Monad Faces Community Backlash After Unveiling Tokenomics

Layer 1 blockchain Monad has revealed plans for a public offering of its native token on Coinbase’s new token sale platform, with 7.5% of the total MON supply offered at a $2.5 billion valuation, implying a $187 million raise if fully subscribed.

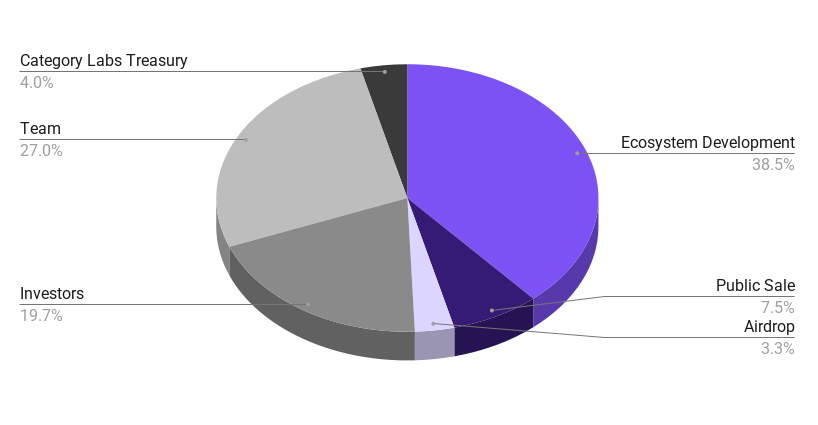

Alongside the announcement, Monad also unveiled its tokenomics, which have left users and community members fuming. Just 3.3% of the total MON supply will be airdropped, with another 7.5% distributed during the public offering, meaning only 10.8% of the total supply will be available to the average retail user.

Meanwhile, investor, team, and treasury allocations account for more than 50% of the total supply.

While the MON pre-market on Hyperliquid trades at a $6 billion valuation, community members are calling out Monad after the upcoming Layer 1 spent years preaching about how its community would be rewarded during the token generation event (TGE), only to disappoint.

Auri, a longstanding member of the Monad community with one of the exclusive “Mon” roles in the Discord, expressed frustration on X, saying, “I gotta say though this is not 'community first' tokenomics. For the first time with Monad, I feel the familiar sour taste of betrayal.”

Investors are voicing concerns as well. One user known as Monkey Rothschild, who invested on behalf of the Wassiverse NFT collection at a $600 million valuation, took to X to unleash a slew of tweets criticizing investors’ vesting compared to the public offering’s 100% unlocks, and the tiny airdrop allocation.

Rothschild said in one post, “3 years, 3%. Not sure how else to spin it, but that's just dirty work lmfao,” alluding to the fact that many users had been active in the Monad Discord for more than 3 years to receive only a 3.3% airdrop allocation.

It is also worth noting that the airdrop distribution is not exclusive to the Monad community but is shared with general EVM users, whether or not they have ever interacted with Monad.

Despite the broad pushback from community members and onlookers, some market participants welcomed today’s announcements.

“Coinbase offering + full tokenomics have made me more bullish monad tbh,” investor Cryptopathic posted today. He continued in the comments thread, insinuating that the MON token’s low circulating supply and its status as the first-ever Coinbase token offering bode well for its price action.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: Telcoin's Future Depends on Ethereum's Strength During Market Slump

- Telcoin's price depends on Ethereum's resilience, stablecoin trends, and macroeconomic shifts like Fed policy and inflation expectations. - Ethereum faces short-term liquidity risks but long-term Dencun upgrades and staking growth could support Telcoin's transaction efficiency. - Stablecoin promotions (e.g., USDD) highlight growing demand for low-volatility assets, potentially boosting Telcoin's mobile payment utility. - Crypto market pessimism and equity corrections may hinder Telcoin adoption in emergi

Whales Shift Investments as Ozak AI's Blockchain-Powered AI Shakes Up Industry Leaders

- Institutional investors and crypto whales are shifting capital to Ozak AI (OZ), a blockchain-AI hybrid project raising $4.5M in presale with 1B tokens sold at $0.012 each. - Ozak AI combines decentralized AI nodes, real-time predictive systems, and cross-chain automation to create a "thinking blockchain," targeting AI analytics and scalability gaps in crypto. - The project gains traction as traditional AI stocks like C3 .ai (-27.4% in 3 months) and Nvidia face valuation declines, positioning Ozak as a pr

SUSHI has dropped by 16.25% over the past month as a result of an extended downward trend

- SUSHI rose 1.56% in 24 hours to $0.4093 but fell 69.9% annually amid prolonged bearish trends. - Short-term gains reflect market corrections, yet lack of catalysts and ecosystem upgrades sustain volatility and investor caution. - Analysts warn SUSHI faces near-term pressure without on-chain activity, with consolidation phases offering speculative buy opportunities. - Future stability hinges on project developments; current bearish outlook persists due to stagnant ecosystem activity and weak fundamentals.