BOB Token Goes Live: Launch Details for Build on Bitcoin's Native Token

Table of Contents

Build on Bitcoin’s native token, BOB, went live on November 20, 2025, following its highly anticipated Token Generation Event (TGE) at 12:00 UTC. This event followed a community sale that raised $4.2 million and distributed tokens to early participants.

Before the TGE, the hybrid Layer 2 blockchain network has recorded over $300 million in total value locked, 1 million wallets, and 545,000 unique users since its mainnet launch 18 months prior. Backed by investors such as Coinbase Ventures, Castle Island VC, and Ledger, the project has raised $23.7 million across seed, strategic, and public rounds.

Build on Bitcoin at a Glance

Build on Bitcoin is a hybrid zero-knowledge rollup built on the OP Stack, offering Ethereum Virtual Machine (EVM) compatibility for smart contracts. It uses zero-knowledge proofs to achieve security comparable to Ethereum while integrating Bitcoin finality via staked BTC. A key component is the native BTC bridge powered by BitVM, which enables trustless, non-custodial BTC transfers without wrappers. This bridge is currently on testnet, with partnerships including Anchorage and RockawayX, and a full production launch planned for early 2026.

The BOB Gateway supports one-click BTC deposits and withdrawals across more than 11 chains, including Ethereum, BNB Chain, and Unichain. It provides SDK integration for over 15,000 decentralized applications and facilitates cross-chain swaps. The network has established integrations with entities like Uniswap, Chainlink, Fireblocks, Lombard, Euler, Solv, and Babylon. Grants from Optimism and Uniswap have supported development. The roadmap includes expanding to additional chains and enhancing BTC-native earning products.

Bitcoin holds a market capitalization of $2.2 trillion, but only 0.3 percent of it participates in decentralized finance, compared to 30 percent for Ethereum. Build on Bitcoin seeks to address this disparity by enabling Bitcoin's use in DeFi, potentially increasing Bitcoin DeFi's total value locked to $700 billion if adoption patterns follow those of Ethereum.

BOB Token Details and Tokenomics

The BOB token serves as the utility, governance, and staking token for the Build on Bitcoin hybrid chain. It is an ERC-20 token minted on the BOB network with a fixed total supply of 10,000,000,000 tokens. No further tokens will be minted after this cap. The full supply unlocks 48 months after launch.

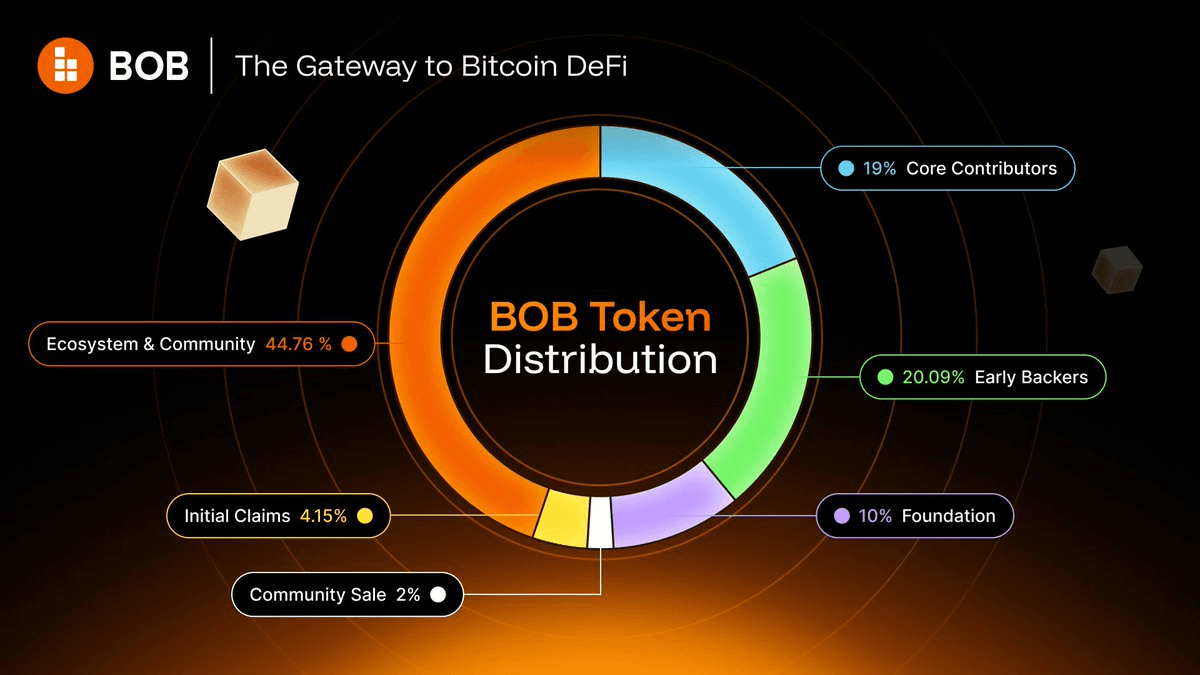

Token Distribution Breakdown

Total Community and Ecosystem Allocation

Token distribution allocates 50.91 percent to community and ecosystem purposes.

Division of Community and Ecosystem Allocation

This is divided into initial claims at 4.15 percent, community sale at 2.00 percent, and ongoing ecosystem and community initiatives at 44.76 percent.

Initial Circulating Supply at Launch

At launch, the initial circulating supply stands at 22.20 percent.

Components of Initial Circulating Supply

This includes 0.51 billion tokens, or 5.1 percent, in community hands via initial claims and the community sale; 1.46 billion tokens, or 14.6 percent, for ecosystem and community; and 0.25 billion tokens, or 2.5 percent, for the BOB Foundation.

Locked Tokens and Vesting Schedules

- Tokens for core contributors and early backers remain locked at launch, with vesting schedules over two to three years.

- In total, 77.8 percent of the supply is locked on day one.

- Foundation and ecosystem allocations vest over 48 months.

- Locked tokens cannot be staked to prevent initial reward concentration among team members and backers.

Ecosystem and Community Allocation Details

The ecosystem and community allocation of 44.76 percent reserves about one-third, or 14.6 percent of the total supply, unlocked at the token generation event, with the rest unlocking linearly over 48 months.

This supports growth initiatives managed by the BOB Foundation and DAO through onchain governance. Uses include community, builder, and DeFi initiatives, as well as staking rewards. Five percent is pre-allocated for early DeFi, liquidity, and ecosystem growth.

Initial Claims and Staking Bonuses

- Initial claims and staking bonuses total 4.15 percent, or 415 million tokens.

- Of this, 2.15 percent goes to initial claims for Fusion users, content creators, and campaign participants.

- Strategic liquidity providers are excluded from the Spice system to avoid dilution and face a 12-month lockup. Some campaign allocations have pre-agreed lockups.

- The remaining 2.00 percent funds staking bonuses, available upon staking and timelocking for set periods.

Community Sale Details

The community sale of 2 percent, or 200 million tokens, occurred from November 10 to 16, 2025, raising $4.2 million. Proven community members, including top Spice holders in Fusion and the top 2,000 Cookie snappers, participated at a discounted valuation. Tokens are 50 percent unlocked at the token generation event, with the remaining 50 percent vesting linearly over three months.

Allocations to BOB Foundation, Core Contributors, and Early Backers

The BOB Foundation receives 10.00 percent to fund research, development, and initiatives. Of this, 2.5 percent unlocks at launch, with the remaining 7.5 percent unlocking linearly over 4 years.

Core contributors get 19.00 percent, vesting linearly over 36 months with a 12-month cliff.

Early backers receive 20.09 percent, with terms varying: strategic and seed at 18.71 percent over 36 months with a 12-month cliff; angels at 0.62 percent over 36 months from launch; and strategic partners at 0.77 percent with a 12-month lockup followed by 12 months linear vesting.

Token Generation Event and Exchange Listings

The TGE took place on November 20, 2025, after a community sale from November 10 to 13, with fully diluted valuations ranging from $165 million for community tranches to $230 million for the public.

Bids ranged from $50 USDT to $250,000, allocated pro rata in USDC or USDT. The public tranche unlocks 20 percent at the event, with linear vesting over 12 months; the community tranche vests fully linearly over 12 months.

The token is listed on exchanges, including Gate, Kucoin, and Kraken. The token is also expected to go live on Coinbase.

Spot trading for BOB (BOBBOB) will go live on 20 November 2025. The opening of our BOBBOB-USD trading pair will begin later today if liquidity conditions are met, in regions where trading is supported. pic.twitter.com/CoyUm1Gghj

— Coinbase Markets 🛡️ (@CoinbaseMarkets) November 20, 2025

Airdrop Details and Claiming Process

The airdrop distributes 415 million tokens, or 4.15 percent of the supply, to reward early supporters.

Eligibility covers about 17,000 core supporters and 200,000 wider community members based on Spice harvested in Fusion Seasons 1-3, with Season 1 weighted 50 percent higher; onchain activity like BTCFi participation; social engagement; quests; and NFT mints such as Cookie Snappers.

Wallets require healthy onchain contributions; inactive ones disqualify. Exclusions include AML flags via TRM Labs, known criminal behavior, and core contributors. Strategic liquidity providers face a 12-month lockup.

Here’s the breakdown:

- The snapshot occurred on November 6, 2025, at 14:00 UTC.

- Allocation splits into 215 million for initial claims and 200 million for staking bonuses.

- Claims opened at 12:00 UTC on November 20 via the official BOB claim page.

- Unclaimed tokens after 45 days return to the ecosystem treasury.

- KYC is recommended for sale participants but not required for airdrop claims.

- Claiming requires a small amount of ETH on the BOB network for gas fees.

- Users check eligibility by pasting their wallet address, connect if eligible, accept terms, and claim.

Conclusion

The launch of the BOB token on November 20, 2025, establishes it as the core asset for staking, governance, and utility in the Build on Bitcoin network. With a fixed supply of 10 billion tokens and allocations prioritizing community at over 50 percent, the tokenomics support long-term network security through vesting and lockups.

The airdrop and staking mechanisms distribute tokens to early participants, while exchange listings provide immediate liquidity. Overall, this structure positions the token to facilitate Bitcoin's role in decentralized finance, emphasizing community involvement and technical integration.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PEPE & XRP Face Institutional Hurdles While Zero Knowledge Proof Surges on $10M Dolphins Deal

CEOs Remain Vigilant as Trump Shakes Up Businesses With String of Directives

Shiba Inu Faces Selling Pressure as Exchange Reserves Soar Above 82 Trillion