Pi Network's 770,000 Coin Increase Indicates Mainnet Launch is Imminent

- Pi Network mapped 770,000 coins in one day, signaling mainnet readiness as blockchain infrastructure advances toward smart contract support. - Testnet 1's low failure rates and v23 protocol testing confirm stability, while developers prepare liquidity pools and token creation tools. - Pi's price rose above $0.22 amid new Pi App Studio features and AI partnerships, expanding its decentralized ecosystem beyond finance. - Fast-track KYC and OpenMind collaboration highlight growth strategies, though regulato

Pi Network Experiences Spike as 770,000 Coins Are Mapped in a Single Day

The mobile-first cryptocurrency initiative, Pi Network, has reached a notable achievement with 770,000 Pi coins mapped within just one day, reflecting increasing

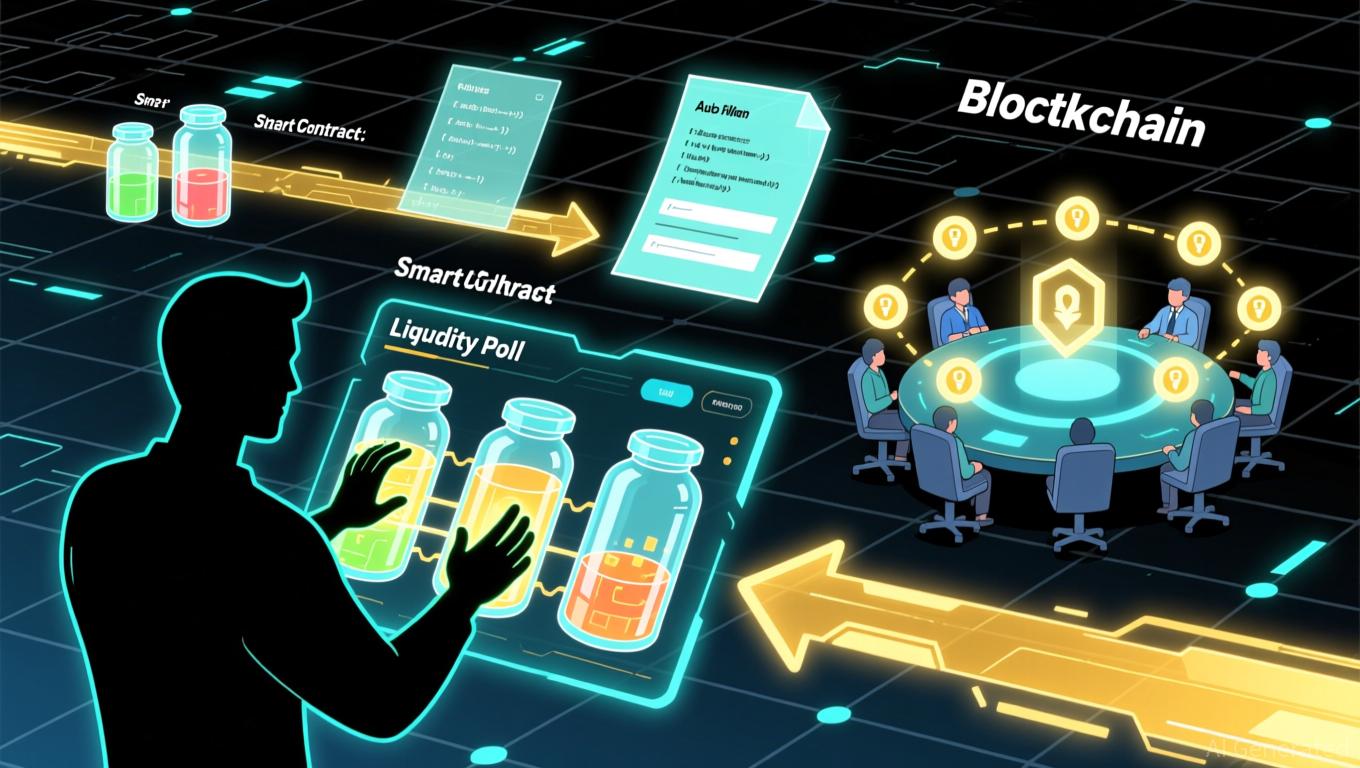

This recent surge is consistent with Pi Network’s overarching plan to evolve from a mobile mining platform into a comprehensive blockchain that can host smart contracts and decentralized applications (dApps).

At the same time, Pi Network’s token price has begun to rebound, trading above $0.2200 as of late November 2025. This positive trend followed the introduction of new features in the Pi App Studio, designed to help developers create tailored applications for the Pi ecosystem.

The network’s growth strategy also reaches beyond finance. Pi Network has joined forces with OpenMind to pursue decentralized AI training, enabling node operators to lend computational resources to AI initiatives. This move highlights Pi’s vision to become a versatile platform,

Although progress has been made, obstacles persist. Skeptics point to the necessity for clearer regulations and broader exchange availability to achieve widespread adoption. With a market capitalization currently around $28.4 million and a price close to $0.2162,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DASH Experiences Rapid Price Increase: Blockchain Activity and Institutional Indicators in 2025

- DASH (Dash) surged 150% in June 2025, driven by on-chain activity and institutional signals. - Dash Platform 2.0 upgrades and retail partnerships boosted utility , while open interest in futures rose 120%. - Institutional adoption remains unclear due to DASH-DoorDash confusion and lack of verified crypto partnerships. - Geopolitical tensions and pro-crypto policies fueled broader market optimism , lifting DASH alongside crypto's $3.3T cap. - Sustainability hinges on protocol upgrades and verifiable insti

Bitcoin News Update: BTC Whale's $64 Million Long Positions Face Off Against $131 Million Shorts Approaching Liquidation as Price Approaches $111,000

- Hyperliquid whale 0x9263 accumulated a $64M BTC long position following a price dip, generating $8.5M in unrealized profits. - A $131M BTC short position faces liquidation if prices exceed $111,770, with $5,327 buffer remaining as of Nov. 10, 2025. - Market data shows $343.89M in 24-hour liquidations (74.7% from shorts), reflecting bullish momentum and institutional buying. - Hyperliquid's $5.336B total positions include $175M in unrealized earnings, but liquidity risks persist after a $5M loss from a me

Mutuum Finance introduces a hybrid lending approach that transforms the effectiveness of DeFi.

- Mutuum Finance (MUTM) emerges as a top DeFi breakout candidate, raising $18.8M in presale ahead of its Sepolia testnet V1 launch. - Its hybrid lending model combines Peer-to-Contract pools with Peer-to-Peer markets, attracting 18,000+ holders and 250% token price growth since 2025. - Gamified presale incentives and institutional-grade efficiency strategies align with DeFi trends, though crypto markets remain fragmented and volatile. - Upcoming V1 launch and potential partnerships could drive further MUTM

Corporate Profits Meet Political Instability as $297 Million in Crypto Set for Release

- A $297M Ethereum-based token unlock this week sparks crypto volatility concerns amid broader macroeconomic uncertainties. - Chinese EV maker ZEEKR reports $4.43B Q3 revenue (+9.1% YoY) but misses estimates by $330M despite 12.5% delivery growth. - Trump's proposed $2,000 "tariff dividend" boosts crypto prices temporarily but faces skepticism over congressional feasibility. - Analysts warn Trump's fiscal rhetoric remains politically symbolic, with crypto markets reacting to perceived liquidity stimuli. -