HBAR Price Falls 18% A Week After Losing Its Month-Long Support

Hedera has suffered a sharp decline over the past week, with its price falling to $0.130 after losing more than 18%. This drop is significant because HBAR broke below a crucial support level that had protected investors’ profits for more than a month. Hedera Is Following The King Hedera’s correlation with Bitcoin currently sits at

Hedera has suffered a sharp decline over the past week, with its price falling to $0.130 after losing more than 18%.

This drop is significant because HBAR broke below a crucial support level that had protected investors’ profits for more than a month.

Hedera Is Following The King

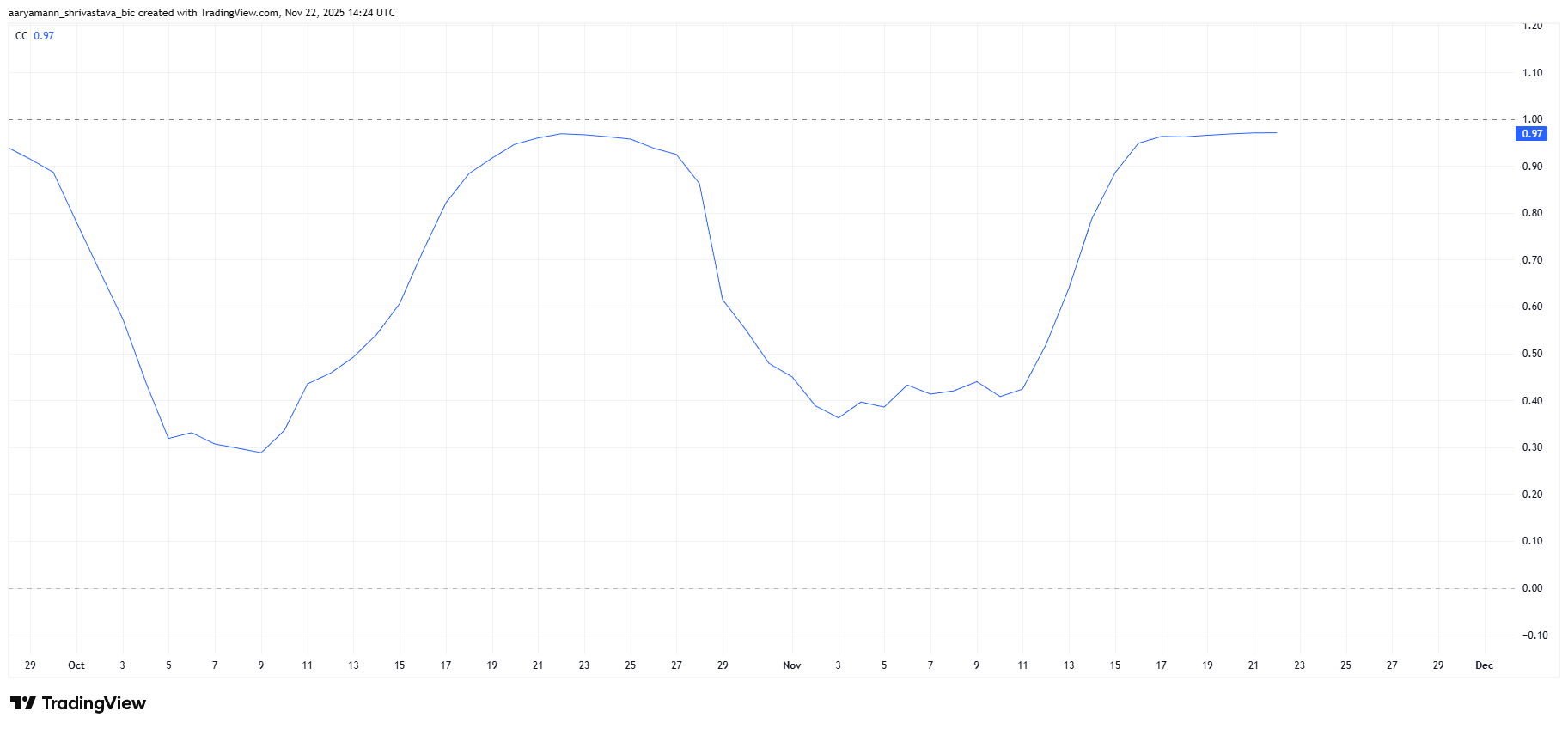

Hedera’s correlation with Bitcoin currently sits at 0.97, one of its highest readings in months. This near-perfect correlation signals that HBAR is heavily mirroring Bitcoin’s price movement.

Such strong alignment becomes especially problematic during periods when BTC faces substantial pressure, as seen this past week.

With Bitcoin dropping to $84,408, HBAR has moved almost in lockstep. The high correlation has erased Hedera’s ability to move independently, making BTC’s decline one of the primary drivers behind the altcoin’s latest losses.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

HBAR Correlation To Bitcoin. Source:

HBAR Correlation To Bitcoin. Source:

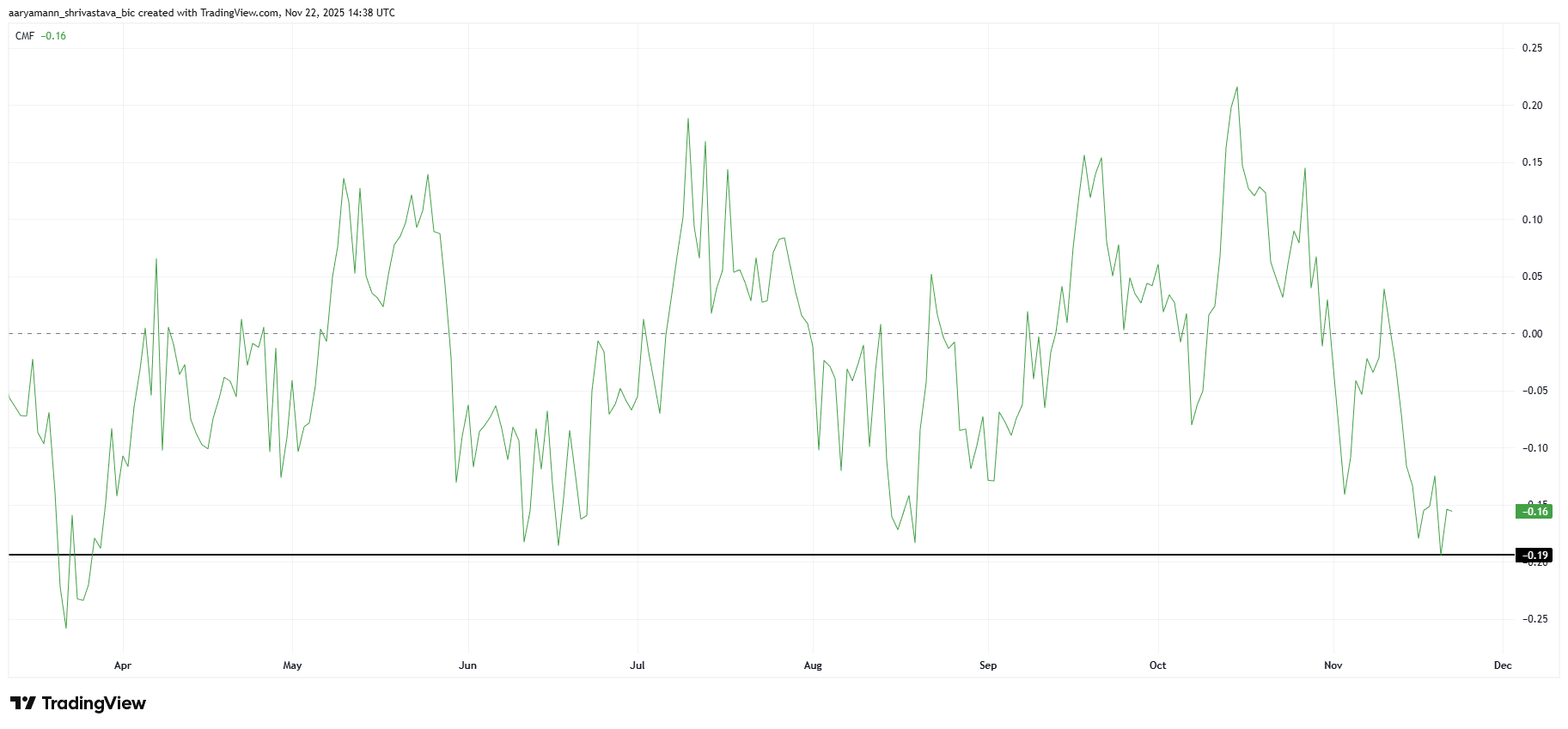

Macro momentum indicators reinforce the bearish picture. The Chaikin Money Flow is sitting near an eight-month low, signaling heavy capital outflows from HBAR.

CMF measures buying and selling pressure, and a deeply negative reading indicates that investors are withdrawing funds at an accelerated pace.

These persistent outflows add pressure to the already declining price trend. As liquidity exits the asset, selling intensifies and recovery efforts weaken.

Unless inflows return, HBAR may continue facing difficulty in regaining upward momentum.

HBAR CMF. Source:

HBAR CMF. Source:

HBAR Price Can Bounce Back

HBAR is down 18% this week after slipping below the crucial $0.162 support level, which had held strong for more than a month.

Losing that support has exposed the altcoin to deeper declines and increased volatility as bearish sentiment grows.

Given that macro conditions have not improved, HBAR could drop to $0.120 from its current price of $0.129.

A fall below $0.120 may trigger additional losses, sending the price toward $0.110 as selling pressure builds.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

If bullish momentum returns, HBAR may attempt a recovery. A move above $0.133 would be the first step toward stabilizing the trend.

Breaking past $0.145 could open the path to $0.154 and higher, invalidating the bearish outlook and restoring investor confidence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Russia Moves Away From The Dollar With Yuan Bond Issuance

Blockchain’s Backbone Reinvented: Avail Connects Disparate Chains through Nexus

- Avail's Nexus Mainnet launches as a cross-chain execution layer to unify liquidity across Ethereum , BNB Chain, and other major blockchains. - Its intent-solver architecture optimizes transaction routing with multi-source liquidity, enabling seamless asset and user movement between chains. - Projects like Lens Protocol and Vanna Finance adopt Nexus for unified collateral management, using the AVAIL token ($0.0080) for governance and coordination. - Avail plans to expand Infinity Blocks to 10 GB per block

Bitcoin News Update: Will Strategy's 71-Year Bitcoin Reserve Withstand Industry Volatility?

- Bitcoin treasury firm Strategy claims 71-year dividend sustainability with $56B Bitcoin holdings, even if prices stagnate at $87,000. - Industry faces instability from JP Morgan boycotts and MSCI's 2026 index exclusion plan, risking automatic crypto sell-offs. - Strategy's 5.9x asset-to-debt ratio and Nasdaq 100 inclusion contrast with peers selling Ethereum reserves amid liquidity pressures. - Market debates long-term viability as Saylor insists on "HODL" strategy, but prolonged Bitcoin declines below $

Bitcoin News Update: Crypto Downturn Intensifies as Technical Indicators and Economic Factors Combine Against Bullish Sentiment

- Bitcoin faces bearish pressure with MACD sell signals and price below key EMAs, risking a 10% drop to $83,111 if support fails. - Ethereum's death cross pattern and XRP's weak technical structure highlight vulnerability near $3,000 and $2.00 support levels. - Macroeconomic uncertainty over Fed rate cuts and ETF outflows amplify downward pressure on crypto markets. - Bitcoin ETFs show fragile recovery with $74M inflow, while Ethereum ETFs face sustained outflows and bearish sentiment. - Speculative intere