Shutdown Hopes, Trump Dividend Talk Lift Bitcoin to $106K

Bitcoin’s price plunged at the start of the week. However, it significantly recovered losses through a weekend rebound, stabilizing near $106,000 mark. The weekly decline, which had approached -10%, ultimately closed at -4.99%.

The rebound was driven by news of an imminent end to the US government shutdown and a social media post from President Trump.

‘Big Short’ Rumors Triggered Initial Plunge

The initial drop was sparked by deteriorating sentiment in the US stock market. On Tuesday, news broke that famous bear Michael Burry had established a $1.2 billion short position in AI stocks like Nvidia (NVDA) and Palantir (PLTR). This news encouraged skeptical investors to sell, leading to declines across all three major US stock indexes.

Despite the fundamental issue lying with AI equities, the crypto sector saw a steeper decline: BTC fell approximately 5% that day, while altcoins recorded even higher losses.

On-chain analysts attributed the sharp drop to an exodus of institutional investors. Major players had been reducing crypto positions since the October 10 “Black Friday” crash. Subsequently, the Tuesday stock market turbulence caused the already fragile supply-demand balance to collapse.

The market imbalance worsened quickly, pushing Bitcoin below the psychological $100,000 support on Wednesday, to a low of $99,000.

365-Day MA Holds as Critical Support

Analysts watched nervously, knowing a further drop would break the 365-day Moving Average (MA) line—a critical inflection point often marking the start of a bear market.

Fortunately, the current drop did not breach this line. Bitcoin found support and rebounded, successfully holding the 365-day MA as it had during two previous crises: the August 2024 Yen carry-trade unwinding and the April 2025 tariff crisis.

Ethereum (ETH), the second-largest crypto, plummeted to $3,100 on Wednesday. However, it recovered alongside Bitcoin, rising above the $3,600 level by Sunday, though its weekly loss stood at -6.55%.

Shutdown Resolution Becomes the Primary Catalyst

During the prolonged slump, analysts actively hoped for the end of the month-long US government shutdown. This was because the shutdown was widely believed to be reducing market liquidity by halting government spending.

The shutdown has resulted in approximately 750,000 federal employees being furloughed and a nearly 10% surge in flight delays due to pay suspensions for air traffic controllers. Ultimately, this has disrupted essential support programs.

Raoul Pal, founder of RealVision, argued that the halt in US fiscal policy was worsening market liquidity, with the crypto sector bearing the brunt. He predicted the shutdown’s resolution would be a powerful potential catalyst for a bullish reversal.

This belief was validated on Sunday when Senate Majority Leader John Thune hinted at the possibility of ending the shutdown. The news immediately spurred a Bitcoin rally. Thune’s comments caused the betting market on Polymarket to shift drastically; the likely end date for the shutdown moved from November 20th to November 11th.

Trump’s Dividend Talk Fuels Buy Impulse

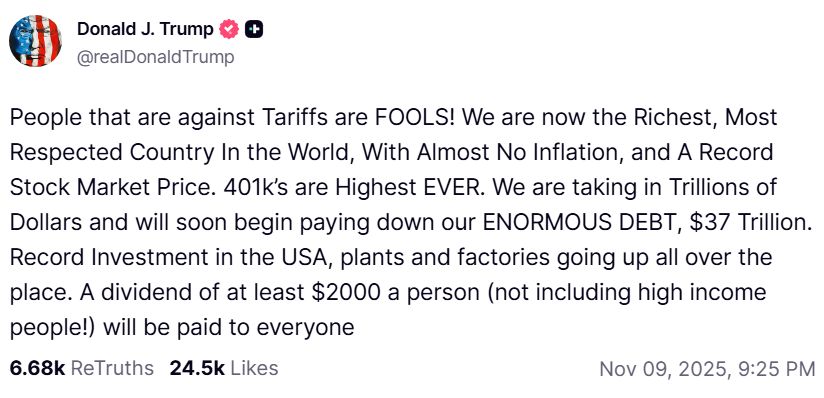

Simultaneously, a social media post from President Trump provided another catalyst. He wrote: “People that are against Tariffs are FOOLS!…A dividend of at least $2000 a person (not including high income people!)”

The prospect of direct cash payments to citizens could be channeled into stock or crypto purchases. This possibility immediately pushed Bitcoin from the $103,000 range to over $105,000.

The Week Ahead: Politics and the Fed

The most critical factor this week will be whether the US government shutdown ends quickly. Initial procedural vote in Congress is expected on Tuesday. As the shutdown has suspended most US macro data collection for over a month, the influence of these figures will be limited for now.

Attention remains fixed on the potential for a further Fed rate cut in the December FOMC meeting. Several influential Fed officials are scheduled to speak this week, including:

- On Monday, Mary Daly (San Francisco Fed President) and Alberto Musalem (St. Louis Fed President),

- On Wednesday, John Williams (New York Fed President), Anna Paulson (Philadelphia Fed President), Raphael Bostic, Chris Waller, Stephen Miran, and Susan Collins.

The content of these speeches is expected to impact Bitcoin volatility significantly.

The post Shutdown Hopes, Trump Dividend Talk Lift Bitcoin to $106K appeared first on BeInCrypto.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Exploring New Challenges in Cryptocurrency Portfolio Management

- 2025 crypto landscape balances innovation with rising token scams, driving stricter regulatory enforcement and operational safeguards. - DOJ/SEC actions against fraudsters like Roger Ver and ByBit hackers, plus UK FCA sandboxes, highlight global accountability trends. - Blockchain analytics tools (TRM Labs, Chainalysis) enable real-time AML/KYC compliance and $2.17B+ stolen fund recovery through AI-driven monitoring. - FINRA/Georgetown and university programs build crypto literacy, while Kryptosphere-Del

COAI Price Reduction and Its Impact on Clean Energy Markets

- COAI Index's 88% November 2025 drop exposed crypto AI and clean energy market vulnerabilities, triggered by C3.ai's leadership crisis and $116.8M Q1 loss. - Regulatory ambiguity from the CLARITY Act and corporate governance failures forced capital flight to stable AI infrastructure stocks like Celestica (5.78% weekly gain). - U.S. clean energy investment fell 36% in H1 2025 due to policy uncertainty, contrasting with Europe's $30B offshore wind surge amid Trump-era fossil fuel/nuclear shifts. - CCUS, blu

DASH rises 20.24% in a day amid insider selling and growth strategy announcements

- DoorDash executives sold shares via prearranged Rule 10b5-1 plans, including $2.7M by CFO Ravi Inukonda and $4.6M by President Prabir Adarkar. - Sales occurred amid strategic expansion plans, including DashPass enhancements and global food delivery partnerships to strengthen market leadership. - DASH shares rose 20.24% in 24 hours despite insider sales, with institutional investors adding 53,632 shares as confidence in expansion persists. - Analysts maintain positive outlooks (avg. $275.62 target), thoug

Bitcoin News Update: Nasdaq's IBIT Options Growth Signals Bitcoin's Entry into Institutional Mainstream

- Nasdaq proposes raising IBIT options limits to 1M contracts, aligning Bitcoin with top-tier assets like Apple and Microsoft . - BlackRock's IBIT now manages $65.34B in assets, dominating 69% of Bitcoin ETF volume with $157B+ market cap. - Texas and Abu Dhabi's $5M IBIT investments highlight growing institutional adoption, with Abu Dhabi tripling holdings in Q3 2025. - Analysts predict Bitcoin could reach $100K by 2026 as derivatives expansion enables hedging and reduces volatility.