NFT sales drop 5.4% to $79m, Pudgy Penguins plunge 36%

NFT sales volume has fallen by 5.41% to $79.31 million, down from last week’s $84.44 million.

- NFT sales dropped 5.41% to $79.31M even as buyers jumped nearly 1,000% this week.

- Algebra Positions NFT-V2 surged to $7.81M in sales while Pudgy Penguins plunged 37%.

- Ethereum and BNB Chain led NFT blockchains as Bitcoin and Polygon volume declined.

According to CryptoSlam data, NFT buyers have surged by 989.62% to 222,294 and sellers have surged by 714.77% to 189,963. NFT transactions dropped by 20.92% to 1,097,565.

This NFT sales drop happened as the Bitcoin ( BTC ) price has tumbled to the $96,000 level as selling pressure continues to mount.

Ethereum ( ETH ) has lost the $3,200 level, extending its recent decline. The global crypto market cap has contracted to $3.26 trillion, down from last week’s $3.48 trillion.

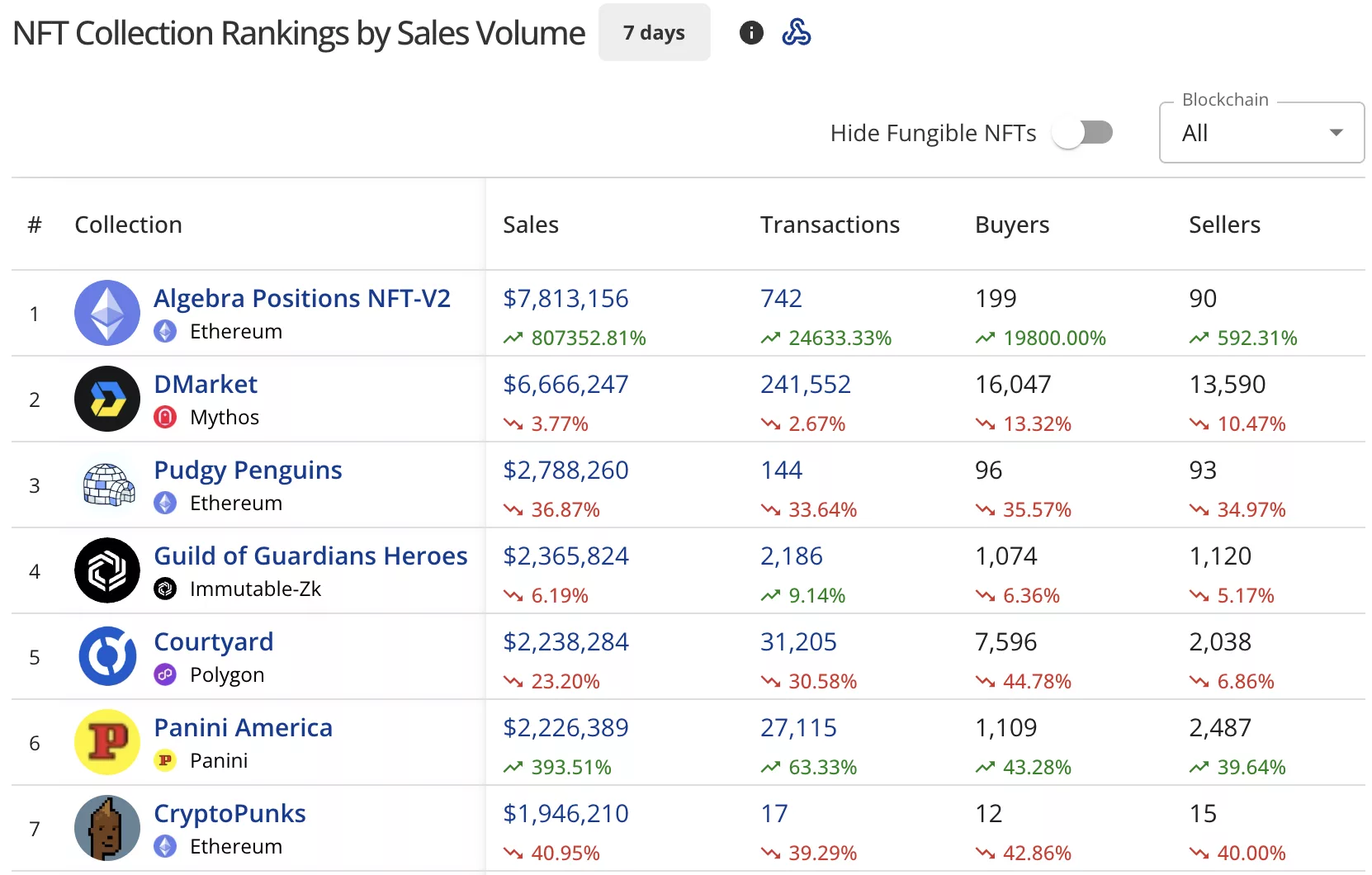

Algebra Positions NFT-V2 surges as Pudgy Penguins tumble

Algebra Positions NFT-V2 on Ethereum has spiked into first place with $7.81 million in sales, posting a 807,352.81% surge. The collection processed 742 transactions with 199 buyers and 90 sellers.

DMarket on the Mythos blockchain slipped to second with $6.67 million, down 3.77% from last week’s $6.88 million. The collection recorded 241,552 transactions with 16,047 buyers and 13,590 sellers.

Pudgy Penguins dropped to third place with $2.79 million, plunging 36.87% from last week’s $4.38 million. The Ethereum collection saw 144 transactions with 96 buyers and 93 sellers.

Source: Top collections by NFT Sales Volume (CryptoSlam)

Source: Top collections by NFT Sales Volume (CryptoSlam)

Guild of Guardians Heroes on Immutable-Zk held fourth position at $2.37 million, down 6.19% from last week’s $2.48 million. The collection had 2,186 transactions.

Courtyard on Polygon ( POL ) secured fifth place with $2.24 million, down 23.20% from last week’s $2.91 million. The collection processed 31,205 transactions.

Panini America on the Panini blockchain surged into sixth with $2.23 million, up 393.51%. The collection recorded 27,115 transactions.

CryptoPunks fell to seventh at $1.95 million, down 40.95% from last week’s $3.30 million. The collection had just 17 transactions with 12 buyers and 15 sellers.

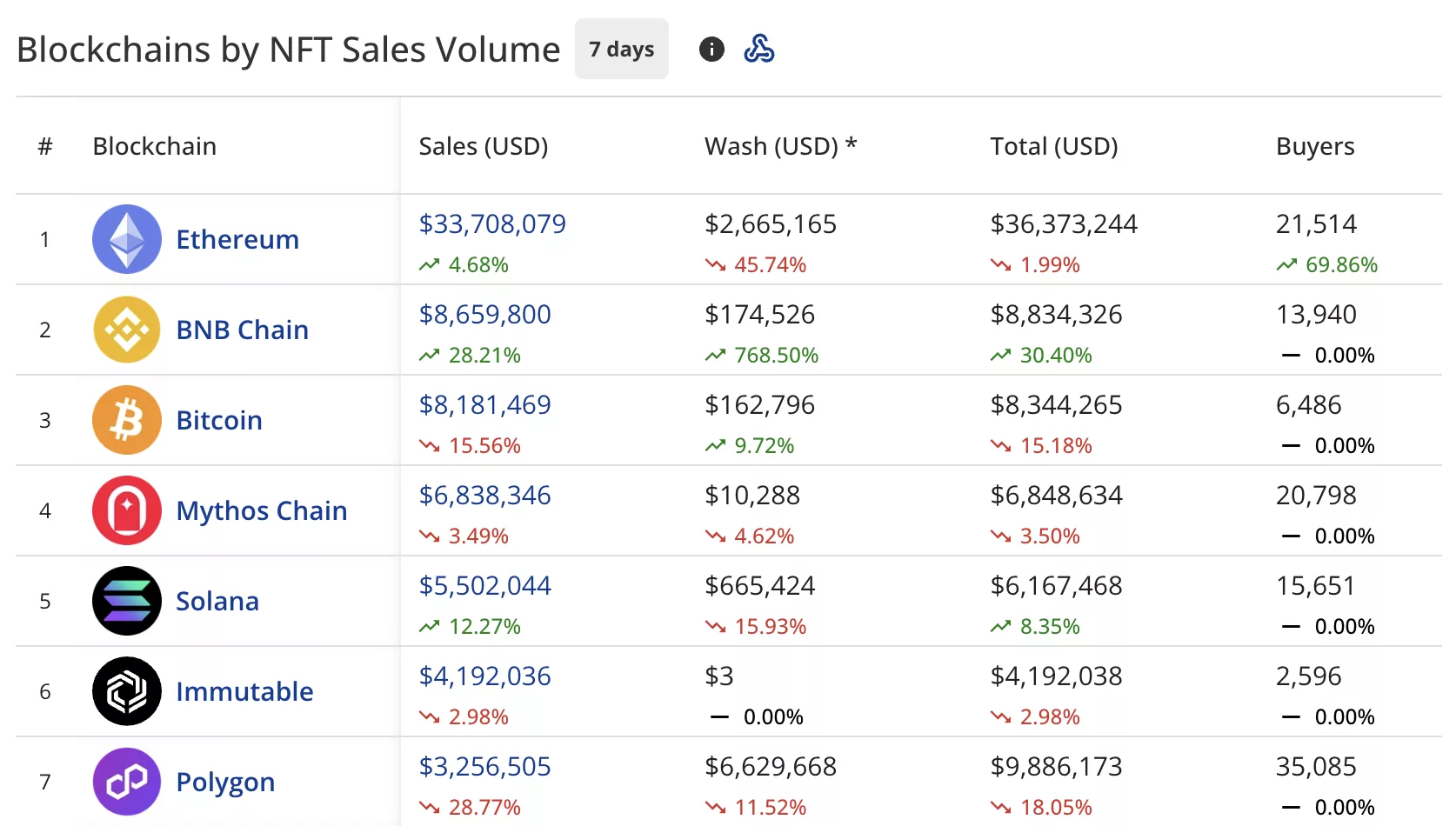

Ethereum extends gains as BNB Chain surges

Ethereum maintained first position with $33.71 million in sales, up 4.68% from last week’s $32.97 million .

The network recorded $2.67 million in wash trading, bringing its total to $36.37 million. Buyers jumped 69.86% to 21,514.

BNB Chain ( BNB ) climbed to second place with $8.66 million, up 28.21% from last week’s $6.15 million. The blockchain recorded $174,526 in wash trading, bringing its total to $8.83 million. Buyers remained at 13,940 with 0.00% change.

Source: Blockchains by NFT Sales Volume ( CryptoSlam )

Source: Blockchains by NFT Sales Volume ( CryptoSlam )

Bitcoin dropped to third with $8.18 million, down 15.56% from last week’s $9.15 million. The network saw 6,486 buyers with 0.00% change.

Mythos Chain placed fourth at $6.84 million, down 3.49% from last week’s $7.10 million. The blockchain attracted 20,798 buyers.

Solana ( SOL ) secured fifth position with $5.50 million, up 12.27% from last week’s $5.12 million. The network recorded 15,651 buyers.

Immutable ( IMX ) landed in sixth at $4.19 million, down 2.98% from last week’s $4.26 million. The blockchain had 2,596 buyers.

Polygon placed seventh with $3.26 million, down 28.77% from last week’s $4.50 million. The blockchain recorded $6.63 million in wash trading, bringing its total to $9.89 million. Buyers stood at 35,085.

Top sales for the week

Autoglyphs #141 topped individual sales at $199,135.19 (56 WETH), sold three days ago.

Two V1 Cryptopunks Wrapped #7139 NFTs followed:

- First sale at $196,267.55 (57 WETH) three days ago

- Second sale at $194,923.31 (57.0299 WETH) two days ago

Two CryptoPunks rounded out the top five:

- CryptoPunks #6207 sold for $152,619.45 (43.99 ETH) three days ago

- CryptoPunks #4427 sold for $131,430.42 (36.9 ETH) four days ago

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bolivia’s Digital Currency Bet: Navigating Volatility with Stable Solutions

- Bolivia's government permits banks to custody cryptocurrencies and offer crypto-based services, reversing a 2020 ban to combat inflation and dollar shortages. - Stablecoin transactions surged 530% in 2025, with $14.8B processed as Bolivians use USDT to hedge against boliviano depreciation (22% annual inflation). - State-owned YPFB and automakers like Toyota now accept crypto payments, while Banco Bisa launches stablecoin custody to expand financial inclusion for unbanked populations. - The policy faces c

Switzerland's Postponement of Crypto Tax Highlights Worldwide Regulatory Stalemate

- Switzerland delays crypto tax data sharing until 2027 due to ongoing political negotiations over OECD CARF partner jurisdictions. - Revised rules require crypto providers to register and report client data by 2026, but cross-border data exchange remains inactive until 2027. - Global alignment challenges exclude major economies like the U.S., China, and Saudi Arabia from initial data-sharing agreements. - Domestic legal framework passed in 2025, but partner jurisdiction negotiations delay implementation u

Visa and AquaNow Upgrade Payment Infrastructure through Stablecoin Integration

- Visa partners with AquaNow to expand stablecoin settlement in CEMEA via USDC , aiming to cut costs and settlement times. - The initiative builds on a $2.5B annualized pilot program, leveraging stablecoins to modernize payment infrastructure. - Visa's multicoin strategy aligns with industry trends, as regulators and competitors like Mastercard also explore stablecoin integration. - Regulatory progress in Canada and risks like volatility highlight evolving opportunities and challenges in digital asset adop

Bitcoin Updates: Large Holder Liquidations and Retail Investor Anxiety Lead to a Delicate Equilibrium in the Crypto Market

- A long-dormant crypto whale sold 200 BTC after a 3-year hibernation, intensifying market scrutiny over investor sentiment and liquidity shifts. - Bitcoin struggles above $92,000 amid weak technical indicators, mixed ETF flows ($74M inflow for BTC vs. $37M ETH outflow), and diverging institutional/retail behaviors. - Whale activity highlights fragile market balance: large holders accumulate BTC while retail investors liquidate, with over $557M in BTC moved from Coinbase to unknown wallets. - Technical bea