Tether’s Latest Gold Move Mirrors Central Banks

Tether is building a bullion desk like a central bank, signaling a shift toward gold-backed digital reserves amid global de-dollarization.

USDT stablecoin issuer Tether is deepening its exposure to physical gold as global monetary dynamics change. The company reportedly brought in two senior HSBC traders, Vincent Domien and Mathew O’Neill, to oversee its gold operations.

Both have decades of experience in metals trading and are expected to help Tether scale its bullion holdings.

Private Stablecoins, Public Strategy

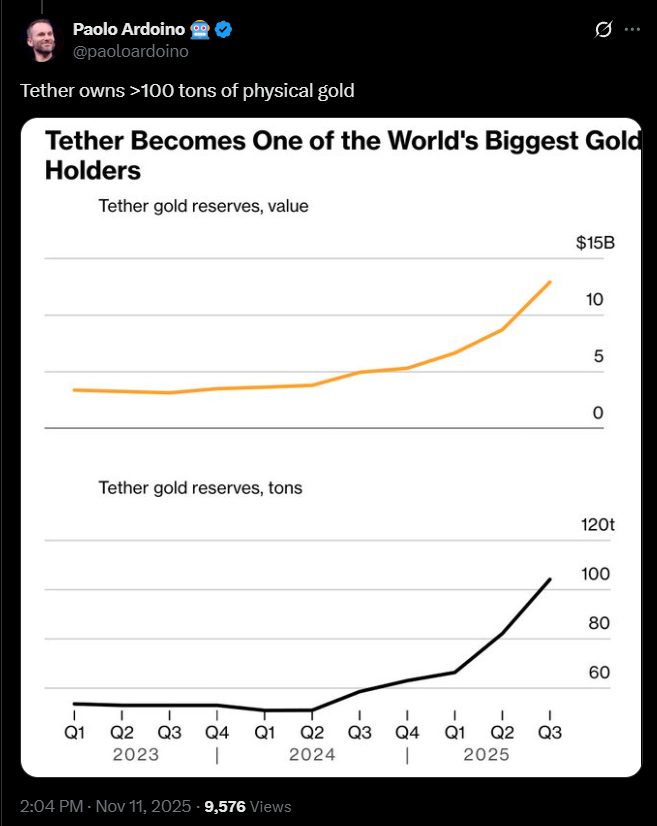

This move follows reports that Tether has already stockpiled billions in physical gold. The company is showing a strong preference for hard assets over fiat-based instruments.

Tweet From Tether CEO

Tweet From Tether CEO

The timing coincides with record central bank purchases of gold and rising global demand for non-dollar reserves.

While central banks diversify away from the US dollar, Tether appears to be following a similar path in the private sector. The company’s shift suggests it views gold as a strategic hedge—both against fiat volatility and regulatory pressure.

Unlike Circle’s USDC, which primarily holds short-term US Treasuries, Tether’s bullion reserves signal a break from dollar dependency.

Also, this divergence highlights a broader divide in stablecoin reserve philosophy: yield generation versus long-term security.

Tether’s bullion buildup could alter the perception of stablecoins from digital cash to privately managed reserve assets.

In effect, Tether is acting less like a payment processor and more like a sovereign wealth fund.

Tether isn’t stacking dollars. They’re stacking gold. $12.9B worth. If this ain’t your wake up call to go long gold I don’t know what is.

— Mr. Uppy (@MisterUppy) November 7, 2025

Tether’s Footsteps Echo of Central Bank Behavior

Central banks purchased more than 1,000 tonnes of gold in 2024, the second-highest annual total on record.

Much of that buying came from emerging economies seeking insulation from dollar-linked volatility. Tether’s accumulation of gold mirrors this pattern.

Tether’s bullion operations also introduce new logistical and security challenges. Managing physical assets within a tokenized framework demands strict custody, audit, and cyber resilience measures.

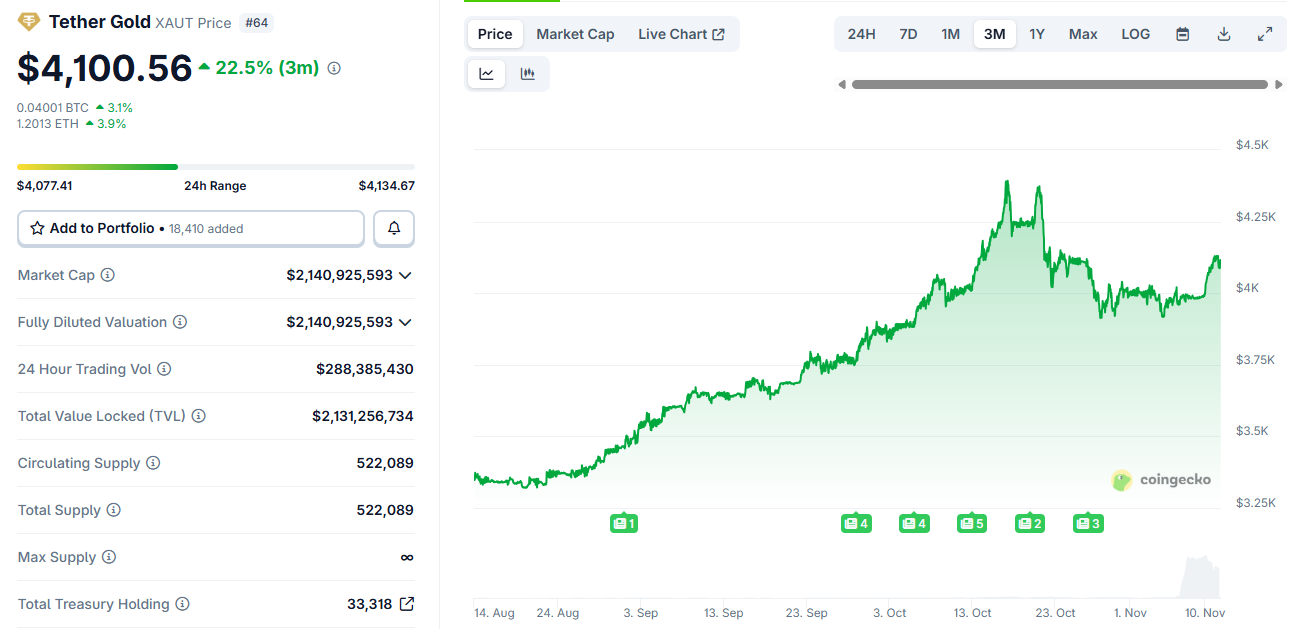

Tether Gold Token Price Chart. Source:

Tether Gold Token Price Chart. Source:

With HSBC veterans now on board, the company appears focused on building that institutional backbone.

However, transparency remains a concern. Critics argue that without frequent independent audits or full reserve disclosure, Tether’s gold strategy could face the same scrutiny that long surrounded its stablecoin reserves.

Overall, the move hints at a coming era where private entities hold diversified, multi-asset reserves rivaling national central banks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

U.S. Marine Policy and Blue Economy Prospects: Key Infrastructure and Geostrategic Roles in Oceanic Commerce

- U.S. oceans policy balances geopolitical strategy, deep-sea tech investments, and UNCLOS ratification challenges to secure maritime influence. - Executive actions accelerate seabed mineral extraction while facing environmental criticism and legal risks from bypassing international seabed authority rules. - Offshore energy partnerships with Australia, Japan, and Saudi Arabia aim to diversify supply chains but face geopolitical tensions in chokepoints like the Red Sea. - Maritime security contracts expand

Aster DEX's On-Chain Momentum: Signaling the Future of DeFi

- Aster DEX reported $27.7B daily volume and $1.399B TVL in Q3 2025, outpacing DeFi benchmarks with 2M users. - Institutional whale activity, including CZ's $2M ASTER purchase, drove $5.7B inflows and 800% volume spikes. - Hybrid AMM-CEX model and ZKP privacy tech enabled 40.2% TVL growth, 77% private transactions, and 19.3% perpetual DEX market share. - ASTER's margin trading upgrades and Stage 4 airdrops fueled 30% price surges, while Aster Chain's 2026 launch will integrate privacy-preserving ZKPs. - On

Astar (ASTR) Price Rally: Protocol Enhancements and Ecosystem Growth Drive Long-Term Value

- Astar (ASTR) surged 150% due to protocol upgrades and ecosystem expansion, positioning it as a sustainable value creation case study in blockchain. - Tokenomics 3.0 (fixed 10.5B supply) and Burndrop mechanism created deflationary incentives, supported by Galaxy Digital's $3. 3M OTC investment and Astar's $29.15M buyback. - Cross-chain interoperability with Polkadot/Plaza and Sony's Soneium, plus partnerships with Toyota and Japan Airlines, expanded real-world utility in logistics, identity, and loyalty p

Astar 2.0 Debut and Tokenomics Revamp: Driving DeFi Innovation and Attracting Institutional Participation

- Astar Network's Astar 2.0 introduces Tokenomics 3.0 with fixed 10.5B ASTR supply and 5% annual burn rate to stabilize value for institutional investors. - The update features Burndrop mechanism, asynchronous cross-chain security, and ESG-aligned protocols to address regulatory risks and attract traditional capital. - Plaza platform enables seamless asset transfers across Ethereum , BSC, and Polkadot , while zkEVM scalability targets 300,000 TPS by 2026 for enterprise-grade DeFi solutions. - Governance sh