Bitcoin Price Outlook for November 2025: Global Portfolios Transformed by Macroeconomic Changes and Growing Institutional Involvement

- Bitcoin surged 8% in Q3 2025 to $114,600 amid Fed rate cuts and geopolitical tensions, solidifying its role as a digital safe-haven asset. - Institutional adoption accelerated, with $9.6B in Ether ETF inflows and JPMorgan boosting Bitcoin holdings via BlackRock's trust. - Corporate reserves reached record levels (e.g., MicroStrategy's $70B BTC), while altcoin ETF applications signaled maturing crypto markets. - Bitcoin's portfolio role evolved from speculative exposure to strategic allocation, outperform

Macroeconomic Shifts: Rate Cuts and Inflationary Pressures

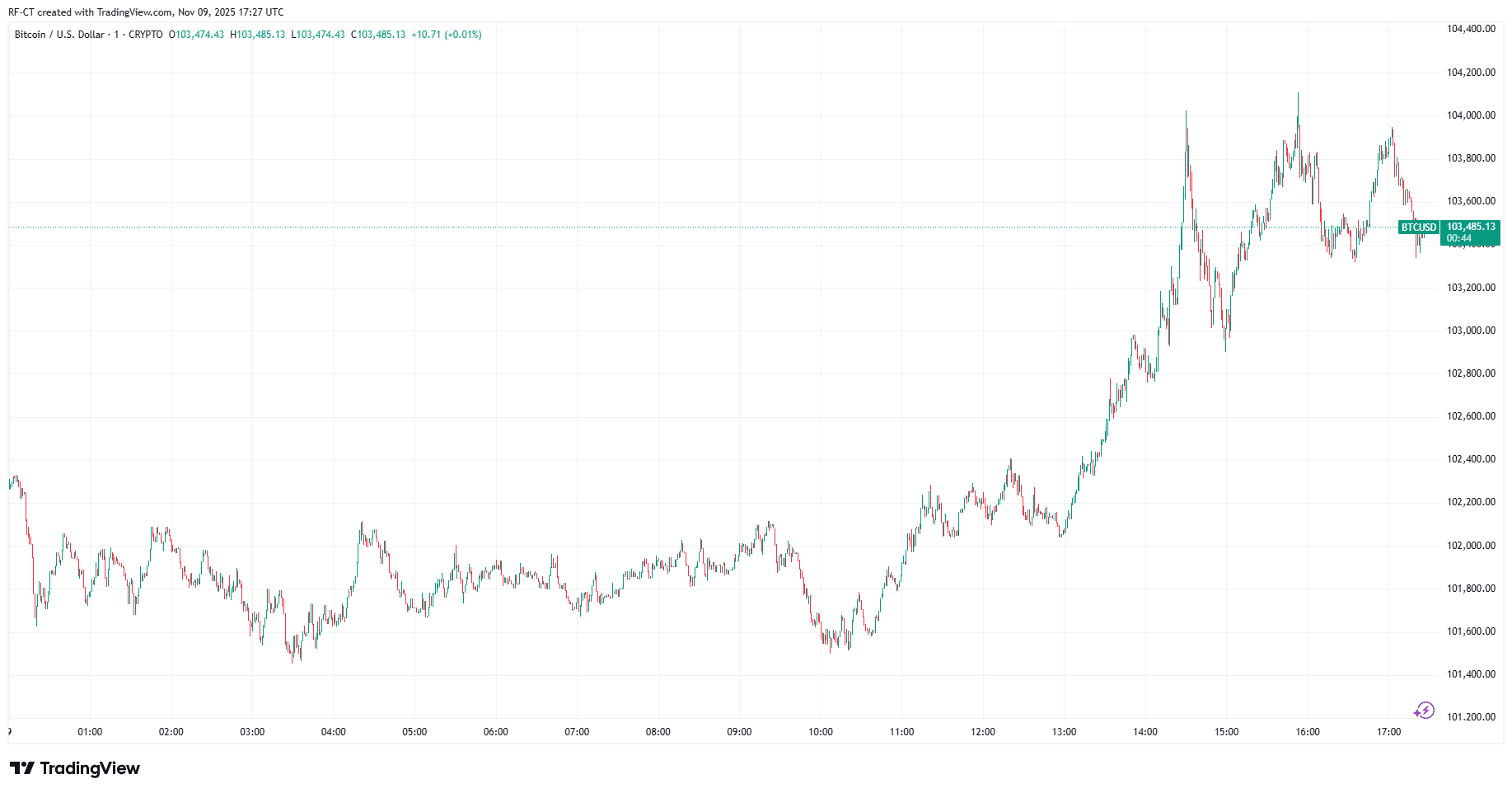

The U.S. Federal Reserve’s decision to lower interest rates by 25 basis points in September 2025 was a significant event for risk assets like Bitcoin. Despite persistent core inflation in developed nations, the Fed’s action indicated a careful move toward loosening monetary policy, prompted by a weakening job market and slower economic growth, as noted in a

Rising geopolitical instability further increased Bitcoin’s attractiveness. Ongoing conflicts in the Middle East and unresolved trade issues between the U.S. and China drove investors toward safe-haven assets. Gold jumped 15.7% in Q3 2025, but Bitcoin’s 8% rise highlighted its growing reputation as a digital alternative to traditional safe havens, according to the

Institutional Adoption: ETFs and Corporate Holdings

Institutional involvement in Q3 2025 propelled Bitcoin’s acceptance in mainstream finance. Ether ETFs saw $9.6 billion in new investments, surpassing the $8.7 billion flowing into Bitcoin ETFs, indicating that institutions are broadening their crypto exposure, as reported by a

The SEC’s review of five new altcoin ETF proposals in October 2025 signaled a more mature market. Assets such as

Bitcoin's Evolving Portfolio Role

Bitcoin’s function in global investment portfolios is shifting from a speculative asset to a deliberate allocation. Its connection to traditional markets has weakened, as it now serves both as an inflation hedge and a beneficiary of looser monetary policy. In Q3 2025, Bitcoin outperformed stocks during turbulent markets, gaining 8% while the S&P 500 fell by 2%, according to the

Nonetheless, there are still obstacles. Although Bitcoin’s market value has surpassed $1.2 trillion, its price swings—intensified by economic uncertainty—demand prudent risk strategies. More institutions are turning to dollar-cost averaging to smooth out short-term volatility, reflecting a growing perception of Bitcoin as “digital gold,” as noted in a

Conclusion: A New Era for Bitcoin

The combined effects of macroeconomic changes and institutional participation are solidifying Bitcoin’s role in global investment portfolios. As central banks address inflation and geopolitical uncertainty, Bitcoin’s dual function as both a hedge and a store of value is likely to draw more investment. However, its future will be shaped by regulatory progress and economic stability. For investors, the message is clear: Bitcoin has moved beyond being a niche asset and is now an essential part of a diversified, forward-thinking investment approach.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Astar 2.0: Is This a Strong Opportunity for Institutional Investors to Enter?

- Astar 2.0 upgrades blockchain scalability via Polkadot's async protocol, cutting block time to 6 seconds and boosting TPS to 150,000. - Institutional adoption grows with $3.16M ASTR purchase, 20% QoQ wallet growth, and partnerships with Sony , Casio, and Japan Airlines. - Cross-chain liquidity via Chainlink CCIP and hybrid architecture position Astar as a bridge between decentralized innovation and enterprise needs. - Analysts project ASTR could reach $0.80–$1.20 by 2030, though liquidity constraints and

Bitcoin Bounces Back as Trump’s $2,000 Dividend Plan and Michael Saylor’s Hint Spark Market Optimism

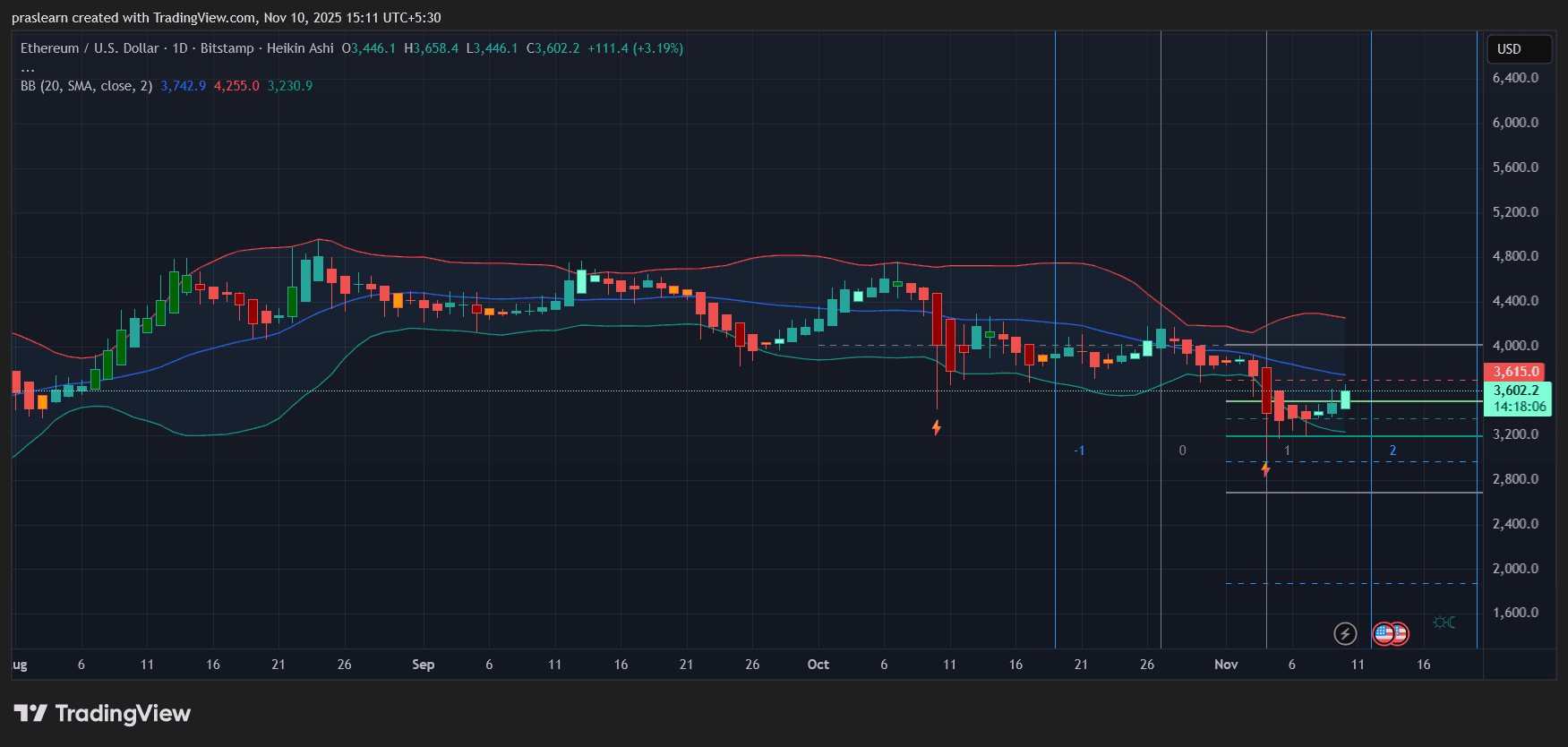

Will Political Calm Push ETH Price Toward $4,000?

Vitalik Buterin's Latest Advocacy for ZK Technology in Ethereum: Evaluating the Impact of ZK on Ethereum's Future Scalability and Investment Potential

- Vitalik Buterin prioritizes ZK proofs to enhance Ethereum's scalability, privacy, and quantum resistance amid institutional demand and post-AGI risks. - Ethereum's "Lean Ethereum" upgrades remove modexp precompiles and adopt GKR protocol, boosting TPS and quantum security while temporarily affecting gas fees. - ZK layer 2 solutions like Lighter (24k TPS) and ZKsync (15k TPS) drive institutional adoption, with 83% of enterprise smart contracts now using ZK-rollups. - ZK-driven infrastructure (ZKsync, Star