ZK Atlas Enhancement and Its Influence on Layer 2 Scaling

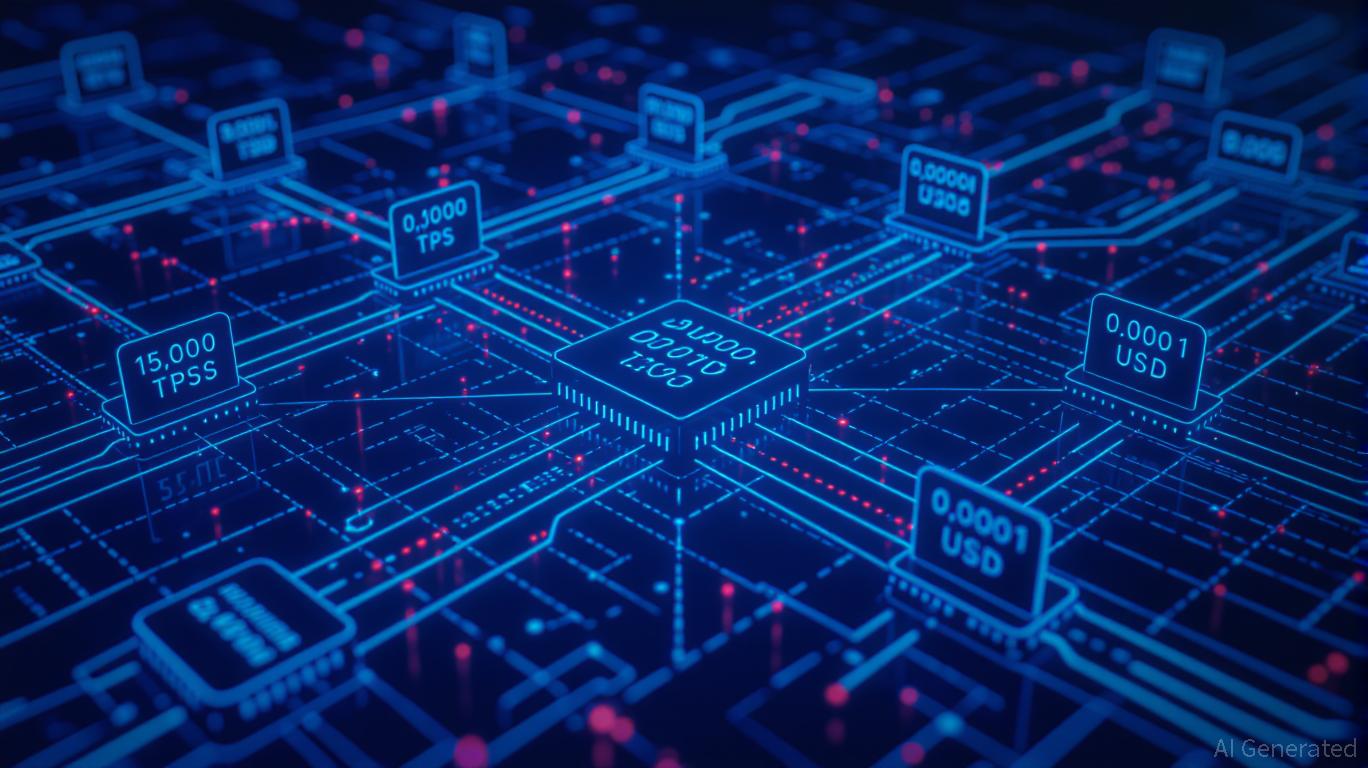

- The ZK Atlas Upgrade (Oct 2025) revolutionized Layer 2 scalability with 15,000+ TPS and $0.0001/tx costs via innovations like Atlas Sequencer and Airbender prover. - Vitalik Buterin's GKR protocol reduced ZK verification costs 10-15x, slashing Ethereum gas fees by 90% and boosting DeFi competitiveness. - ZK ecosystem TVL hit $3.5B by 2025, with $15B in Bitcoin ETF investments and 60.7% CAGR projected for ZK Layer 2 market growth to $90B by 2031. - Institutional adoption accelerated as stablecoins capture

Key Features of the

ZK

Atlas Upgrade

The ZK Atlas Upgrade brought forth three major breakthroughs: the Atlas Sequencer, Airbender prover, and ZKsync OS. Together, these innovations allow ZK protocols to

Importantly, the upgrade also incorporated Vitalik Buterin’s innovation with the GKR protocol, which

Developer Activity and Ecosystem Growth

The ZK Atlas Upgrade has sparked a notable increase in developer participation and ecosystem expansion. Bitget’s research shows that the total value locked (TVL) in ZK rollups—including zkSync,

Metrics on developer engagement further demonstrate the upgrade’s influence. ZKsync Era’s daily and weekly active wallet counts have soared, surpassing many Layer 1 networks. The ZK ecosystem has also

Institutional Adoption and Market Trends

The ZK Atlas Upgrade has propelled institutional involvement, especially within DeFi and stablecoin markets. Stablecoins now represent 30% of all on-chain crypto transaction volume,

Institutional funding has also grown, with spot Bitcoin ETFs channeling $15 billion into ZK-related ventures in 2025. This momentum is projected to persist, with estimates suggesting a 61% increase in institutional crypto allocations by 2026,

Challenges and Risks

Despite its advantages, the ZK Atlas Upgrade is not without obstacles. Regulatory oversight remains a pressing issue, particularly for privacy-oriented coins like Zcash. Furthermore, the technical demands of ZK technology—which require expertise in cryptography and distributed systems—may hinder adoption among smaller development teams.

Future Outlook and Investment Potential

The ZK Atlas Upgrade has established a foundation for scalable and affordable blockchain systems. With Ethereum’s “Lean Ethereum” initiative and the industry’s broader move toward Layer 2, ZK protocols are poised to lead the next wave of crypto growth. Investors should keep an eye on TVL trends, TPS gains, and institutional capital flows.

Nonetheless, prudence is necessary. Although the long-term perspective is optimistic, short-term market swings and regulatory ambiguity could affect returns. Spreading investments across various ZK projects (such as zkSync and StarkNet) and managing privacy coin exposure may help address these risks.

Conclusion

The ZK Atlas Upgrade marks a pivotal point for blockchain scalability. By tackling throughput, expenses, and interoperability, it has opened up new opportunities for DeFi, institutional finance, and international payments. For investors, the upgrade’s success will depend on ongoing developer involvement, regulatory progress, and sustained institutional interest. As the ZK ecosystem evolves, it presents a strong case for long-term investment in the post-upgrade landscape.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aster News Today: Optimism Faces Prudence: ASTER Approaches $1.21 Following RSI CEO's 16% Stake Sale

- Aster (ASTER) rose 8% toward $1.21 as Binance-backed DEX hit $3T in cumulative trading volume. - RSI CEO sold 16% stake ($11M+), raising doubts despite Q2 revenue growth (19.7%) and EPS beat. - ASTER faces mixed signals: bullish triangle pattern vs. declining fees, 50% open interest drop, and stagnant adoption. - Analysts remain divided: RSI's 22% YTD gain contrasts with ASTER's uncertain breakout potential amid waning trader enthusiasm.

The ChainOpera AI Token Crash: An Urgent Warning for Cryptocurrency Projects Powered by AI

- ChainOpera AI's COAI token collapsed 96% in late 2025, exposing systemic risks in AI-driven DeFi ecosystems. - Centralized governance (10 wallets controlled 87.9% supply) and misaligned incentives exacerbated panic selling during crises. - Technical flaws included untested AI models with 270% increased vulnerabilities and inadequate smart contract security audits. - Regulatory shifts like the GENIUS Act compounded liquidity challenges, highlighting the need for compliance-ready AI crypto projects. - Inve

How large a portion of the AI data center surge will rely on renewable energy sources?

Amazon satellite network receives a new name — and no longer emphasizes its low-cost promise