Standard Chartered Sees Year-End Bitcoin Rally Amid Sell-Off Signals

Bitcoin’s pullback may be nearing exhaustion, with Standard Chartered expecting a year-end rally even as macro pressures and technical signals keep volatility high. Traders now watch liquidity trends and on-chain metrics to gauge the next move.

Bitcoin (BTC) is pulling back again after slipping below the $90,000 psychological level. Amid the ongoing recovery, Standard Chartered signals that the recent sell-off may have run its course.

Elsewhere, BitMine chairman Tom Lee says if the Bitcoin price manages to achieve a new all-time high this year, it would obviate the fact that there is a four-year cycle.

Bitcoin Set for Year-End Rally, Standard Chartered Says

In an email to clients, the bank’s Head of Digital Asset Research noted the recent pullback “is nothing more than a fast, painful version of the third one of the past couple of years.”

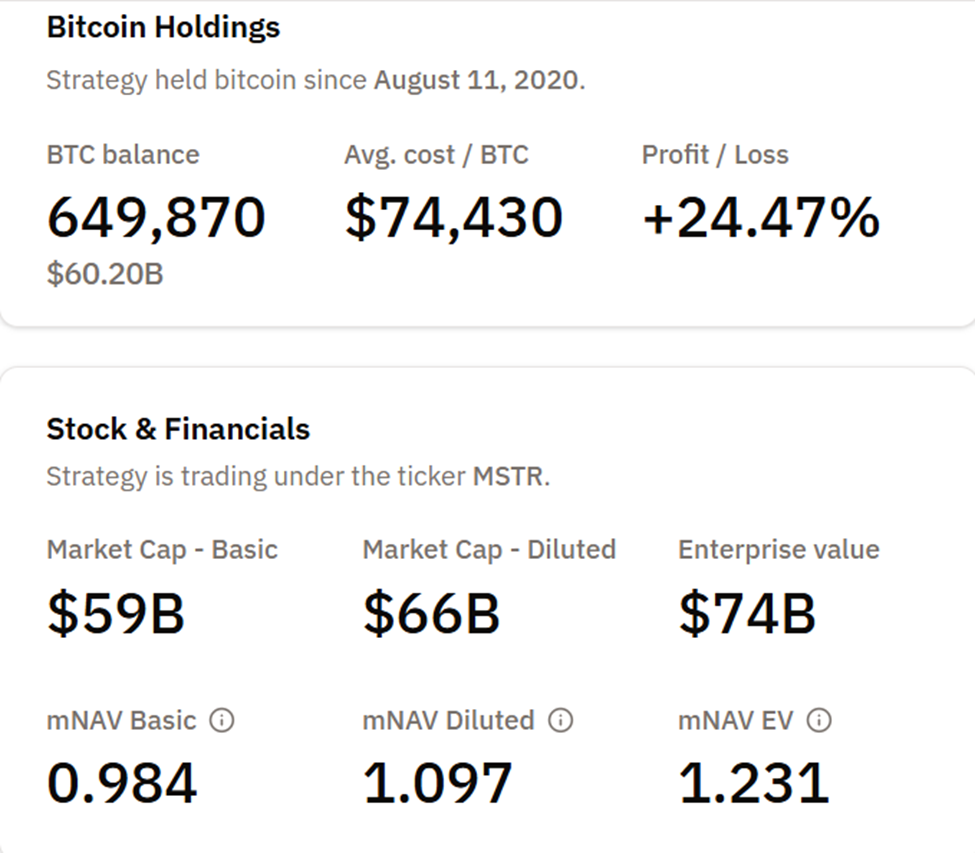

According to Geoff Kendrick, multiple on-chain metrics have reached absolute lows, including MicroStrategy’s mNAV, which is now at 1.0.

MicroStrategy mNAV. Source:

Bitcoin Treasuries

MicroStrategy mNAV. Source:

Bitcoin Treasuries

“A rally into year-end is my base case,” Kendrick said in the email.

On-chain analyst Ali highlighted that Bitcoin’s realized loss margin currently stands at -16%, which is below the -12% threshold historically associated with rebounds.

Bitcoin $BTC usually rebounds when traders’ realized loss margin falls below -12%. It’s now sitting at -16%.

— Ali

Additionally, the SuperTrend indicator on the weekly chart, which has consistently flagged major trend shifts since 2014, recently flipped to sell mode. Past signals have resulted in declines averaging 61%, indicating potential near-term volatility.

“Applying that average to the current market structure points to a potential move toward $40,000,” the analyst stated.

These mixed signals reflect a market caught between historical corrective patterns and bullish expectations from major financial institutions.

Macro Context: Liquidity vs. Opportunity Cost

Despite a $7 trillion increase in global M2 money supply since late 2024, Bitcoin has struggled to capitalize on the liquidity surge fully. EndGame Macro explained that, while the global liquidity pool remains historically high, much of the capital is being absorbed by government debt issuance and short-term instruments that pay yields of 4–5%.

“The way I see it, liquidity is being taxed,” the analyst noted.

With risk-free alternatives yielding tangible returns, speculative assets like Bitcoin face a higher opportunity cost.

This dynamic has contributed to choppy trading, with sharp bounces when shorts get crowded and sudden drops triggered by macro jitters. This reflects a more cautious investor environment.

Bullish commentators argue Bitcoin’s current price reflects undervaluation, suggesting the cryptocurrency could reach $150,000 amid ongoing monetary expansion. Meanwhile, Skeptics say that the correlation between liquidity and BTC price is no longer straightforward, citing competing market forces and regulatory nudges toward safer assets.

Traders and investors should brace for continued volatility as leverage unwinds and macro positioning adjusts.

Standard Chartered’s forecast of a year-end rally hinges on the assumption that the sell-off has exhausted its momentum. Still, risks remain in the form of potential corrections or policy-induced market swings.

On-chain metrics, including realized loss margins and SuperTrend signals, will likely remain key indicators for timing entries and exits.

As 2025 draws to a close, Bitcoin could either rebound in line with institutional forecasts or continue trading as a volatile, non-yielding asset, amid a macro environment that increasingly rewards caution.

Investors must conduct their own research and watch both liquidity flows and policy signals to gauge the next leg of price action.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Russia Moves Away From The Dollar With Yuan Bond Issuance

Blockchain’s Backbone Reinvented: Avail Connects Disparate Chains through Nexus

- Avail's Nexus Mainnet launches as a cross-chain execution layer to unify liquidity across Ethereum , BNB Chain, and other major blockchains. - Its intent-solver architecture optimizes transaction routing with multi-source liquidity, enabling seamless asset and user movement between chains. - Projects like Lens Protocol and Vanna Finance adopt Nexus for unified collateral management, using the AVAIL token ($0.0080) for governance and coordination. - Avail plans to expand Infinity Blocks to 10 GB per block

Bitcoin News Update: Will Strategy's 71-Year Bitcoin Reserve Withstand Industry Volatility?

- Bitcoin treasury firm Strategy claims 71-year dividend sustainability with $56B Bitcoin holdings, even if prices stagnate at $87,000. - Industry faces instability from JP Morgan boycotts and MSCI's 2026 index exclusion plan, risking automatic crypto sell-offs. - Strategy's 5.9x asset-to-debt ratio and Nasdaq 100 inclusion contrast with peers selling Ethereum reserves amid liquidity pressures. - Market debates long-term viability as Saylor insists on "HODL" strategy, but prolonged Bitcoin declines below $

Bitcoin News Update: Crypto Downturn Intensifies as Technical Indicators and Economic Factors Combine Against Bullish Sentiment

- Bitcoin faces bearish pressure with MACD sell signals and price below key EMAs, risking a 10% drop to $83,111 if support fails. - Ethereum's death cross pattern and XRP's weak technical structure highlight vulnerability near $3,000 and $2.00 support levels. - Macroeconomic uncertainty over Fed rate cuts and ETF outflows amplify downward pressure on crypto markets. - Bitcoin ETFs show fragile recovery with $74M inflow, while Ethereum ETFs face sustained outflows and bearish sentiment. - Speculative intere