Dogecoin Is Overvalued, But Monday Could Flip the Script

Dogecoin has been sliding over the past several days as bearish sentiment spreads across the broader crypto market. Despite the decline, the meme coin is currently overvalued due to heightened speculation surrounding the upcoming launch of Grayscale’s Dogecoin ETF (GDOG). This hype may translate into substantial transaction volume on Monday, potentially reshaping DOGE’s short-term outlook.

Dogecoin has been sliding over the past several days as bearish sentiment spreads across the broader crypto market. Despite the decline, the meme coin is currently overvalued due to heightened speculation surrounding the upcoming launch of Grayscale’s Dogecoin ETF (GDOG).

This hype may translate into substantial transaction volume on Monday, potentially reshaping DOGE’s short-term outlook.

Dogecoin Investors Provide Support

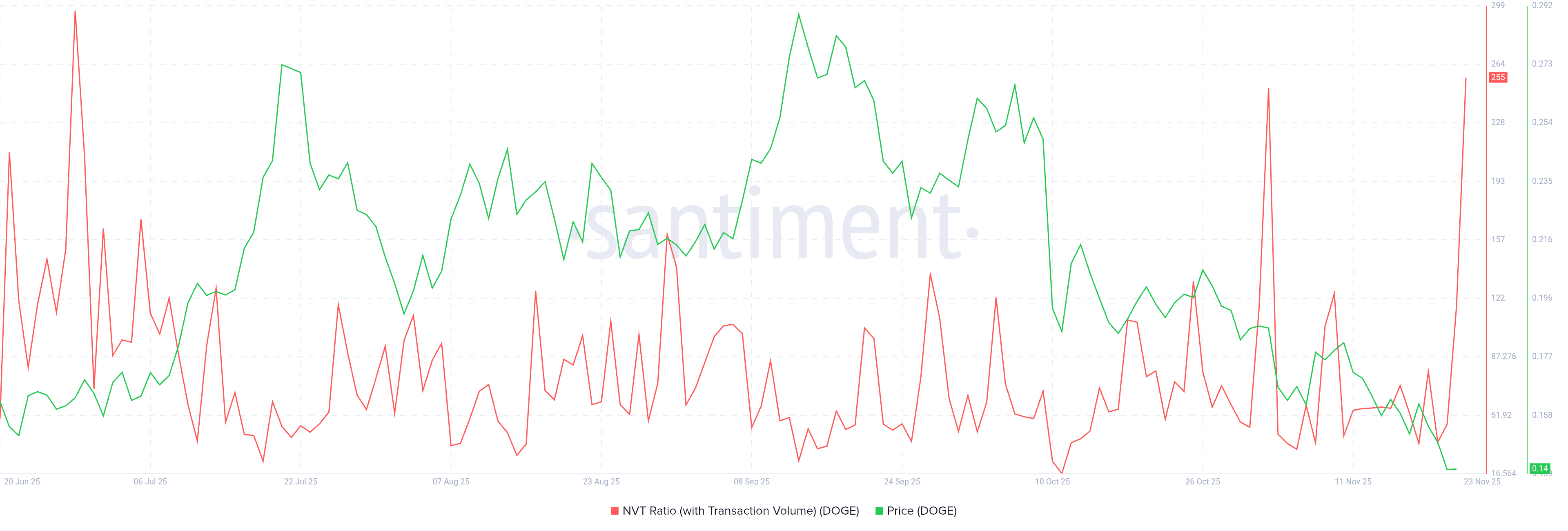

Dogecoin’s NVT Ratio is spiking sharply, signaling a disconnect between valuation and on-chain activity.

The ratio compares market capitalization with transaction volume, and a surge typically indicates limited transactional utility relative to price. While DOGE is attracting strong social attention and broad support, its actual transaction levels are not keeping pace.

This mismatch can often lead to overvaluation, which in bearish conditions may trigger a drop.

However, the timing of this spike aligns with the anticipated launch of Grayscale’s Dogecoin ETF. The ETF is expected to draw notable capital inflows, which could reset the NVT Ratio and restore balance between price and on-chain activity.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Dogecoin NVT Ratio:

Santiment

Dogecoin NVT Ratio:

Santiment

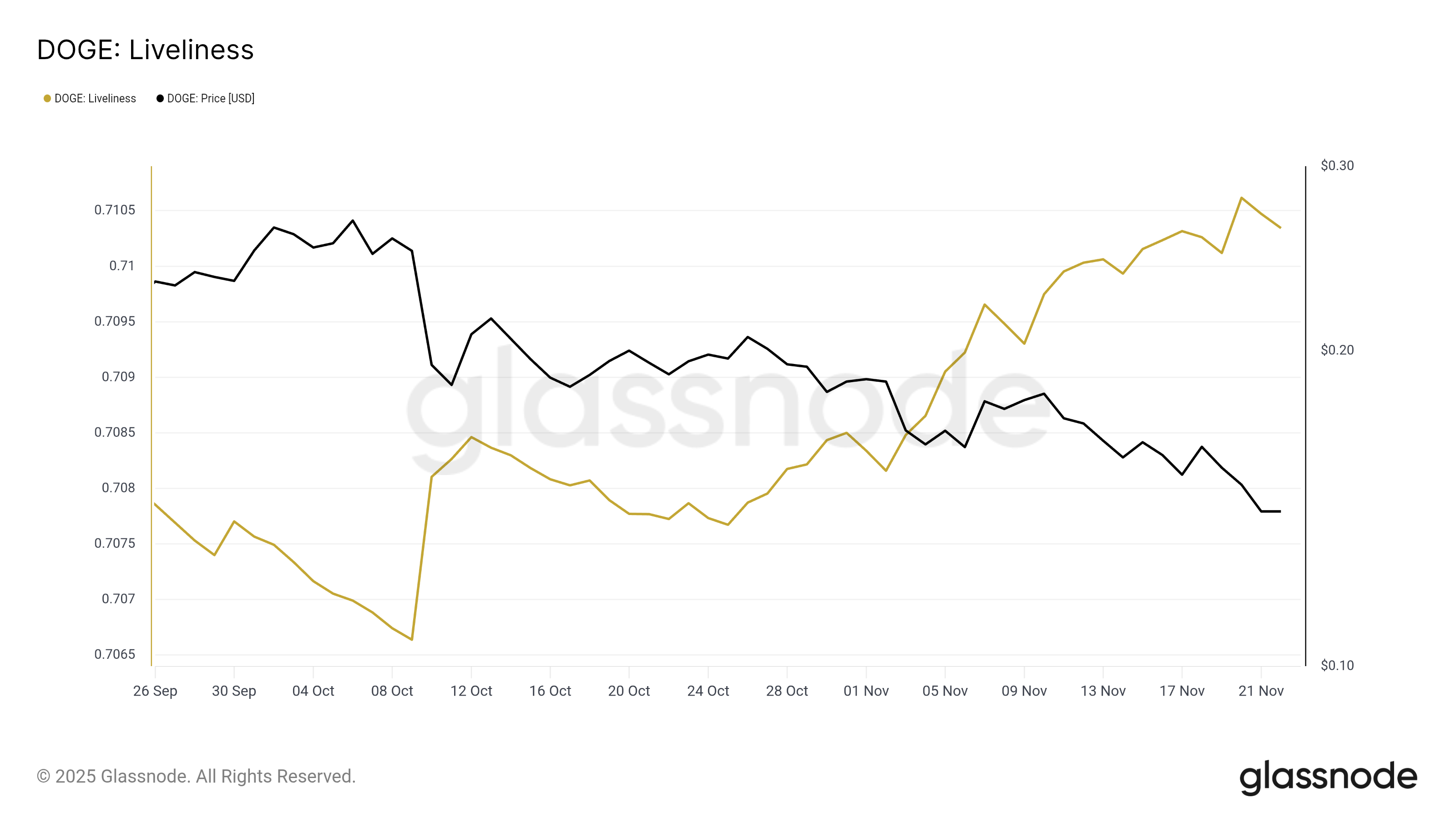

Macro indicators also paint an encouraging picture. Dogecoin’s Liveliness metric has been rising for several days, indicating increased HODLing behavior among long-term holders.

Liveliness rises when coins remain dormant for longer periods rather than being spent, suggesting that key holders are protecting their positions.

This trend is particularly important during downturns. Long-term holders often act as the backbone of price stability, resisting volatility caused by short-term traders.

Their continued conviction reduces the risk of abrupt sell-offs and shows confidence in Dogecoin’s ability to recover once market conditions shift.

Dogecoin Liveliness. Source:

Glassnode

Dogecoin Liveliness. Source:

Glassnode

DOGE Price Could Shoot Up

Dogecoin is trading at $0.143 and holding near the $0.142 support level. The meme coin remains trapped under a month-long downtrend that it has repeatedly failed to break. Current bearish conditions make recovery difficult without a significant catalyst.

The launch of the DOGE ETF could provide that catalyst. A successful debut may lift DOGE above $0.151, opening the path toward $0.165. A move of this scale would invalidate the downtrend and signal a shift in momentum supported by new inflows.

DOGE Price Analysis. Source:

TradingView

DOGE Price Analysis. Source:

TradingView

If the ETF hype fails to translate into buying pressure, Dogecoin could extend its decline. A drop toward $0.130 remains possible.

But if DOGE does not face a drop this sharp, it may continue struggling beneath the $0.151 resistance, prolonging the ongoing downtrend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Russia Moves Away From The Dollar With Yuan Bond Issuance

Blockchain’s Backbone Reinvented: Avail Connects Disparate Chains through Nexus

- Avail's Nexus Mainnet launches as a cross-chain execution layer to unify liquidity across Ethereum , BNB Chain, and other major blockchains. - Its intent-solver architecture optimizes transaction routing with multi-source liquidity, enabling seamless asset and user movement between chains. - Projects like Lens Protocol and Vanna Finance adopt Nexus for unified collateral management, using the AVAIL token ($0.0080) for governance and coordination. - Avail plans to expand Infinity Blocks to 10 GB per block

Bitcoin News Update: Will Strategy's 71-Year Bitcoin Reserve Withstand Industry Volatility?

- Bitcoin treasury firm Strategy claims 71-year dividend sustainability with $56B Bitcoin holdings, even if prices stagnate at $87,000. - Industry faces instability from JP Morgan boycotts and MSCI's 2026 index exclusion plan, risking automatic crypto sell-offs. - Strategy's 5.9x asset-to-debt ratio and Nasdaq 100 inclusion contrast with peers selling Ethereum reserves amid liquidity pressures. - Market debates long-term viability as Saylor insists on "HODL" strategy, but prolonged Bitcoin declines below $

Bitcoin News Update: Crypto Downturn Intensifies as Technical Indicators and Economic Factors Combine Against Bullish Sentiment

- Bitcoin faces bearish pressure with MACD sell signals and price below key EMAs, risking a 10% drop to $83,111 if support fails. - Ethereum's death cross pattern and XRP's weak technical structure highlight vulnerability near $3,000 and $2.00 support levels. - Macroeconomic uncertainty over Fed rate cuts and ETF outflows amplify downward pressure on crypto markets. - Bitcoin ETFs show fragile recovery with $74M inflow, while Ethereum ETFs face sustained outflows and bearish sentiment. - Speculative intere