Ethereum’s Recovery to $3,000 Could Be Challenged by New Holders

Ethereum has struggled to recover from its recent dip, with the altcoin king attempting to regain momentum after slipping below key levels. While ETH has strong support from long-term holders, the recovery still requires fresh investment. That inflow of new capital, however, appears limited at the moment, creating uncertainty around Ethereum’s next move. Ethereum Holders

Ethereum has struggled to recover from its recent dip, with the altcoin king attempting to regain momentum after slipping below key levels. While ETH has strong support from long-term holders, the recovery still requires fresh investment.

That inflow of new capital, however, appears limited at the moment, creating uncertainty around Ethereum’s next move.

Ethereum Holders Have Mixed Feelings

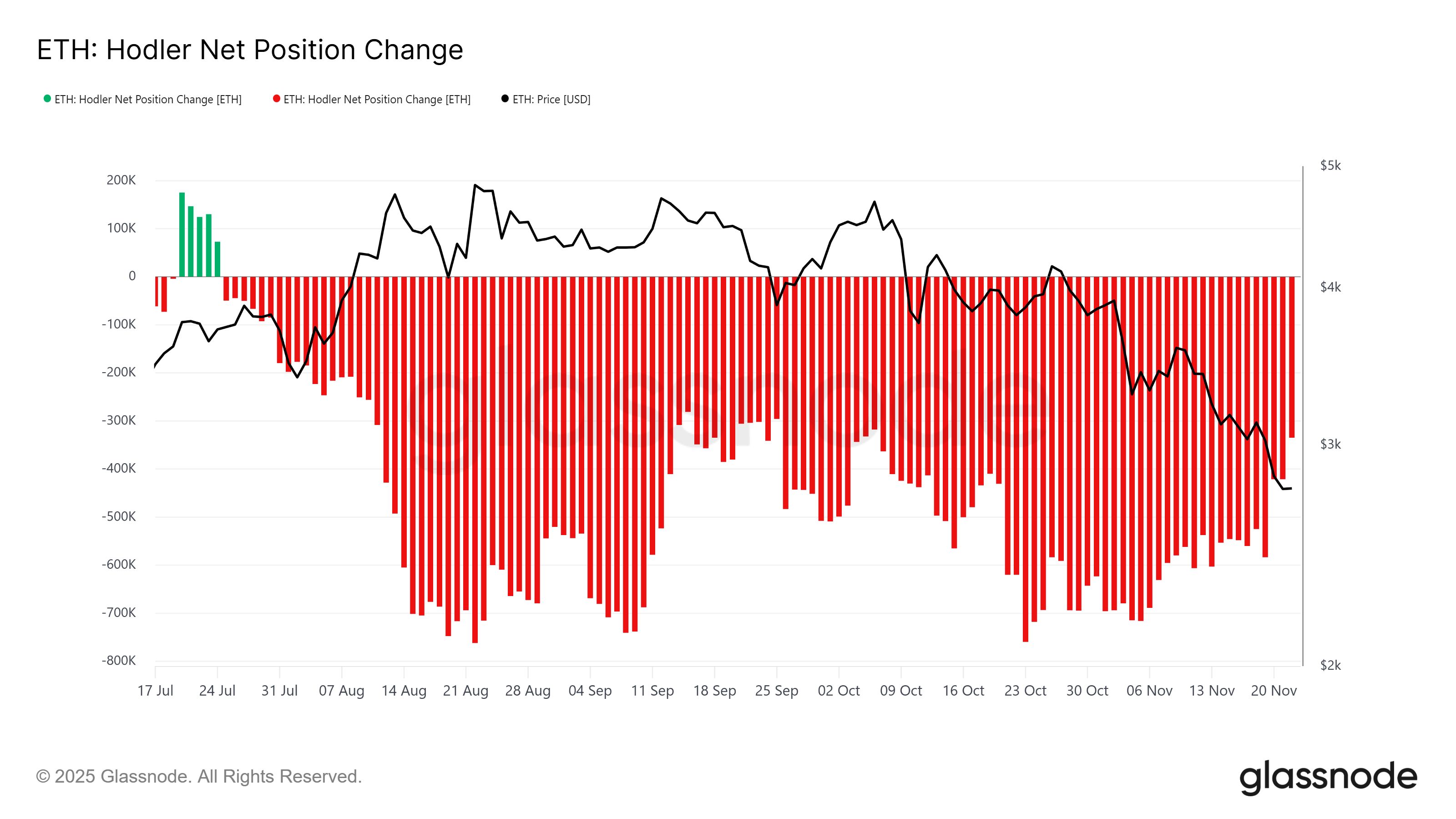

The HODLer Net Position Change indicator is showing a steady incline, signaling improving confidence among long-term holders. This metric measures the movement of ETH within LTH wallets, and the current rise from the negative zone suggests that outflows are slowing. Historically, a shift like this often precedes renewed accumulation.

As long-term holders reduce selling, the market gains stability. Their conviction in Ethereum’s recovery strengthens the asset’s foundation even during volatile conditions.

If this trend continues, LTHs may soon transition from holding to accumulating, providing meaningful support for ETH’s next upward push.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Ethereum HODLer Net Position Change. Source:

Glassnode

Ethereum HODLer Net Position Change. Source:

Glassnode

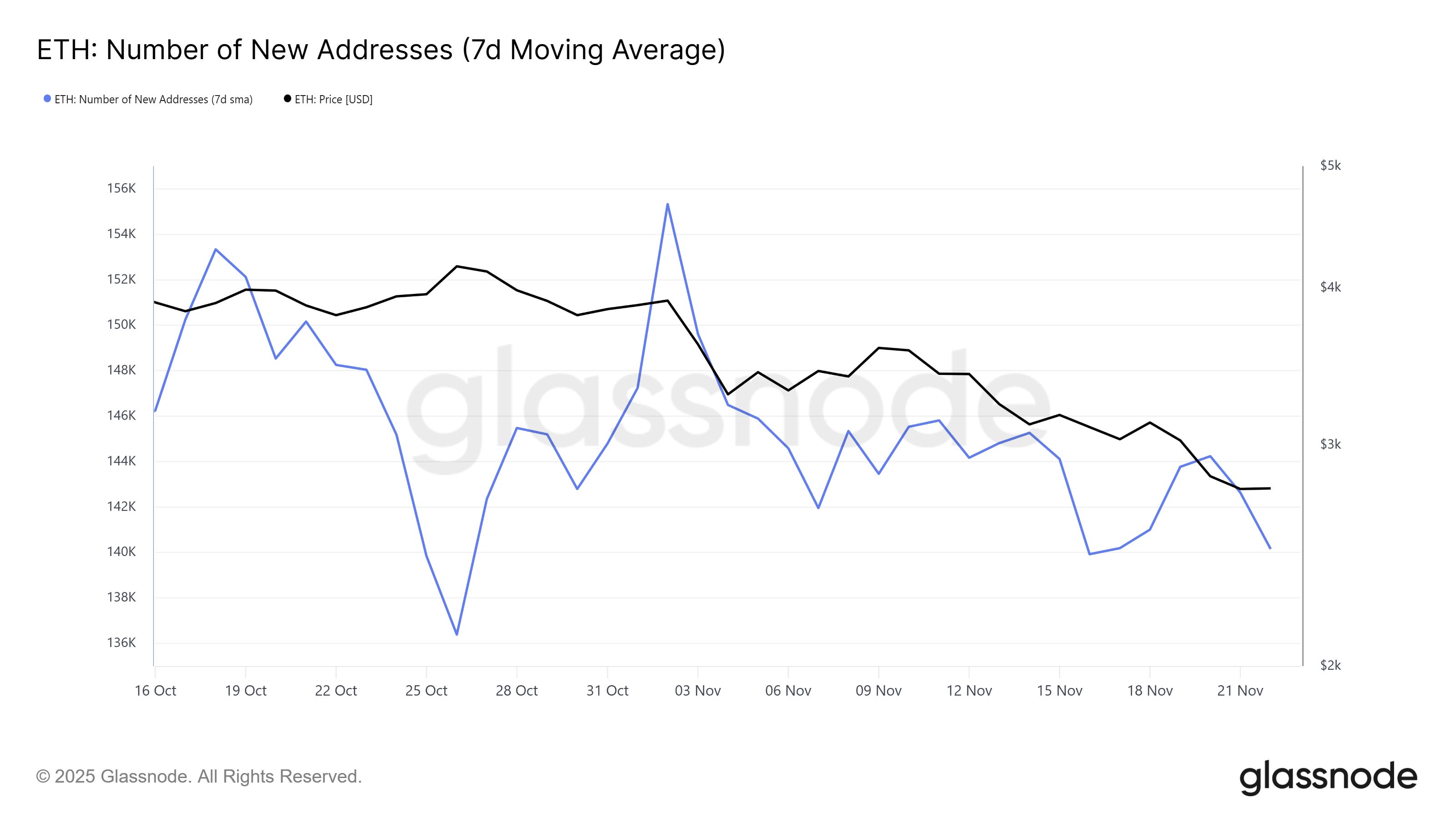

Despite improving sentiment from long-term holders, broader macro momentum remains mixed. The number of new Ethereum addresses is moving sideways, indicating weak interest from potential new investors.

This stagnation is concerning because fresh demand is a critical component of sustained price recovery.

Without an increase in new market participants, inflows may not be strong enough to propel ETH toward the $3,000 mark. Even with solid support from existing holders, a lack of external capital could delay or weaken any meaningful rally.

Ethereum New Addresses. Source:

Glassnode

Ethereum New Addresses. Source:

Glassnode

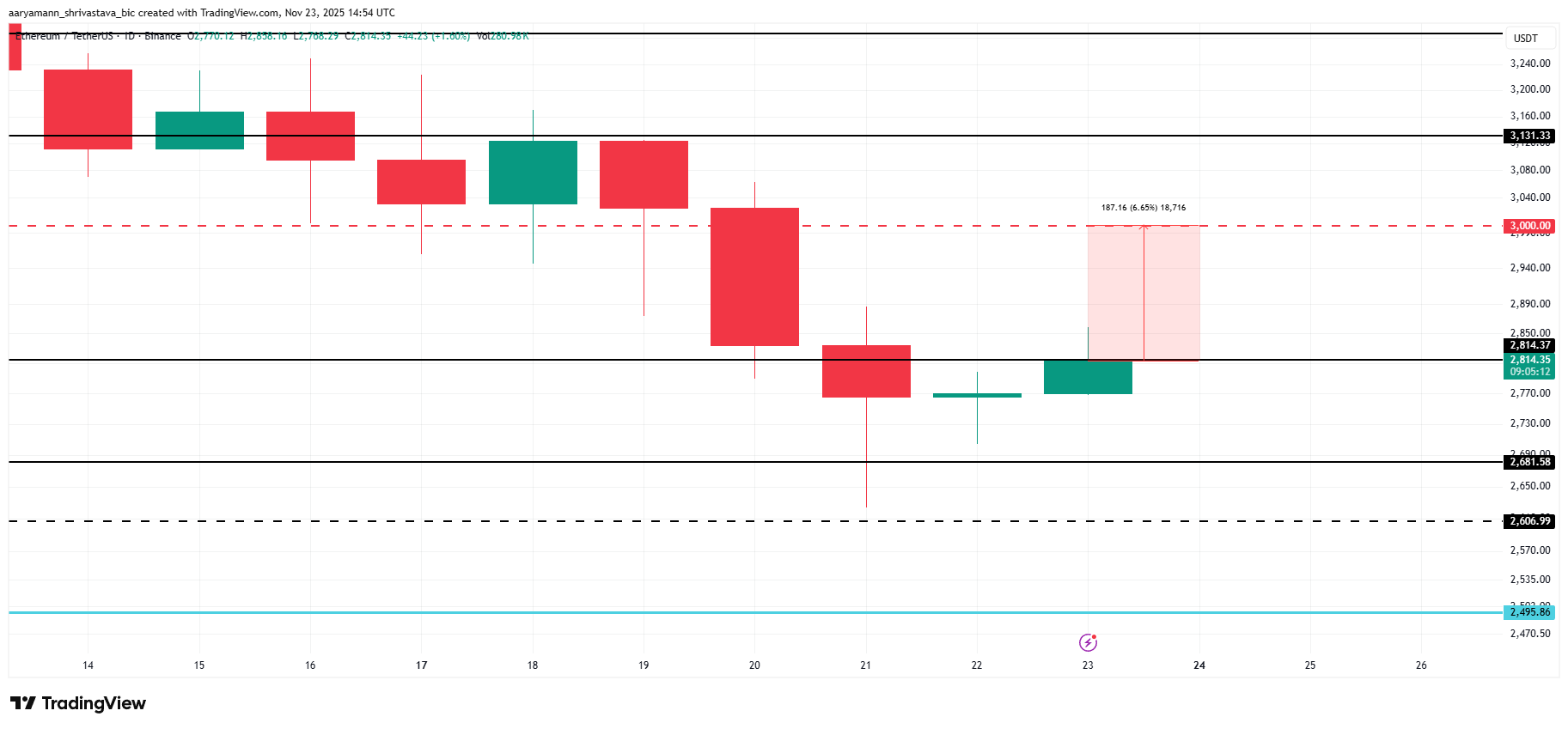

ETH Price Needs To Recover

Ethereum is trading at $2,814, sitting directly beneath a key resistance level. At this distance, ETH is just 6.6% away from reclaiming $3,000, a psychologically significant barrier for both traders and long-term investors.

For Ethereum to reach this threshold, support from new investors is essential. If new demand remains weak, ETH may consolidate below $3,000 as existing capital alone may not be sufficient to drive an extended rally. The altcoin king needs broader participation to sustain a breakout.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

If inflows improve and new investors re-engage, Ethereum could rally to $3,000 and attempt to flip the level into support. Successfully reclaiming this zone may pave the way for $3,131 or higher. This would invalidate the bearish outlook and restore bullish momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Russia Moves Away From The Dollar With Yuan Bond Issuance

Blockchain’s Backbone Reinvented: Avail Connects Disparate Chains through Nexus

- Avail's Nexus Mainnet launches as a cross-chain execution layer to unify liquidity across Ethereum , BNB Chain, and other major blockchains. - Its intent-solver architecture optimizes transaction routing with multi-source liquidity, enabling seamless asset and user movement between chains. - Projects like Lens Protocol and Vanna Finance adopt Nexus for unified collateral management, using the AVAIL token ($0.0080) for governance and coordination. - Avail plans to expand Infinity Blocks to 10 GB per block

Bitcoin News Update: Will Strategy's 71-Year Bitcoin Reserve Withstand Industry Volatility?

- Bitcoin treasury firm Strategy claims 71-year dividend sustainability with $56B Bitcoin holdings, even if prices stagnate at $87,000. - Industry faces instability from JP Morgan boycotts and MSCI's 2026 index exclusion plan, risking automatic crypto sell-offs. - Strategy's 5.9x asset-to-debt ratio and Nasdaq 100 inclusion contrast with peers selling Ethereum reserves amid liquidity pressures. - Market debates long-term viability as Saylor insists on "HODL" strategy, but prolonged Bitcoin declines below $

Bitcoin News Update: Crypto Downturn Intensifies as Technical Indicators and Economic Factors Combine Against Bullish Sentiment

- Bitcoin faces bearish pressure with MACD sell signals and price below key EMAs, risking a 10% drop to $83,111 if support fails. - Ethereum's death cross pattern and XRP's weak technical structure highlight vulnerability near $3,000 and $2.00 support levels. - Macroeconomic uncertainty over Fed rate cuts and ETF outflows amplify downward pressure on crypto markets. - Bitcoin ETFs show fragile recovery with $74M inflow, while Ethereum ETFs face sustained outflows and bearish sentiment. - Speculative intere