Solana shows early signs of bounce: $131 support holds line

Solana price is flashing a daily bullish divergence while holding key support at $131, suggesting early signs of strength and the possibility of a short-term reversal toward higher resistance levels.

- Momentum shift emerges as Solana steadies at a long-tested support zone

- Market behavior reflects early accumulation after extended sell pressure

- Divergence hints that downside exhaustion may be forming beneath recent lows

Solana’s ( SOL ) latest price action is showing encouraging signals after an extended period of downside pressure. A clear bullish divergence has formed on the daily chart, hinting that momentum may be shifting back toward buyers.

With price holding a major support level and several indicators showing alignment, and with Wormhole’s new Sunrise DeFi platform launching on Solana and debuting Monad’s MON as its first listing, the current structure suggests that Solana may be preparing for a relief move.

Solana price key technical points

- Daily bullish divergence forming between price and RSI

- Major support at $131 continues to act as a reaction zone

- Key resistance lies at the value area low and later at $167

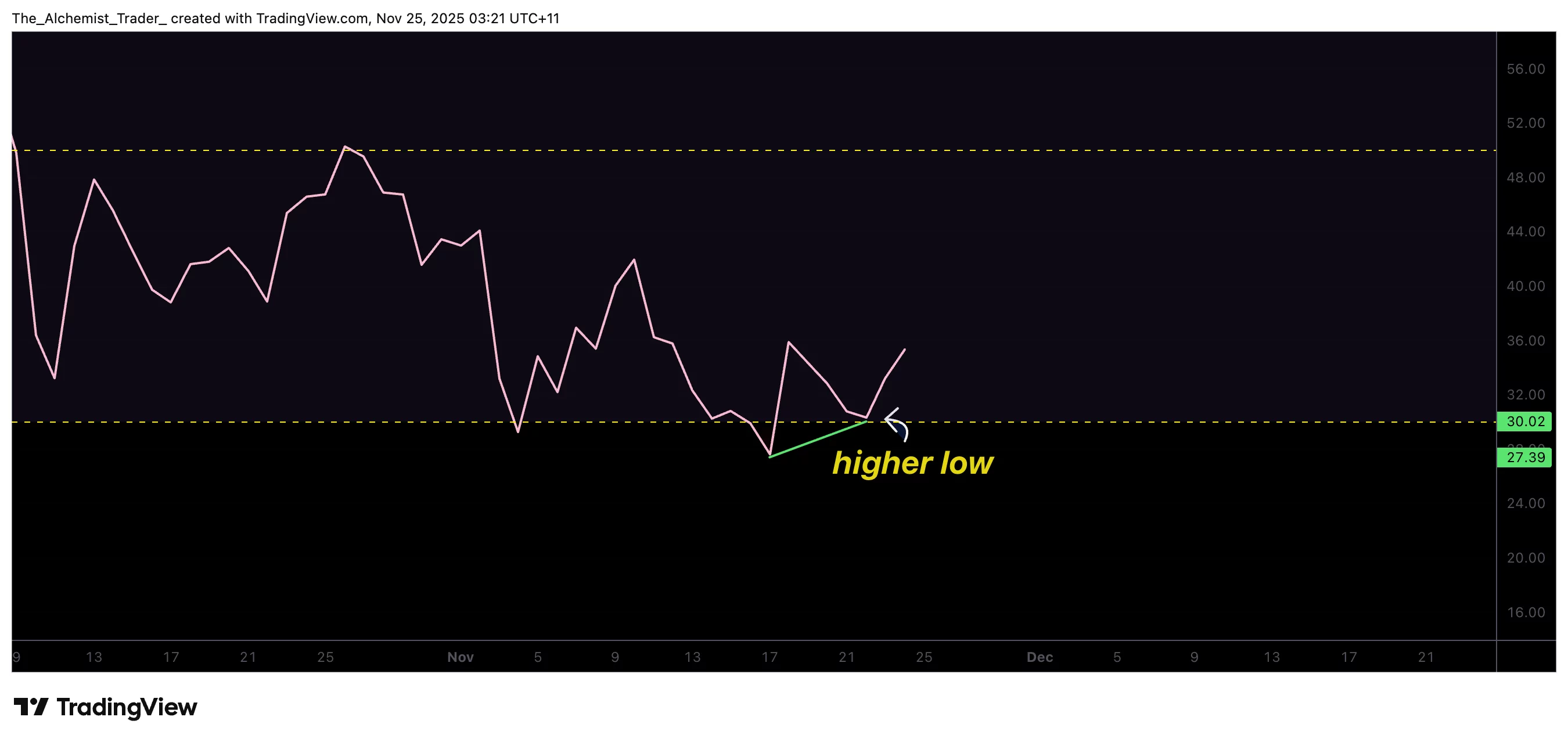

SOLUSDT (1D) Chart, Source: TradingView

SOLUSDT (1D) Chart, Source: TradingView

Solana is currently printing one of the most reliable early-reversal signals in technical analysis: a bullish divergence on the daily time frame. While price has recently formed a lower low, the RSI has created a higher low. This separation between momentum and price often suggests that sellers are losing strength even as price continues drifting downward.

Solana RSI, Source: TradingView

Solana RSI, Source: TradingView

The $131 region has become a focal point in recent sessions. This area has held as support multiple times, with price hovering above it for several days. Such behavior typically indicates the market is entering an accumulation phase where buyers absorb selling pressure before attempting a shift in direction.

If this support continues to hold, the next key level to watch is the value area low. Reclaiming this region would signal that buying pressure is returning, and that Solana may be preparing for a rotation toward the next significant resistance at $167. This level aligns with high-time-frame resistance and has historically acted as a significant decision point for trend continuation or rejection.

With new Solana ETFs from Grayscale and VanEck launching amid rising volatility, market flows may also help shape how the price reacts at this key level.

Price action and momentum indicators are now converging, suggesting a short-term reversal is becoming more likely. Bullish divergences often appear at the end of aggressive sell-offs, and Solana’s recent behavior fits this pattern. While confirmation is still pending, early signals suggest a potential shift in market sentiment.

Price action

If Solana maintains support at $131 and activates the bullish divergence, a move toward $167 may follow. A loss of support would delay the reversal and return the asset to a bearish continuation phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Texas Adds Digital Gold to State Reserves, Leading the Way in Crypto Protection

- Texas becomes first U.S. state to allocate $5M in public funds to Bitcoin via BlackRock's IBIT ETF, purchasing at $87,000 per BTC. - The temporary investment aims to diversify state reserves and hedge inflation, with plans for direct self-custody pending 2026 RFP. - Governor Abbott's June 2025 legislation established a $10M Strategic Bitcoin Reserve, positioning Texas as a crypto policy leader alongside gold and Treasuries. - While boosting ETF inflows and attracting institutional interest, critics warn

Fed Faces Balancing Act Between Inflation and Employment Amid Political and Market Scrutiny

- Fed officials remain divided on a December rate cut amid conflicting inflation and labor market signals. - Boston Fed's Collins opposes cuts, citing persistent inflation risks despite recent 119,000 jobs gain and 4.4% unemployment. - Trump's tariff-driven policies face criticism for sustaining high prices, mirroring Biden's inflation challenges. - Crypto sector shows resilience with $4.6B Q3 VC funding, as regulators push for digital asset tax clarity under Trump . - Fed's December decision will balance

Buffett Embraces AI: Berkshire Gains $1.4 Billion from Alphabet Investment

- Berkshire Hathaway earned $1.4B profit from its Alphabet stake as shares surged 19.2% in November, marking its 10th-largest holding at $4.33B. - Buffett's shift to tech stocks reflects Alphabet's AI/cloud expansion, including Gemini 3 AI model and $100B AI infrastructure fund. - Alphabet's $34% Google Cloud growth and $2B Turkey data center partnership highlight its enterprise AI dominance ambitions. - Market optimism boosts Alphabet's $4T valuation despite regulatory risks, with BNP Paribas upgrading sh

Bitcoin Updates Today: Buddy's BTC Wager: The Ongoing Struggle in Crypto Between Downward Adjustments and Upbeat Expectations

- Prominent crypto investor Buddy reopens $18.63M BTC long position amid market volatility, signaling renewed confidence in Bitcoin's long-term potential. - Institutional adoption grows as KindlyMD holds 5,398 BTC ($681M) and Harvard increases ETF stake to $443M, while Japan/UAE tighten crypto regulations with 2026 liability rules and DeFi oversight. - BTC rebounds above $88K amid Fed rate cut speculation but remains 30% below October 2025 highs, with analysts divided on $60K-$200K 2025 price forecasts. -