Date: Tue, Nov 11, 2025 | 08:40 AM GMT

The cryptocurrency market continues to highlight strong performance among Dino altcoins. Tokens like ZEC, ICP, and DASH have already delivered notable gains, and now attention is shifting toward several other assets showing early-stage bullish structures — including ELF, the native token of the aelf blockchain platform.

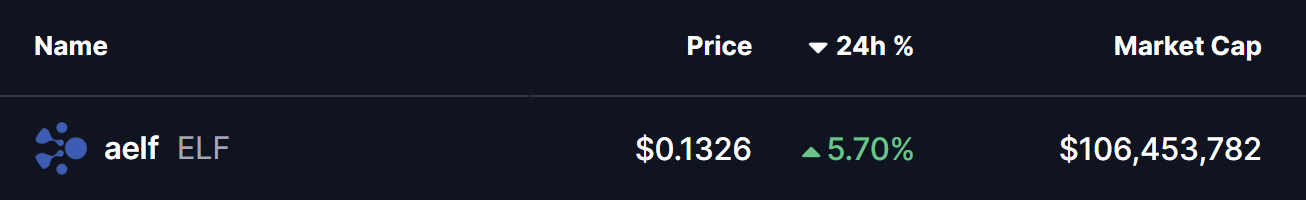

ELF is up more than 5 percent today, and the latest price action suggests that the token may be gearing up for a stronger move.

Source: Coinmarketcap

Source: Coinmarketcap

Falling Wedge Breakout

As shown on the 4H chart, ELF had been consolidating inside a falling wedge pattern — a classic bullish reversal setup that often signals the exhaustion of selling pressure and the start of a recovery phase.

Price formed a solid base near $0.1144, and buyers stepped in with conviction. This pushed ELF above the wedge’s descending resistance line at around $0.1242, marking its first decisive bullish breakout since mid-October.

aelf (ELF) 4H Chart/Coinsprobe (Source: Tradingview)

aelf (ELF) 4H Chart/Coinsprobe (Source: Tradingview)

Following the breakout, ELF climbed above the $0.13 region, showing early resilience and hinting at a potential shift in momentum.

What’s Next for ELF?

The breakout structure remains constructive while ELF trades near $0.13. From here, the token may either retest the breakout zone or continue its move higher if buyers sustain the momentum. The next key resistance stands at the 200-day moving average around $0.1387. Reclaiming this level would strengthen the bullish bias and could open the door to the next target at $0.1738 — the measured move projection from the wedge, representing nearly a 33 percent upside from current levels.

If ELF fails to hold above the 50-day moving average support at $0.1216, the bullish setup may be invalidated, delaying any upward continuation.

For now, the breakout is encouraging, and ELF is showing the early signs of a trend reversal that traders will be watching closely through the week.