Date: Fri, Nov 07, 2025 | 06:20 AM GMT

The cryptocurrency market today sees both Bitcoin (BTC) and Ethereum (ETH) trading slightly in the red. However, despite the broader weakness, several altcoins are beginning to show early signs of strength — including Injective (INJ).

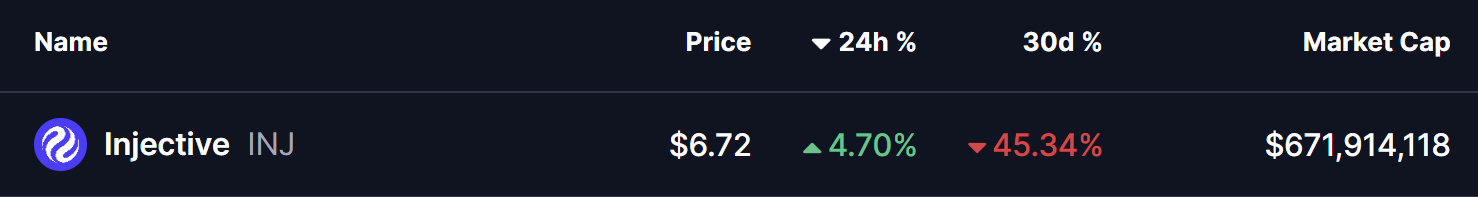

INJ is up by 4% today, though it still sits on a sharp 45% monthly decline. Yet beneath the recent weakness, its current technical structure is starting to hint at a potential short-term rebound, with price action holding firmly above a key support zone.

Source: Coinmarketcap

Source: Coinmarketcap

Descending Broadening Wedge in Play

On the 4-hour chart, INJ continues to move inside a descending broadening wedge, a bullish reversal formation that typically develops during extended downtrends.

In the latest pullback, INJ was rejected near the wedge’s upper boundary around $8.125, pushing the price back down toward the lower trendline near $5.95. Encouragingly, buyers once again defended this zone, allowing the token to bounce and trade near $6.73 — above the wedge support and recent lows.

Injective (INJ) 4H Chart/Coinsprobe (Source: Tradingview)

Injective (INJ) 4H Chart/Coinsprobe (Source: Tradingview)

What’s Next for INJ?

If buyers continue holding the lower wedge boundary, INJ could build up momentum toward the next key resistance near $7.04. A strong breakout above this zone would confirm a bullish continuation pattern, potentially opening the path for a larger recovery toward the 200-day moving average (MA) at $9.07 in the coming sessions.

However, any breakdown below the $5.95 support would invalidate the wedge pattern and expose INJ to deeper losses, shifting momentum firmly back to the bears.

For now, INJ’s structure leans cautiously positive — the descending broadening wedge remains intact, and buyers have once again defended a crucial support, indicating that a potential upside breakout attempt may be developing if market sentiment remains steady.