Major Exchange Listings Fail to Boost Prices as Crypto Market Sentiment Nosedives

Exchange listings that once triggered sharp rallies are now falling flat, with tokens dropping despite new market exposure as Extreme Fear and heavy liquidations shape trading behavior.

Recently, crypto token listings on major exchanges have failed to generate sustained price rallies, signaling a significant shift in market behavior.

This comes as the entire crypto market remains under pressure, with investor sentiment deteriorating sharply as losses deepen across the board.

Are Crypto Exchange Listings Losing Impact?

Historically, major exchange listings have been accompanied by sharp price surges. This happens because listings often increase visibility, expand liquidity, and attract new buyers. As a result, tokens typically experience a rapid influx of trading activity and interest immediately after going live.

However, in November 2025, the trend has slowed. For instance, today, OKX, one of the leading crypto exchanges, announced the listing of SEI (SEI) and DoubleZero (2Z).

“OKX is pleased to announce the listing of SEI (Sei), 2Z (DoubleZero) on our spot trading markets. SEI, 2Z deposits will open at 3:00 am UTC on November 14, 2025. SEI/USDT spot trading will open at 7:00 am UTC on Nov 14, 2025. 2Z/USDT spot trading will open at 9:00 am UTC on Nov 14, 2025,” the announcement read.

Nonetheless, neither token saw significant gains. BeInCrypto Markets data showed that SEI has dipped by over 8% in the past 24 hours. At the time of writing, it was trading at $0.16. At the same time, 2Z has fallen nearly 5% to $0.16.

This subdued reaction isn’t isolated. Other major platforms show similar behavior. Coinbase added Plasma (XPL) and Toncoin (TON) to its listing roadmap on November 13. The former jumped by around 8% after nearly 90 minutes of the announcement, while TON rose from $2.0 to $2.05.

However, the latest market data showed that both coins were down today. XPL traded at $0.23, down nearly 12% over the past day. TON dropped 6.4% in the same period to $1.94.

Lastly, BeInCrypto reported that Binance listed Lorenzo Protocol (BANK) and Meteora (MET) yesterday. These tokens saw brief, sharp pre-listing surges—60% for BANK and 8.6% for MET—but quickly lost traction. The altcoins closed in red on November 13.

According to the latest price data, BANK has lost nearly 46% of its value in the past day alone. Furthermore, MET has slipped nearly 1%. This highlights how cautious capital inflows are diminishing the impact of exchange listings on price performance.

Market Sentiment Reaches Extreme Fear

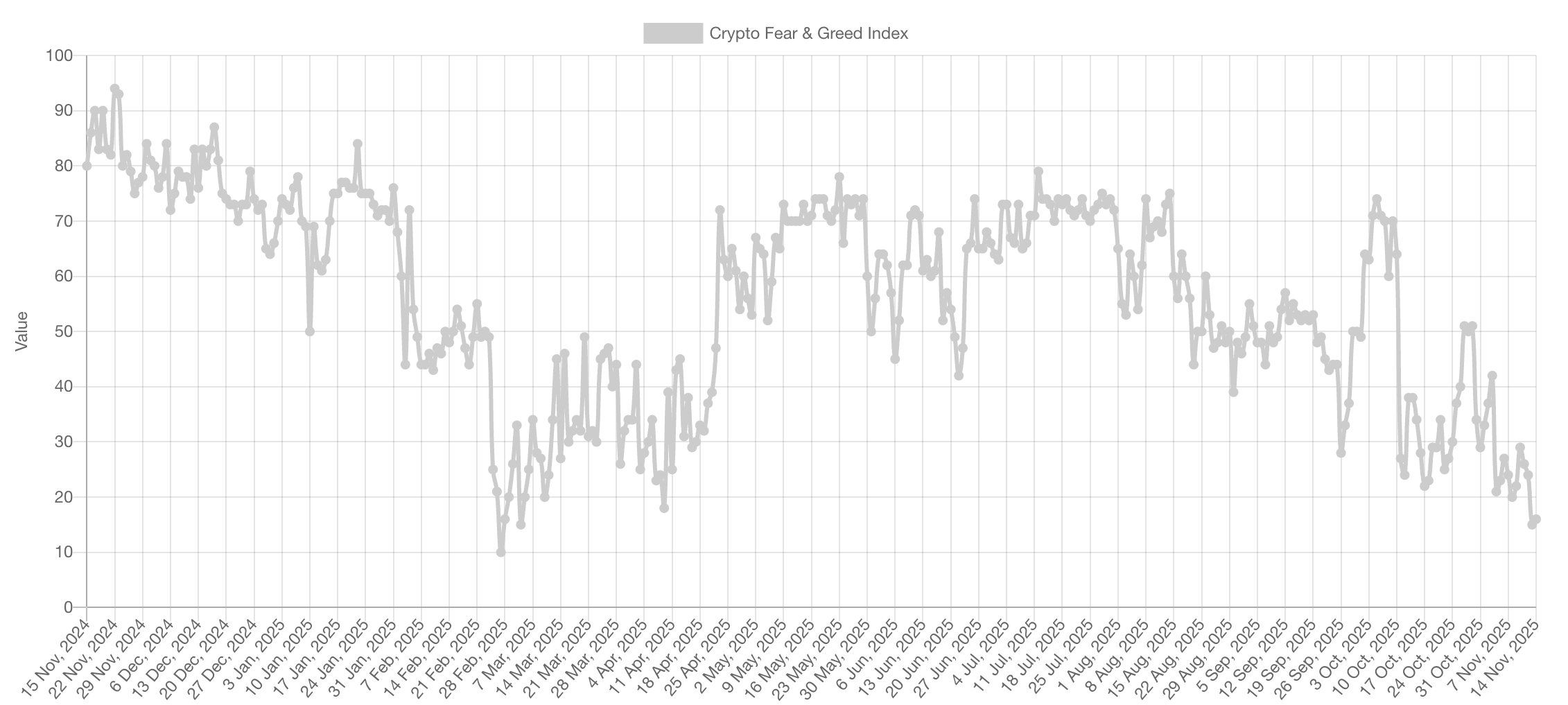

The shift could likely be tied to deteriorating sentiment, which continues to shape trader behavior across the market. The Crypto Fear and Greed Index, widely regarded as a gauge of market sentiment, has plummeted into “Extreme Fear.” Yesterday, the index dropped to 15, its lowest level since February.

Crypto Fear and Greed Index. Source:

Alternative.me

Crypto Fear and Greed Index. Source:

Alternative.me

A surge of liquidations has amplified the market’s difficulties. CoinGlass data shows that over $900 million in long positions were liquidated over the past 24 hours. Overall, the crypto liquidations affected 249,520 traders, resulting in widespread losses and weakening their market position.

With confidence collapsing and liquidity thinning, traders may be more focused on preserving capital than chasing exchange listings. The market is now driven primarily by fear and defensive positioning, overshadowing the speculative enthusiasm that once fueled sharp post-listing rallies.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Update: Institutional Interest Soars as XRP ETFs Lead to Tightening Supply

- XRP's surge in institutional demand, driven by new spot ETFs like Franklin Templeton's XRPZ and Grayscale's GXRP , has triggered a $628M inflow and price rebound to $2.08. - Regulatory clarity post-Ripple-SEC settlement confirmed XRP's non-security status, while ETF structures reduce supply and amplify demand through creation cycles. - Despite record inflows, XRP's volatility persists, dipping below $2 after whale sales and highlighting structural fragility with 41.5% of supply in loss. - Analysts debate

XRP News Today: Institutional Confidence Drives XRP Surge While ETFs Connect Conventional Finance and Crypto

- XRP rebounds above $2.20 after ETF launches boost liquidity and institutional trust. - Standard Chartered partners with 21Shares to custody XRP ETPs, bridging traditional-crypto finance. - Technical indicators show bullish momentum toward $2.60 target despite whale selling pressure. - ETF-driven market structure changes enable regulated institutional access to XRP.

Bitcoin Updates: Abu Dhabi's Investment in Bitcoin Grows Threefold as the UAE Adopts a Digital Gold Approach

- Abu Dhabi's ADIC triples Bitcoin ETF stake to $518M, positioning UAE as top sovereign holder via U.S. ETFs. - Strategic shift from oil revenue to "digital gold" coincides with BTC's $86,600 level and $238M ETF inflow reversal. - Analysts flag $88,000 as critical resistance for bullish momentum, while XRP traders profit from November rebounds. - Institutional/retail dynamics shape BTC's outlook, with 4-year cycle risks and $90,000 threshold defining near-term direction.

South Africa's Growing Stablecoin Adoption Undermines National Monetary Authority

- South Africa's central bank warns stablecoin growth threatens foreign exchange controls and financial stability. - Stablecoin trading surged to 80B rand by 2024, bypassing regulations as USD-pegged tokens outpace Bitcoin in local adoption. - Global watchdogs highlight systemic risks from unregulated stablecoins, while SARB accelerates crypto regulation to address capital flight concerns. - Emerging market dilemma emerges: balancing crypto innovation with monetary sovereignty amid $314B global stablecoin