Corporate Crypto-Treasury Firms Under Pressure as BlackRock Pushes New Staked Ether Fund

Quick Breakdown

- Corporate crypto-treasury firms face deep valuation pressures as their Ether holdings fall below cost basis.

- BitMine Immersion Technologies holds $10.7B in ETH but sits on a $3.7B unrealized loss.

- BlackRock’s move into staked Ether ETFs could intensify competition and threaten the economics of existing DATs.

Corporate treasuries struggle amid falling Ether valuations

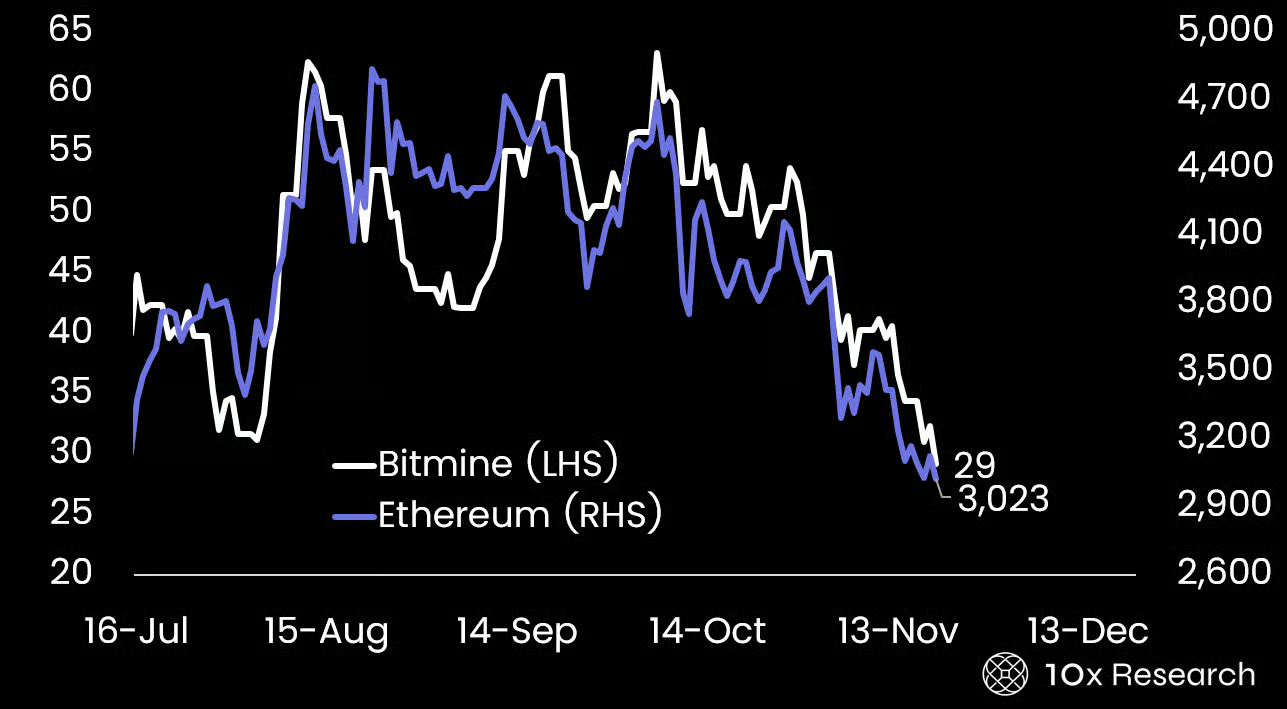

Concerns are growing over the long-term sustainability of corporate crypto-treasury firms as the value of their Ether holdings continues to slide. A new report from 10x Research highlights steep unrealized losses across the sector, with many investors now stuck in positions they can’t exit without major losses.

Source:

10X Research

Source:

10X Research

BitMine Immersion Technologies, the largest corporate Ether holder, is bearing the biggest hit. The company is currently down around $1,000 per ETH, resulting in a cumulative unrealized loss of roughly $3.7 billion. BitMine holds about 3.56 million ETH, valued at approximately $10.7 billion, representing 2.94% of the total Ethereum supply. Its average cost basis stands at $4,051 per ETH.

10x Research founder Markus Thielen warned that the decline in net asset value is leaving shareholders in what he described as a “Hotel California scenario,” where investors are effectively trapped unless they accept steep losses. He argued that, unlike ETFs, digital-asset treasury firms (DATs) often layer on opaque, hedge-fund-like fees that quietly dilute returns.

mNAV declines signal capital raising challenges

The report also points to rapidly falling mNAV (market NAV) ratios, a key metric that compares a company’s enterprise value to the value of its crypto holdings. An mNAV above 1 enables companies to issue new shares to buy more digital assets , while values below 1 signal that securing fresh capital becomes harder.

BitMine’s basic mNAV is now 0.77, with a diluted mNAV of 0.92, indicating restricted room for expansion according to data from Bitminetracker. Other major DATs, including Strategy, Metaplanet, Sharplink Gaming, Upexi, and DeFi Development Corp, have seen similar declines.

BlackRock enters the arena with lower-cost staked Ether ETF

The challenges facing DATs are set to intensify as BlackRock steps deeper into the Ether market. The world’s largest asset manager has registered a new staked Ether ETF in Delaware, signalling a push toward Ethereum-based yield products.

BlackRock joins other asset managers, such as REX-Osprey and Grayscale, both of which launched staked ETH ETFs earlier this year.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin plunges 30%. Has it really entered a bear market? A comprehensive assessment using 5 analytical frameworks

Further correction, with a dip to 70,000, has a probability of 15%; continued consolidation with fluctuations, using time to replace space, has a probability of 50%.

Data Insight: Bitcoin's Year-to-Date Gains Turn Negative, Is a Full Bear Market Really Here?

Spot demand remains weak, outflows from US spot ETFs are intensifying, and there has been no new buying from traditional financial allocators.

Why can Bitcoin support a trillion-dollar market cap?

The only way to access the services provided by bitcoin is to purchase the asset itself.

Crypto Has Until 2028 to Avoid a Quantum Collapse, Warns Vitalik Buterin