Nearly $115 Million Longs Liquidated As Bitcoin Drops to 7-Month Low, $70,000 Incoming?

Over $112 million in Bitcoin longs vanished as BTC plunged below $90,000 ahead of the FOMC minutes. Analysts warn the sell-off may extend toward $70,000 amid fading rate-cut expectations and accelerating ETF outflows.

In the past 60 minutes, over $112 million longs have been liquidated as traders de-risk in anticipation of the FOMC minutes.

Bitcoin slipped below the $90,000 psychological levels, blowing millions in long positions out of the water.

$115 Million Longs Wiped Out Amid FOMC Minutes Jitters

Data on Coinglass shows that over $112 million in long positions have been liquidated over the past hour. These positions were flushed out as the Bitcoin price dipped below the $90,000 psychological level, testing a seven-month low.

Bitcoin (BTC) Price Performance. Source: TradingView

Bitcoin (BTC) Price Performance. Source: TradingView

Meanwhile, the drop was not limited to the Bitcoin, as crypto stocks also registered losses, following the pioneer crypto’s fall to a 7-month low.

CRYPTO STOCKS FALL AS BITCOIN NEAR SEVEN-MONTH LOW🔸 COINBASE GLOBAL DOWN 4.9% 🔸 BITFARMS FALLS 7.5%🔸 STRATEGY SLIPS 10.3%🔸 RIOT PLATFORMS FALLS 3.7%🔸 HUT 8 MINING DOWN 3.3%🔸 MARA HOLDINGS DROPS 6.6%

— *Walter Bloomberg (@DeItaone)

It comes ahead of the October FOMC minutes, which is barely an hour out, suggesting investors are de-risking.

Beyond crypto and related stocks, indices were also down, with the Nasdaq and S&P 500 turning negative.

S&P 500 AND NASDAQ TURN NEGATIVE; S&P 500 DOWN 0.2%, NASDAQ DOWN 0.2%

— *Walter Bloomberg (@DeItaone)

This drop comes barely an hour before the October FOMC minutes release, with sentiment already reflected on social media.

Amid the anticipation, US President Trump said Fed chair Jerome Powell is “grossly incompetent,” citing too high interest rates.

Meanwhile, the Bureau of Labor Statistics has also revealed that it will not publish the October Jobs report. This gap likely steps from the recently concluded US government shutdown, which saw authorities run basically blind.

“After the September jobs report (out Thursday), there won’t be another jobs report until after the Dec. 9-10 FOMC meeting BLS: The October jobs report is cancelled. The November report won’t land until December 16. Sept JOLTS is also cancelled. October JOLTS will be published December 9,” wrote Nick Timiraos.

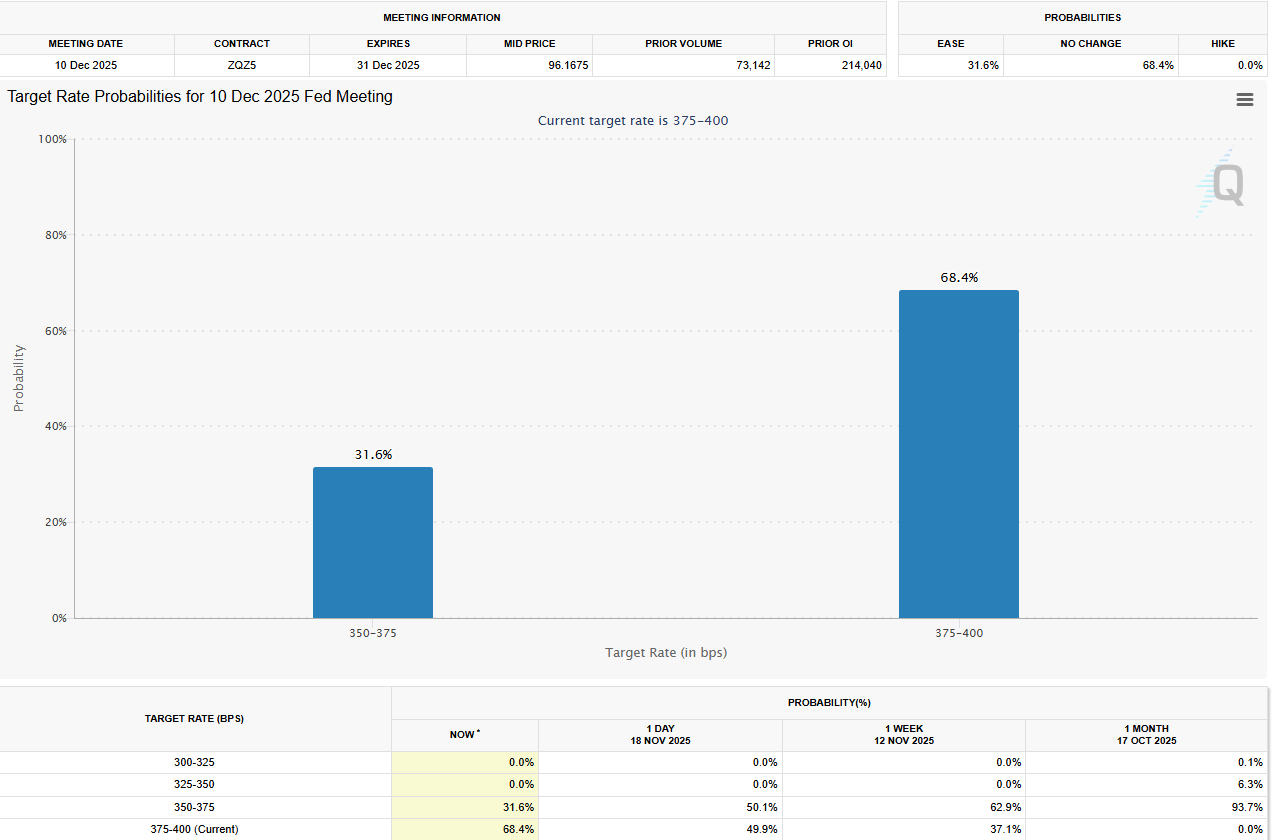

Based on this gap in the October Jobs report, December Fed rate cut bets have dwindled, with nearly 70% anticipating policymakers will hold interest rates steady.

Interest Rate Cut Probabilities. Source:

CME FedWatch Tool

Interest Rate Cut Probabilities. Source:

CME FedWatch Tool

Some analysts also ascribe the prevailing bearish sentiment to FUD (fear, uncertainty, and doubt), as institutional players signal a lack of conviction for BTC.

This is seen with ETF outflows from the likes of BlackRock, which the asset manager posting record negative flows of on Tuesday.

“BlackRock Dumps Record $523M in Bitcoin as BTC Slips Further in Bear Market. They sold $523M in Bitcoin, the largest single-day outflow IBIT has EVER recorded. Wall Street entered, profited, and exited. Bitcoiners got played hard,” analyst Jacob King remarked.

Even as the Bitcoin price continues to drop, some analysts say the downside potential remains very much alive, potentially as low as $70,000 in the near term, or worse.

Below $98,650, the next key Bitcoin $BTC levels are:• $75,740• $56,160• $52,820

— Ali (@ali_charts)

As of this writing, the Bitcoin price was trading for $88,977, down by almost 5% in the last 24 hours.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Astar (ASTR) Price Rally: On-Chain Usage and Institutional Engagement Fuel Lasting Expansion

- Astar (ASTR) surged 40% in late 2025 driven by on-chain adoption and institutional investments. - Q3 2025 saw 20% growth in active wallets and $2.38M TVL, supported by Agile Coretime upgrades and 150,000 TPS cross-chain infrastructure. - A $3.16M institutional investment and Astar 2.0's EVM compatibility highlight its multichain infrastructure vision and technical maturity. - Strategic partnerships with Animoca Brands and Sony Soneium, plus Chainlink CCIP integration, strengthen Astar's interoperability

DASH Soars 150% in a Week: Unpacking the Factors Behind the Privacy Coin’s Comeback

- Dash (DASH) cryptocurrency surged 150% in 7 days, driven by institutional adoption and thematic investment trends in blockchain privacy solutions. - The rally coincided with DoorDash (NASDAQ:DASH) stock's media attention, creating confusion between the crypto and equity assets despite unrelated fundamentals. - On-chain data showed increased DASH activity, reflecting retail interest in privacy-focused protocols amid post-FTX market shifts and DeFi optimism . - Analysts warn of risks from ticker symbol amb

Vitalik Buterin Supports ZKsync: Strategic Impact on Ethereum Layer 2 Growth and Institutional Investment in Crypto

- Vitalik Buterin endorsed ZKsync's 2025 Atlas upgrade, highlighting its role in Ethereum's scalability and institutional adoption. - The upgrade enables 15,000 TPS with near-zero fees via ZK Stack, enhancing liquidity sharing and Layer 2 interoperability. - ZKsync attracted $15B in 2025 inflows, with ZK token surging 50% post-endorsement, signaling institutional confidence. - Upcoming Fusaka upgrade aims for 30,000 TPS, strengthening ZKsync's position against rivals like Arbitrum and Optimism . - Buterin'

Google reports that cybercriminals accessed information from 200 firms after the Gainsight security incident