Hyperliquid’s Push Into Lending Meets Rising Security Risks From Fake App

The fake Hyperliquid app has already stolen more than $281,000, underscoring the vulnerability of traders as official mobile support remains absent.

Hyperliquid is experimenting with a borrowing and lending module on its Hypercore testnet, signaling a potential expansion of the platform’s core offering.

The development surfaced after on-chain researcher MLM noted that the team has begun running tests for a feature labeled BLP, which he believes stands for BorrowLendingProtocol.

Is Hyperliquid Exploring a Native Lending Market?

His finding suggests that Hyperliquid may be preparing to introduce a native money-market layer on Hypercore. This layer would support borrowing, supplying, and withdrawing assets.

MLM said the testnet version of BLP currently lists only USDC and PURR, but he noted that even limited asset support creates a foundation for something larger.

The Hyperliquid team is currently testing something called BLP on the Hypercore testnet – which I assume stands for BorrowLendingProtocol. It appears to be a native borrowing and lending market on Hypercore, with functions like borrowing, supplying, and withdrawing.Currently,…

— MLM (@mlmabc) November 8, 2025

He argued that integrating a lending layer could help Hyperliquid introduce multi-margin trading more safely. In his view, margin positions would sit on top of verifiable lending pools rather than isolated balance sheets.

That architecture would mirror systems already used across established DeFi money markets and could make leverage more transparent for traders.

If rolled out, this feature would expand Hyperliquid’s footprint beyond perpetuals and provide users with access to DeFi functions currently missing from the ecosystem.

The move could also consolidate activity on a single platform, creating a more integrated trading environment for users who now rely on external lending markets.

Fake Hyperliquid App Sparks Security Concerns

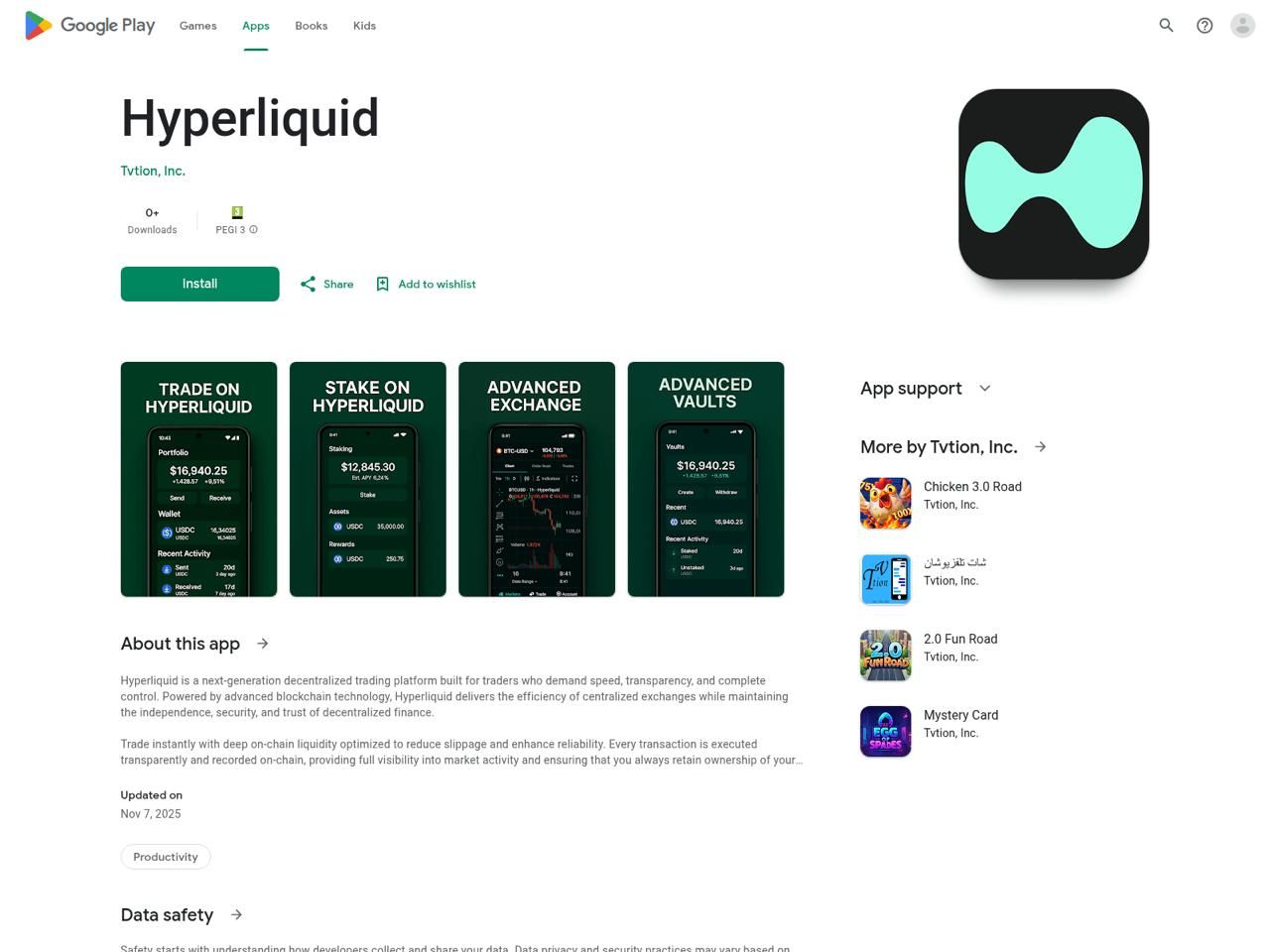

While the team experiments with new functionality, Hyperliquid users are battling a separate threat: a fraudulent mobile application that has appeared on the Google Play Store.

The app mimics Hyperliquid’s branding despite the exchange not offering an official Android or iOS product. Its presence has raised questions about app-store screening standards, especially as users increasingly rely on mobile platforms for financial activity.

Crypto investigator ZachXBT warned that the fake app is designed to steal funds by phishing wallet credentials and private keys.

He identified an Ethereum address linked to the operation that has already collected more than $281,000 in stolen assets. His alert prompted users to check recent downloads and revoke permissions to avoid further losses.

Fake Hyperliquid App On Google Play Store

Fake Hyperliquid App On Google Play Store

The fake listing fits into a broader pattern. Several malicious developers have created look-alike applications for projects such as SushiSwap and PancakeSwap, exploiting the convenience of mobile access to mislead users.

Scammers often combine these apps with sponsored ads on Google, ensuring that fraudulent links appear above legitimate search results. This increases the likelihood that unsuspecting users click through.

As Hyperliquid experiments with new infrastructure and users search for easier access points, the coordinated wave of impersonation attempts highlights a persistent risk.

Attackers continue to target platforms as they grow, and users remain vulnerable when official mobile apps do not exist.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Experiences Steep Drop: What Causes the Sudden Sell-Off?

- Bitcoin plummeted 30% in November 2025, erasing $1 trillion in market cap amid macroeconomic pressures and institutional profit-taking. - Central bank uncertainty (Fed, ECB) and leveraged liquidations amplified the selloff, with ETF outflows exceeding $3.79 billion. - Bitcoin's 0.90 correlation with the S&P 500 highlighted its shift from "digital gold" to risk-on asset, contrasting gold's 55% surge. - On-chain metrics revealed structural weaknesses: hash rate declines, miner revenue drops, and divergent

PENGU USDT Sell Alert and Stablecoin Price Fluctuations: Evaluating Algorithmic Dangers Amid Changing Cryptocurrency Markets

- PENGU USDT's 2025 volatility reignited debates on algorithmic stablecoin fragility amid regulatory uncertainty and post-UST market skepticism. - Technical analysis showed conflicting signals: overbought MFI vs bearish RSI divergence, with critical support/resistance levels at $0.010-$0.013. - $66.6M team wallet outflows and 32% open interest growth highlighted liquidity risks, while UST's collapse legacy exposed algorithmic design flaws. - Investors increasingly favor fiat-backed alternatives like USDC ,

HYPE Token Experiences Rapid Growth in December 2025: Evaluating Authenticity and Investment Opportunities Amidst an Unstable Post-ETF Cryptocurrency Landscape

- HYPE token surged in Dec 2025 amid post-Bitcoin ETF crypto optimism , raising questions about its investment legitimacy. - Hyperliquid's 72.7% decentralized trading volume share and $106M monthly revenue highlight its DeFi infrastructure strength. - Institutional backing from Paradigm and a $1B DAT fund signals confidence, though major exchange listings remain pending. - Price volatility, token unlocks, and mixed expert opinions underscore risks, with potential $53–$71 targets contingent on market condit

LUNA Falls by 5.77% Over 24 Hours Despite Fluctuating Medium-Term Performance

- LUNA fell 5.77% in 24 hours to $0.1512, but rose 47.52% in 7 days and 105.96% in 30 days. - However, it still faces a 64.14% annual loss, highlighting crypto market volatility and long-term risks for investors. - The price swing reflects sensitivity to macroeconomic shifts and sentiment, with analysts noting ongoing uncertainty in forecasts. - Investors are weighing recent resilience against regulatory challenges and institutional behavior shifts, monitoring if the drop signals a bearish trend or tempora