Satoshi Nakamoto Loses $43 Billion as Bitcoin Price Falls Over 30%

Satoshi Nakamoto’s legendary Bitcoin fortune has dropped by an estimated $41 billion, as BTC’s price slid more than 30% from its all-time high. The pseudonymous creator’s 1.1 million Bitcoin, tracked using the Patoshi mining pattern, fell from $138 billion in October to about $96 billion as of this writing. This sharp decline moved Satoshi from

Satoshi Nakamoto’s legendary Bitcoin fortune has dropped by an estimated $41 billion, as BTC’s price slid more than 30% from its all-time high.

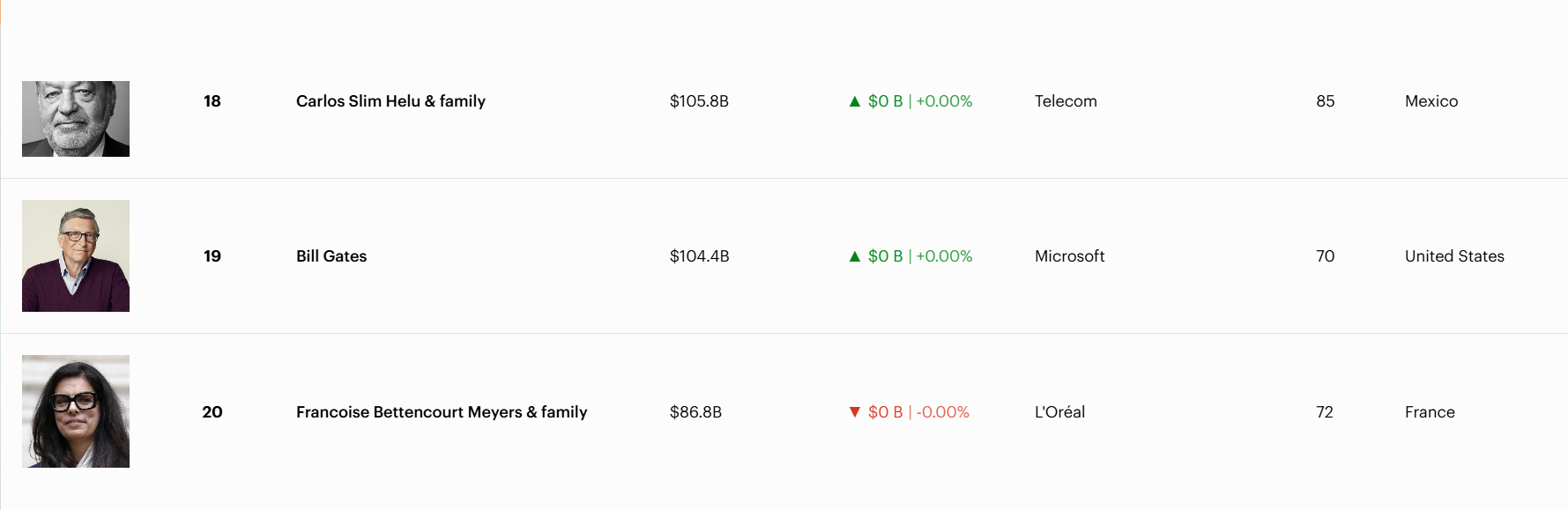

The pseudonymous creator’s 1.1 million Bitcoin, tracked using the Patoshi mining pattern, fell from $138 billion in October to about $96 billion as of this writing. This sharp decline moved Satoshi from 11th to around 20th among the world’s wealthiest people, now just below Bill Gates.

BTC Price Crashed, But What Happened to Satoshi’s Bitcoin Stash

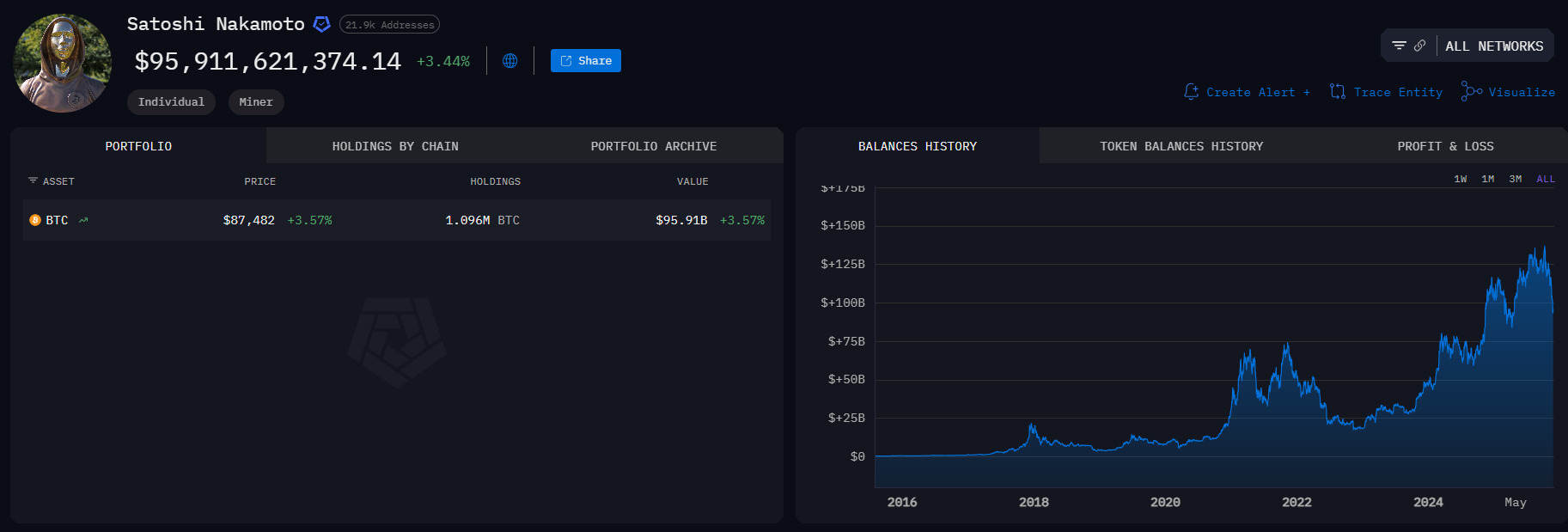

Arkham Intelligence, a blockchain analytics firm, estimates Satoshi’s Bitcoin using mining analysis and on-chain forensics.

The “Patoshi Pattern,” discovered by Sergio Lerner, identifies more than 22,000 early addresses likely controlled by one entity, widely believed to be Satoshi Nakamoto. These coins, untouched for over a decade, continue to fuel intense speculation.

As of October 6, 2025, when the pioneer crypto established an all-time high of $126,296, Satoshi’s Bitcoin stash was valued at $138.92 billion. However , Bitcoin’s price has since dropped by over 30% to trade for $87,390 as of this writing.

Bitcoin (BTC) Price Performance. Source:

Bitcoin (BTC) Price Performance. Source:

With this drop, Satoshi’s Bitcoin stash has shrunk to $96.129 billion, meaning $42.79 billion of this fortune disappeared in weeks.

If Forbes listed Satoshi among the list of the world’s richest people, the Bitcoin founder would rank just below Bill Gates and right above Françoise Bettencourt Meyers & family at position 20.

Satoshi’s Place Among Richest People in the World. Source:

Satoshi’s Place Among Richest People in the World. Source:

Despite the vast scale of Satoshi’s holdings, Forbes and other wealth trackers do not count the Bitcoin founder in their official billionaire lists. The reasons include Satoshi’s unverified legal status and the fact that the assets have remained dormant, leaving ownership questions unresolved.

“Forbes does not include Satoshi Nakamoto on our Billionaire rankings because we have not been able to verify whether he or she is a living person, or one person vs. a collective group of people,” the magazine told BeInCrypto.

Ironically, Satoshi’s coins remain among the most visible fortunes due to the blockchain’s transparency.

Satoshi’s Bitcoin Holdings. Source:

Satoshi’s Bitcoin Holdings. Source:

Some experts suggest Forbes and others should consider including pseudonymous crypto wallets in their lists, even though ownership is anonymous.

Nonetheless, the long-term dormancy has also led to speculation that the fortune could be lost, inaccessible, or deliberately abandoned, an unusual scenario among billionaires.

Quantum Threats and Satoshi’s Secret

Elsewhere, the rise of quantum computing has renewed debate about Satoshi’s future and potential identity. Because quantum computers might one day break early Bitcoin cryptography, some experts propose freezing Satoshi’s coins or forking the network before a possible “Q-Day.” If these risks emerge, the controller of these coins may need to surface.

Important not to scaremonger here about quantum timelines.Running Shor's algorithm is not the same thing as breaking an actual 256-bit ECC key. You can use Shor's algorithm to factor a number—that will be impressive—but will take a huge degree of scaling and engineering to…

— Haseeb >|< (@hosseeb) November 18, 2025

Nakamoto’s enigma will reach a global audience in 2026 with “Killing Satoshi,” a film exploring the mystery and geopolitical implications of dormant Bitcoin wealth.

Until these coins are moved or declared lost, Satoshi’s fortune remains a symbol of Bitcoin’s origins and its greatest secret.

If Bitcoin surges to $320,000–$370,000, Satoshi could become the world’s richest person. For now, the fortune remains unchanged for over 15 years, highly visible, but untouched.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: Privacy First: Buterin Backs Messaging’s Fundamental Transformation

- Vitalik Buterin donates 128 ETH ($390K) to Session and SimpleX to advance metadata privacy and permissionless design. - Platforms use decentralized infrastructure and cryptographic IDs to protect communication metadata, resisting censorship and AI surveillance risks. - Donation counters regulatory threats like EU's Chat Control while promoting privacy-focused innovation in encrypted communication. - Experts emphasize permissionless account creation as critical for digital freedom, despite trade-offs like

Bitcoin News Update: Growing Optimism Faces ETF Withdrawals: The Delicate Balance of Crypto Stability

- Crypto markets show fragile stabilization as Fear & Greed Index rises to 20, but Bitcoin remains 30% below October peaks amid $3.5B ETF outflows. - Stablecoin market cap drops $4.6B and on-chain volumes fall below $25B/day, weakening Bitcoin's liquidity absorption capacity. - Select altcoins like Kaspa (22%) and Ethena (16%) gain traction while BlackRock's IBIT returns $3.2B profits, signaling mixed institutional confidence. - Technical indicators suggest tentative support at $100,937 for Bitcoin, but So

BCH Rises 0.09% as Momentum Fuels Outperformance

- BCH rose 0.09% in 24 hours but fell 4.22% in seven days, yet gained 22.72% annually. - It outperformed its Zacks Banks - Foreign sector with 0.66% weekly gains vs. -2.46% industry decline. - Earnings estimates rose twice in two months, boosting consensus from $2.54 to $2.56. - With a Zacks Rank #2 (Buy) and Momentum Score B, BCH shows strong momentum potential. - Annual 63.46% gains and positive revisions solidify its position as a top momentum stock.

DOGE drops 1.36% as Bitwise ETF debuts

- Bitwise launched the first Dogecoin ETF (BWOW) on NYSE, offering institutional-grade exposure to the memecoin. - DOGE fell 1.36% in 24 hours but rose 7.34% weekly, reflecting mixed short-term market sentiment. - The ETF aligns with growing institutional adoption and regulatory momentum for altcoins, despite a 52.35% annual decline. - Similar products like Bonk’s ETP and Ethereum upgrades highlight maturing crypto infrastructure and investor demand.