- Circle has minted $500M more in USDC

- $15B in stablecoins minted post-crash

- Surge reflects growing demand for stable assets

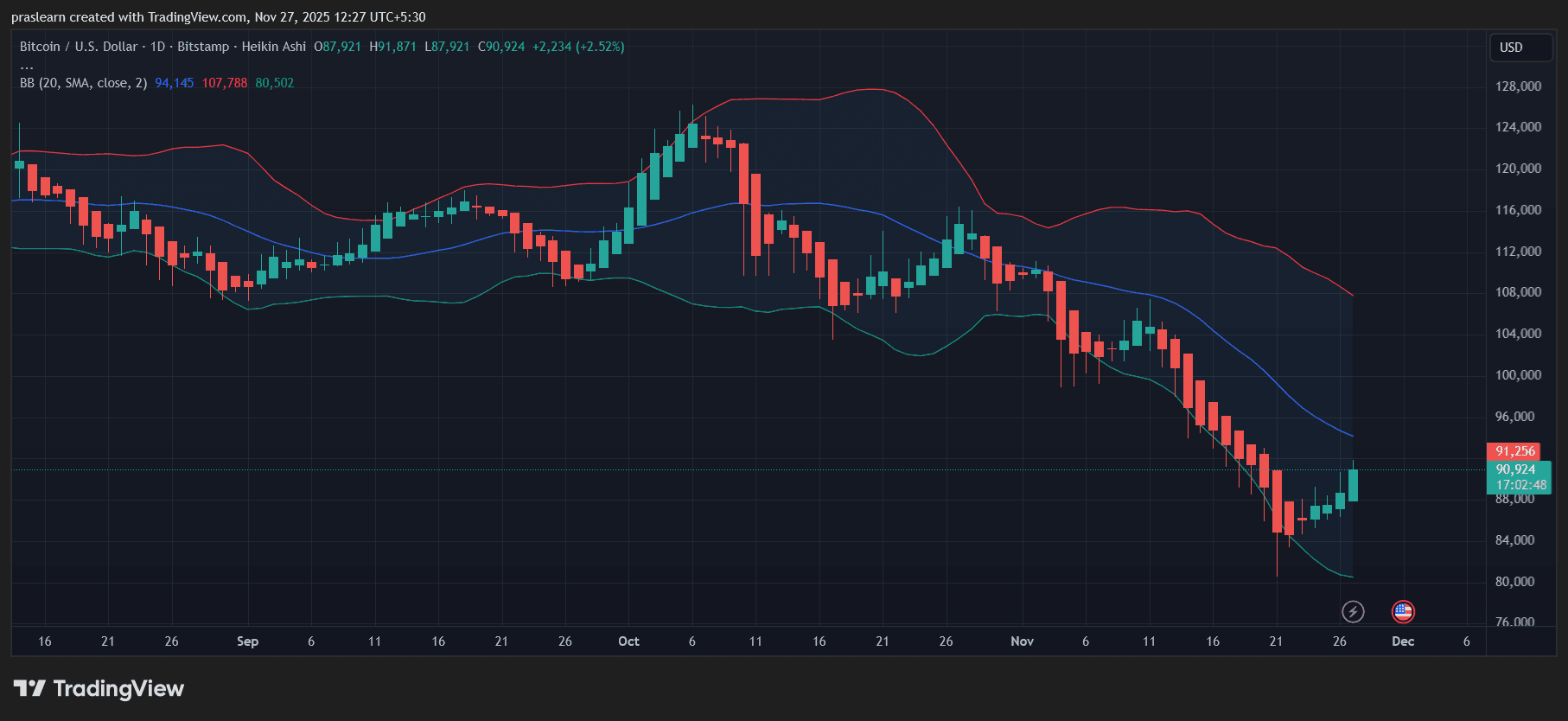

In the aftermath of the November 10–11 crypto market crash, major stablecoin issuers have responded swiftly. Circle, the company behind the popular stablecoin USD Coin (USDC), has just minted an additional $500 million worth of USDC. This brings the total stablecoins minted by Circle and Tether to over $15 billion since the crash.

This sudden increase in stablecoin supply is a clear sign of rising demand for dollar-pegged digital assets. When market volatility spikes, both investors and institutions tend to move their funds into stablecoins to preserve value and wait for the markets to stabilize.

Why Did Circle Mint $500 Million More?

Circle’s decision to mint $500 million USDC is a direct response to user demand. As traders exit volatile crypto assets, they often seek the safety of stablecoins like USDC. These tokens, pegged 1:1 with the US dollar, offer a secure alternative amid sharp price drops.

This minting also reflects the growing use of USDC across decentralized finance ( DeFi ) platforms, exchanges, and cross-border transactions. USDC’s increasing role in the broader crypto economy continues to solidify its position as a reliable stablecoin choice.

$15B in Stablecoins: What Does It Mean?

The combined $15 billion in new stablecoin issuance—between Tether (USDT) and Circle (USDC)—underscores the critical role of stablecoins in the crypto ecosystem. These assets provide liquidity, support trading pairs, and serve as an on-ramp for new users entering the space.

With increased minting activity, we might also see rising regulatory attention. Nonetheless, this surge highlights the resilience of stablecoins and their importance during periods of high volatility.

Read Also :

- VerifiedX Partners with Crypto.com for Institutional Custody and Liquidity Solution

- Michael Selig Backs Crypto Oversight, Warns of Offshore Risk

- Numerai Raises $30 Million Series C Led by Top University Endowments, at $500 Million Valuation

- Logos Unifies Under One Identity to Deliver a Private Tech Stack to Revitalise Civil Society

- MEXC Partners with Hacken for Monthly Reserve Audits