ZK Technology's Price Rally: An In-Depth Analysis of On-Chain Usage and Protocol Enhancements

- ZKsync's Q3 2025 protocol upgrades (OS v0.0.5) achieved 15,000 TPS and 1-second block times, enabling high-frequency trading and institutional compliance via Merkle-proof verification. - November 2025 saw ZK rollups process 15,000 TPS, $3.3B TVL in ZKsync, and $2.98B derivatives volume, driven by enterprise adoption from Goldman Sachs and major banks . - Developer activity surged 230% with solx Compiler beta and LLVM-based tooling, while 35+ institutions tested ZKsync's Prividium for confidential cross-b

Protocol Upgrades: Laying the Groundwork for Scalability and Regulatory Alignment

The protocol improvements made by ZKsync in Q3 2025, notably the deployment of OS v0.0.5, represented a significant leap forward. This version brought in correctness validations, addressed technical liabilities, and reduced block times to below one second with 200 ms intervals,

On-Chain Adoption: Growth in Transactions and Institutional Interest

The Q3 2025 enhancements sparked a notable rise in on-chain usage. By November 2025, ZK rollups were handling up to 15,000 TPS,

Developer Activity: Accelerated Ecosystem Expansion

Developer participation in the ZKsync ecosystem surged in late 2025. The solx Compiler entered beta, allowing contracts to comply with Ethereum’s 24 kB size limit and passing validation for 24 production projects. The zksync-era GitHub repository experienced rapid growth in contributors,

Institutional Adoption: Bridging Compliance and Practical Use

Institutional uptake became a cornerstone of ZK’s expansion. The reversal of Tornado Cash sanctions in late 2025 eliminated regulatory ambiguity, while ZKsync’s selective disclosure features (via Prividium) enabled confidential international payments and intraday repo transactions in a pilot with over 35 financial institutions.

Obstacles and Future Prospects

Despite these advances, ZKsync encountered some short-term challenges.

Conclusion: A Strong Case for Investment

The price rally of ZK technology in November 2025 is grounded in real advancements in scalability, compliance, and institutional integration, rather than mere speculation. With transaction throughput surpassing 15,000 TPS, TVL reaching $3.3 billion, and a 230% jump in developer activity, the ecosystem has proven its ability to sustain growth. For investors, the convergence of protocol improvements, robust on-chain data, and institutional demand provides a solid basis for medium-term value creation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aster DEX’s Latest Protocol Update and What It Means for DeFi Liquidity Providers

- Aster DEX's 2025 protocol upgrade enables ASTER token use as 80% margin collateral for perpetual trading, enhancing capital efficiency and reducing liquidation risks. - LPs benefit from 5% fee discounts and reduced impermanent loss risks via leveraged positions, potentially outperforming competitors like Uniswap V3 in yield generation. - CZ's $2M ASTER purchase triggered 800% trading volume surge, while TVL rebounded to $1B post-upgrade despite earlier declines, highlighting cross-chain appeal. - The hyb

DASH Aster DEX: Transforming DeFi Liquidity with Hybrid Innovations and AI-Powered Approaches

- DASH Aster DEX combines DEX transparency with CEX performance via a hybrid AMM-CEX model, addressing liquidity inefficiencies and institutional hesitancy in DeFi. - Its AI-driven liquidity routing aggregates cross-chain assets, boosting trade efficiency and attracting $1.399B TVL and 2M users by Q3 2025. - Aster Chain’s ZKP integration ensures privacy and scalability, securing $50B in value while processing 10,000 TPS. - The ASTER token’s airdrop incentives and 1,650% price surge reflect strong community

The Transformation of Trust Wallet Token’s Value: Institutional Integration and Key Alliances Towards the End of 2025

- Trust Wallet Token (TWT) surged in late 2025 due to governance upgrades and institutional partnerships enhancing its utility. - Trust Premium's tiered rewards created recurring demand, stabilizing TWT's price through on-chain activity incentives. - RWA integrations with platforms like Ondo expanded TWT's use cases, attracting institutional capital despite regulatory risks. - The Onramper partnership enabled global crypto access for 210M users, bridging traditional finance and DeFi ecosystems. - These dev

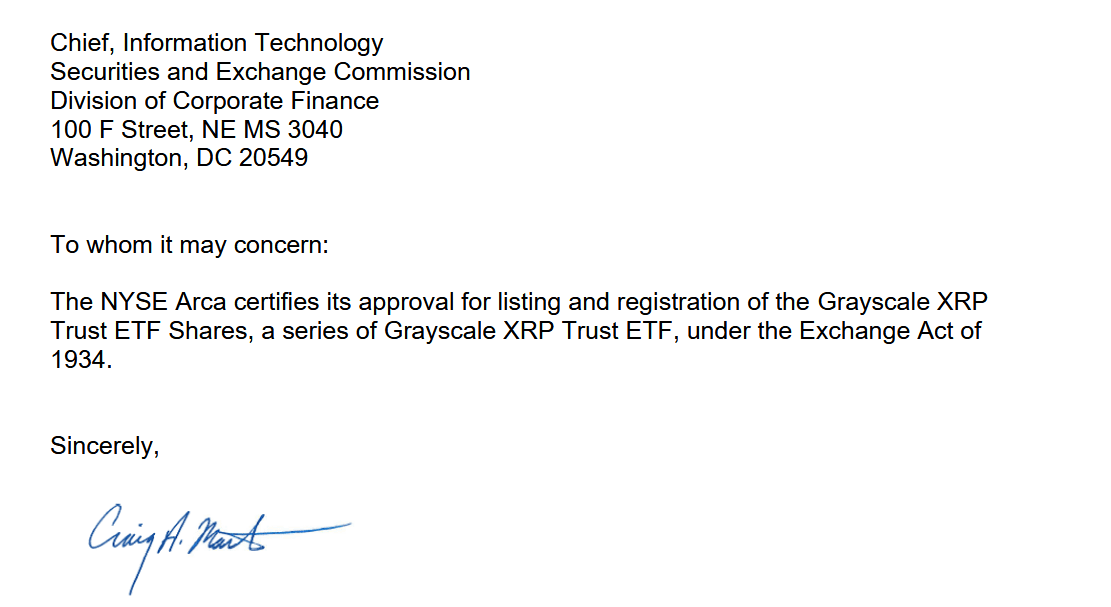

Grayscale’s Dogecoin and XRP ETFs Set for Monday Launch