What key signals did the U.S. "sleepless night" reveal to the market?

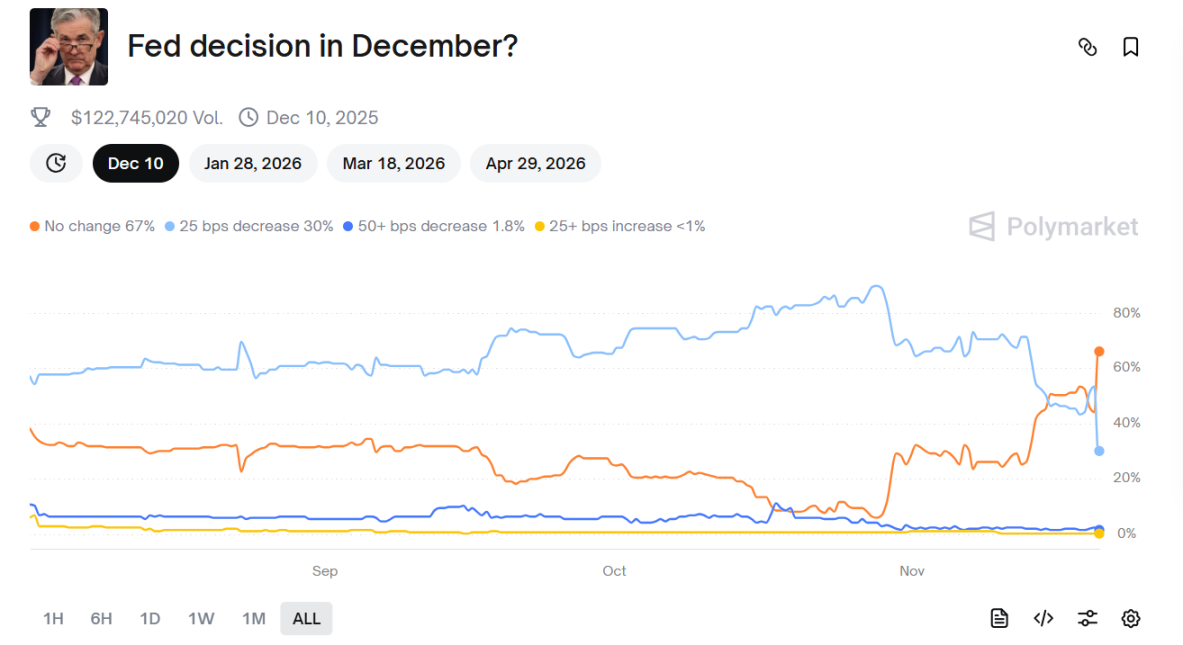

According to the latest data from Polymarket, the probability that the Federal Reserve will not cut interest rates in December this year has risen to 67%.

According to the latest data from Polymarket, the probability that the Federal Reserve will not cut interest rates in December this year has risen to 67%.

Written by: 1912212.eth, Foresight News

On November 19, both the US stock market and the crypto market were sleepless, as the highly anticipated AI leader NVIDIA was about to release its earnings report, which would greatly influence subsequent market trends. The Nasdaq once fell to 22,231, the S&P 500 dropped to 6,574, and bitcoin plunged from $93,000 at around 4 a.m. on November 19 to a low near $88,600.

Fortunately, NVIDIA's earnings report brought good news to the market.

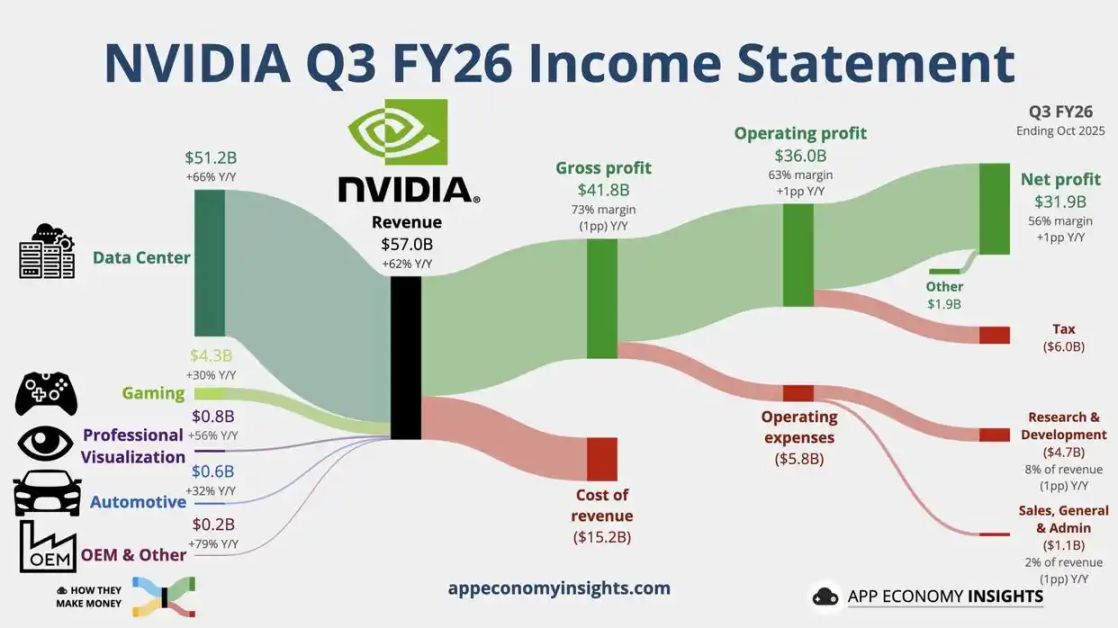

NVIDIA Q3 Revenue Hits $57 Billion, Exceeds Expectations

As the "shovel seller" of the AI era, NVIDIA not only supports half of the Nasdaq but has also become a bellwether for global risk assets. Data shows that over the past six months, the correlation between bitcoin and the Nasdaq 100 Index (NDX) has remained high. The ups and downs of the Nasdaq largely depend on NVIDIA's performance.

On November 20 (East 8th time zone), NVIDIA released its Q3 earnings report (natural year August–October), with revenue of $57.01 billion, exceeding the expected $55.19 billion; adjusted EPS was $1.30, surpassing the expected $1.26; data center revenue reached $51.2 billion, a year-on-year increase of 62%.

With its performance still unbeatable, NVDA once surged to $187.

NVIDIA CEO Jensen Huang stated in the earnings announcement that the company's latest generation Blackwell architecture chips "sold far beyond expectations, and cloud GPUs are sold out," and that "the demand for computing in training and inference continues to grow exponentially. We have entered a virtuous cycle for AI." On the earnings call, he once again refuted the AI bubble theory, saying there is much talk about an AI bubble, but "from our perspective, it looks completely different."

NVIDIA's earnings data gave the US stock market a shot of confidence, halting the downward trend, and the crypto market also rebounded. BTC has now recovered to oscillate near $92,000.

Federal Reserve Divided Internally, December Rate Cut Still Uncertain

The minutes of the October FOMC meeting released yesterday showed a rare split within the Federal Reserve over whether to continue cutting rates in December. Hawkish members clearly stated they are "more data-dependent," worrying about the risk of inflation rebounding; doves emphasized that the labor market is cooling rapidly and "preemptive rate cuts" are needed.

The current federal funds rate target range is 3.75%–4.00%, which is the level after the second 25bp rate cut in 2025. However, the minutes included the phrase "a number of participants noted that it might be appropriate to pause," which directly stunned the market.

According to the latest data from the CME FedWatch tool, the probability of a 25bp rate cut in December has plummeted from 95% two weeks ago to 28% now. The latest data from Polymarket shows that the probability of a 25bp rate cut by the Federal Reserve in December has dropped to 30%, while the probability of no rate cut has risen to 67%.

Now that rate cut expectations have been slashed, the shadow of tightening liquidity looms again, putting pressure on risk asset prices.

To make matters worse, the US November nonfarm payrolls report has been officially postponed to December 16—this is due to government funding expiration affecting the work of the BLS (Bureau of Labor Statistics). The October nonfarm data had already been significantly revised down due to factors such as hurricanes, and the September data was also delayed. Now, the November data will have to wait nearly another month.

The market has completely lost its core anchor.

The latest forecast from Goldman Sachs predicts that nonfarm payrolls in November will likely increase by only 50,000–80,000 jobs, far below the previous value of 220,000, and the unemployment rate may rebound to 4.3%. If the data turns out to be very poor, the hawks at the Federal Reserve will completely gain the upper hand, and the rate cut cycle may be directly paused in the first quarter of 2026. Conversely, if the data is unexpectedly strong, it will further reinforce the "no rate cut" expectation.

Trump Criticizes Powell, New Fed Chair Candidate May Be Announced Before December 25

Less than two hours after NVIDIA's earnings report was released (UTC+8), Trump directly criticized Powell in an interview: "I would love to fire him (Powell)," calling him "extremely incompetent."

At the US-Saudi Investment Forum held in Washington, D.C., Trump urged US Treasury Secretary Bessent to speed up the search for Powell's successor. Trump said to Bessent, who was sitting in the audience: "You have to work harder, Bessent. The only thing Bessent has messed up is the Fed."

Powell's term as Federal Reserve Chair will expire in May next year, while his term as a Fed governor runs until 2028. Trump also half-jokingly pressured Bessent:

Interest rates are too high, Bessent. If you don't get it done soon, I'll have to fire you.

He said that Bessent has been privately persuading him not to fire Powell, while Commerce Secretary Lutnick is "more inclined to fire" Powell.

Bessent, who is leading the search for a new Fed Chair, recently stated that Trump will meet with the three final candidates after Thanksgiving on November 27, and the new candidate may be announced before Christmas on December 25. According to Polymarket data, the market currently bets that Kevin Hassett has the highest probability.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

WLFI Faces Security Breach Leading to $22M Token Burn and Wallet Freezes

Samourai Wallet Co-Founder Sentenced to Four Years, Highlighting Legal Risks for Crypto Privacy Tools

Corporate Crypto-Treasury Firms Under Pressure as BlackRock Pushes New Staked Ether Fund

Crypto and Tech Stocks Surge as Nvidia Shatters Earnings Expectations, Boosting Market Confidence