Bitcoin drops below $90K, triggering $947M in liquidations

Key Takeaways

- Bitcoin's price fell below $90,000 amid heightened market volatility.

- The drop represents a significant downturn following recent record highs in the crypto market.

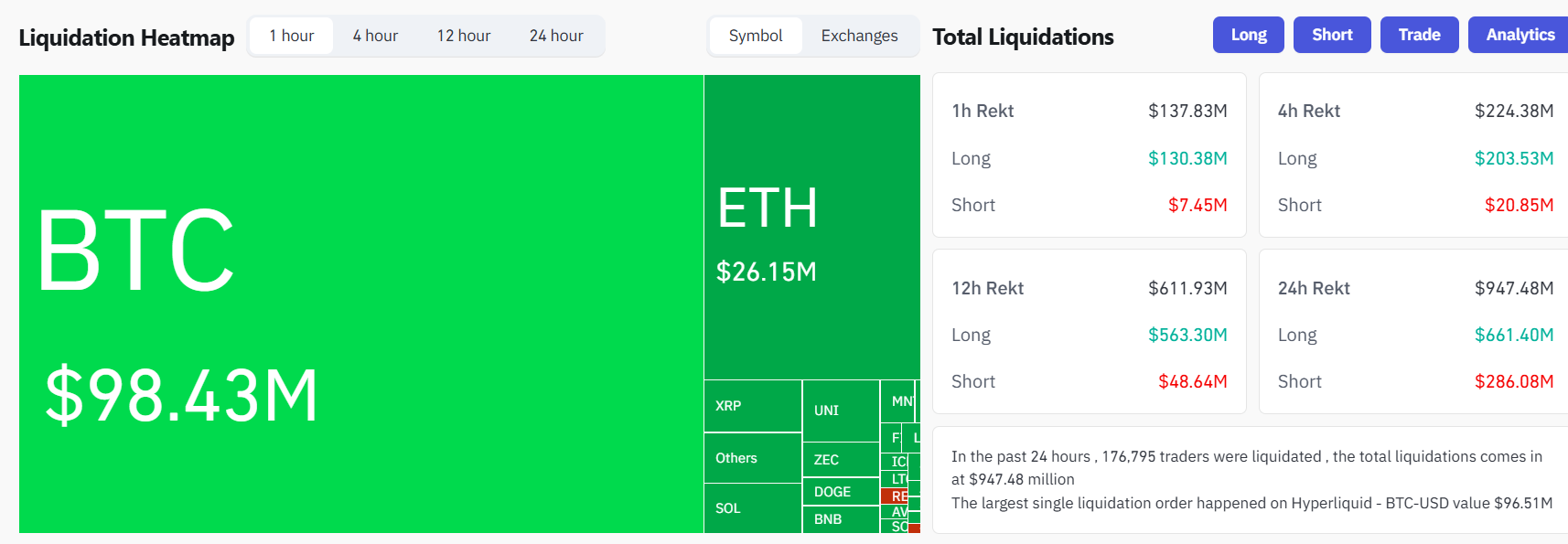

Bitcoin fell to $89,700 after failing to hold below the $90,000 level on Monday, extending its slide and triggering roughly $947 million in leveraged liquidations over the past 24 hours, according to data from CoinGecko and CoinGlass.

Losses extended beyond Bitcoin. Ethereum dipped 7% to below $3,000, XRP shed 6%, and Solana and BNB each lost around 4%. The crypto market’s total value dropped 5% to $3.1 trillion, while sentiment plunged to “extreme fear” with the Fear and Greed Index reading at 11.

With Bitcoin heading for a 15% monthly loss, November is shaping up to be one of its weakest months of 2025. The decline has fully reversed the year’s gains, leaving BTC almost 3% lower year-to-date.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PENGU Token Technical Review: Managing Immediate Market Fluctuations and Blockchain Indicators

- PENGU token faces critical juncture with conflicting technical indicators and accumulating on-chain activity in November 2025. - Short-term bearish signals (RSI 38.7, 12 sell signals) clash with bullish MACD/OBV divergence and whale accumulation ($273K acquired). - On-chain patterns suggest potential breakout above $0.0235 resistance, with $0.026 target if volume supports, but $0.01454 support remains vulnerable. - Risks persist due to unquantified NVT score and bearish pressure from broader indicators,

Bitcoin News Update: Retail Investors Panic While Whales Remain Confident as Bitcoin Hits Lowest Point in Seven Months

- Bitcoin fell to a seven-month low near $89,250, sparking debates over a potential bottom or prolonged correction amid mixed technical and institutional signals. - Analysts highlight a possible 40% rebound by year-end, driven by bullish figures like Michael Saylor and whale accumulation of 345,000 BTC since October. - Retail investors flee as fear metrics hit extremes, contrasting with institutional confidence seen in Czech National Bank's $1M Bitcoin pilot and ETF inflows. - Technical indicators warn of

COAI Experiences Significant Price Decline in Early November 2025: Combined Impact of Disappointing Earnings and Changing Market Sentiment

- COAI Index fell 88% YTD in 2025, sparking debates over AI/crypto AI sector revaluation vs. overreaction. - Mixed Q4 earnings: Cisco showed $14.7B revenue growth, while C3.ai reported $31.2M operating loss despite 26% revenue rise. - C3.ai's leadership crisis (CEO change, lawsuit) and governance issues amplified COAI's decline amid regulatory uncertainty. - CLARITY Act's ambiguous crypto regulations and institutional flight to stable tech stocks worsened sector sentiment. - Market re-rating of speculative

Hyperliquid (HYPE) Price Rally: Institutional Embrace and Changing Market Sentiment in Decentralized Trading

- Hyperliquid's HYPE token surged due to institutional adoption and shifting market sentiment, defying broader crypto slumps. - A $1B HYPE Digital Asset Treasury merger with Rorschach I LLC and partnerships like Hyperion DeFi's HAUS protocol boosted token utility and capital inflows. - Q3 2025 analysis shows HYPE trading between $35-$60 with strong on-chain metrics, though manipulation risks and Fed policy remain critical factors. - 21Shares' HYPE ETF application and Hyperliquid's expanded $1B fundraising