Ethereum News Update: Ethereum Whale Makes $1.33B Leveraged Move—Sign of Confidence or Risky Overextension?

- Ethereum whale "66kETHBorrow" injected $1.33B into ETH via leveraged Aave borrowing, stabilizing prices near $3,500. - Whale's 385k ETH holdings and $270M Aave-funded purchases signal institutional confidence despite market volatility. - Analysts note leveraged accumulation often precedes recoveries, though risks include amplified losses if prices correct further. - Market remains divided as whale's strategy contrasts with $183M Ethereum ETF outflows and key support/resistance levels.

Ethereum's market landscape is evolving as a prominent whale steps up its accumulation efforts,

The whale's moves have

Although the whale's actions reflect institutional-level confidence, they also carry risks. Using borrowed capital increases potential losses if prices drop further, and

Ethereum's ability to stay above $3,500 is also supported by

The whale's impact goes beyond price stabilization,

Opinions remain mixed regarding Ethereum's short-term direction.

As Ethereum moves through this consolidation period, the balance between whale-driven buying and institutional outflows will play a crucial role. With over $1.33 billion already invested and more capital available through borrowed USDT,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aster News Today: Aster Sets New Standard for DEXs by Introducing CEX-Level Liquidity Hybrid

- Aster launches Stage 4 "Harvest" airdrop and $10M "Double Harvest" trading competition to boost ecosystem growth. - Dual-reward system allows users to earn airdrop and competition tokens simultaneously through trading activity. - Platform develops on-chain order-book protocol for CEX-like speeds and expands gold/index perpetual contracts. - Global expansion includes Binance events and wallet integrations, while token utility expands to staking and governance. - Hybrid model combines decentralized infrast

The Federal Reserve's Change in Policy and Its Unexpected Effect on Solana's Price Rally

- The Fed's 2025 shift to easing policy, ending QT and cutting rates, injected liquidity, boosting Solana and other cryptos as risk assets. - Historical parallels show Fed liquidity expansions correlate with crypto rallies, though Solana's December 2025 price data remains unclear. - Cryptocurrencies now exhibit macroeconomic sensitivity, with Fed easing potentially increasing demand for high-volatility assets like Solana. - Investors must balance Fed-driven liquidity benefits against crypto's volatility an

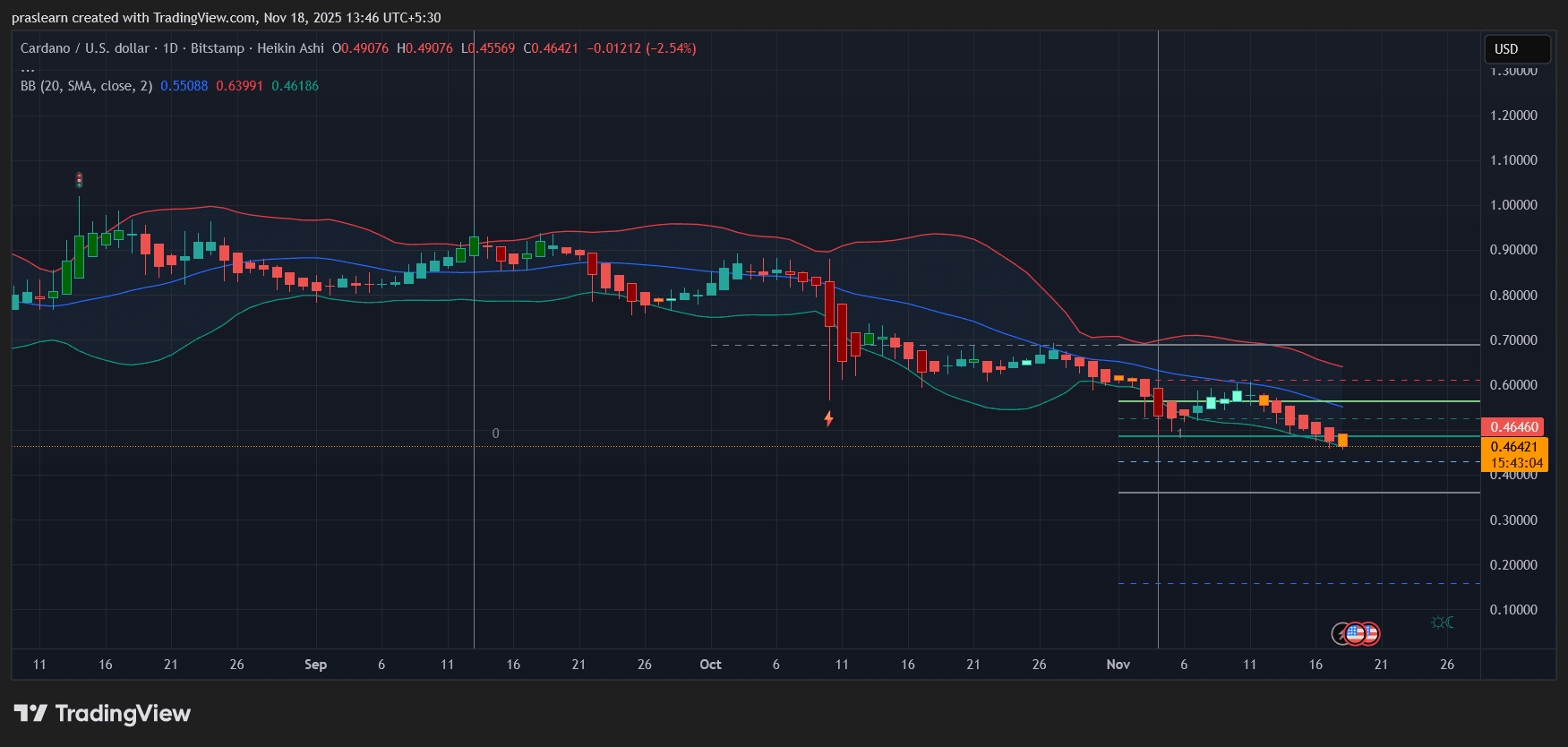

Cardano Price Crashes: Is $0.40 Next?

Bitcoin Updates: Investor’s $33M ETH Wager Withstands $1.1B Liquidation Surge While Crypto Markets Approach Bearish Levels

- A top crypto trader liquidated $7. 3M before re-entering with a $33M ETH long amid $1.1B market-wide liquidations on Nov 14, 2025. - Long positions suffered 973M losses vs 131M short liquidations, with a $44.29M BTC-USDT position marking extreme leverage use. - Bitcoin's RSI hit "massively oversold" levels and fell below its 3-year volatility band, echoing 2022 FTX-era market stress. - The crisis reignited debates over leveraged trading risks, with 246,000 traders forced to exit positions during the shar