November 21st Market Key Intelligence, How Much Did You Miss?

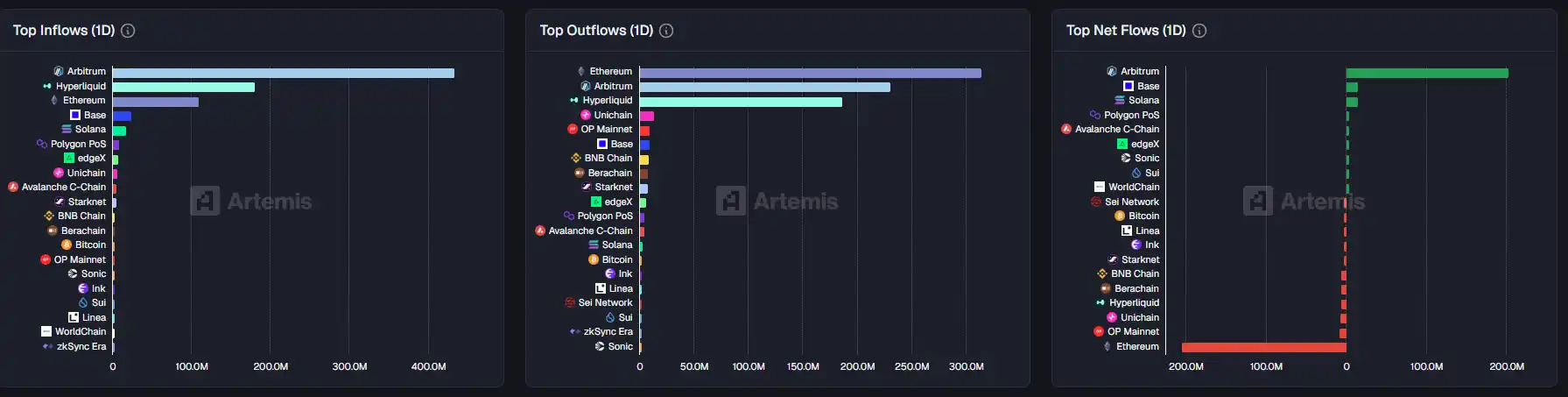

1. On-Chain Flows: $203.3M USD inflow to Arbitrum today; $204.6M USD outflow from Ethereum 2. Largest Price Swings: $TNSR, $OOB 3. Top News: DAT Flywheel Stalls as Top Investor Suggests DAT Corp Reserves Sell-Off, Market Poised for Further Deep Dive

Featured News

1. DAT Flywheel Stalls, Top Investor Suggests DAT Company Will Sell Reserves, Market Still Faces Deep Washout

2. Bitcoin Breaks Below $82,000 Again, 24-hour Decline Widens to 8.9%

3. Independent Researcher Claims $610 Billion AI Ponzi Scheme Collapse

4. Global Mainstream Assets Experience Broad Declines, US Stocks, European Stocks, Oil, Silver See Varied Declines

5. "Binance Life" Market Cap Falls Below $1 Billion, 24-hour Decline Exceeds 26%

Featured Articles

1. "Where Is the Strongest ZEC Copycat Headed in This Round?"

Over the past 2 months, ZEC, which has surged nearly 10 times and has maintained its independent trend, has always been the focal point of the market. The logical discussion around ZEC has gradually evolved from early endorsements of privacy concepts by figures such as Naval, Arthur Hayes, and Ansem to the current stage of debate between the bullish view based on the actual demand for privacy Track, and the bearish view from the perspective of mining power and mining revenue of the coin. So, apart from the endorsements of well-known figures, what are the detailed arguments for the bullish and bearish sides of ZEC?

2. "Dialogue Between the Strongest Bulls and Bears in the Crypto Community: Has the Four-Year Crypto Cycle Failed?"

The 2025 crypto market is at a delicate inflection point: Bitcoin ETF approval, intertwining liquidity and debt refinancing cycles, the AI boom siphoning off funds, and traditional financial and tech giants accelerating their embrace of blockchain. Against this backdrop, the market structure has become anomalous, with a lack of buying pressure for altcoins, underperformance of high-performance blockchains like Solana, and investor sentiment swinging between extreme optimism and fear. In this issue of "The Journey Man," Raoul Pal (former global macro investor, Real Vision founder) and Chris Burniske (Placeholder partner) delve deep into market cycles, liquidity dynamics, investor psychology, and industry structural changes.

On-Chain Data

On-chain fund flows for the week of November 21

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SolarPlus Forum 2025 Review: A Clear Look at Germany’s Evolving Solar Landscape

Memecoins and AI Tokens Crash Hard: Market Caps Nosedive as Panic Deepens

Bitcoin News Today: Key Support Level for Bitcoin: Will It Enter a Bear Market or Rebound Past $82K?

- Bitcoin fell below $86,000 on Nov 20, 2025, its lowest in seven months, sparking investor panic amid a 7% annual decline. - The selloff was driven by Fed rate-cut skepticism, quantum computing fears, and a $1.3B whale dump by Owen Gunden. - Derive.xyz data shows a 50% chance of year-end prices below $90,000, with $85,000 puts and $910M in 24-hour liquidations amplifying bearish sentiment. - Technical analysis highlights $82,000–$84,000 as critical support, with rebounds potentially targeting $125,000, wh

Bitcoin Updates Today: Is Bitcoin’s Market Strength Signaling an Upcoming Altcoin Surge or Extended Deleveraging?

- Altcoin Season Index (ASI) drops to 24, signaling Bitcoin's dominance as capital consolidates in BTC amid broader market deleveraging. - Bitcoin's 30% pullback and macroeconomic uncertainties drive risk-off sentiment, with altcoins underperforming BTC by over 40% since September. - Analysts debate whether BTC's dominance mirrors pre-2019 altcoin rally patterns or reflects prolonged bearish conditions requiring ETH/BTC stabilization. - Bitcoin Policy Institute's tax-payment proposal and AI/HPC sector gain