Trump’s Federal Reserve Strategy: Hassett’s Proposed Reductions Face Resistance from Central Bank Prudence

- Trump plans to nominate Kevin Hassett as Fed chair, prioritizing aggressive rate cuts over Powell's cautious approach. - Hassett's market-driven policies face political risks, with internal resistance warning against destabilizing Fed independence ahead of 2026. - Fed officials remain divided on rate cuts, balancing inflation control against weakening labor market signals. - Critics argue Trump's focus on short-term cuts risks inflation, while Bessent's post-Thanksgiving recommendations will shape U.S. m

President Donald Trump is nearing a decision to select Kevin Hassett as his top choice to replace Jerome Powell as the head of the Federal Reserve, with the National Economic Council director signaling he would accept the role if offered. Hassett, known for advocating significant interest rate reductions, stated in a Bloomberg interview that he favors a 50 basis point cut to the Fed’s key rate at the December meeting,

Hassett’s possible nomination highlights Trump’s desire for a Fed leader who aligns with his economic agenda. During his interview, Hassett stressed his readiness to challenge the Fed’s present policies, which he claims have become “uncomfortably aligned with partisan interests.”

The political dynamics surrounding the nomination are still complicated.

The Federal Reserve itself is facing a tricky situation. Some members, such as Governor Christopher Waller, are pushing for rate reductions due to a softening job market, while others, including Cleveland Fed President Beth Hammack, believe policy should stay “somewhat restrictive” to fight ongoing inflation

Trump’s advocacy for a more accommodative Fed fits with his broader economic strategy, which also involves reducing tariffs and tackling inflation. Hassett, who has previously been on the Fed’s board, describes his approach as a mix of market-oriented reforms and structural changes aimed at lowering costs for consumers

As the administration nears a final decision, whoever is chosen will need to balance Trump’s expectations with the Fed’s responsibility to maintain long-term economic health.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Turmoil and AI Breakthroughs: Grok 4.1, Gemini 3, Cloudflare Outage

AI Confidence and Economic Concerns Set Crypto Strength Against Market Downturn

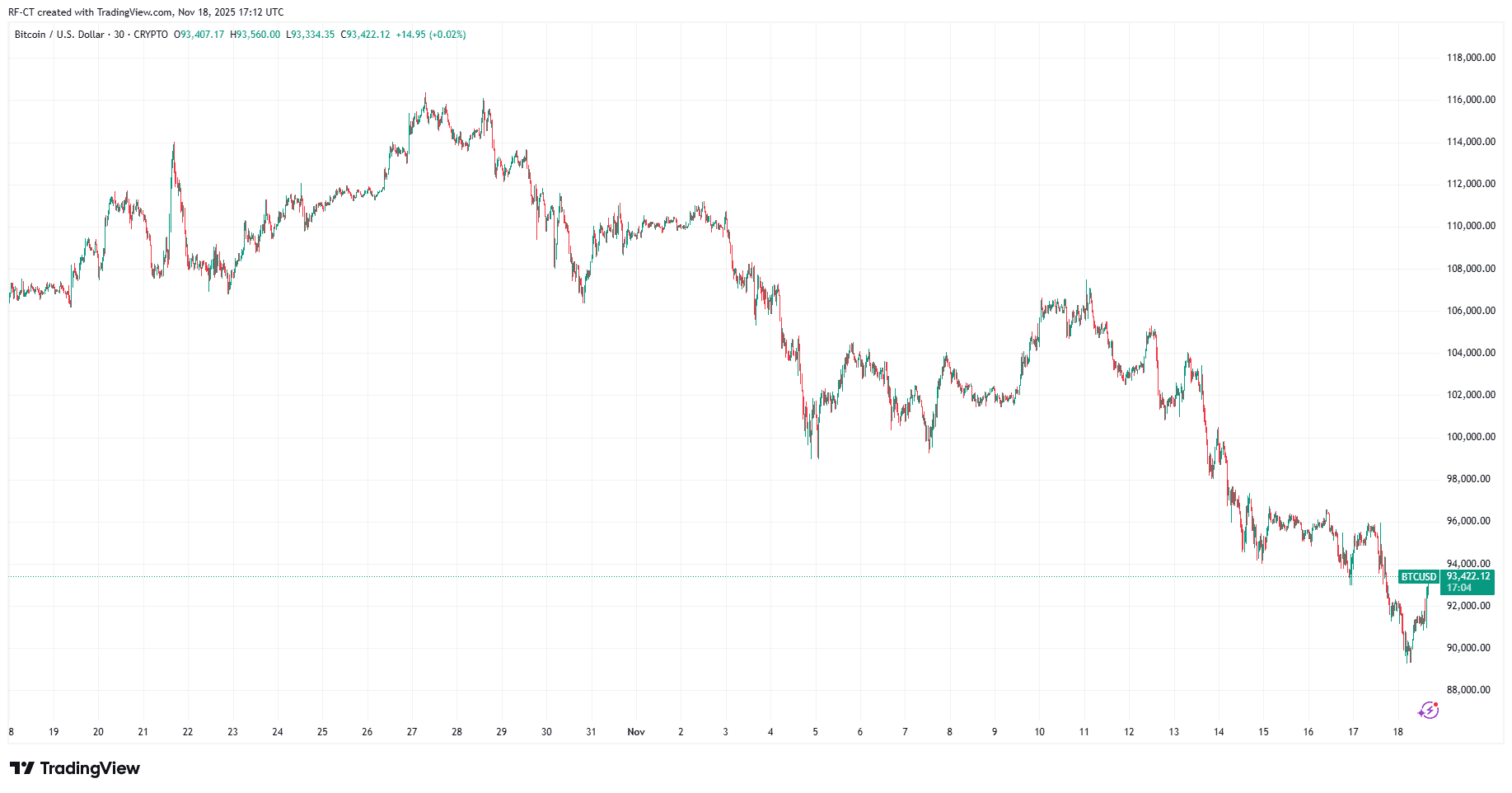

- U.S. stock indexes fell on Nov. 18, 2025, while crypto and AI-linked stocks showed resilience amid broader market weakness. - Nvidia's upcoming earnings and 54% YOY EPS forecast fueled gains in correlated stocks like TSMC (+41% YTD) and SMCI (+15% YTD). - Bitcoin rebounded 1% temporarily, but analysts warned crypto remains vulnerable to inflation fears and $1B+ leveraged liquidations. - Home Depot's 3% premarket drop dragged on the Dow after missing Q3 earnings and slashing profit forecasts amid housing

Solana's Breakthrough: Ushering in a New Age of Fast and Scalable Smart Contracts?

- Solana's 2025 upgrades (Firedancer, Alpenglow) achieved 1M TPS and sub-150ms latency, outperforming Ethereum and Sui . - Enterprise partnerships with Visa , PayPal , and Stripe leverage Solana's speed and low fees for payments and remittances. - Institutional ETF inflows and energy-efficient proof-of-history consensus boost Solana's appeal for green finance. - Challenges include competition from Ethereum upgrades, stablecoin liquidity declines, and regulatory risks.

Trump’s Federal Reserve Shakeup Raises Concerns Over Stagflation and Divides Within GOP

- Trump announced his Fed chair pick but withheld the name, criticizing resistance to removing Powell before his 2026 term ends. - Shortlisted candidates include Waller, Bowman, and Rieder, with Trump hinting at a "standard" choice amid political tensions. - The dispute with Rep. Greene over Epstein files highlights GOP fractures, as Trump accused her of betraying party loyalty. - Critics warn politicizing the Fed risks stagflation, while the Epstein files debate underscores transparency vs. loyalty tensio