TWT’s Updated Tokenomics Framework: Ushering in a New Era for DeFi Governance and Ensuring Token Value Stability

- Trust Wallet's 2025 TWT tokenomics shifts governance to community-driven models with tiered rewards for active participation. - Deflationary mechanics (88.9B tokens burned) and utility integration (gas payments, RWA tokenization) stabilize TWT's value and expand real-world applications. - Partnerships with Ondo Finance and institutional adoption drive TWT's price growth from $0.7 to $1.6 in 2025, with analysts projecting $15 by 2030. - Risks include Solana blockchain dependency and governance participati

Governance: Shifting from Passive Ownership to Proactive Involvement

The 2025 TWT tokenomics introduces a governance structure that gives token holders the authority to vote on essential matters like platform fees, new partnerships, and operational upgrades

This approach differs from conventional DeFi governance, where holders often focus on short-term profits rather than active participation. By linking governance privileges to practical benefits—such as collateral use in DeFi or transaction fee savings—TWT encourages a stronger alignment between its community and developers

Token Value Stability: Deflationary Approach and Embedded Utility

A key element of TWT’s 2025 plan is its deflationary supply mechanism. The permanent removal of 88.9 billion tokens in 2020—cutting the circulating supply by over 40%—has played a crucial role in curbing inflation and boosting scarcity

TWT’s value is further anchored by its use in real-world scenarios. Collaborations with platforms such as Ondo Finance have broadened TWT’s reach beyond DeFi, enabling the tokenization of U.S. Treasury bonds and drawing institutional players

Comparative Analysis: TWT Versus Top DeFi Platforms

Although TWT’s governance shares features with Uniswap’s fee-burning model, its focus on gamified utility distinguishes it. The Trust Premium program, for example, offers tiered incentives (from Bronze to Gold) based on swapping, staking, and holding TWT, promoting long-term user activity

Regarding price stability, TWT’s capped supply and diverse utility—including gas payments, staking, and real-world asset tokenization—create a sturdier system than those relying on variable supply. For instance, TWT’s price

Risks and Challenges

Despite its advantages, TWT’s framework faces certain risks. Its value is indirectly linked to the stability of the

Conclusion

The 2025 TWT tokenomics model showcases an innovative direction for DeFi governance and price stability. By integrating deflationary policies, practical incentives, and institutional collaborations, Trust Wallet has built a system that aligns the interests of users and developers while reducing volatility. Although challenges persist, TWT’s thoughtful integration into both decentralized and traditional finance could make it a frontrunner in the next wave of DeFi evolution.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CFTC’s Expanded Crypto Responsibilities Challenge Regulatory Preparedness and Cross-Party Cooperation

- Senate Agriculture Committee confirmed Trump's CFTC nominee Michael Selig along party lines, advancing his nomination for final Senate approval. - Selig, an SEC crypto advisor, would expand CFTC's oversight of crypto spot markets under the CLARITY Act, positioning it as a key digital asset regulator. - Democrats raised concerns about CFTC's limited resources (543 staff vs. SEC's 4,200) and potential single-party control after current chair's expected resignation. - Selig emphasized "clear rules" for cryp

Bitcoin Updates: Bitcoin Approaches Crucial Support Level Amid Heightened Fear, Indicating Possible Recovery

- Bitcoin fell to a seven-month low near $87,300, testing key support levels amid heavy selling pressure and extreme bearish sentiment. - Analysts highlight a "max pain" zone between $84,000-$73,000, with historical patterns suggesting rebounds after fear indices hit annual lows. - The Crypto Fear & Greed Index at 15—a level preceding past rebounds—aligns with historical 10-33% post-dip recovery trends. - A 26.7% correction triggered $914M in liquidations, but a 2% rebound to $92,621 shows resilience amid

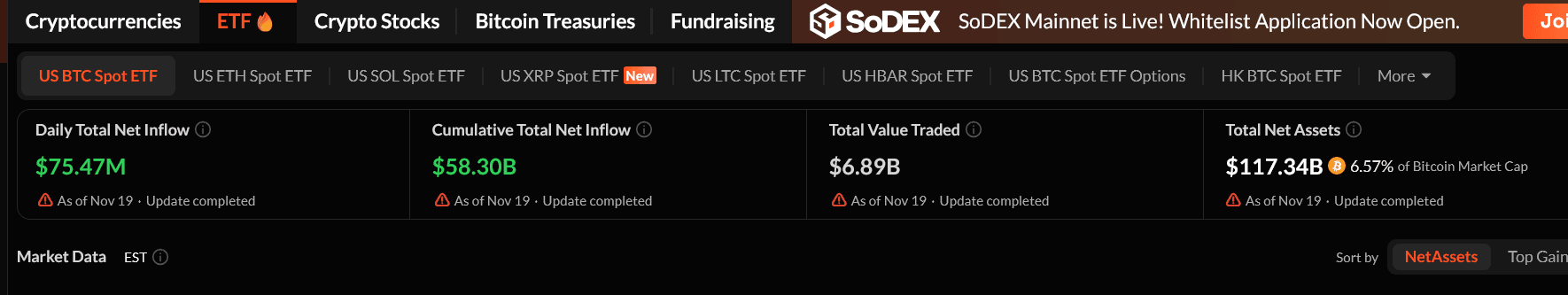

Bitcoin ETFs Are Back: Did the Crash Just End?

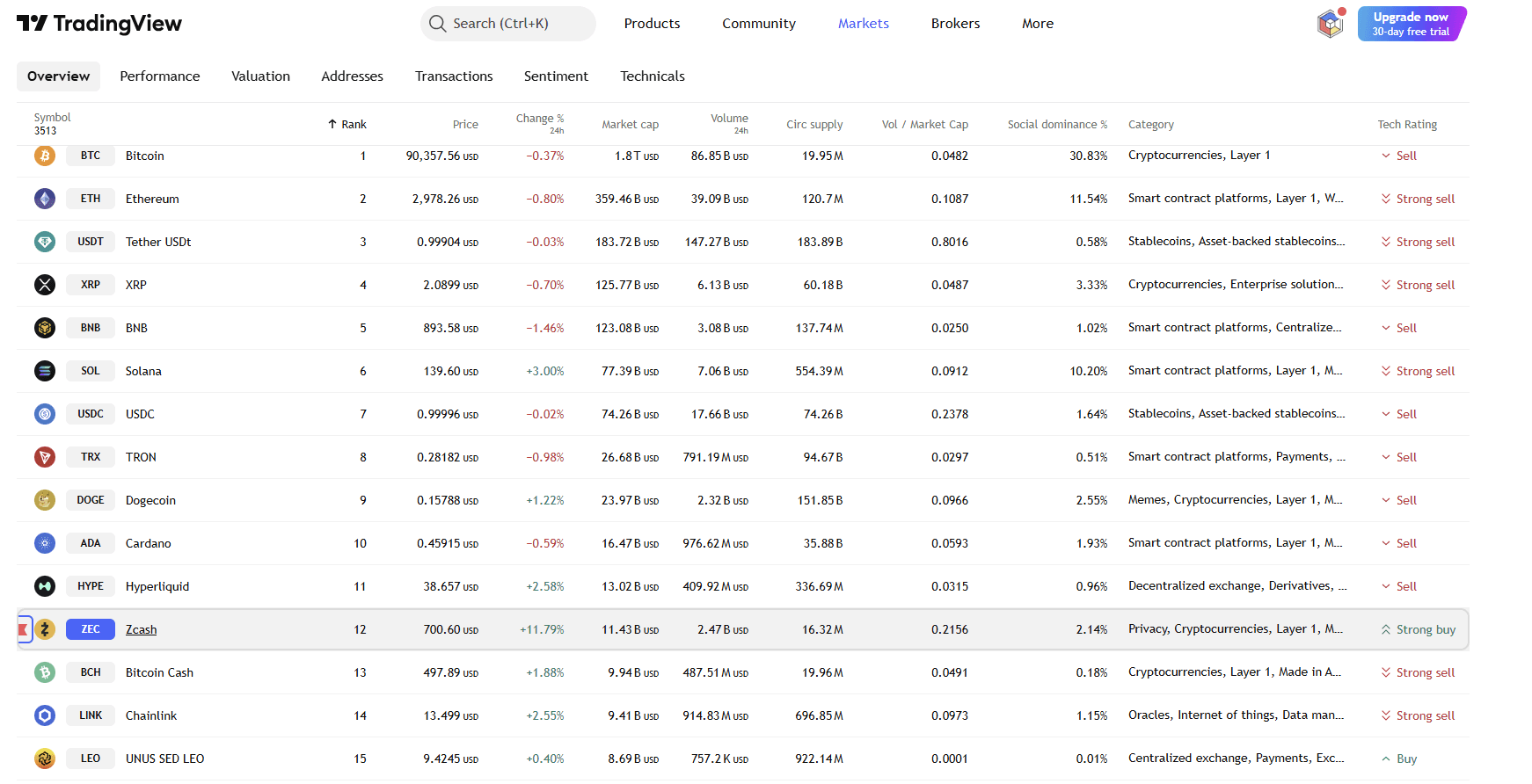

Should You Buy ZEC During the Market Crash? Here’s What’s Really Happening