The COAI Token Controversy: Exposing Weaknesses in DeFi and Charting a Course for Safeguarding Investors

- COAI token's 2025 collapse wiped $116.8M, exposing DeFi's fragility due to governance flaws, regulatory gaps, and technical vulnerabilities. - Smart contract failures and concentrated ownership in ten wallets amplified manipulation risks, eroding trust in C3.ai's leadership. - Regulatory ambiguity, like the U.S. CLARITY Act's vague definitions, hindered institutional investment and enabled scams in Southeast Asia. - Experts urge real-time audits, diversification into AI hardware, and global frameworks li

Technical and Governance Failures

The downfall of the COAI token stemmed from significant issues in its smart contract design and instability among its leadership.

Security audits of smart contracts, which are vital for DeFi safety, were either inadequate or disregarded. Specialists now stress the importance of obligatory independent audits by organizations such as CertiK or OpenZeppelin to catch vulnerabilities before launch. The lack of these protections in the COAI incident enabled attackers to exploit technical gaps, a trend also seen in other DeFi breaches in 2025, including the

Regulatory Ambiguity and Global Enforcement Gaps

The COAI controversy also revealed shortcomings in current regulatory systems. The U.S. CLARITY Act,

Southeast Asia has emerged as a major center for crypto-related fraud,

Investor Protection: A Call for Proactive Measures

Following the COAI collapse, there is a growing demand from investors for more robust protections. Bitget’s experts suggest a comprehensive strategy:

1. Real-Time Auditing:

2. Diversification Strategies: Shifting investments into less correlated fields, like AI hardware or quantum computing, to reduce exposure to sector-specific downturns.

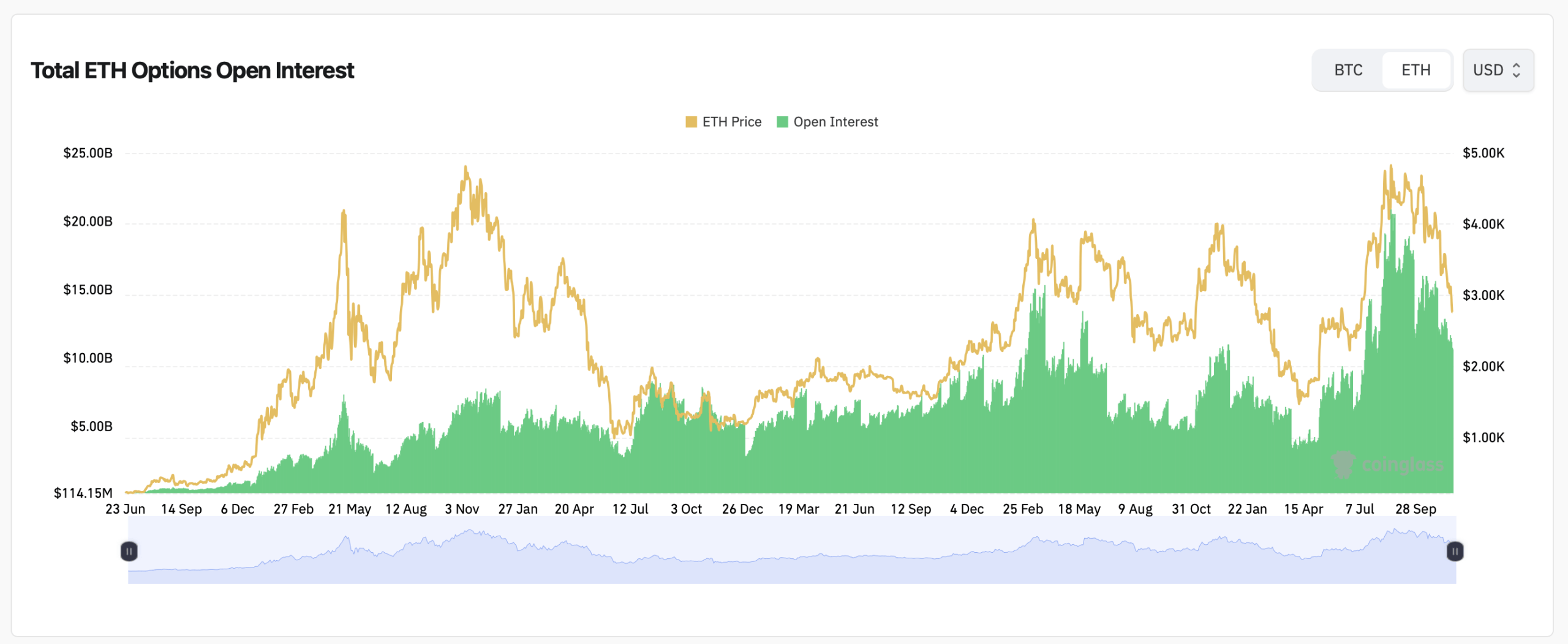

3. Hedging Instruments: Employing inverse crypto ETFs or options as a buffer against market swings.

4. Regulatory Advocacy:

Nevertheless, regulatory advancements are inconsistent. For example, the IRS’s updated DeFi reporting requirements are being contested over privacy issues, while the SEC’s move to classify stablecoins as securities has imposed significant compliance challenges on smaller platforms.

Conclusion

The COAI token incident encapsulates the wider issues facing DeFi: intricate technology, unstable governance, and fragmented regulation. For the sector to progress, it is essential for all parties to emphasize openness, enforce strict due diligence, and push for unified global regulations. As Bitget’s research

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Anti-CZ Whale Loses $61M Profit in 10 Days on Hyperliquid

Quick Take Summary is AI generated, newsroom reviewed. The "Anti-CZ Whale" lost $61 million in profit in 10 days, suffering losses on aggressive long positions in ETH and XRP. The whale's overall realized and unrealized profit dropped from $100 million to $38.4 million. One of the whale's accounts is running 12.22x leverage on a $255 million long exposure, with alarmingly thin 95.40% margin usage. The reversal highlights the high risk and volatility in perpetual futures trading, even for successful contrar

Watch Out: Numerous Economic Developments and Altcoin Events in the New Week – Here is the Day-by-Day, Hour-by-Hour List

‘I Won’t Back Down,’ Michael Saylor Reinforces Strategy’s Bitcoin Mission

Ethereum Price Stalls as Derivatives Traders Load up for the Week Ahead