Date: Thu, Nov 20, 2025 | 07:42 AM GMT

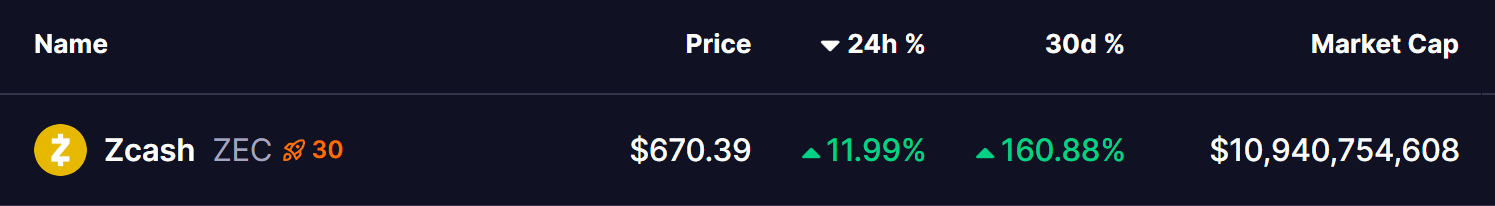

Privacy-focused cryptocurrencies are once again gaining momentum, and at the centre of this excitement is Zcash (ZEC), which has delivered a strong showing over the past several weeks. The token has jumped 11% in the past 24 hours alone and now stands more than 160% higher compared to the previous month — a remarkable surge for a project that had remained relatively quiet for much of the year.

But beyond the explosive gains, the chart is now revealing something far more interesting: a clean harmonic pattern that may be signaling that this rally still has more room to climb.

Source: Coinmarketcap

Source: Coinmarketcap

Harmonic Pattern Hints at Bullish Continuation

On the 4H timeframe, ZEC appears to be carving out a Bearish ABCD harmonic pattern — a structure typically associated with the final part of an uptrend. While this pattern eventually leads to a potential reversal at its completion zone, the CD leg itself often attracts aggressive bullish momentum before any cooling phase begins.

The pattern kicked off at Point A near $481.96, followed by a powerful push into Point B around $734.53. After that, ZEC slid into a corrective move that bottomed near Point C at $543.23. Notably, this retracement aligned almost perfectly with the 100-period moving average, where buyers stepped in quickly to defend the structure.

Zcash (ZEC) 4H Chart/Coinsprobe (Source: Tradingview)

Zcash (ZEC) 4H Chart/Coinsprobe (Source: Tradingview)

Since then, ZEC has recovered sharply, climbing back to the $670 region — a rebound that indicates the CD leg is now underway.

What’s Next for ZEC?

If the ABCD structure continues to play out, the CD leg could stretch toward the 1.32 Fibonacci projection of the BC segment, aligning the Potential Reversal Zone (PRZ) near $795.80. This level stands approximately 19% above current prices — a zone where traders often begin preparing for either a short-term pullback or an eventual reversal.

As long as ZEC maintains its structure within the CD leg and avoids losing momentum, this bullish outlook remains intact. The key will be holding above intermediate supports to prevent invalidation of the pattern.

A breakdown below the CD structure, however, would weaken the harmonic setup and expose ZEC to renewed selling pressure, potentially forcing a retest of lower support areas before any fresh upside attempt begins.