FIRO’cious Price Rally Shows No Signs of Slowing — Can It Extend Beyond $10?

FIRO’s surge continues as the privacy-coin market heats up. The price has broken out of a flag pattern, backed by rising money flow and strong bull-bear pressure. With resistance zones approaching and double-digit projections returning, FIRO now stands at a critical point that could decide whether the rally extends toward $10+ or stalls.

The FIRO price has surged almost 60% in the past 24 hours and is now up more than 300% over the past month. The move has outpaced even Zcash, one of the strongest privacy coins this cycle. FIRO, previously known as Zcoin, is clearly riding the renewed momentum in the privacy coin space.

The key question now is whether this rally still has fuel left — and whether FIRO can realistically revisit the $10+ zone.

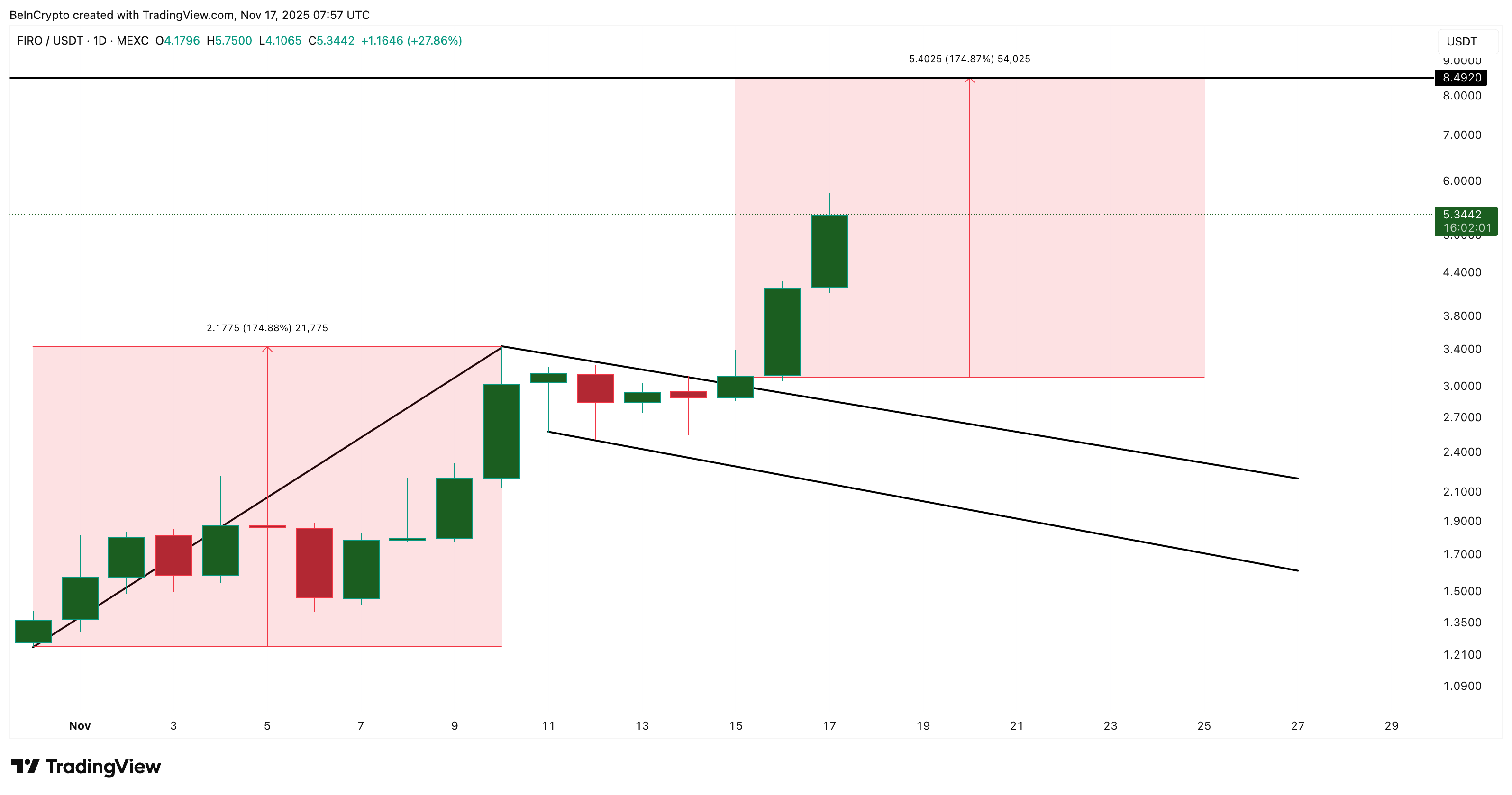

Flag Breakout Sets the Tone for FIRO’s Rally

FIRO recently broke out of a flag pattern, a classic bullish continuation structure that forms when price pauses after a sharp run-up.

The pole formed between October 31 and November 10, followed by a tight consolidation from November 10–15. FIRO then broke out on November 15, completing the pattern.

FIRO Breakout:

TradingView

FIRO Breakout:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Based on the pole projection, the technical target sits near $8.49, assuming broader market conditions remain supportive. With privacy coins catching strong flows across the board, FIRO has a realistic shot at reaching this extension.

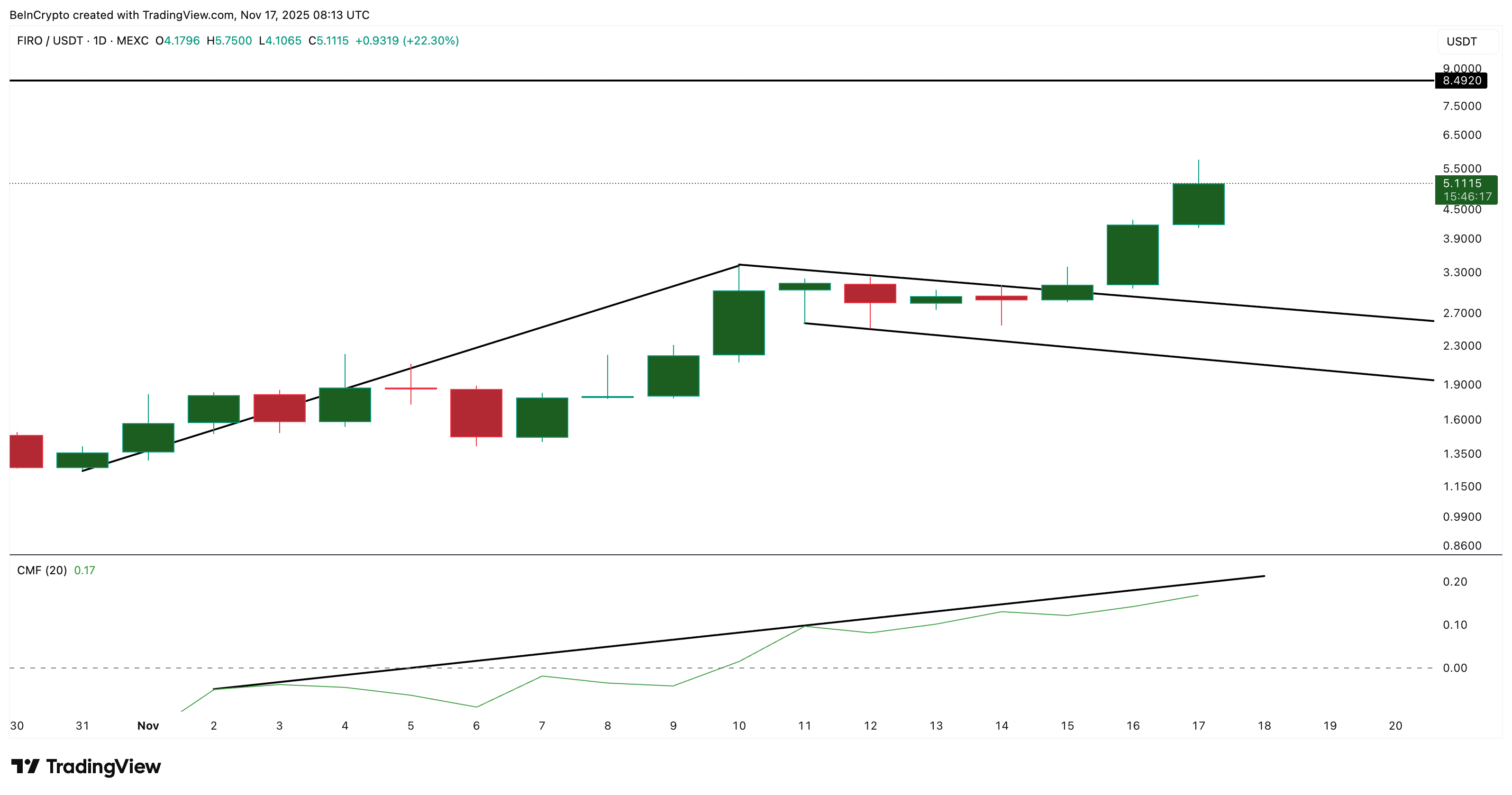

Big Money Flows and Bull-Bear Power Add Strength to the Move

The breakout has strong backing from volume-based indicators. FIRO’s Chaikin Money Flow (CMF) — an indicator that measures buying vs selling pressure weighted by volume — has been rising through the consolidation. CMF held steady even as the FIRO price was consolidating, indicating that big wallets were quietly accumulating during the dip.

Rising Inflows:

TradingView

Rising Inflows:

TradingView

The CMF ascending trendline breakout is still pending. A clean move above the upper CMF trendline would confirm a new wave of inflows and support FIRO’s next leg toward the projected target. However, until the CMF breakout happens, the FIRO price action remains prone to pullbacks.

The Bull-Bear Power indicator also confirms strength. This indicator measures the gap between buying pressure and selling pressure. On FIRO’s chart, Bull-Bear Power has surged to bullish levels higher than those seen during the original pole, validating the force behind this breakout.

Bulls Control The FIRO Price:

TradingView

Bulls Control The FIRO Price:

TradingView

Both indicators support the idea that the FIRO price rally might have more room to run.

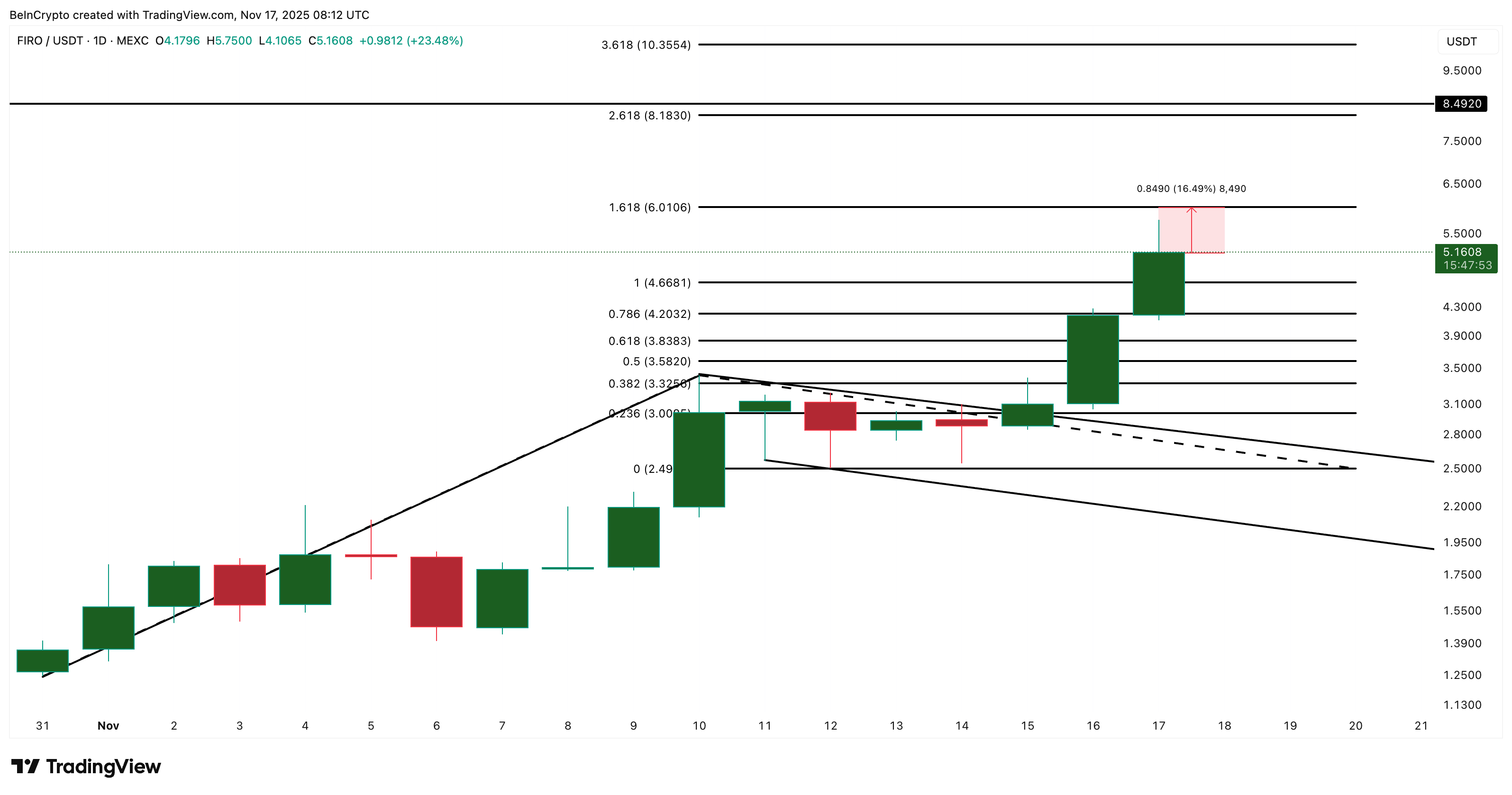

FIRO Price Levels That Matter Next

The FIRO price now faces two major hurdles.

- The first resistance sits at $6.01. A daily close above this level strengthens the momentum case.

- The next major resistance sits at $8.18, just below the pole-derived target.

Crossing both levels keeps the $8.49 projection in play.

FIRO Price Analysis:

TradingView

FIRO Price Analysis:

TradingView

If FIRO clears $8.49 (the pole projection), the next psychological and technical target becomes $10.35, marking the return of the double-digit zone.

On the downside, a move below $3.00 weakens the structure, and falling under $2.49 breaks it completely. These are the invalidation levels for the current rally. That could happen only if a FIRO price pullback runs deeper, led by big money exiting and not breaking the trendline that we mentioned earlier.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Nordic investors look for reliability in 21Shares’ physically-backed cryptocurrency ETPs

- 21Shares AG launched six new physically-backed crypto ETPs on Nasdaq Stockholm, expanding its Nordic offerings to 16 products. - The ETPs provide diversified exposure to major cryptocurrencies and index baskets, eliminating custody risks through full collateralization. - With $8B AUM and a focus on regulatory compliance, 21Shares strengthens its leadership in institutional-grade crypto access across Europe. - The expansion aligns with growing Nordic demand for transparent digital asset solutions amid int

Uniswap Latest Update: Major Holder Sells UNI After 5 Years, Incurring $11.7M Loss and Underscoring Cryptocurrency Market Volatility

- A crypto whale ended a 5-year UNI token hold by depositing 512,440 tokens into Binance, resulting in a $11.7M unrealized loss. - The move highlights crypto market volatility, with UNI's value dropping from $15.34M (2020) to $3.64M (2024) despite a $15 peak in 2021. - On-chain analytics platforms like Onchain Lens track such large-scale activity, revealing liquidity shifts and market sentiment patterns. - The transaction underscores risks of long-term crypto holding, where 76% value erosion emphasizes the

Aave Falls 24.95% Over the Past Month as Large Investor Moves and ETP Listings Underscore DeFi Market Fluctuations

- AAVE token fell 24.95% in a month, with a 44.48% annual drop, reflecting DeFi market volatility. - A whale added $3M in USDC to its Aave position, signaling confidence in governance and liquidity dynamics. - A leveraged trader’s $80M WBTC position faces $3.73M loss risk as WBTC nears liquidation threshold. - Aave’s V4 testnet introduces a "Hub and Spoke" architecture and Risk Premiums to enhance capital efficiency and collateral safety. - 21Shares expanded Nasdaq Stockholm offerings with Aave ETPs, offer

Bitcoin Drops 2.8% Amid Whale Movements and ETF Withdrawals

- Bitcoin whale Owen Gunden deposited 2,499 BTC ($228M) on Kraken, signaling strategic rebalancing amid prior 11,000 BTC liquidation. - El Salvador bought 1,090 BTC during price dip, expanding holdings to 7,474 BTC despite IMF concerns over public sector risk exposure. - BlackRock's IBIT saw $523M single-day outflow, contributing to $3B November net outflows as ETFs face worst monthly performance. - DDC Enterprise acquired 300 BTC (total 1,383 BTC) while mid-cycle holders increased selling pressure amid ma