NEAR Intents Hits Record Transaction Volume, Raising Hopes That a Price Recovery is “NEAR”

In November, NEAR Intents’ daily fee revenue reached an all-time high. At the same time, its daily trading volume increased tenfold compared to the previous quarter. However, NEAR’s price continued to show weak performance and remained stuck in its 2025 accumulation range. These positive metrics sparked expectations that investors may secure strong entry positions before

In November, NEAR Intents’ daily fee revenue reached an all-time high. At the same time, its daily trading volume increased tenfold compared to the previous quarter. However, NEAR’s price continued to show weak performance and remained stuck in its 2025 accumulation range.

These positive metrics sparked expectations that investors may secure strong entry positions before overall market fear fades and fundamentals begin to take effect.

How NEAR Intents Became a Late-2025 Catalyst for NEAR’s Price

NEAR Intents is a multichain trading protocol built on NEAR Protocol, a blockchain platform focused on AI and chain abstraction.

The protocol removes the need for users to perform complex manual actions. These include bridging tokens, managing gas fees across multiple networks, or handling intermediate steps. NEAR Intents allows users—or AI agents—to express an “intent” for the desired outcome. The protocol then automates the entire process, delivering a smooth and efficient experience.

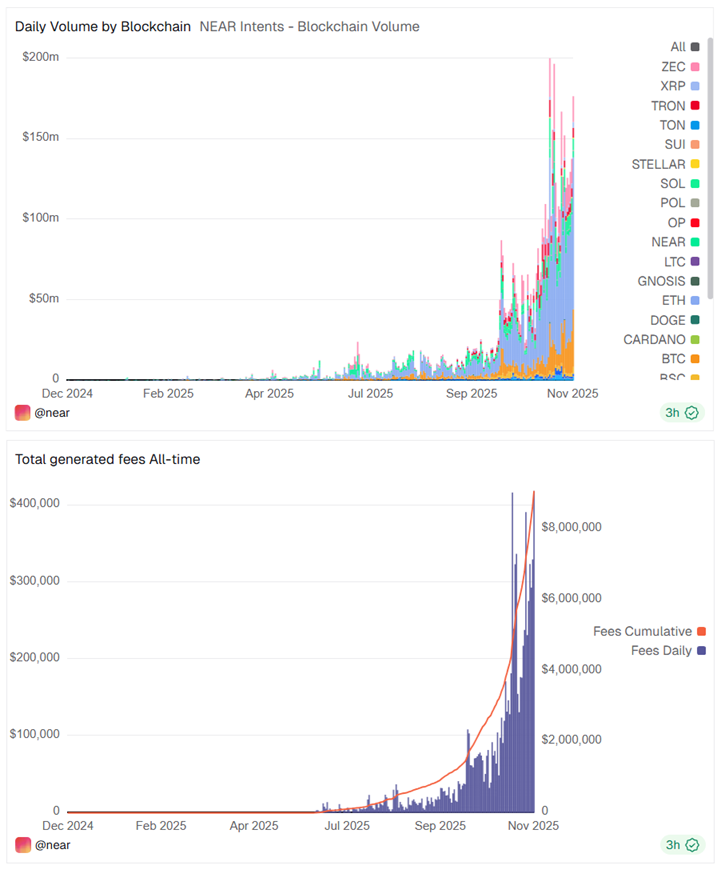

According to Dune Analytics, NEAR Intents’ daily fee revenue reached a record level of more than $400,000. This pushed total cumulative fees above $10 million. Meanwhile, daily trading volume consistently remained above $150 million, representing a tenfold increase from the previous quarter.

Daily Volume & Fee on NEAR Intents. Source: Dune.

Daily Volume & Fee on NEAR Intents. Source: Dune.

NEAR Protocol also reported that its 30-day cumulative trading volume recently surpassed $3 billion.

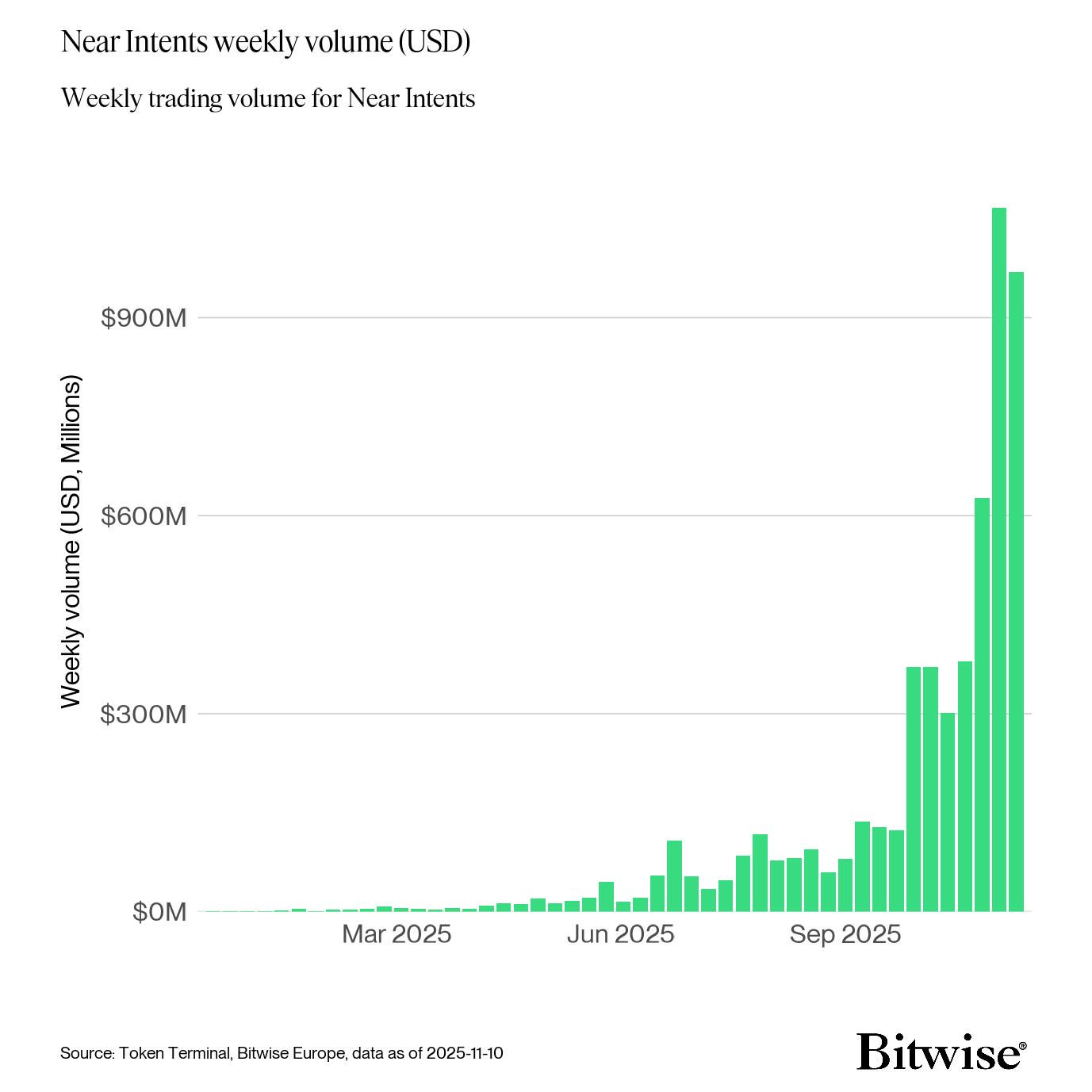

Additionally, a Bitwise report noted that NEAR Intents recorded $969 million in trading volume for the week beginning November 10, 2025. Bitwise predicted that NEAR Intents will expand weekly trading volume more than tenfold and reach $10 billion by June 2026.

Near Intents Weekly Volume. Source:

Bitwise

Near Intents Weekly Volume. Source:

Bitwise

This growth will naturally have a positive impact on the NEAR token.

“NEAR’s token model is designed to capture value from AI-native activity. This includes intent-routing fees, infrastructure services, and model execution, extending beyond traditional blockspace monetisation,” Bitwise stated.

What Drives This Surge in Volume?

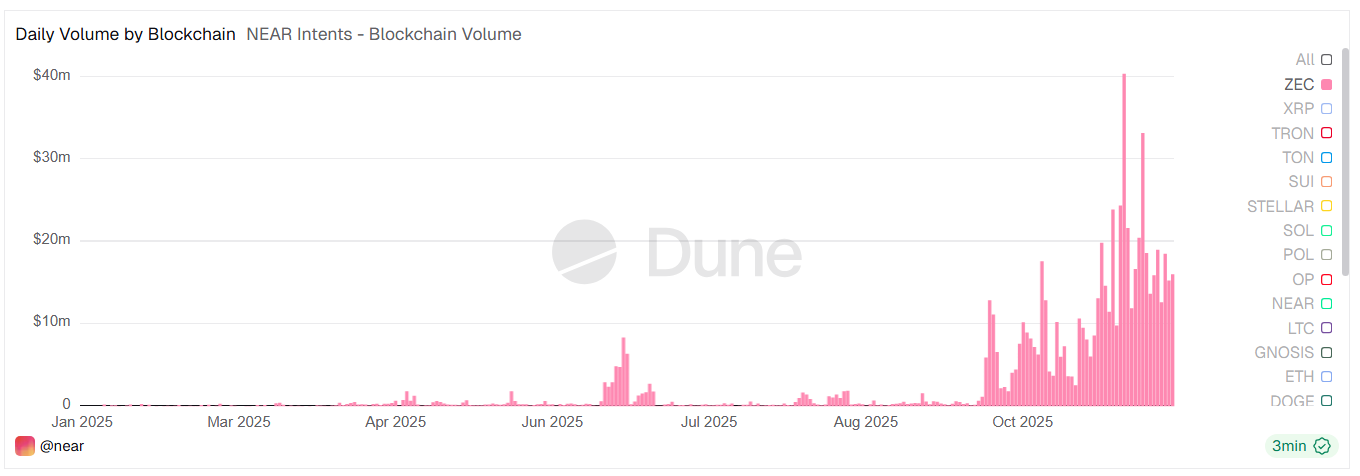

A CoinMetrics report highlighted the role of the Zashi wallet. This wallet integrates with NEAR Intents, enabling seamless multichain swaps into shielded ZEC. Meanwhile, the amount of ZEC held in shield pools reached new highs as demand for privacy accelerated.

ZEC Volume on NEAR Intents. Source:

Dune

ZEC Volume on NEAR Intents. Source:

Dune

As a result, investors have increasingly turned to NEAR Intents. Trading in ZEC now accounts for about 10% of the protocol’s daily volume, averaging $15 million per day.

NEAR’s Price Remains Stuck in the 2025 Accumulation Range

Despite these developments, NEAR’s price remains trapped in its 2025 accumulation zone. TradingView data shows NEAR moving between $1.90 and $3.10 since the beginning of the year.

NEAR Price Performance. Source:

TradingView.

NEAR Price Performance. Source:

TradingView.

Analyst Vespamatic attributed this stagnation to Bitcoin’s price decline. This pressure could cause altcoins to drop even further, even when their fundamentals remain strong.

“NEAR has a risk of falling to $0.6, especially if Bitcoin falls to $84,000. In a bear market, almost 99% of altcoins can be destroyed, even though they have strong fundamentals,” Vespamatic predicted.

However, analysts also noted that NEAR’s current price near $1.9 aligns with the year’s strongest support. Combined with recent positive catalysts, this level may set the stage for a potential price rebound.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Crypto Enthusiasts and Conventional Experts Debate $1 Million Bitcoin Projection

Berkshire’s Wager on Alphabet: Fresh Leadership Challenges Buffett’s Doubts About Tech

- Warren Buffett's Berkshire Hathaway made its first major $4.3B Alphabet investment in 27 years, signaling leadership transition and strategic shift under incoming CEO Greg Abel. - The move contrasts Buffett's historical tech skepticism, reflecting growing influence of managers like Todd Combs who steered recent tech bets including Amazon shares. - Simultaneous 15% Apple stake reduction and Bank of America divestment highlight risk diversification, while Alphabet's valuation and cash flow justify cautious

The Emergence of ICP Caffeine AI and Its Impact on Decentralized Computing Markets

- ICP Caffeine AI, developed by DFINITY, redefines decentralized compute by enabling AI app development via natural language and reducing inference costs by 20–40%. - Its reverse-gas token model and "chain-of-chains" architecture boost scalability while creating deflationary incentives, attracting $237B TVL but facing 22.4% dApp activity declines. - Competitors like Palantir ($1.18B Q3 revenue) and struggling BigBear .ai highlight ICP's unique censorship-resistant niche, though centralized rivals maintain

Hyperliquid News Today: Reduced Fees or Doubts? Hyperliquid’s Bold Strategy for Expansion

- Hyperliquid, a top-20 DeFi exchange, faces a 25% HYPE token price drop to $25 amid market volatility and declining investor confidence. - Its HIP-3 Growth Mode initiative slashes trading fees by 90% to attract new markets but has yet to reverse downward trends or boost liquidity. - Analysts warn fee cuts may not address long-term user retention challenges in a crowded DeFi landscape dominated by centralized rivals like Binance. - Market skepticism persists as traders await volume explosions and tighter s