YFI Falls 37.57% Over the Year Despite 6% Surge in the Past Month

- YFI fell 0.34% in 24 hours to $5011, contrasting a 11.85% weekly gain and 6% monthly rise amid a 37.57% annual decline. - Recent volatility reflects broader market swings and investor sentiment, highlighting YFI's sensitivity to short-term shifts. - Technical indicators show mixed signals, with narrowing moving averages and RSI in mid-range, indicating a consolidating market. - A backtesting strategy examines historical YFI performance after 37.57% annual declines to assess post-drop recovery patterns.

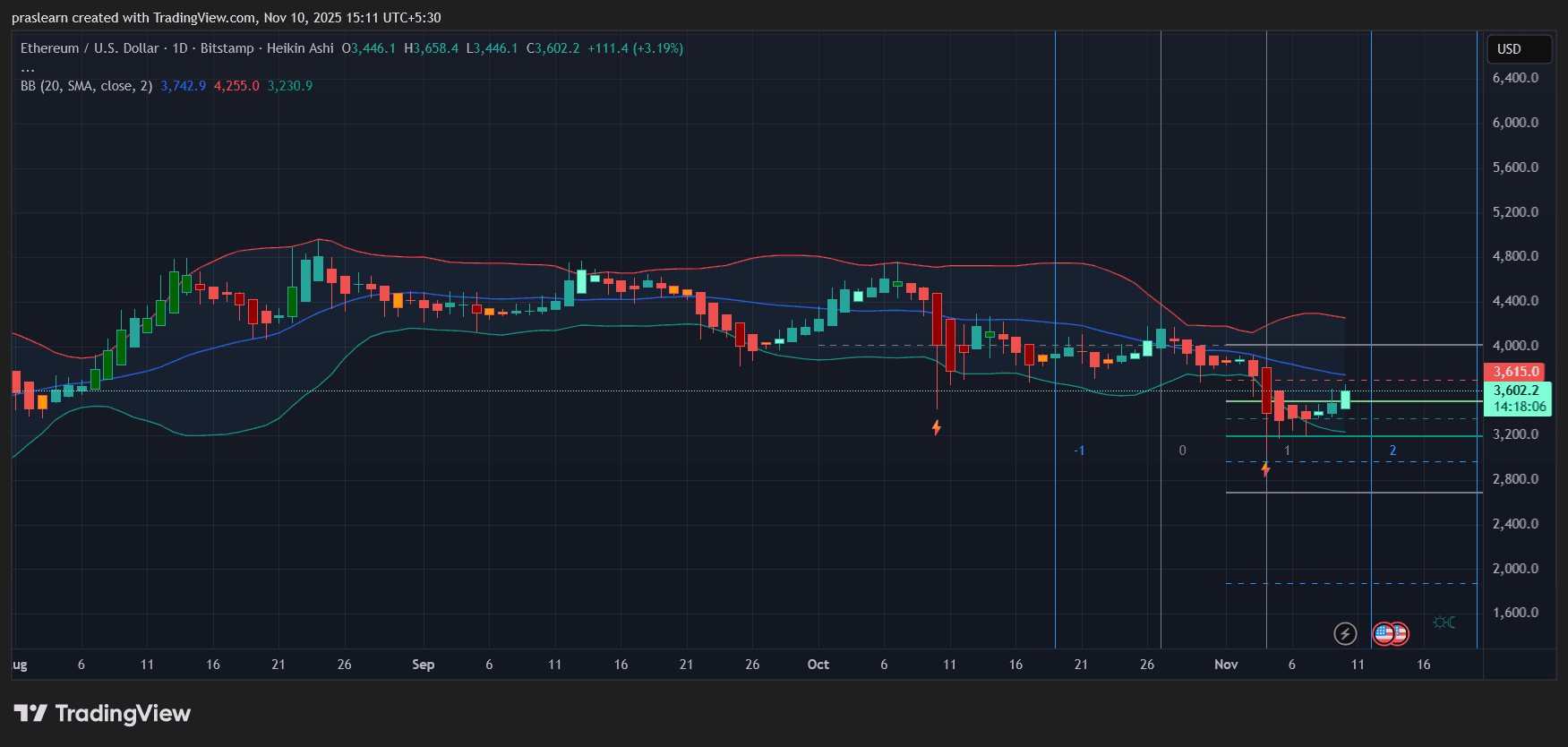

As of November 10, 2025, YFI experienced a 0.34% decrease over the past 24 hours, settling at $5011. Despite this short-term dip, the token climbed 11.85% in the previous week and posted a 6% increase over the last month. In contrast, its year-to-date performance remains negative, with a notable 37.57% drop since the start of the year.

YFI's recent price fluctuations mirror broader trends in the market and shifting investor attitudes, which have contributed to pronounced volatility throughout the year. Although the latest 0.34% decline is relatively modest compared to longer-term movements, it highlights YFI’s ongoing responsiveness to immediate market changes.

Technical analysis over the past month has yielded mixed results. The gap between the 50-day and 200-day moving averages has narrowed, pointing to a possible consolidation period. Meanwhile, the RSI has hovered around the midpoint, suggesting the asset is neither heavily bought nor sold. These indicators reflect a market in transition, where short-term participants may be capitalizing on rebounds to secure profits or reestablish positions.

Backtest Hypothesis

Considering the substantial 37.57% loss over the past year, a backtesting approach could analyze YFI’s historical performance following similar significant annual declines. An event study might be conducted to pinpoint occasions when YFI dropped by around 37.57% or more within a 12-month period, then evaluate subsequent returns over intervals such as 1, 3, 6, and 12 months. The analysis would report metrics like average and median returns, hit rates, and other indicators to better understand YFI’s typical behavior after major downturns. This method seeks to equip investors with data-driven insights into how YFI has historically reacted to comparable sharp declines.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DTCC Lists Five XRP Spot ETFs, Fueling Anticipation for U.S. Market Debut

Astar 2.0: Is This a Strong Opportunity for Institutional Investors to Enter?

- Astar 2.0 upgrades blockchain scalability via Polkadot's async protocol, cutting block time to 6 seconds and boosting TPS to 150,000. - Institutional adoption grows with $3.16M ASTR purchase, 20% QoQ wallet growth, and partnerships with Sony , Casio, and Japan Airlines. - Cross-chain liquidity via Chainlink CCIP and hybrid architecture position Astar as a bridge between decentralized innovation and enterprise needs. - Analysts project ASTR could reach $0.80–$1.20 by 2030, though liquidity constraints and

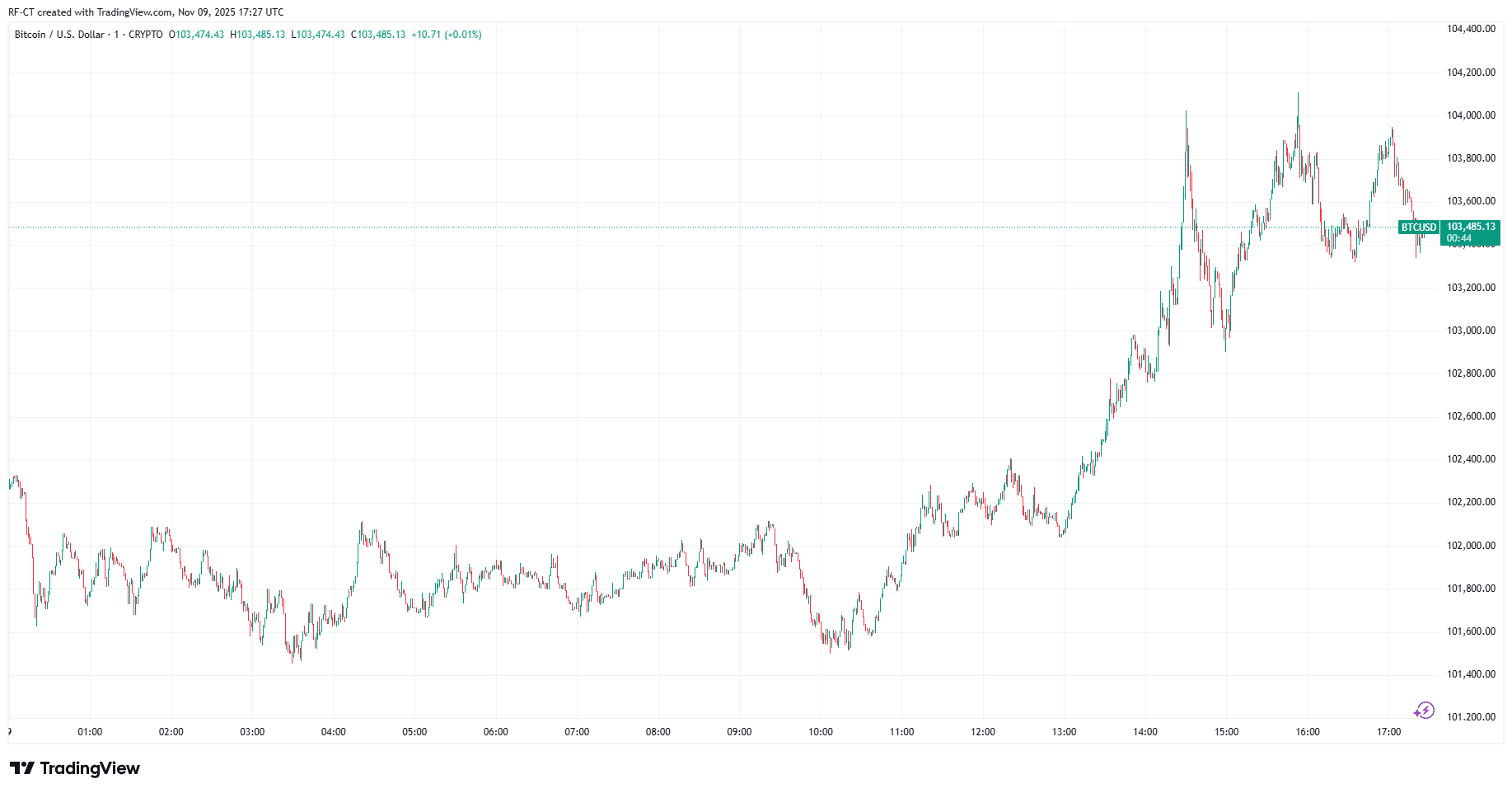

Bitcoin Bounces Back as Trump’s $2,000 Dividend Plan and Michael Saylor’s Hint Spark Market Optimism

Will Political Calm Push ETH Price Toward $4,000?