Date: Sat, Nov 08, 2025 | 09:50 AM GMT

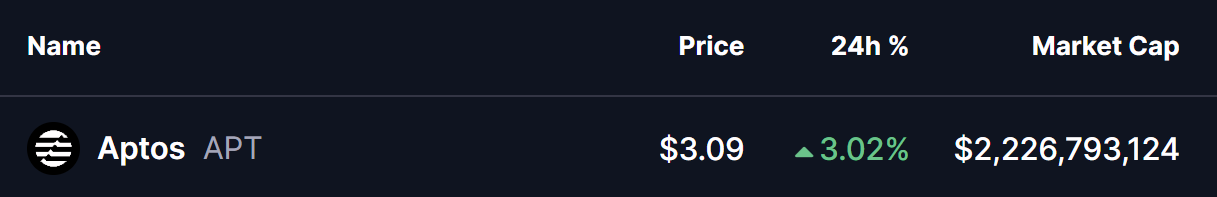

The cryptocurrency market continues to highlight strong performance as the price of Ethereum (ETH) jumps more than 5 percent today, allowing several major altcoins to show signs of strength — including Aptos (APT).

APT is showing modest gains, but what stands out more is its emerging “Power of 3” (PO3) reversal pattern — a structure that often forms near major market bottoms and signals an early shift in trend direction.

Source: Coinmarketcap

Source: Coinmarketcap

Power of 3 Pattern in Play

On the daily chart, APT’s recent price structure aligns closely with the three phases of the PO3 model: accumulation, manipulation, and expansion.

Accumulation Phase

From May through October, APT traded sideways inside a broad consolidation zone, with resistance around $5.66 and support near $4.10. The extended range indicates a potential accumulation period, where larger players often position themselves before a major trend shift.

Manipulation Phase

On October 10, APT broke below the $4.10 support and dropped sharply to $2.39 before bouncing. This deep wick into lower levels reflects the manipulation phase, shaking out weak hands before a possible bullish expansion begins.

Aptos (APT) Daily Chart/Coinsprobe (Source: Tradingview)

Aptos (APT) Daily Chart/Coinsprobe (Source: Tradingview)

APT is now trading around $3.11, still inside the manipulation zone shown on the chart.

What’s Next for APT?

APT remains in the manipulation phase, suggesting that short-term volatility is still likely. The next decisive levels will determine whether the expansion phase of the PO3 pattern begins to take shape. A breakout above the $4.10 resistance and a reclaim of the 200-day moving average at $4.58 would signal a bullish shift in momentum.

If APT successfully breaks above $5.66, it could trigger a strong move toward the $8.92 target zone, representing a potential 184% rise from the recent low.

The current market structure is already showing early signs of a possible reversal. While confirmation is still needed, the developing PO3 pattern indicates that APT may be gearing up for a significant upward trend—provided buyers continue to show strength and reclaim these critical resistance levels.