Big Short Investor Exits Wall Street Again —Is Crypto the Only Trade Left Standing?

Michael Burry closes Scion Asset Management amid an AI-driven bubble. As he exits Wall Street again, investors ask: Is crypto the last trade standing?

Michael Burry, the investor immortalized in The Big Short, has officially liquidated Scion Asset Management, his American hedge fund headquartered in California. The move ends a six-year run, reviving comparisons to his 2008 retreat.

The fund is best known for profiting from the subprime mortgage crisis and for paving the way for the GameStop short squeeze.

Michael Burry Walks Away from the Markets — Is He Quietly Turning Toward Crypto?

In a letter to investors dated October 27, 2025, Burry wrote that his “estimation of value in securities is not now, and has not been for some time, in sync with the markets.”

Michael Burry’s Letter to Investors

Michael Burry’s Letter to Investors

The move marks the second time Burry has voluntarily closed a fund while holding deep contrarian positions. Initially, it was after profiting from the subprime collapse. This time, it comes amid what he calls an “AI-bubble dynamic.”

For investors charting stretched equity valuations and rising crypto optimism, his exit may signal a pivotal rotation point.

In recent posts on X (Twitter), Burry accused major tech firms of “fudging depreciation schedules” to inflate AI-related earnings, likening the mania to the late-1990s dot-com bubble surge.

Understating depreciation by extending useful life of assets artificially boosts earnings -one of the more common frauds of the modern era.Massively ramping capex through purchase of Nvidia chips/servers on a 2-3 yr product cycle should not result in the extension of useful…

— Cassandra Unchained (@michaeljburry)

His latest 13F filing, submitted unusually early, shows tens of thousands of long-dated put options extending to 2026 and 2027. These compose aggressive bearish wagers against stocks such as Palantir ($PLTR).

The disclosure positions Burry for a potential multi-year correction driven by overextended liquidity and investor euphoria around artificial intelligence.

“Burry’s tweet is pure contempt. The system is rigged. He knows it. The man who shorted the world is staring at a market that refuses to bleed…That’s why he said it. Not to warn. He’s tired,” one user remarked in a post.

If Burry’s thesis holds, it would echo the macro conditions that preceded both the 2008 financial crisis and Bitcoin’s early rise as an alternative, non-correlated asset.

From Fund Manager to Self-Custody

By deregistering Scion and shifting to a family office model, Burry effectively removes himself from quarterly disclosures and investor pressures, a step toward full control of capital.

Analysts note that the move embodies the same self-sovereign philosophy that underpins crypto adoption:

- Independence from institutional gatekeepers and

- Long-term conviction over short-term performance.

Why It Matters for Crypto Investors

The liquidation comes as Bitcoin consolidates in the $103,000 range, and institutional interest in crypto ETFs accelerates. Market watchers suggest that if Burry’s forecast of an equity-market unwind materializes, capital could flow toward “hard” digital assets, which are seen as liquidity hedges.

“Michael Burry throwing in the towel and shutting down Scion is the most compelling anecdotal signal I’ve seen yet of a potential top forming in the equity market,” one user commented.

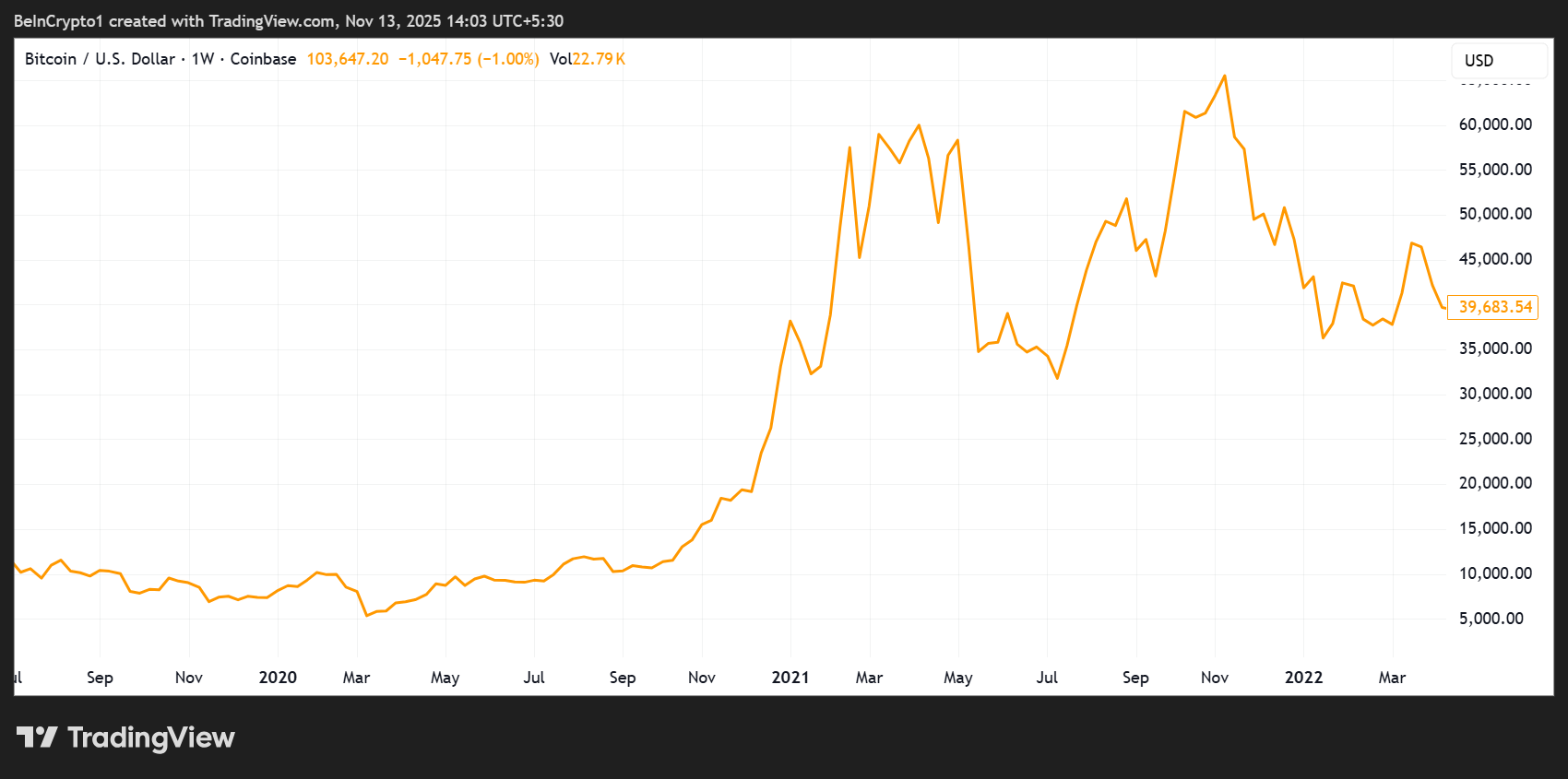

Historically, similar periods of monetary tightening followed by stimulus (2008 and 2020) have preceded major Bitcoin rallies.

Bitcoin Price Performance (2020). Source: TradingView

Bitcoin Price Performance (2020). Source: TradingView

Burry himself has not disclosed any crypto exposure. Still, his flight from traditional markets aligns with the logic that many Bitcoin advocates cite, including distrust of inflated valuations, central bank liquidity, and unsustainable corporate leverage. Burry also hinted at a new focus due on November 25, barely two weeks from now.

“On to much better things, November 25,” he noted.

Whether that means alternative assets, private ventures, or rest, his latest retreat suggests a broader sentiment shift that even legendary stock pickers are questioning Wall Street’s price signals.

When traditional markets look detached from reality, self-custody and hard-asset exposure may again prove to be the ultimate contrarian trade.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Timeless Strategies for Investing in Today's Market

- R.W. McNeel and Warren Buffett share timeless value investing principles emphasizing emotional discipline, long-term vision, and intrinsic value. - Both stress faith in the U.S. economy, with Buffett's Berkshire Hathaway exemplifying this through long-term investments in American icons like Apple and Coca-Cola . - Retained earnings and margin of safety strategies, demonstrated by Apple's reinvestment and Berkshire's share buybacks, highlight compounding's role in mitigating market volatility. - Modern be

Investing for Tomorrow: Preparing the Workforce and Advancing Tech Education in the Digital Age

- AI, cybersecurity, and data analytics are reshaping industries, driving 29% growth in cybersecurity roles and 56% wage premiums for AI skills. - Educational institutions like CCBC and Cengage Work are bridging skill gaps through AI-powered training and industry partnerships. - Government-industry collaborations aim to train 500 AI researchers by 2025, emphasizing workforce readiness as a shared responsibility. - ROI metrics for tech education now include operational efficiency gains and strategic alignme

FARTCOIN Trades at $0.347 as 9.6% Daily Gain Meets Strong $0.38–$0.40 Resistance

Aster Holds Near $1.06 as Tightening Channel Highlights Key Resistance