A 300% Spike in Selling Pressure Could Threaten the Ethereum Price Bounce

Ethereum price bounced almost 10% from this week’s lows near $2,600, and the price is up about 1% today. The move looks positive, but the recovery may not last. Two major bearish signals have emerged simultaneously. Together, they threaten to end the bounce before it grows. Holder Selling Surges 300% as a Death Cross Forms

Ethereum price bounced almost 10% from this week’s lows near $2,600, and the price is up about 1% today. The move looks positive, but the recovery may not last.

Two major bearish signals have emerged simultaneously. Together, they threaten to end the bounce before it grows.

Holder Selling Surges 300% as a Death Cross Forms

Two connected signals now point to deeper weakness.

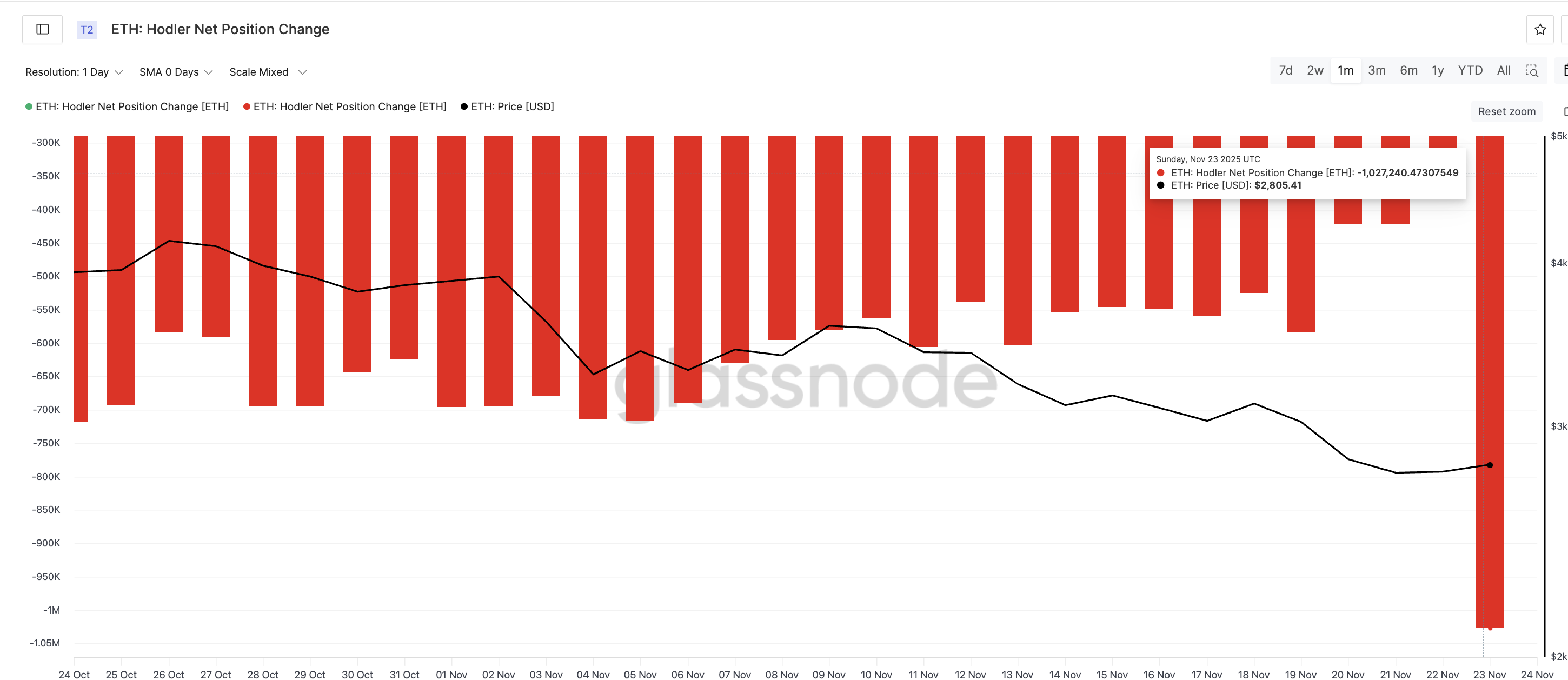

The first comes from long-term investors, often called hodlers. These are wallets that usually hold ETH for more than 155 days. When hodlers increase their selling, it usually shows fear or a shift in long-term belief.

On November 22, net selling from these wallets was about 334,600 ETH. On November 23, it jumped to 1,027,240 ETH — a 300% spike in one day. This is a major exit from long-term holders and adds heavy supply at a time when ETH already trades in a broader downtrend.

ETH Sellers Have The Upper Hand:

Glassnode

ETH Sellers Have The Upper Hand:

Glassnode

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

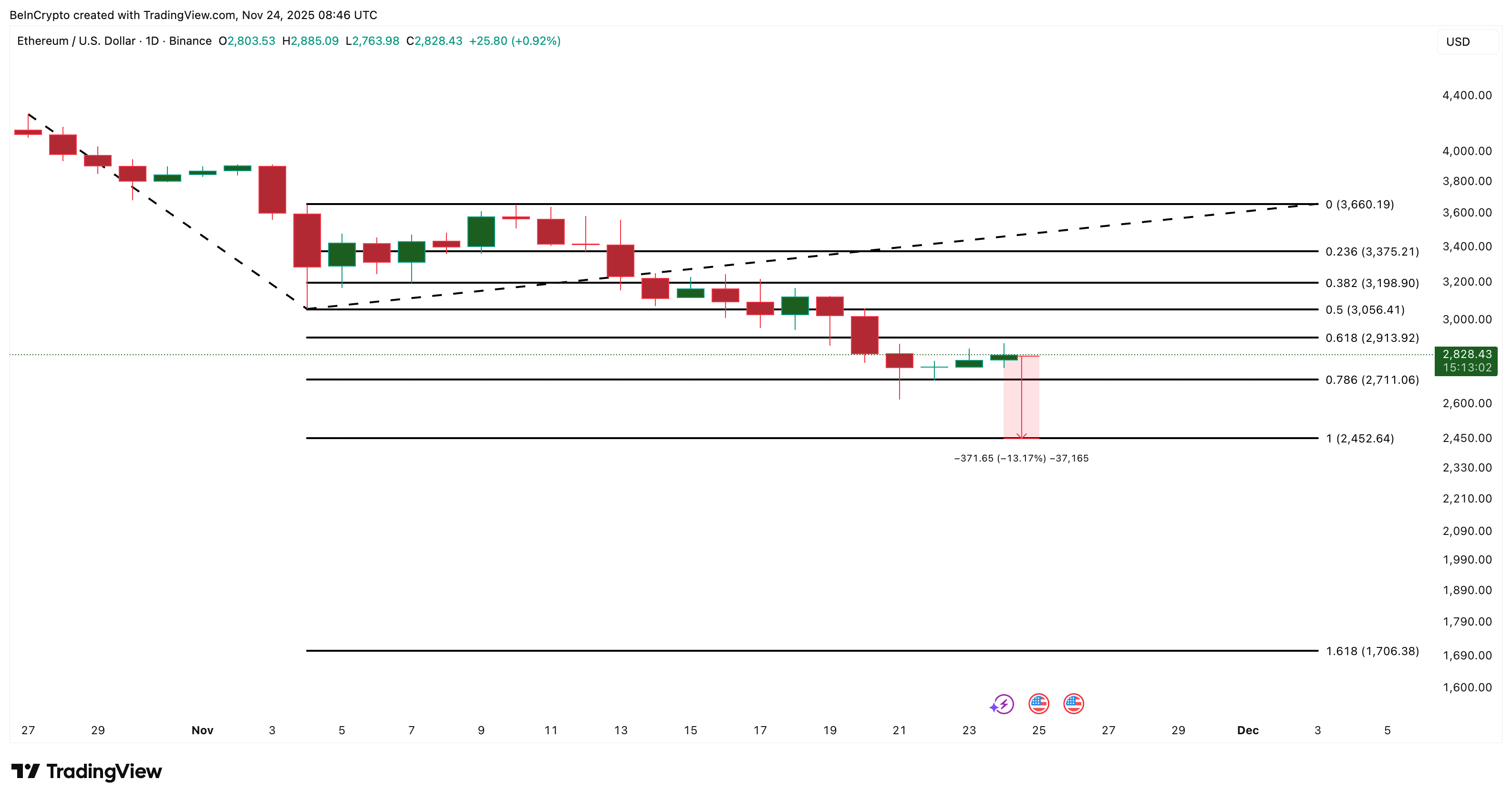

At the same time, a death cross has almost formed. A death cross appears when the 50-day exponential moving average (EMA) drops under the 200-day EMA. An EMA gives more weight to recent prices, so it reacts faster than a simple moving average.

When the 50-day EMA crosses below the 200-day, it signals strong downward momentum. That could hit the ETH prices significantly if the selling pressure continues to rise.

Bearish Risks Build:

TradingView

Bearish Risks Build:

TradingView

Here is the key connection:

Hodler selling is rising sharply at the exact moment the EMA structure is turning bearish. That means the selling pressure is reinforcing the death-cross signal instead of slowing it down. When these two appear together, recoveries usually fail and prices retest lower supports.

Ethereum Price Action: Downside Risk Still Outweighs the Bounce

Ethereum now trades near $2,820, but the chart shows more pressure above than support below.

The first level ETH must defend is $2,710, the 0.786 Fibonacci zone. Losing this level opens a drop toward $2,450, which marks roughly a 13% downside from current levels. If the death cross completes while hodler selling continues, ETH can fall directly toward this level and even under it if the market conditions weaken.

Ethereum Price Analysis:

TradingView

Ethereum Price Analysis:

TradingView

Below $2,452, the next deeper support sits near $1,700 — the broader extension from the descending structure. This only activates if the trend accelerates and sellers remain dominant.

Upside remains limited unless the ETH price can reclaim:

- $3,190, the first meaningful resistance

- $3,660, the stronger ceiling that signals an early trend shift

Under current conditions, hitting these levels looks difficult because both bearish signals — the surge in hodler selling and the death-cross setup — remain active.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Robinhood’s 2026 platform seeks to make prediction markets more accessible to everyday investors

- Robinhood acquires 90% of MIAXdx to launch a CFTC-regulated futures/derivatives exchange by 2026, expanding into prediction markets. - The platform reported $9B in prediction market contracts traded by 1M+ users since March 2025, driven by partnerships like Kalshi. - Industry-wide growth sees Kalshi ($4.47B 30-day volume) and Polymarket ($3.58B) competing with crypto-based prediction platforms. - Robinhood aims to democratize speculative trading through fully collateralized products, leveraging MIAXdx's

Mutuum’s Robust DeFi Framework Drives 600% Token Growth and Secures $18.9M in Funding

- Mutuum Finance's MUTM token surged 250% since presale launch, with Phase 6 now 99% sold out ahead of 20% price hike in Phase 7. - The $18.9M raise attracted 18,200+ holders, positioning MUTM as 2025's most subscribed DeFi token with $0.035 current price (600% above initial $0.01). - Halborn's security audit and Sepolia testnet launch in Q4 2025 reinforce credibility, while mtToken-based lending protocol combines pooled liquidity with P2P borrowing. - Strategic features like card purchases and daily rewar

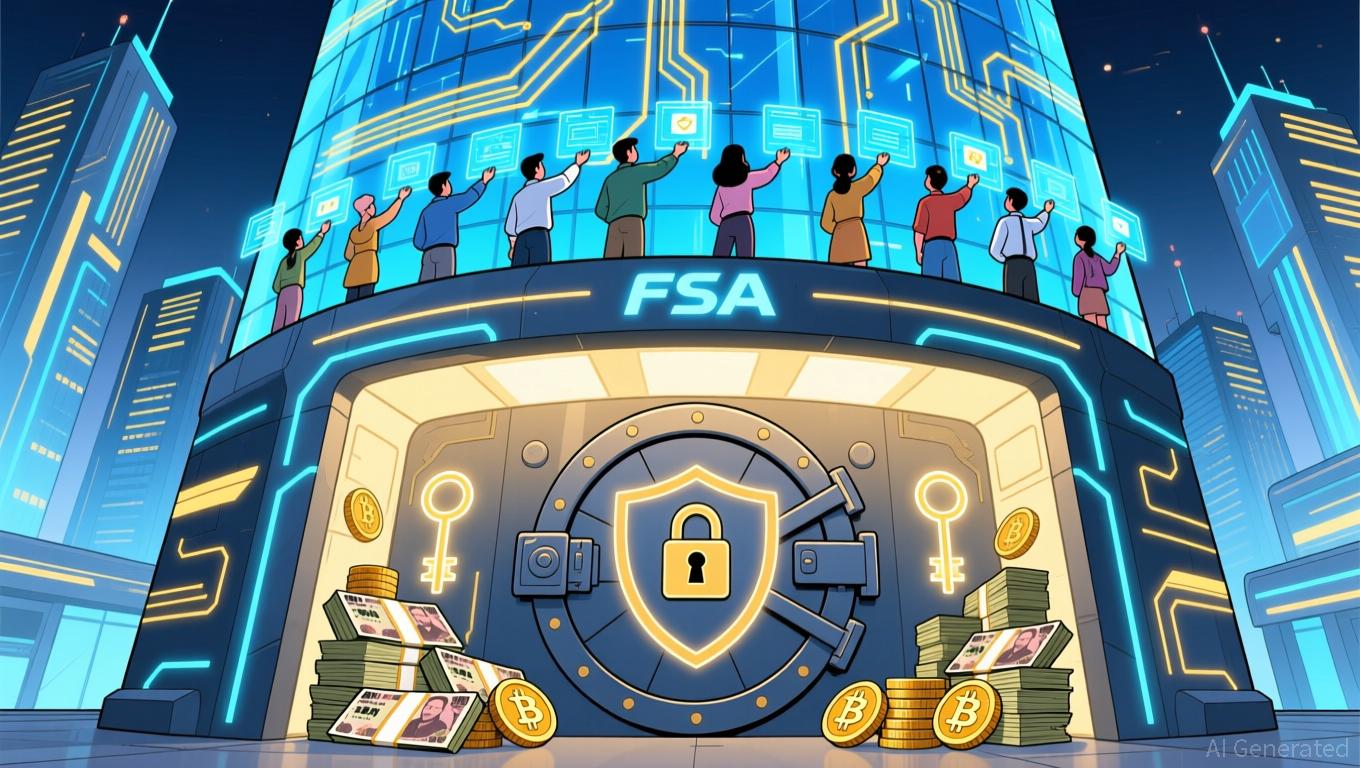

Japan Equips Crypto Exchanges with Conventional Financial Protections

- Japan's FSA mandates crypto exchanges to hold liability reserves from 2026, aligning with traditional financial safeguards after major exchange collapses. - Reserve requirements will be volume-based and incident-adjusted, allowing insurance to offset costs, ensuring immediate user compensation without bailouts. - The reform reclassifies crypto as financial instruments under strict oversight, including audit enhancements and insider-trading bans, mirroring securities firm standards. - Larger exchanges lik

Private Transactions, No Registration Required: ShopinBit's Crypto Concierge Manages International Orders with Complete Privacy

- ShopinBit launched a privacy-focused web app enabling crypto payments for global services using Bitcoin , Monero, USDT, and 2,000+ altcoins via EXOLIX. - The no-account platform offers 2% cashback for early users and handles high-end logistics with a 10% transparent service fee, emphasizing "Ultra Privacy Mode" with no data storage. - Distinguishing itself from competitors like TrustLinq, ShopinBit prioritizes discreet crypto transactions while managing complex orders through EU-based logistics partners.