ETF Greenlight? Government Shutdown Deal Could Trigger Massive XRP Rally

DTCC lists nine spot XRP ETFs, with a November 2025 launch eyed. Price peaks at $2.45, but SEC approval and US Senate deal are critical factors.

The US Depository Trust & Clearing Corporation (DTCC) has listed nine spot XRP Exchange-Traded Funds (ETFs), intensifying expectations of a November launch pending US SEC approval.

With the potential US Senate deal to end the government shutdown, this could speed up SEC reviews and push XRP’s price to a high of $2.46.

DTCC Listing Expands XRP ETF Landscape

The list includes Bitwise XRP ETF and Franklin XRP ETF, among nine spot XRP ETFs—Canary XRP ETF (XRPC), Volatility Shares XRP ETF (XRPI), ETF Opportunities T-REX 2x Long XRP (XRPK), CoinShares XRP ETF (XRPL), Amplify XRP 3% Monthly ETF (XRPM), ETF Opportunities T-REX Osprey XRP (XRPR), Volatility Shares 2x XRP ETF (XRPT), and Franklin XRP ETF (XRPZ)—indicating market readiness.

🚨 BREAKING:Nine XRP Spot ETFs are now listed on the DTCC signaling readiness ahead of a possible launch this month. 👀🤯📊 Listed ETFs:↪️Bitwise XRP ETF (XRP)↪️Canary XRP ETF (XRPC)↪️Volatility Shares XRP ETF (XRPI)↪️ETF Opportunities T-REX 2x Long XRP (XRPK)… pic.twitter.com/00usToMVhX

— Xaif Crypto🇮🇳|🇺🇸 (@Xaif_Crypto) November 10, 2025

The Senate’s progress in halting a 40-day shutdown may restore SEC staffing, aiding approval. However, Ripple’s unresolved SEC litigation since 2020, with a year-end decision expected, poses risks. Over the past week, XRP’s trading volume increased to approximately $27.3 billion.

XRP’s trading volume:

CoinGecko

XRP’s trading volume:

CoinGecko

Global Markets Monitor Regulatory Progress

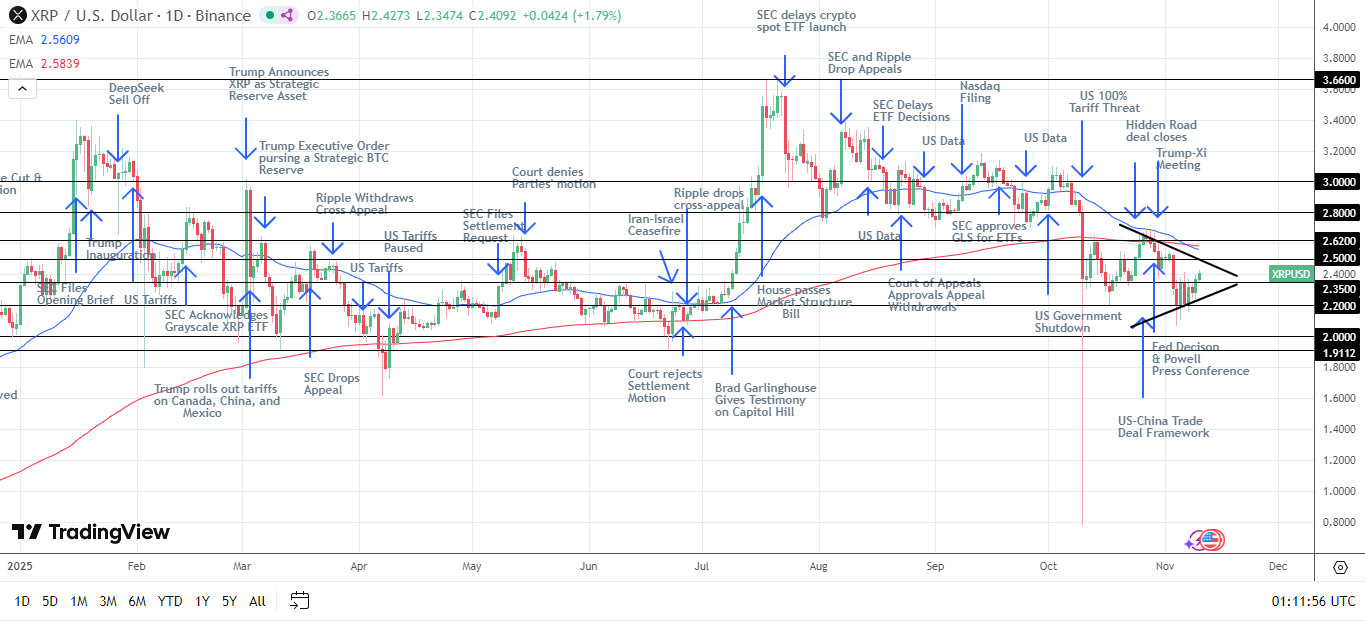

The XRP price surge to $2.45 follows a breakout above the 50-day moving average, with analysts targeting $3 by Q1 2026.

XRP price chart: BeInCrypto

XRP price chart: BeInCrypto

Technical analysis indicates that near-term support levels lie at $2.0 and $1.9, while key resistance lies at $2.5 and $2.62.

This movement occurs as XRP ETP success contrasts with Asia’s cautious stance. Asian exchanges like Bitget are awaiting clarity from US regulators. Analysts caution that a delay in the SEC’s regulatory approval could push prices down to $1.80.

the 50-day moving average, targeting $3 by Q1 2026 :

FXEmpire

the 50-day moving average, targeting $3 by Q1 2026 :

FXEmpire

JP Morgan estimates a launch could draw $3-5 billion in inflows, similar to Bitcoin ETFs, enhancing XRP’s institutional appeal. The Senate deal, if finalized, may accelerate this, though uncertainty persists. Europe’s success offers a global adoption model, but investors await clarity from the SEC and legislators.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: The 2025–2031 Battle for Bitcoin: Long-Term Confidence Faces Near-Term Uncertainty

- Bitcoin's 2025 price dropped 30% to $85,000 amid Fed policy shifts and ETF outflows, triggering market recalibration. - Institutional investors like Harvard and Japan's Metaplanet are accumulating BTC, signaling potential 2026–2031 bull phases. - Analysts project $160,000–$350,548 targets by 2026–2031, but warn of $53,489–$58,000 bear risks amid macroeconomic uncertainties. - Long-term bullish sentiment persists despite short-term volatility, with on-chain data showing whale accumulation at discounted le

Spain’s Revamp of Crypto Tax Laws May Spark Market Turmoil, Opponents Caution

- Spain's Sumar group proposed crypto tax hikes to 47% and a risk "traffic light" system for platforms in November 2025. - The plan introduces dual taxation for individuals/businesses and expands seizable crypto assets beyond EU MiCA rules. - Experts warn of legal challenges, market instability, and "absolute chaos" if the reforms create compliance burdens for investors. - Critics argue the measures could deter crypto adoption, drive activity underground, and destabilize Spain's emerging crypto sector.

Solana News Today: "November's Investor Challenge: Support Struggling Solana or Chase Profits with Mutuum's Surge?"

- November 2025 crypto markets show Solana (SOL) down 22% amid macroeconomic uncertainty, while Mutuum Finance (MUTM) raises $18.9M in presale with 18,200 holders. - Solana faces declining confidence ($134 price, $7.3B flat open interest) as Fed rate uncertainty and bearish derivatives sentiment weaken its position. - Mutuum's Phase 6 presale (95% sold at $0.035) gains momentum through direct debit access, security audits, and a 20% price jump to $0.06 in Phase 7. - Analysts highlight Mutuum's dual DeFi mo

XRP News Today: XRP ETFs Draw $58M Investments During Price Fluctuations, Prompting Concerns

- Canary Capital’s XRPC ETF sees $26.5M inflows, contrasting Bitcoin ETF outflows. - Franklin Templeton/Bitwise XRP ETFs launch Nov 18-20, signaling institutional interest. - XRP stabilizes near $2 support but faces pressure from mixed technical indicators. - $15.8M ETF inflow amid volatility highlights uncertain market dynamics for altcoins.