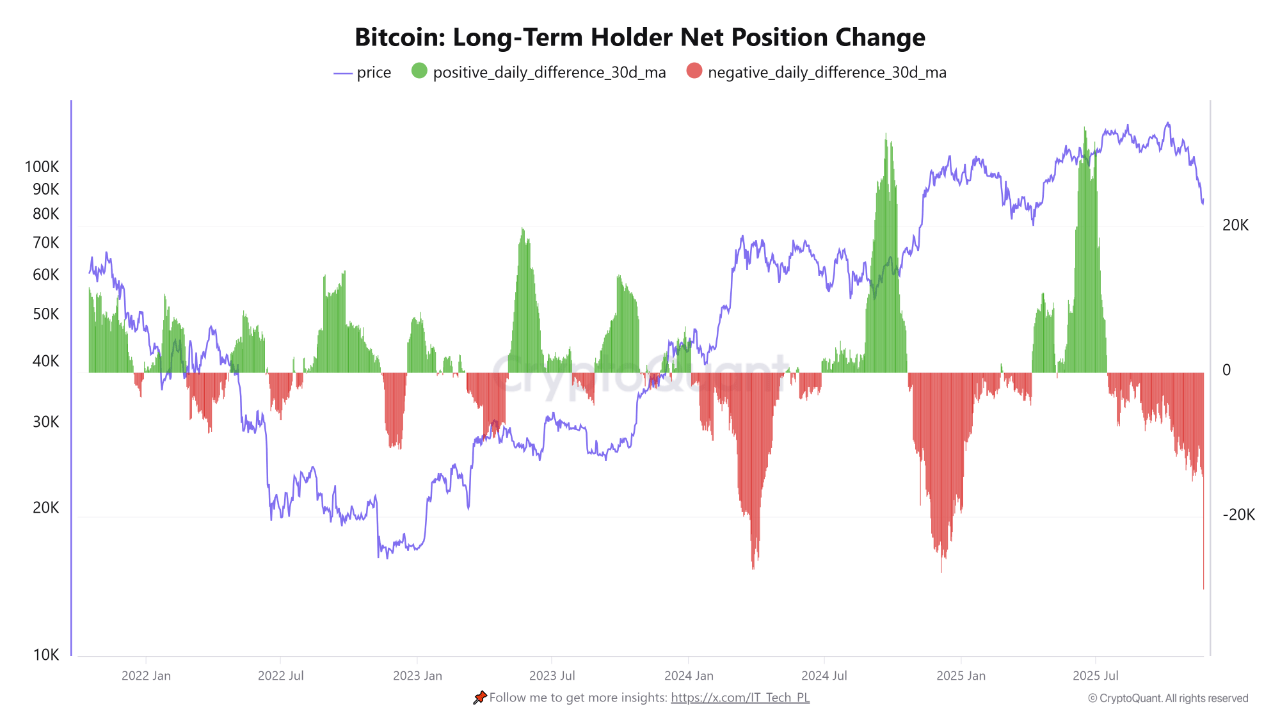

A new report from CryptoOnchain, published via CryptoQuant, highlights one of the most significant developments of this cycle: a historic 63,000 BTC has moved from long-term holders (LTHs) to short-term holders (STHs). This unprecedented transfer is clearly visible in the Long-Term Holder Net Position Change chart, which shows a massive red bar — a negative daily difference signaling heavy outflows from long-term holder wallets.

This type of behavior typically appears during late-stage bull markets or near local and cycle tops, when long-time investors with substantial profit margins begin realizing gains. At the same time, the corresponding Short-Term Holder Net Position Change chart shows a huge green bar, confirming that newer, more reactive market participants are buying these coins, often at elevated prices.

Long-Term Holders Distribute as Short-Term Buyers Absorb Supply

CryptoOnchain explains that the current market structure is being shaped by a clear divergence in behavior between Long-Term Holders (LTHs) and Short-Term Holders (STHs). LTHs — historically considered the “strong hands” of the market — are now heavily distributing, sending large amounts of Bitcoin into the market after months or even years of holding.

At the same time, STHs are aggressively buying and accumulating this supply, often entering positions at elevated prices despite growing volatility.

This dynamic is not inherently a bearish signal on its own. In fact, such transitions are common during late-stage bull markets, where early investors secure profits while new participants enter the market with fresh capital. It reflects a natural rotation of supply from experienced holders to newer ones, a pattern seen repeatedly in previous cycles.

However, the volume of distribution is significant, and it raises an important risk: if incoming demand fails to fully absorb the coins being offloaded by LTHs, the market could face a deeper correction or extended consolidation phase. This supply pressure can weigh on price, especially in a context where sentiment is fragile and macro conditions remain uncertain.

Weekly Chart Signals a Critical Retest of Macro Support

Bitcoin is attempting to stabilize around the $87,000 level after an intense multi-week sell-off that dragged price as low as $85,946. On the weekly chart, Bitcoin has now tapped the 100-week moving average (green line), a historically important support level during bull-market retracements. This line acted as a springboard in previous cycles, but the current bounce remains weak and indecisive, reflecting the fear dominating the market.

Momentum has clearly shifted bearish. The breakdown from the $110K–$100K consolidation zone triggered accelerated selling, confirming a loss of market structure on the weekly timeframe. Candles over the past three weeks show high-volume distribution, with sellers overwhelming demand each time Bitcoin attempted to reclaim higher levels. The steep slope of the 50-week MA turning slightly down is another sign that trend strength has softened.

However, the reaction at the 100-week MA is critical. Bulls aggressively defended this area in prior macro corrections, and holding above $83K–$86K keeps the long-term bull structure intact. A weekly close below this zone, however, opens the door to deeper downside toward the 200-week MA near $56K–$60K.

Featured image from ChatGPT, chart from TradingView.com

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Robinhood’s 2026 platform seeks to make prediction markets more accessible to everyday investors

- Robinhood acquires 90% of MIAXdx to launch a CFTC-regulated futures/derivatives exchange by 2026, expanding into prediction markets. - The platform reported $9B in prediction market contracts traded by 1M+ users since March 2025, driven by partnerships like Kalshi. - Industry-wide growth sees Kalshi ($4.47B 30-day volume) and Polymarket ($3.58B) competing with crypto-based prediction platforms. - Robinhood aims to democratize speculative trading through fully collateralized products, leveraging MIAXdx's

Mutuum’s Robust DeFi Framework Drives 600% Token Growth and Secures $18.9M in Funding

- Mutuum Finance's MUTM token surged 250% since presale launch, with Phase 6 now 99% sold out ahead of 20% price hike in Phase 7. - The $18.9M raise attracted 18,200+ holders, positioning MUTM as 2025's most subscribed DeFi token with $0.035 current price (600% above initial $0.01). - Halborn's security audit and Sepolia testnet launch in Q4 2025 reinforce credibility, while mtToken-based lending protocol combines pooled liquidity with P2P borrowing. - Strategic features like card purchases and daily rewar

Japan Equips Crypto Exchanges with Conventional Financial Protections

- Japan's FSA mandates crypto exchanges to hold liability reserves from 2026, aligning with traditional financial safeguards after major exchange collapses. - Reserve requirements will be volume-based and incident-adjusted, allowing insurance to offset costs, ensuring immediate user compensation without bailouts. - The reform reclassifies crypto as financial instruments under strict oversight, including audit enhancements and insider-trading bans, mirroring securities firm standards. - Larger exchanges lik

Private Transactions, No Registration Required: ShopinBit's Crypto Concierge Manages International Orders with Complete Privacy

- ShopinBit launched a privacy-focused web app enabling crypto payments for global services using Bitcoin , Monero, USDT, and 2,000+ altcoins via EXOLIX. - The no-account platform offers 2% cashback for early users and handles high-end logistics with a 10% transparent service fee, emphasizing "Ultra Privacy Mode" with no data storage. - Distinguishing itself from competitors like TrustLinq, ShopinBit prioritizes discreet crypto transactions while managing complex orders through EU-based logistics partners.