From pumps to dumps: Pump.fun transfers large stablecoin sums as PUMP token goes flat

Memecoin launchpad Pump.fun has transferred substantial stablecoin holdings to exchanges, drawing scrutiny from crypto investors amid declining platform revenue, according to blockchain data.

- Since mid-October, Pump.fun has moved significant amounts of stablecoins to Kraken and then to Circle, likely representing withdrawals tied to its declining revenue.

- Pump.fun’s native PUMP token, sold to institutional investors in June, has fallen below its issue price.

- The official Pump.fun account and co-founder Alon have been largely inactive since mid-November, raising investor concerns.

The Solana-based platform has moved significant amounts of stablecoins since mid-October 2025, following a crypto market downturn that reduced trading activity and monthly revenue, according to blockchain data platform Lookonchain.

Since October 15, Pump.fun has transferred stablecoin holdings to the exchange Kraken, blockchain data shows. In the past week, the platform moved large sums to Kraken, with similar amounts subsequently transferred from Kraken to Circle, the stablecoin issuer, likely representing withdrawals, according to the data.

The funds originated from sales of the PUMP token to institutional private placements in June, according to blockchain analytics. The token has since fallen below that issue price.

The not-so-fun side of PUMP

The transfers have drawn criticism from crypto investors, who view them as potential selling pressure while the platform’s monthly revenue has decreased significantly. The official Pump.fun account on X has been inactive for more than a week, and co-founder Alon was last active in mid-November, according to social media records.

Pump.fun’s native token has declined sharply and is trading well below its all-time high recorded in September 2025. The price drop reflects platform-specific challenges and broader market conditions, analysts said.

Pump.fun, launched in January 2024 on Solana, allows users to create and trade memecoins. The platform uses a bonding curve model to determine token prices. It includes a mechanism designed to prevent “rug pulls” by requiring tokens to reach a certain market capitalization before listing on decentralized exchange Raydium.

The platform has faced controversies, including issues around livestreaming features and regulatory warnings about unregulated gambling in some jurisdictions, according to industry reports.

A new federal lawsuit alleged that the company and its partners ran a meme coin operation designed to defraud users .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

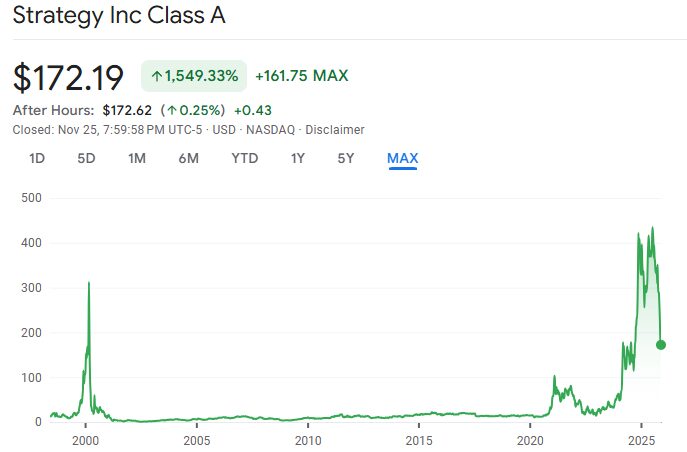

Bitcoin Updates: Bitcoin Approaches $90k Amidst Economic Challenges as Institutions Seek Protection and Projects Drive Innovation

- Bitcoin surged past $90,000 in Nov 2025 amid JPMorgan's Bitcoin-backed structured notes tied to BlackRock's ETF, signaling institutional adoption. - Bitcoin Munari's $0.10-$3.00 presale with 21M fixed supply and Solana deployment highlights innovation in digital asset scarcity models. - Analysts remain divided on Bitcoin's trajectory, with $80,000 support level critical for avoiding further declines toward $75,000. - JPMorgan's leveraged ETF-linked notes (up to 16% returns) demonstrate institutional risk

The ZK Protocol Boom: Unveiling the Driving Force Behind the Latest Surge

- ZK Protocol's 2025 market surge reflects $28B TVL and 43,000 TPS scalability, driven by zero-knowledge proofs (ZKPs) addressing blockchain's scalability-privacy tradeoff. - Institutional adoption by Goldman Sachs and Deutsche Bank highlights ZK's role in compliance frameworks, with StarkNet's 200% Q4 TVL growth and 70% gas fee reductions. - Regulatory alignment emerges as key strength, with ZK-based solutions enabling EU DSA compliance and CISA-mandated data integrity through cryptographic verification t

Is DAT Boom Collapsing? All Eyes on MSCI’s Deadline

Bitcoin Updates: Senate Decision on Crypto Approaches While ETFs Lose $3.5B and Market Liquidity Declines

- A $101M crypto futures liquidation in October triggered a 30% Bitcoin price drop, marking the largest single-day selloff since 2022 amid ETF outflows and macroeconomic uncertainty. - $3.5B in November ETF redemptions and $4.6B stablecoin outflows highlight liquidity tightening, while leveraged traders face heightened volatility risks as retail investors retreat. - The U.S. Senate's upcoming crypto market structure bill could redefine regulatory clarity, potentially attracting institutional investment if