US Govt and Mt. Gox Shift Millions in Hidden Crypto Transfers

New blockchain movements from the US government and Mt. Gox are drawing trader scrutiny, with delayed creditor payouts helping calm market fears.

Blockchain tool Arkham detected small but impactful moves that could have lasting effects for months.

The US government and Mt. Gox, the defunct Japanese exchange, made significant transfers that have traders watching closely.

US Government Moves Seized Crypto

Blockchain intelligence firm Arkham revealed that the US government recently moved $23,000 worth of WIN tokens on Tron. These assets were seized from Alameda Research nearly two years ago.

ARKHAM ALERT: US GOVERNMENT MOVING FUNDSThe US Government moved $23K of WIN on Tron seized from Alameda Research 2 years ago. pic.twitter.com/98goLfxUrd

— Arkham (@arkham) November 18, 2025

While small in dollar terms, the move signals that authorities are still actively managing high-profile crypto seizures.

Such transfers can precede auctions, compliance actions, or other administrative steps, with minor movements, just like major ones, capable of influencing market sentiment for linked tokens.

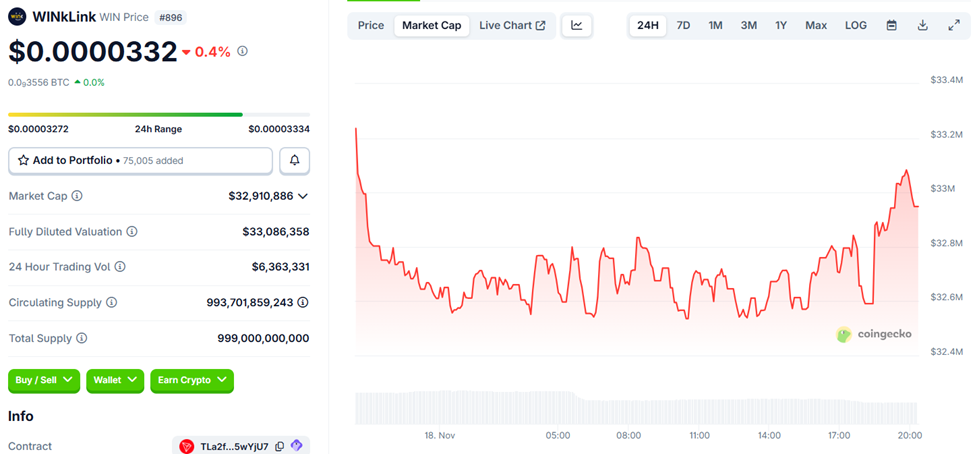

WINkLink (WIN) Price Performance. Source:

WINkLink (WIN) Price Performance. Source:

Data on CoinGecko shows the WINkLink token on Tron was trading for $0.0000332 as of this writing, down by 0.4% in the last 24 hours.

Mt. Gox Transfers $16.8 Million in Bitcoin

More attention is focused on Mt. Gox, which transferred 185 BTC, valued at approximately $16.8 million, to the following a test transaction. An additional $936 million in Bitcoin was shifted to another Mt. Gox wallet, according to Arkham.

MT GOX JUST TRANSFERRED $16.8M OF $BTC TO KRAKENMt Gox just transferred 185 BTC ($16.8M) to Kraken after a test transaction. $936M of change BTC has been moved to another Mt. Gox wallet.Mt. Gox made their last major movement 8 months ago, depositing $77.4M worth of Bitcoin to… pic.twitter.com/5YQYJqqxBw

— Arkham (@arkham) November 18, 2025

This follows the exchange’s last major transfer, eight months ago, when $77.4 million in Bitcoin was sent to Kraken for creditor distributions.

On October 27, Mt. Gox announced that Bitcoin repayments will now occur by October 31, 2026. This locks 34,689 BTC, approximately $4 billion, and temporarily removes a significant source of potential selling pressure.

“It has become desirable to make the repayments to such rehabilitation creditors to the extent reasonably practicable,” rehabilitation trustee Nobuaki Kobayashi stated in the letter, citing court approval for the one-year extension.

Analysts say the delay calms Mt. Gox FUD and provides near-term market clarity. By pushing the next major liquidity event out by a year, investors gain stability and confidence amid delayed selling pressure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: The 2025–2031 Battle for Bitcoin: Long-Term Confidence Faces Near-Term Uncertainty

- Bitcoin's 2025 price dropped 30% to $85,000 amid Fed policy shifts and ETF outflows, triggering market recalibration. - Institutional investors like Harvard and Japan's Metaplanet are accumulating BTC, signaling potential 2026–2031 bull phases. - Analysts project $160,000–$350,548 targets by 2026–2031, but warn of $53,489–$58,000 bear risks amid macroeconomic uncertainties. - Long-term bullish sentiment persists despite short-term volatility, with on-chain data showing whale accumulation at discounted le

Spain’s Revamp of Crypto Tax Laws May Spark Market Turmoil, Opponents Caution

- Spain's Sumar group proposed crypto tax hikes to 47% and a risk "traffic light" system for platforms in November 2025. - The plan introduces dual taxation for individuals/businesses and expands seizable crypto assets beyond EU MiCA rules. - Experts warn of legal challenges, market instability, and "absolute chaos" if the reforms create compliance burdens for investors. - Critics argue the measures could deter crypto adoption, drive activity underground, and destabilize Spain's emerging crypto sector.

Solana News Today: "November's Investor Challenge: Support Struggling Solana or Chase Profits with Mutuum's Surge?"

- November 2025 crypto markets show Solana (SOL) down 22% amid macroeconomic uncertainty, while Mutuum Finance (MUTM) raises $18.9M in presale with 18,200 holders. - Solana faces declining confidence ($134 price, $7.3B flat open interest) as Fed rate uncertainty and bearish derivatives sentiment weaken its position. - Mutuum's Phase 6 presale (95% sold at $0.035) gains momentum through direct debit access, security audits, and a 20% price jump to $0.06 in Phase 7. - Analysts highlight Mutuum's dual DeFi mo

XRP News Today: XRP ETFs Draw $58M Investments During Price Fluctuations, Prompting Concerns

- Canary Capital’s XRPC ETF sees $26.5M inflows, contrasting Bitcoin ETF outflows. - Franklin Templeton/Bitwise XRP ETFs launch Nov 18-20, signaling institutional interest. - XRP stabilizes near $2 support but faces pressure from mixed technical indicators. - $15.8M ETF inflow amid volatility highlights uncertain market dynamics for altcoins.