How Grayscale Holds XLM as the Price Drops More Than 50%

Stellar faces steep market fear, yet Grayscale’s firm position and rising ecosystem activity signal potential stabilization ahead. The network’s payments push and RWA growth could help buffer continued pressure.

From its 2025 peak, Stellar (XLM) has fallen from $0.52 to $0.26. Grayscale — one of the leading crypto investment funds — has notably managed its XLM holdings during this downturn.

Extreme market fear at the end of the year continues to fuel negative expectations. What does Stellar (XLM) have to face these headwinds?

Grayscale Holds More Than 116 Million XLM

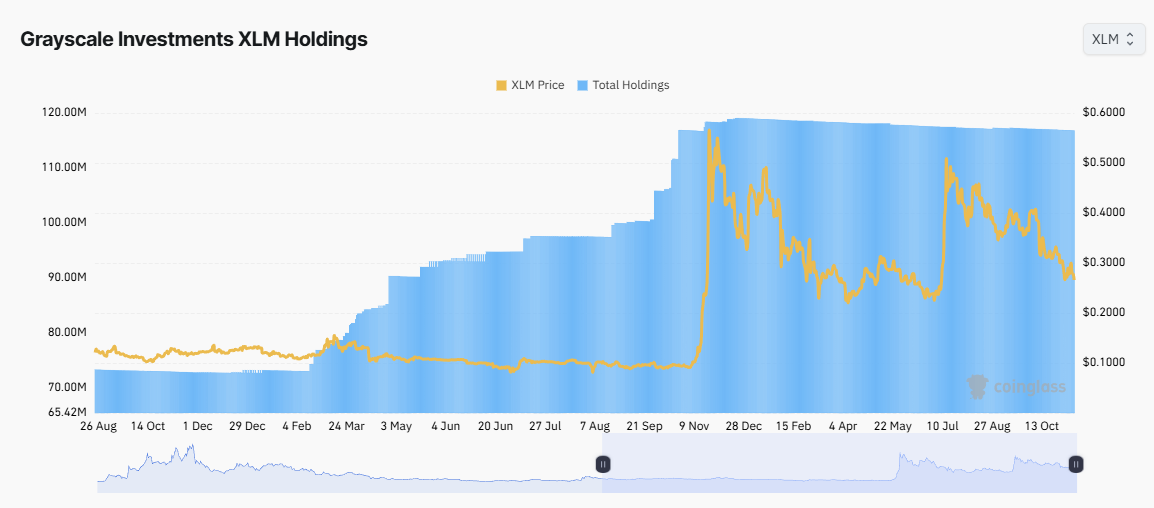

According to the latest data from Coinglass, Grayscale’s XLM holdings increased from last year, before XLM printed a “god candle” in November 2024 with nearly 600% growth.

Grayscale successfully accumulated XLM from 70 million to 119 million ahead of the rally. This move highlights the fund’s effectiveness as a smart-money participant that positioned itself before major market swings.

Grayscale Investments XLM Holdings. Source:

Coinglass

Grayscale Investments XLM Holdings. Source:

Coinglass

However, since early 2025, the fund has stopped accumulating. XLM’s price has stopped setting new highs and entered a downward trend. Compared to the 2025 peak, Grayscale’s XLM holdings slightly decreased to 116.8 million.

The fund’s refusal to sell aggressively reflects its investors’ long-term perspective. They appear to view XLM as a valuable asset in the cross-border payments sector.

More notably, shares of Grayscale Stellar Lumens Trust (GXLM) trade at a premium over its actual Net Asset Value (NAV).

Grayscale Stellar Lumens Trust Performance. Source:

Grayscale

Grayscale Stellar Lumens Trust Performance. Source:

Grayscale

GXLM’s market value sits at $24.85, while its NAV per share is $22.29.

The market price is about 10–15% higher than NAV. This premium indicates that investors are willing to pay above the underlying asset value. This condition has dominated most of the trading sessions in 2025.

However, when comparing Grayscale’s XLM holdings to the more than 32 billion XLM circulating supply, the fund only controls about 0.36% of the supply. This share remains too small to create any decisive impact on the market.

What Does Stellar (XLM) Have to Counter Selling Pressure?

November 2025 marked a pivotal moment when seven major crypto players — Fireblocks, Solana Foundation, TON Foundation, Polygon Labs, Stellar Development Foundation, Mysten Labs, and Monad Foundation — officially launched the Blockchain Payments Consortium (BPC).

This alliance aims to promote blockchain-based payment standards. BPC focuses on cross-chain integration, enabling XLM to reach millions of users across other ecosystems. These developments could boost demand in 2026.

“During Q3, the Stellar network saw 37% growth in full-time developers, 8 times faster than the industry growth rate,” Stellar stated.

In parallel, the Stellar ecosystem continues to see explosive growth in Real-World Assets (RWA). Total RWA value on the network reached a record $654 million in November 2025, up from $300 million at the beginning of the year.

Tokenized Asset Value on Stellar. Source:

RWA

Tokenized Asset Value on Stellar. Source:

RWA

Charts from RWA.xyz show significant contributions from tokenized funds, including Franklin OnChain US Government Fund and WisdomTree Prime.

However, real adoption stories do not always align with market sentiment. Recent analysis indicates that XLM has historically performed poorly in November. With altcoins drowning in extreme fear, XLM may struggle to escape the broader negative trend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

COAI Experiences Steep Price Drop: Opportunity for Contrarian Investors or Red Flag for Junior Gold Mining Stocks?

- COAI refers to both ChainOpera AI and junior gold miners' index, with this analysis focusing on the latter's market dynamics. - Junior gold miners (GDXJ ETF) fell 27% in six months amid dollar strength, inflation fears, and overbought conditions after a 128.8% rally. - Technical indicators show bearish signals: broken trend channels, negative volume balance, and RSI divergence, though long-term bull trends persist. - GDXJ's 163.9% surge outpaced gold bullion gains, creating valuation gaps, while ChainOpe

Silver Soars Amid Ideal Conditions of Policy Shifts and Tightening Supply

- Silver surged to $52.37/oz as Fed rate cut expectations (80% probability) and falling U.S. Treasury yields boosted demand for non-yielding assets. - China's record 660-ton silver exports and 2015-low Shanghai warehouse inventories intensified global supply constraints, pushing the market into backwardation. - Geopolitical risks (Ukraine war) and potential U.S. silver tariffs added volatility, while improved U.S.-China relations eased short-term trade concerns. - Prices face critical $52.50 resistance; Fe

XRP News Today: As XRP Declines, Retail Investors Turn to GeeFi's Practical Uses

- GeeFi's presale hits 80% of Phase 1 goal with $350K raised, targeting 3,900% price growth as XRP declines 20% monthly. - GEE's utility-driven features like crypto cards, multi-chain support, and 55% staking returns contrast with XRP's institutional dependency and shrinking retail base. - Deflationary tokenomics and 5% referral bonuses drive FOMO, positioning GeeFi as a 2026 crypto disruptor amid XRP's regulatory and adoption challenges.

Sloppy implementation derails MegaETH's billion-dollar stablecoin aspirations

- MegaETH abandoned its $1B USDm stablecoin pre-deposit plan after technical failures disrupted the launch, freezing deposits at $500M and issuing refunds. - A misconfigured Safe multisig transaction allowed early deposits, causing $400M inflows before the team scrapped the target, citing "sloppy execution" and operational misalignment. - Critics highlighted governance flaws, uneven access (79 wallets >$1M vs. 2,643 <$5K deposits), and 259 duplicate addresses, raising concerns about transparency and bot ac