What Altcoins are showing bullish momentum?

Most of the crypto market is stuck in a defensive crouch. The Fear and Greed Index is sitting at 12, which tells you sentiment is at rock-bottom. But this is where coin-specific catalysts matter more than the macro cycle. Supply shocks, major listings, and ecosystem upgrades can flip the script for individual tokens, even when the market mood is gloomy.

That’s exactly what is happening with altcoins TNSR , PARTI , and DYM . Their rallies aren’t random. They’re tied to real events that shift token economics, demand drivers, and long-term expectations.

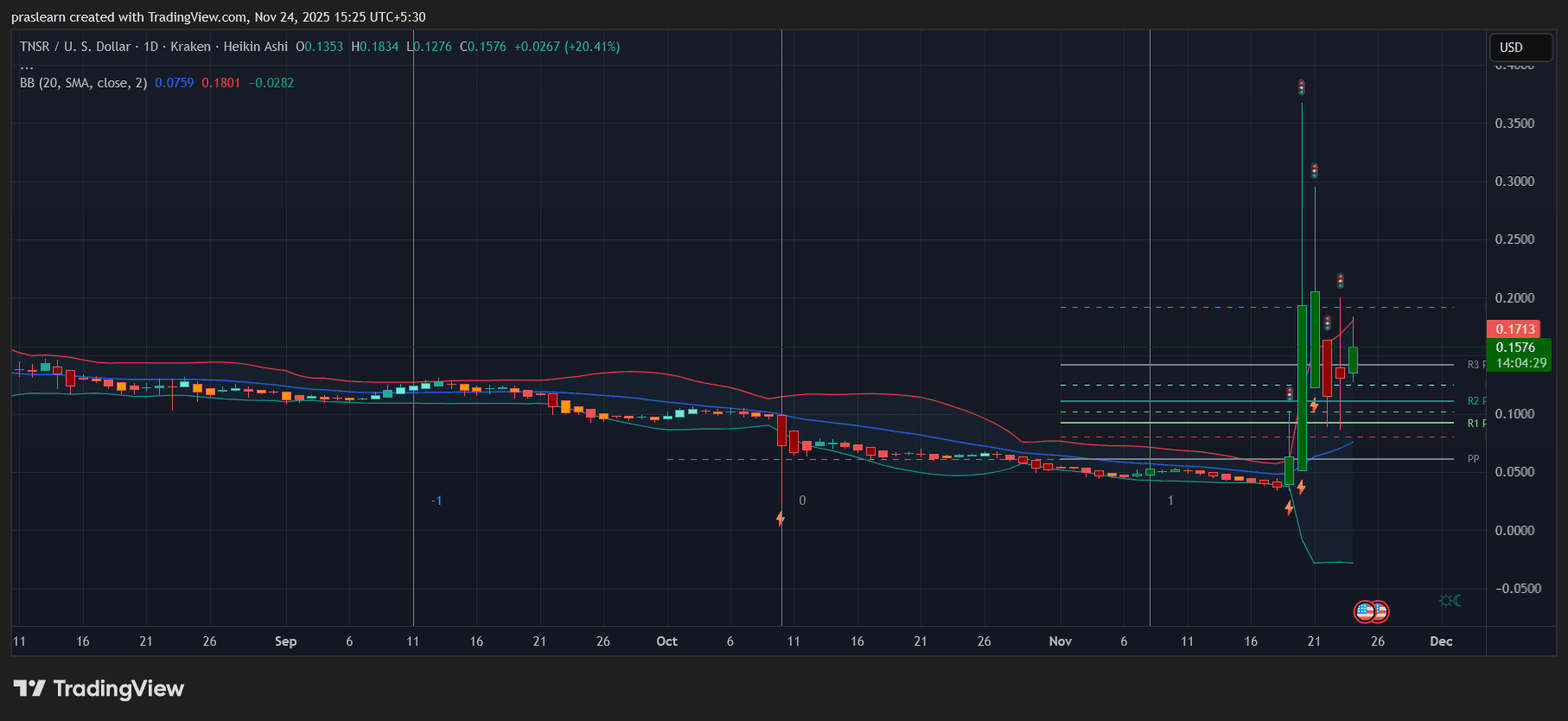

Tensor (TNSR): A Supply Shock Meets Coinbase Muscle

TNSR/USD Daily Chart- TradingView

TNSR/USD Daily Chart- TradingView

Tensor exploded more than 74 percent in a single day and over 300 percent across the week. The spark was Coinbase acquiring Vector, a Solana trading platform deeply linked to Tensor’s ecosystem. That acquisition triggered a 21.6 percent token supply burn and locked the founders’ tokens until 2028. This kind of supply reduction always catches traders’ attention, but pairing it with a top-tier exchange’s involvement amplified the effect.

The volume tells the story: $1.07B traded in 24 hours, with RSI flying above 90. That’s aggressive buying, but also a warning sign. When momentum gets this overheated, you usually see a pullback. The real test is whether TNSR can defend the $0.17 support zone once the dust settles. If it holds, the supply burn narrative can sustain another leg up. If it breaks, the post-acquisition euphoria may deflate quickly.

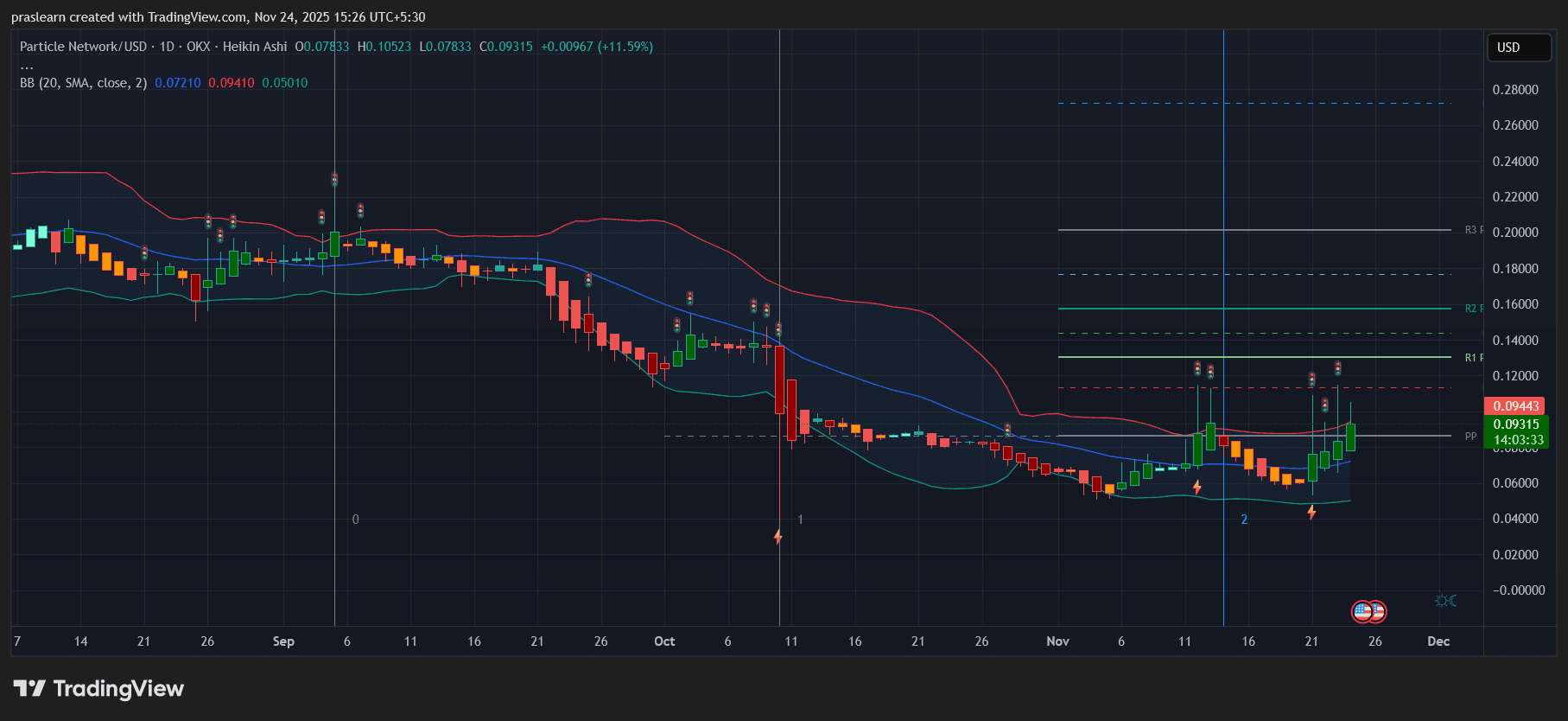

Particle Network (PARTI): Real Utility Starts Showing

PARTI/USD Daily Chart- TradingView

PARTI/USD Daily Chart- TradingView

Particle Network isn’t moving because of hype. Its breakout—over 50 percent in 24 hours—tracks directly to two tangible drivers: a KRW listing on Bithumb and the Universal SDK launch. KRW listings almost always bring fresh liquidity from Korea, and we saw that immediately with volume jumping more than 300 percent.

The bigger story though is chain abstraction. Developers finally have a clearer path to building cross-chain apps without dealing with the usual connectivity headaches. The RSI at 77 shows momentum is strong but not wild. The key question is whether PARTI can keep the $0.20 to $0.22 support band intact. If it does, the token decouples further from broader market trends and turns into a pure utility play rather than a speculative pump.

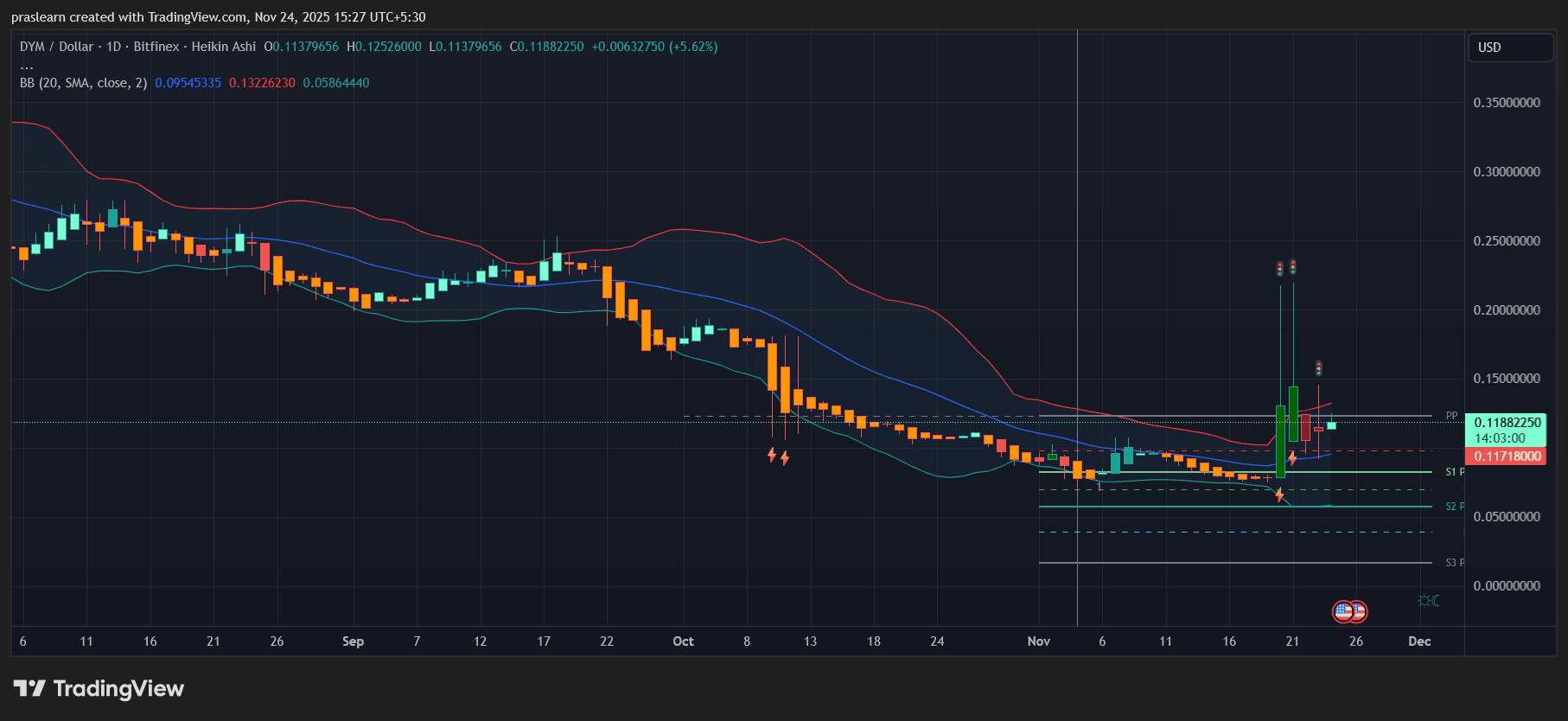

Dymension (DYM): Tech Upgrades That Actually Matter

DYM/USD Daily Chart- TradingView

DYM/USD Daily Chart- TradingView

Dymension’s move is tied to fundamentals rather than hype cycles. The Beyond upgrade is a genuine architecture shift, cutting block times to a single second. Pair that with a steady weekly burn of 115,000 tokens and you get a mix of speed, scarcity, and growing use cases.

The market rewarded that. DYM is up more than 34 percent in 24 hours and nearly 54 percent across the week. The bullish MACD crossover reinforces the momentum, but the bigger picture sits in the RollApps ecosystem and the eye-catching 50 percent APY staking rewards. Traders will want to watch how fast new RollApps come online and how quickly the upgrade drives real adoption. That will decide whether DYM breaks into a sustained growth cycle.

So What Happens Next?

When the crypto market is fearful, altcoins usually fall into two categories: hype-driven spikes that fade quickly or structurally strong moves backed by catalysts. TNSR, PARTI, and DYM land in the second group. Each has a driver that isn’t tied to general market sentiment: a supply shock, a major listing with real utility, and a core protocol upgrade.

The predictive angle comes down to two checkpoints:

- Do they sustain their volumes above key moving averages? If volume collapses, momentum breaks.

- Do roadmap events deliver what traders are pricing in? Token burns, SDK launches, and L1 upgrades only matter if adoption follows.

Right now, $TNSR is the most vulnerable to a sharp correction because RSI overheating rarely ends gently. $PARTI looks the most stable if it protects its new support zone. $DYM sits in the middle but has the strongest long-term story tied to its ecosystem expansion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Exploring New Challenges in Cryptocurrency Portfolio Management

- 2025 crypto landscape balances innovation with rising token scams, driving stricter regulatory enforcement and operational safeguards. - DOJ/SEC actions against fraudsters like Roger Ver and ByBit hackers, plus UK FCA sandboxes, highlight global accountability trends. - Blockchain analytics tools (TRM Labs, Chainalysis) enable real-time AML/KYC compliance and $2.17B+ stolen fund recovery through AI-driven monitoring. - FINRA/Georgetown and university programs build crypto literacy, while Kryptosphere-Del

COAI Price Reduction and Its Impact on Clean Energy Markets

- COAI Index's 88% November 2025 drop exposed crypto AI and clean energy market vulnerabilities, triggered by C3.ai's leadership crisis and $116.8M Q1 loss. - Regulatory ambiguity from the CLARITY Act and corporate governance failures forced capital flight to stable AI infrastructure stocks like Celestica (5.78% weekly gain). - U.S. clean energy investment fell 36% in H1 2025 due to policy uncertainty, contrasting with Europe's $30B offshore wind surge amid Trump-era fossil fuel/nuclear shifts. - CCUS, blu

DASH rises 20.24% in a day amid insider selling and growth strategy announcements

- DoorDash executives sold shares via prearranged Rule 10b5-1 plans, including $2.7M by CFO Ravi Inukonda and $4.6M by President Prabir Adarkar. - Sales occurred amid strategic expansion plans, including DashPass enhancements and global food delivery partnerships to strengthen market leadership. - DASH shares rose 20.24% in 24 hours despite insider sales, with institutional investors adding 53,632 shares as confidence in expansion persists. - Analysts maintain positive outlooks (avg. $275.62 target), thoug

Bitcoin News Update: Nasdaq's IBIT Options Growth Signals Bitcoin's Entry into Institutional Mainstream

- Nasdaq proposes raising IBIT options limits to 1M contracts, aligning Bitcoin with top-tier assets like Apple and Microsoft . - BlackRock's IBIT now manages $65.34B in assets, dominating 69% of Bitcoin ETF volume with $157B+ market cap. - Texas and Abu Dhabi's $5M IBIT investments highlight growing institutional adoption, with Abu Dhabi tripling holdings in Q3 2025. - Analysts predict Bitcoin could reach $100K by 2026 as derivatives expansion enables hedging and reduces volatility.