Franklin Templeton has integrated its Benji tokenization platform with the Canton Network, enhancing institutional access to regulated onchain assets like its US government money market fund. This move bridges traditional finance and blockchain, enabling tokenized assets as collateral and improving liquidity in digital markets.

-

Benji platform expansion: Franklin Templeton’s proprietary technology now connects to Canton for seamless tokenized asset management.

-

Canton’s design supports regulated financial institutions, facilitating secure collateral and settlement processes.

-

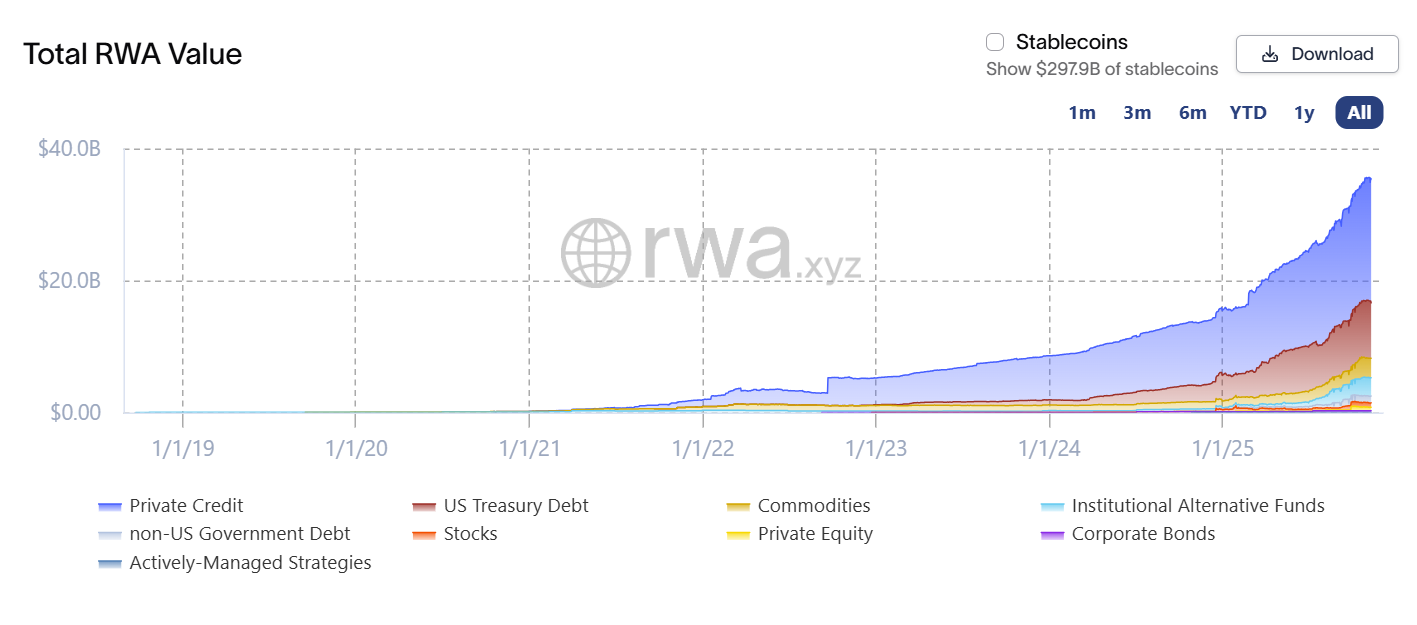

Tokenized RWAs reach $36.6 billion in value, excluding stablecoins, with institutional funds contributing $3 billion according to industry trackers.

Discover how Franklin Templeton Benji platform Canton Network integration advances tokenized assets. Explore regulatory benefits and institutional adoption in blockchain finance today.

What is the Franklin Templeton Benji Platform Integration with Canton Network?

Franklin Templeton Benji platform Canton Network integration connects the firm’s tokenized investment platform to a specialized blockchain for financial institutions. This allows Benji’s onchain US government money market fund to serve as collateral within Canton’s ecosystem. The partnership, announced in late 2025, supports intraday yield calculations and onchain ownership records, promoting efficiency in traditional finance.

Source: Canton Network

Canton’s Global Collateral Network links banks, market makers, and asset managers to tokenize and mobilize assets for collateral management and settlement. Backed by institutions like HSBC and BNP Paribas, the network emphasizes compliance and interoperability. Digital Asset, its developer, secured $135 million in funding to bolster infrastructure growth.

By incorporating Benji, Franklin Templeton enriches Canton’s offerings with regulated investment products. Each Benji token represents a share in the money market fund, enabling institutions to leverage blockchain for faster, transparent transactions. This step aligns with broader efforts to integrate digital assets into established financial systems.

How Does Tokenization Benefit Institutional Investors?

Tokenization transforms real-world assets into digital tokens on blockchain, offering institutional investors benefits like accelerated settlement times and reduced costs. For instance, Franklin Templeton’s Benji tokens allow for real-time yield tracking, which traditional funds often process daily. According to data from RWA.xyz, the tokenized RWA market excluding stablecoins has grown to $36.6 billion, with $3 billion in institutional funds and $8.4 billion in tokenized US Treasurys.

Experts highlight improved liquidity as a key advantage. Hashgraph CEO Eric Piscini notes that clearer regulations in major markets are driving this adoption, as seen in initiatives from BlackRock and Citi. Pharos CEO Alex Zhang emphasizes the need for compliant infrastructure, stating in a recent analysis that interoperable systems are essential for scaling tokenized finance. Short sentences underscore the process: assets are digitized, ownership is verified onchain, and transactions settle instantly, minimizing intermediaries.

The tokenized RWA market has experienced significant expansion this year. Source: RWA.xyz

The integration supports collateral use in Canton’s network, where assets can be mobilized across participants. This setup enhances transparency, as all movements are recorded immutably. Industry reports indicate potential for trillions in RWAs to shift onchain, driven by operational efficiencies and regulatory progress.

Frequently Asked Questions

What Are the Key Features of Franklin Templeton’s Benji Tokens?

Benji tokens represent shares in Franklin Templeton’s onchain US government money market fund, with intraday yield calculations and blockchain-recorded ownership. Designed for institutional use, they enable tokenized assets to function as collateral on networks like Canton, ensuring regulatory compliance and seamless integration into digital financial workflows.

How Is the Canton Network Shaping Institutional Blockchain Adoption?

The Canton Network provides a privacy-enabled blockchain tailored for financial institutions, connecting entities for asset tokenization and settlement. Its focus on regulation attracts major players like HSBC and supports efficient collateral management. As Digital Asset expands with recent funding, it positions itself as a cornerstone for bridging traditional and digital finance seamlessly.

Key Takeaways

- Strategic Integration: Franklin Templeton’s Benji platform now leverages Canton Network for broader access to tokenized assets, enhancing institutional liquidity.

- Market Growth: Tokenized RWAs have surged to $36.6 billion, signaling strong momentum in blockchain-based finance as per RWA.xyz data.

- Regulatory Momentum: Clearer rules are accelerating adoption; institutions should monitor developments to capitalize on onchain opportunities.

Conclusion

The Franklin Templeton Benji platform Canton Network integration marks a pivotal advancement in tokenized real-world assets, combining regulated investment products with robust blockchain infrastructure. As institutional adoption grows amid supportive regulations, this collaboration exemplifies the fusion of traditional finance and digital innovation. Financial professionals are encouraged to evaluate these platforms for portfolio diversification and efficiency gains in the evolving crypto landscape.