ASTER Breakout Confirmed, But Price Flashes Warning

ASTER has finally broken out after weeks of tight trading, but the move has cracks under the surface. Bearish divergences and long-heavy leverage tilt the setup toward caution. A clean break above $1.28 is now the key signal traders need before trusting the next leg up.

The ASTER price is up over 8% today and about 12% in the past week. The token has finally broken out of a falling wedge, which is normally a bullish pattern.

But even with today’s sharp jump, some warning signs are forming. Two momentum divergences and a heavy long buildup on the liquidation map show that the next move may not be a straight continuation. The question now is whether ASTER can extend the breakout or if a pullback hits first.

Momentum Shows Strength, But Divergences Are Appearing

The first concern comes from the Relative Strength Index (RSI). RSI measures buying pressure and indicates whether the move has underlying strength. Between November 2 and November 16, ASTER’s price made a lower high while RSI made a higher high. That is a hidden bearish divergence. It appears that when buying pressure rises, the price fails to follow. It usually warns of a pullback.

ASTER Shows RSI Divergence

ASTER Shows RSI Divergence

The Money Flow Index (MFI), which tracks dip buying by combining price and volume, is flashing the same problem. Between November 11 and November 16, the price formed a higher low, but MFI formed a lower low. This means dip buying is getting weaker.

Dip Buying Slowing Down:

Dip Buying Slowing Down:

Both divergences point to the same message. Buyers pushed ASTER high enough to break the wedge, but they did not push strongly enough to confirm a rally. A daily candle close above $1.28 is the only level that clears both divergences and confirms real strength.

Long Heavy Positioning Raises Pullback Risk

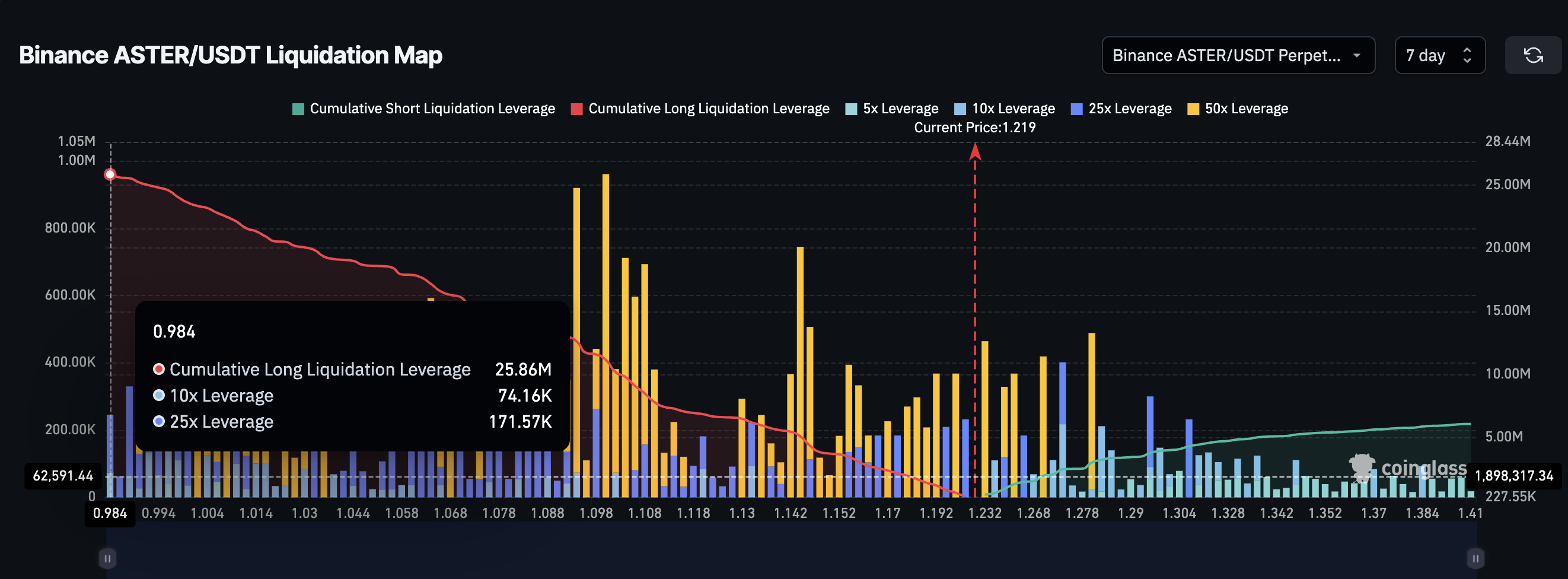

The bigger risk comes from leverage. On Binance’s ASTER-USDT liquidation map, long liquidation leverage is $25.86 million. Short liquidation leverage is only $6.06 million.

So longs are more than four times larger than shorts. This setup means the move is built on aggressive long positioning. If the ASTER price even dips modestly, these longs are at risk. When long liquidations fire, the price usually drops faster because forced selling accelerates the move.

Long-Biased Liquidation Map:

Long-Biased Liquidation Map:

This pairs directly with the divergences. If momentum weakens and the price pulls back, the Aster price could face a deeper slide because the long side is overloaded. That is the core risk hidden under today’s breakout.

ASTER Price Needs $1.28 To Confirm Strength

The ASTER price chart shows the same tension. ASTER broke the falling wedge today. But the breakout only becomes reliable above $1.28. That is the key level at which the structure transitions from an unstable breakout to a definite trend change.

If the divergences play out and the pullback begins, the first level ASTER needs to defend is $1.09. Holding that level keeps the drop limited to a simple correction.

Losing $1.09 opens the way toward $0.99, which is also where most long-liquidation clusters sit on the Binance map. A move into that zone would likely accelerate the drop because the long-side leverage is heavy.

ASTER Price Analysis:

ASTER Price Analysis:

If ASTER closes above $1.28 instead, the divergences get invalidated and the path opens toward $1.59. That is the next major level the chart points to.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bald Eagle Drops Cat Remains, Smashes Windshield and Stuns Driver

- North Carolina driver claims a bald eagle dropped a cat carcass through her windshield, shattering it on U.S. Route 74 near Great Smoky Mountains National Park. - A witness corroborated the account, while wildlife experts noted eagles typically scavenge roadkill rather than hunt domestic cats. - The incident echoes a 2019 case of a catfish falling through a windshield, highlighting unusual bird-human interactions amid rebounding bald eagle populations. - Authorities confirmed the report but provided no f

Fed Focuses on Curbing Inflation Rather Than Lowering Rates, Even as Economy Shows Strength

- Boston Fed's Susan Collins opposes December rate cut, citing persistent inflation and a strong economy, emphasizing "restrictive policy is very appropriate right now." - FOMC meeting minutes reveal divided policymakers: Stephen Miran advocated larger cuts, while Kansas City's Jeff Schmid opposed any reduction, marking first 2019-style dissent. - Government shutdown delayed November jobs data until December 16, heightening uncertainty as officials struggle to assess economic conditions ahead of the Decemb

"First Fatality from H5N5 Bird Flu Signals a Turning Point in Pandemic Readiness"

- First human death from H5N5 bird flu reported in Washington state, with the patient having underlying health conditions and contact with poultry/wild birds. - No person-to-person transmission detected; health officials emphasize low public risk but stress vigilance in poultry/wildlife monitoring. - WHO warns of H5 virus genetic diversity and pandemic potential, while vaccine makers monitor H5N5 despite no current specific vaccine. - Case highlights zoonotic disease risks and the need for global surveilla

Trump’s Shift on Epstein Case Deepens Republican Divide, Unresolved Issues Remain

- Trump signed a bill forcing DOJ to release Epstein files by Dec. 19, fracturing MAGA allies and sparking GOP dissent. - The law mandates unclassified release of records but allows withholding sensitive data, with critics doubting full transparency. - Tensions with Rep. Greene over accountability led to her resignation, weakening GOP House majority and exposing Trump's waning control. - Right-wing media scrambled to reframe Trump's reversal as a "victory," while public skepticism grew over Epstein ties to