3 Bitcoin Mining Stocks To Watch In The Third Week Of November 2025

BMNR, BTDR, and HIVE face heavy declines but oversold conditions and strong fundamentals hint at possible rebounds in the third week of November.

When we look at Bitcoin’s price, the concern extends to the altcoins as well; however, it should also extend to the companies associated with BTC-related activities.

In line with the same, BeInCrypto has analysed three Bitcoin mining companies’ stock performance and what lies ahead for them.

BitMine Immersion Technologies (BMNR)

BMNR has dropped 24% this week and trades at $30.95. Despite the decline, Bitmine has continued accumulating ETH, adding 54,156 ETH worth more than $170 million over the past seven days. This signals a strong long-term conviction from the company.

The RSI is nearing the oversold zone, which often precedes a reversal. If conditions stabilize, BMNR could rebound from the $30.88 support and climb toward $34.94 or even $37.27, offering relief after a week of heavy losses.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

BMNR Price Analysis. Source:

TradingView

BMNR Price Analysis. Source:

TradingView

If Bitcoin weakens further, BMNR may follow the broader downturn. A deeper decline could send the stock below $27.80, with potential downside extending to $24.64. This would invalidate the bullish outlook and signal intensified bearish momentum.

Bitdeer Technologies Group (BTDR)

Bitdeer has recorded some of the steepest losses among Bitcoin mining stocks, falling 53% over seven sessions. The share price now sits at $10.63, reflecting intense selling pressure as broader market weakness continues to weigh on mining companies.

BTDR’s RSI is deep in the oversold zone, signaling conditions that often precede a reversal. If buyers step in, the stock could rebound from $9.56 and move toward $11.92, with potential upside extending to $15.24 if momentum strengthens.

BTDR Price Analysis. Source:

TradingView

BTDR Price Analysis. Source:

TradingView

If market conditions fail to improve, BTDR could continue its decline. A breakdown below $9.56 may drive the price toward $7.96. This would invalidate the bullish outlook and signal an extended downside for the mining firm.

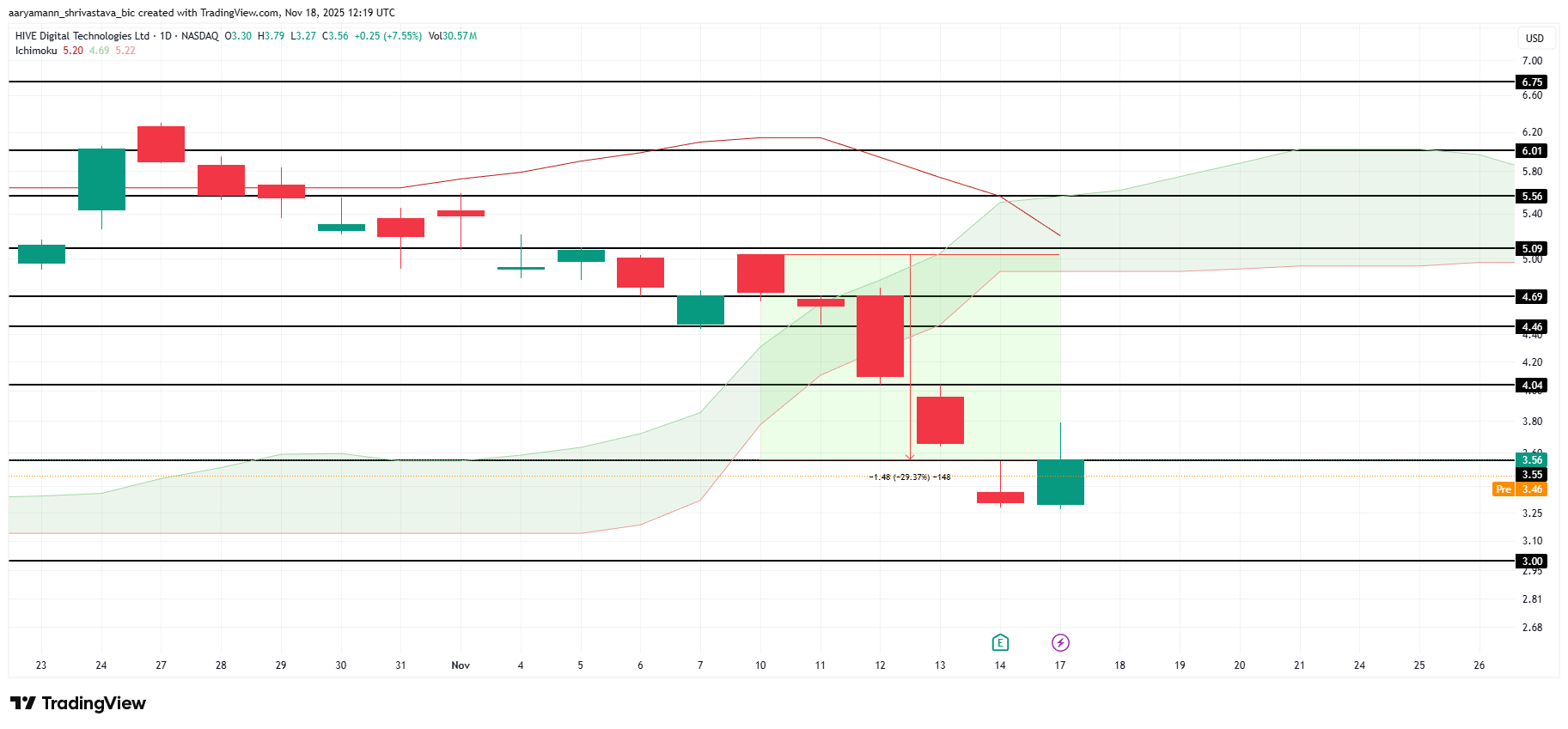

HIVE Digital Technologies Ltd. (HIVE)

Bitcoin mining company HIVE has dropped 29% over the past week but now trades at $3.56 after gaining 7.5% today. The surge follows the company’s announcement of 285% revenue growth in Q2, which has boosted investor confidence despite recent volatility.

This strong performance could fuel a broader recovery and lift HIVE toward $4.04. Restoring recent losses would require a move to $5.09. Reaching this target may take time, but it remains possible if momentum and sentiment continue improving.

HIVE Price Analysis. Source:

TradingView

HIVE Price Analysis. Source:

TradingView

If the stock fails to capitalize on the company’s earnings strength, HIVE may resume its decline. A drop toward the $3.00 support level or lower would invalidate the bullish thesis and signal renewed weakness.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: The Growth of Blockchain Real Estate May Position XRP as the Next Worldwide Benchmark

- Ledger Man's analysis links blockchain real estate systems to XRP's potential $79.73 surge, citing tokenization's market modernization potential. - New Jersey's 370,000 property records blockchain pilot and Dubai's XRP-based title deeds highlight government adoption of the technology. - BlackRock's $10T asset tokenization plans and McAllen's fractionalized $235K home demonstrate real-world blockchain applications in real estate. - XRP's regulatory partnerships and Netcapital's digital securities platform

XRP News Today: Crypto Market Splits: ETFs Gain Stability While Presales Remain Speculative

- New XRP and Dogecoin ETFs launch as U.S. regulatory approvals materialize, signaling institutional crypto adoption growth. - BNB outperforms XRP with stronger technical resilience and deflationary model, while XRP lags in cross-border utility growth. - Apeing’s presale gains traction as a high-risk 1000x return opportunity, contrasting with stable BNB and Litecoin dips. - Regulated ETFs and speculative presales highlight diverging investor strategies, with next 12–18 months shaping crypto’s new equilibri

Ethereum Updates Today: Ethereum ETFs Recover as Investors Weigh Immediate Fluctuations Against Future Improvements

- Ethereum spot ETFs recorded a $55.7M net inflow, led by FETH's 60% share, reflecting institutional confidence in post-upgrade fundamentals. - ETH/BTC ratio hit 0.052 (7-month low) as Bitcoin dominance rose to 53.2%, with Ethereum trading below key EMAs amid bearish technical indicators. - Upcoming Dencun upgrade (EIP-4844) and $7.4B+ real-world asset tokenization drive long-term optimism despite short-term volatility and higher ETF fees. - Staking infrastructure grows (Lido's 8.95M ETH, MAVAN network) wh

Bitcoin Updates: The Crypto Market Splits—Bitcoin ETFs See Outflows While Altcoin Enthusiasts Seek Returns and New Developments

- Bitcoin ETFs lost $3B in November, with BlackRock’s IBIT seeing $523M outflow as prices fell below $90K. - Bitwise’s Solana and XRP ETFs gained $580M and $420M inflows, offering staking rewards and cross-border payment exposure. - Institutional investors repositioned capital, shorting 53% of Bitcoin while Ethereum retained 55% long positions. - Analysts highlight altcoin ETFs’ yield advantages, but warn of Bitcoin’s liquidity risks and XRP’s weak derivatives market. - Market divergence reflects crypto-na