XRP Price Bounces, But One “Unlucky 13″% Threat Still Lingers

The XRP price is up about 2.3% in the past 24 hours and has trimmed its weekly losses to under 7%. The bounce looks healthy at first glance, especially after the bottoming signs we tracked earlier this week. But the structure behind this bounce hasn’t improved enough. A critical risk is back on the table

The XRP price is up about 2.3% in the past 24 hours and has trimmed its weekly losses to under 7%. The bounce looks healthy at first glance, especially after the bottoming signs we tracked earlier this week. But the structure behind this bounce hasn’t improved enough.

A critical risk is back on the table — a setup that could push the XRP price down by over 13%.

Momentum Improves, but Volume and Supply Pressure Compete

XRP’s short-term strength starts with On-Balance Volume (OBV). OBV shows whether real volume is entering or leaving the market. XRP’s OBV has finally moved above its short trend line, hinting that buyers are returning.

But this move carries a warning. OBV tried the same breakout on November 18 and failed. That failure triggered a 19% drop between November 18 and November 21.

The latest push above the line is only marginal, not a clean breakout. If it slips again, the same pattern could repeat.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

XRP Faces Trendline Risk:

TradingView

XRP Faces Trendline Risk:

TradingView

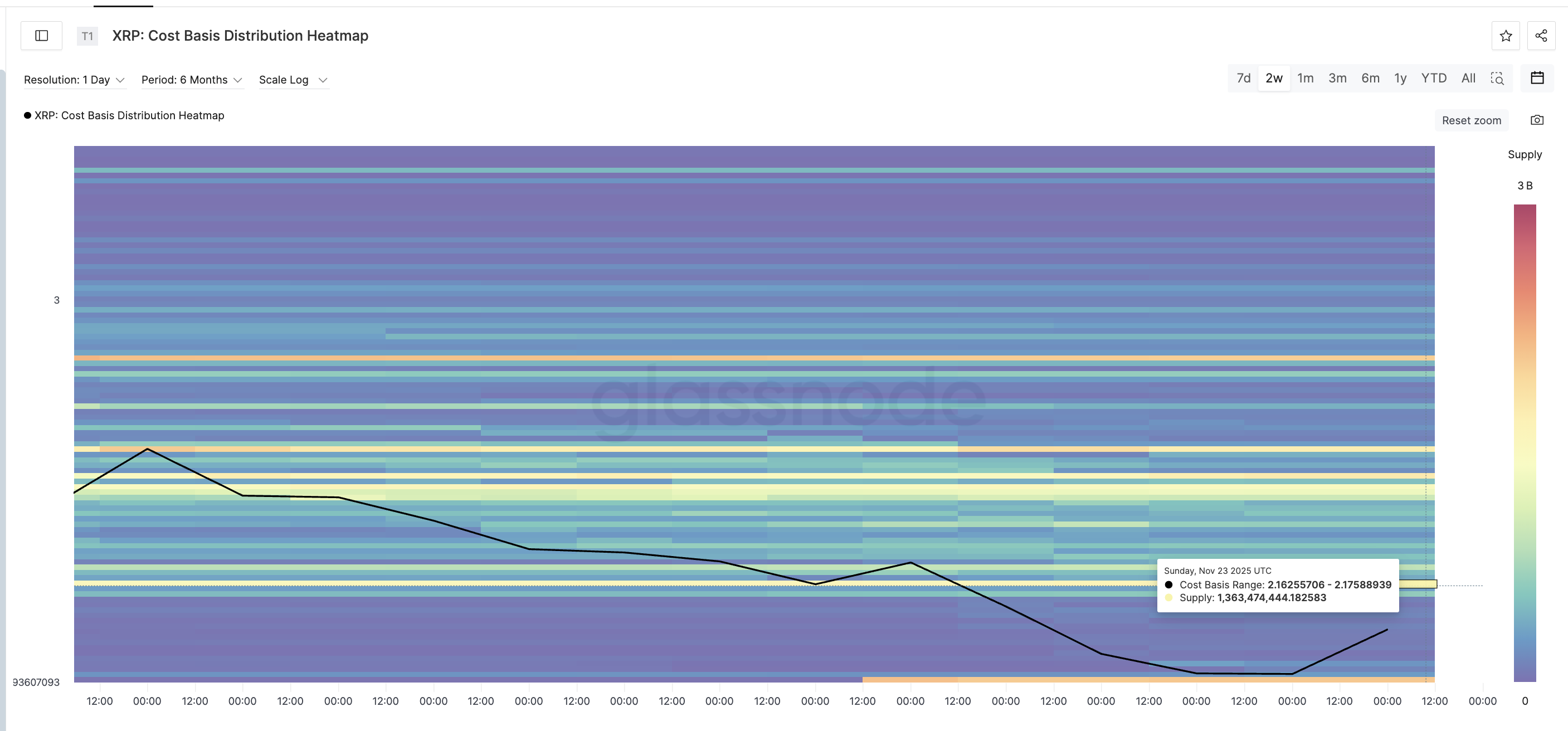

There is also supply pressure overhead. The cost-basis heatmap shows a dense cluster between $2.16 and $2.17, where roughly 1.36 billion XRP sits, worth almost $2.86 billion. These holders sit near breakeven and often sell into small recoveries.

Strong Supply Clusters Sit Overhead:

Glassnode

Strong Supply Clusters Sit Overhead:

Glassnode

If OBV weakens while the XRP price faces this supply zone, the bounce can fade quickly.

Still, OBV moving higher is one of the few positives for now. A decisive break above 6.93 billion on the OBV chart would confirm stronger volume support and improve XRP’s odds of clearing resistance.

XRP Price Action: The Unlucky 13% Risk Still Hangs Over XRP

Even with a mild recovery, the XRP price still trades under the major moving averages. The 100-day exponential moving average (EMA) and the 200-day EMA are both angled down, and the 100-day is now about to cross below the 200-day.

An exponential moving average gives more weight to recent prices, so it reacts faster than a simple moving average. When the 100-day EMA drops under the 200-day EMA, a bearish crossover forms. And it can amplify the downside.

This is the core risk for XRP right now. If the crossover completes, the XRP price could slide toward $1.81, which is the same bottoming zone the recent candles have pointed to. That would be a 13% dip from the current levels. If sellers stay active while the crossover forms, XRP could easily revisit that level. Even the previous OBV breakout failure amplifies the risk of a similar XRP price drop.

XRP Price Analysis:

TradingView

XRP Price Analysis:

TradingView

There is one way out, though!

A clean daily close above $2.25 would weaken the crossover setup. That move would also show buyers breaking through the $2.16–$2.17 supply wall, where about 1.36 billion XRP sit. Holding above $2.25 would allow the 100-day EMA to curl upward again and reduce the crossover impact.

Until that happens, the bearish EMA structure keeps the 13% XRP price downside threat alive, even with OBV turning up.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Robinhood’s 2026 platform seeks to make prediction markets more accessible to everyday investors

- Robinhood acquires 90% of MIAXdx to launch a CFTC-regulated futures/derivatives exchange by 2026, expanding into prediction markets. - The platform reported $9B in prediction market contracts traded by 1M+ users since March 2025, driven by partnerships like Kalshi. - Industry-wide growth sees Kalshi ($4.47B 30-day volume) and Polymarket ($3.58B) competing with crypto-based prediction platforms. - Robinhood aims to democratize speculative trading through fully collateralized products, leveraging MIAXdx's

Mutuum’s Robust DeFi Framework Drives 600% Token Growth and Secures $18.9M in Funding

- Mutuum Finance's MUTM token surged 250% since presale launch, with Phase 6 now 99% sold out ahead of 20% price hike in Phase 7. - The $18.9M raise attracted 18,200+ holders, positioning MUTM as 2025's most subscribed DeFi token with $0.035 current price (600% above initial $0.01). - Halborn's security audit and Sepolia testnet launch in Q4 2025 reinforce credibility, while mtToken-based lending protocol combines pooled liquidity with P2P borrowing. - Strategic features like card purchases and daily rewar

Japan Equips Crypto Exchanges with Conventional Financial Protections

- Japan's FSA mandates crypto exchanges to hold liability reserves from 2026, aligning with traditional financial safeguards after major exchange collapses. - Reserve requirements will be volume-based and incident-adjusted, allowing insurance to offset costs, ensuring immediate user compensation without bailouts. - The reform reclassifies crypto as financial instruments under strict oversight, including audit enhancements and insider-trading bans, mirroring securities firm standards. - Larger exchanges lik

Private Transactions, No Registration Required: ShopinBit's Crypto Concierge Manages International Orders with Complete Privacy

- ShopinBit launched a privacy-focused web app enabling crypto payments for global services using Bitcoin , Monero, USDT, and 2,000+ altcoins via EXOLIX. - The no-account platform offers 2% cashback for early users and handles high-end logistics with a 10% transparent service fee, emphasizing "Ultra Privacy Mode" with no data storage. - Distinguishing itself from competitors like TrustLinq, ShopinBit prioritizes discreet crypto transactions while managing complex orders through EU-based logistics partners.